tupungato/iStock Editorial via Getty Images

tupungato/iStock Editorial via Getty Images

In my article in January this year, I detailed how Tesla (NASDAQ:TSLA) can thrive on the back of its strong position in China and elsewhere in Asia. This has indeed happened. Since then the company has consolidated Shanghai as its largest and most productive factory. At the same time Asian sales revenues continue to grow rapidly.

As Tesla ramps up its production capacity to meet over-arching demand, it is likely that we will shortly see further investments in Asia.

As the world’s largest and fastest-growing continent, Tesla investors should welcome these developments in Asia. It presages continuing strong growth in sales revenue and continuing production capacity in competitive manufacturing locations. Many Asian economies will be the fastest growing in coming years.

The supply chain networks all very much favour Shanghai as a base. Some analysts have recently stated that they think the China dependency will erode. To my mind that view is very much mistaken and this article aims to explain why.

In August, Tesla delivered 76,965 cars from Shanghai. Of these, 34,502 were sold locally and 42,463 were shipped overseas. Shanghai’s annual capacity is now close to 1 million cars. Production is ramping up after a couple of months where factory upgrading was taking place. Covid disruptions also had some negative effects. Earlier this month the company completed its upgrade of production lines. It is reported this now gives them the capacity for 22,000 Model 3 and Model Y cars per week. That would equate to 1.144 million cars per annum. This is all leading to greatly improved lead-times which itself should lead to an even faster pace of sales growth.

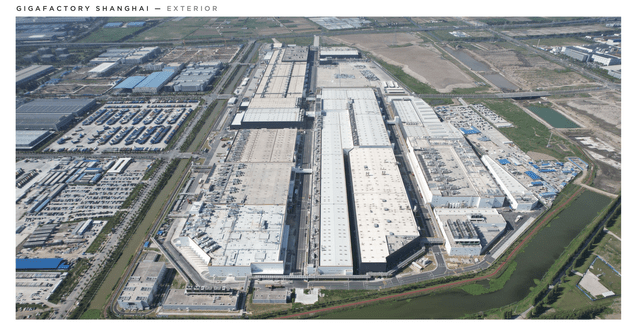

It is being predicted that Tesla will produce a record 100,000 cars in the month of September as these efficiencies come into effect. The ever-growing factory with plenty of room for expansion is viewed below:

Tesla Inc

Tesla Inc

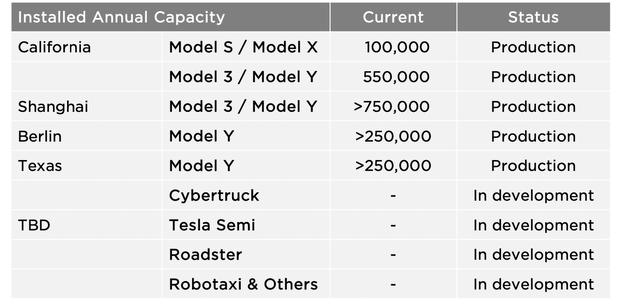

The company’s Q2 Update clearly shows that Shanghai is now the company’s most important factory. It is the one that will be used as essentially its main export hub:

Tesla Inc

Tesla Inc

Fremont has limited room to expand, possibly another 100,000 per annum will eventuate. Berlin was expected to grow to 500,000 by 2024. Recent developments with planning controls makes this unlikely. Texas is expected to grow to 500,000 by 2024. Outside Shanghai, this is where Tesla may well focus on capital spending over the next couple of years. Some capacity there may be passed over to the long-awaited Semi.

The boom in Shanghai is causing issues of its own. For instance Shanghai has problems delineating sufficient time for RHD drive markets in many countries in Asia.

As I detailed here, Shanghai has had many advantages over Fremont. Most notably the margins are far better. It was previously calculated that Shanghai was working on 40% gross margins compared to 20% for Fremont. It is likely that Shanghai is now closer to a still very respectable 30% as competition in China heats up. How margins in Texas and Germany will stack up against this is hard to know at this point. Germany, in particular, would seem to have high costs and restraints on expansion. Additionally, Shanghai has the advantage of being close to the vast majority of the world’s lithium battery manufacture, as well as chip availability.

One way that Shanghai is likely to become far and away the most important of Tesla’s manufacturing hubs concerns a new lower cost car model. Indeed this might well involve a new facility altogether. Sometime ago Elon Musk had talked about a new low-cost Tesla “Model X’ selling at $25,000. This seems to have been put on the back burner for some time. Tesla executive Martin Viecha did however recently had some interesting comments on this. He intimated it had not been a priority for a number of reasons:

* The current high price models were seeing demand far exceeding supply so there was no priority to concentrate resources on a lower-cost model.

* Manufacturing costs were falling sharply, making a lower cost car in the future more viable.

* Previous problems with battery supply were alleviating.

At some stage the time will be right if Tesla wants to meet its aim of being a volume car manufacturer. At that time it is 95% certain that such a facility will be in Asia. The figure of dollar investment that is put into China will increase in coming years but may decrease as a proportion of the whole as investment spreads around the globe to meet the increasing demand. Taking into account the political implications of China, that may not be a bad thing.

