maybefalse/iStock Unreleased via Getty Images

maybefalse/iStock Unreleased via Getty Images

Alibaba Group Holding (NYSE:BABA) is currently in a difficult situation. The SEC has set its sights on Chinese companies with ADR listings, which could lead to companies like Alibaba voluntarily withdrawing from the U.S. stock market.

At the same time that Alibaba is dealing with renewed delisting concerns, the company’s sales growth has slowed to a record low.

Alibaba produced an astonishing 0% growth rate in 1Q-23, indicating that the mighty Chinese eCommerce company has officially become a stagnant business.

With margins contracting and retail sales in China under pressure, investors hold out hope. Alibaba’s stock remains a sell, with no catalysts available.

I am short Alibaba, as I explained in my late-February article, ‘Why I Am Opening Up A Short Position Before Earnings‘.

Alibaba’s sales performance in 1Q-23 may not even be described as disastrous, given that the eCommerce giant has long been regarded as a growth stock.

While we all knew that Alibaba’s growth was slowing due to the Chinese economy’s negative retail sales trends, Alibaba’s actual sales accomplishments in the June quarter were particularly troubling. Alibaba saw no sales growth in the first quarter, effectively putting an end to the company’s decade-long streak of aggressive growth in the eCommerce market.

Furthermore, Alibaba provided no sales guidance for the current fiscal year, implying that management sees too many risks on the horizon to make an accurate sales forecast.

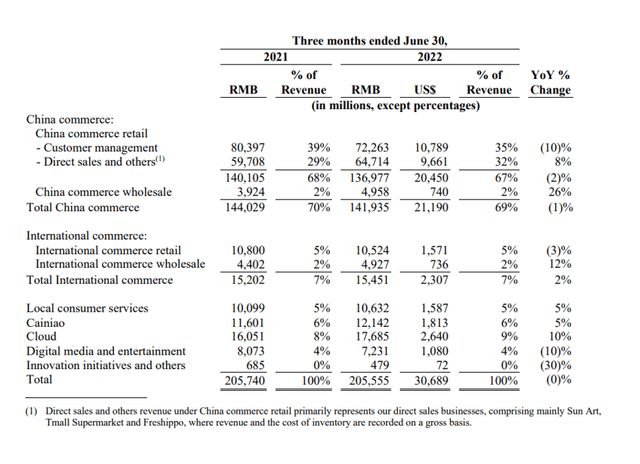

Alibaba’s sales in 1Q-23 were RMB 205.6 billion, compared to RMB 205.7 billion in 1Q-22, representing a 0% growth rate. Even though Alibaba’s wholesale business is gaining traction and cloud sales increased 10% YoY, the results were insufficient to save the day.

1Q-23 Sales Growth (Alibaba Group Holding)

1Q-23 Sales Growth (Alibaba Group Holding)

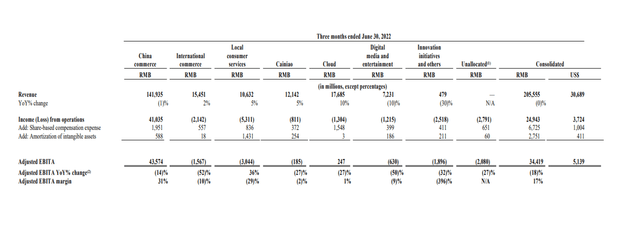

Alibaba’s slowing sales growth coincides with a broad deterioration in the eCommerce company’s margins, which is a concerning development and indicates that growing pressure is building within the eCommerce company.

Except for China commerce and cloud, the majority of Alibaba’s newly structured operating segments reported negative EBITA margins in the June quarter.

China commerce, which accounts for 67% of total sales at Alibaba, saw its segment EBITA fall 14% YoY to RMB 43.6 billion, while margins fell 4 percentage points to 31%. Cloud just barely made a profit with a 1% margin. International commerce, local consumer services, and Cainiao, Alibaba’s logistics business, all lost money in the last quarter.

EBITA (Alibaba Group Holding)

EBITA (Alibaba Group Holding)

The Chinese economy grew at a paltry rate of 0.4% in the second quarter, less than the 1.0% growth estimate and a step-down from 4.8% growth in the first quarter.

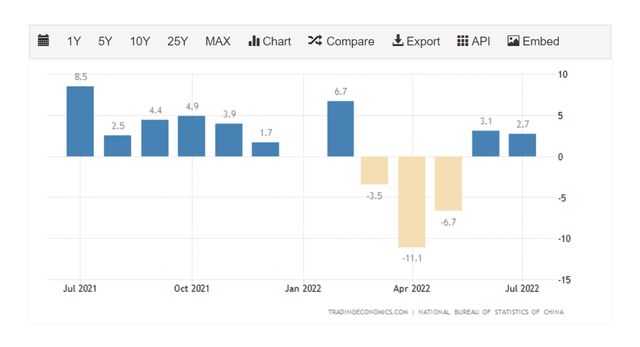

China’s retail sales are also a disaster, and they could exacerbate Alibaba’s already disastrous growth trajectory in the future. In July, Chinese retail sales increased by 2.7%, far less than the 5.0% predicted.

China’s retail sales growth has slowed significantly in 2022, with three quarters of negative growth and retail sales falling as much as 11% YoY in April. While retail trade in China improved slightly in June and July, weak retail sales make it even more difficult for Alibaba to offset falling eCommerce sales.

China’s Retail Sales Growth (TradingEconomics.com)

China’s Retail Sales Growth (TradingEconomics.com)

The SEC recently increased its efforts to compel Chinese companies with ADR listings in the United States to open their books for inspection. As regulators crack down, Alibaba and a slew of other Chinese companies with stock listings in the United States may be forced to exit the market.

Alibaba may beat the SEC to the punch and leave the U.S. stock market voluntarily to avoid a forced delisting, but even a voluntary delisting would likely reduce Alibaba’s appeal to foreign investors.

Even if Alibaba relocates its primary listing to Hong Kong, a withdrawal from the U.S. market would significantly reduce the pool of potential stock buyers.

The market expects less than 5% sales growth this year, and in the worst-case scenario, sales growth could be negative. Because of the reasons discussed in this article, I believe Alibaba will experience negative sales growth this year.

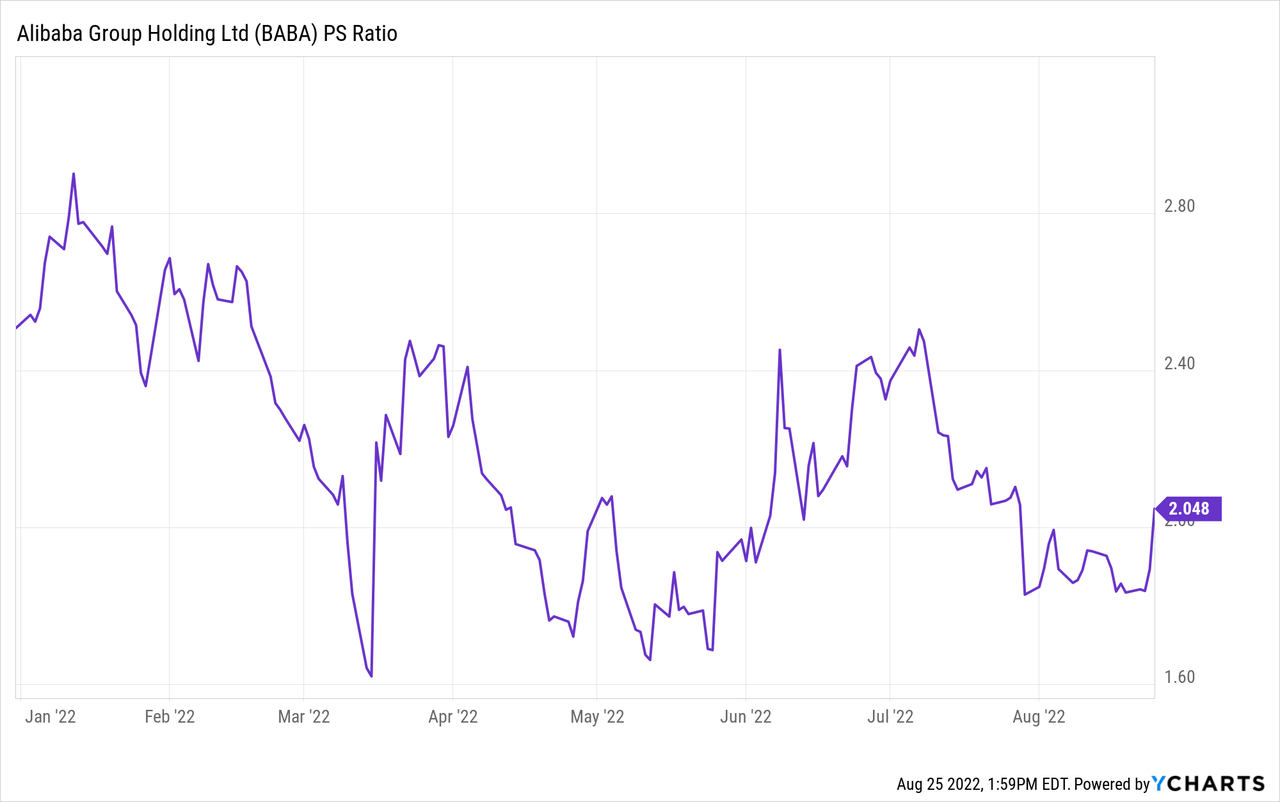

Alibaba has a sales multiple of 2.04x based on $132.3 billion in sales expected this year. Obviously, Alibaba has traded at higher sales multiples than this in the last year, but the stock may still be overvalued given the plethora of headwinds the eCommerce company faces.

Alibaba may not be delisted after all, and the Chinese economy may see a rebound in retail sales and GDP growth, which could boost Alibaba’s sales.

Even in this case, Alibaba will be forced to find new ways to offset broad margin declines. At the moment, I don’t see a critical catalyst that could bring this about.

Hope always dies last. With sales growth slowing to 0% in the last quarter and margins deteriorating, Alibaba’s business performance is not compelling at all right now in my view. The stock, given the Chinese retail market’s weakness, is likely still overvalued, despite a 70% decline since October 2020.

Furthermore, investors remain woefully unaware of the delisting risk that hangs over Alibaba. The company may voluntarily withdraw from the U.S. stock exchange and relocate its primary listing to Hong Kong at any time. Such a decision would almost certainly make Alibaba even less investable than it already is, as well as significantly reduce the pool of Western stock buyers.

In addition to these issues, it is not impossible that Alibaba will experience its first quarter of negative sales growth if the Chinese economy, and thus retail sales, continues to slow.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.