Chairman Robyn Denholm re-asserted in a speech last month that Tesla wanted to be producing 20 million cars by 2030. She confirmed that this would involve new investments on different continents. The USA would no doubt be important in this as Tesla’s most important single country market. The costs involved there mean that most of its product is likely to be for the domestic market. The troubles in building up the Berlin plant might make the company think twice before investing too much in Europe in the future. One can probably discount a facility in South America or Africa. That leaves Asia to take up a substantial proportion of the targeted 20 million number.

The China Passenger Car Association forecasts that NEV sales this year will total six million. EV sales continue to grow strongly despite the economic slowdown and problems caused by Covid shutdowns. In comparison with a six million figure, there were 2.99 million sold in 2021. Six million sales would represent about 28% of the total China auto market. In comparison, approximately 10% of the world auto market numbered EVs in the first seven months of the year according to a new report. That helps explain why the China market is more important to Tesla than any other market.

China is a huge growth market for EVs. Tesla is currently the second biggest EV player in China after BYD Auto (OTCPK:BYDDF). In 2021, Tesla sold about 320,000 vehicles in China, a growth rate of about 81%. It is unlikely to over-take BYD as that company has a very wide range of lower-priced cars than does Tesla. Its sales figures will probably exceed those of Tesla in 2022.

After a slow start to the year because of Covid shutdowns and factory improvements it is expected that the second half of this year will show very strong unit deliveries out of Shanghai. What is not known is how Tesla will apportion deliveries between domestic China sales and exports. What seems certain is that Tesla will have a strong second half of the year. Figures published on Twitter show that as of 31st August Tesla had an order backlog of 414,000 vehicles. The analyst consensus for Q3 deliveries is for 356,000 vehicles. What is not known for certain is the geographical breakdown of these numbers.

Analyst opinion is expecting a very strong Q3 and Q4 for Tesla worldwide for auto sales. In the first 7 months of the year, BYD had 16.2% of the global market for plug-ins. Tesla was second with 12.5%. Running far behind were SGMW, Volkswagen (OTCPK:VWAGY) and BMW (OTCPK:BAMXF).

The Chinese Authorities originally encouraged Tesla to invest in China because they wanted Tesla to improve quality manufacturing in general. They have achieved this. At the same time they have not dominated to such an extent that there might be a backlash against them. So BYD being the pre-eminent EV manufacturer in the country might suit all parties. Other Chinese manufacturers such as NIO (NASDAQ:NIO) and XPeng (NASDAQ:XPEV) probably have promising futures. The ones doing less well in China seem to be the legacy automakers such as Ford (NYSE:F), BMW, Mercedes (DDAIF) (OTCPK:MBGAF) and Volkswagen.

The new Model Y has made the impact that was expected. It is the best-selling premium SUV in the country, way ahead of the Mercedes Benz GLC in second place. In SUV, sales of all categories it is probably second behind the BYD “Song” depending on who you read. The Chinese Automobile Dealers Association has it down as the best-selling SUV with 172,418 units sold in the first 8 months of the year. It is pictured below as used also by the Tesla China corporate promotional site:

Tesla Inc

Tesla Inc

My article July last year detailed the possible problems of Tesla becoming too successful in China. I thought then that this was not likely to be an issue with the Chinese Authorities who have in fact welcomed Tesla at every point. In fact, as Elon Musk previously pointed out on Twitter, the strongest and best competition to Tesla is coming from specialist EV Chinese manufacturers. The old legacy auto companies trying to make the transition to the EV world are having a hard time.

This is even more the case now, as Tesla becomes more important to the Chinese economy as a whole. It is analogous to the position of Apple (NASDAQ:AAPL). I wrote about this in a recent article about Apple. The CCP needs companies like Apple and Tesla to invest in the economy. It will back them as long as they comply with certain regulations and constraints. There is a reason why the CCP granted Tesla unheard of sole ownership of their factory in China, low interest loans to build it, and various tax breaks. A pertinent question is whether Elon Musk can be as good at playing the diplomatic game for Tesla as Tim Cook has been for Apple.

The Chinese car market hit over 21 million new car sales last year. It is no surprise that Tesla is ramping up in the country to increase their offering. It now has 9000 Supercharger stalls in the country and 1300 Supercharger stations. It has over 200 stores. In August they added a further 40 Supercharger stalls and 168 Supercharger stations. The process is continuing in September. It is no surprise that Tesla initiated a new facility last year for the manufacture of Superchargers. In addition there are 700 Destination Charging Stations and 1800 charging points around the country in over 380 cities. The company recently announced it would be expanding its repair services and adding more stores in suburban areas.

Tesla could well have a record sales month in September. Its website is showing greatly reduced lead-times. They are down to as little as one week for both Model 3 and Model Y variants. Additionally the company is offering a discount for those purchasers who take up Tesla Insurance as well. This suggests September will be a month where the company concentrates sales in China rather than exports. There is always this dichotomy between China sales and export sales. Often commentators on SA ignore this and wrongly point to one month’s lower export numbers or domestic sale numbers as a sign of waning demand. It is not the case so far.

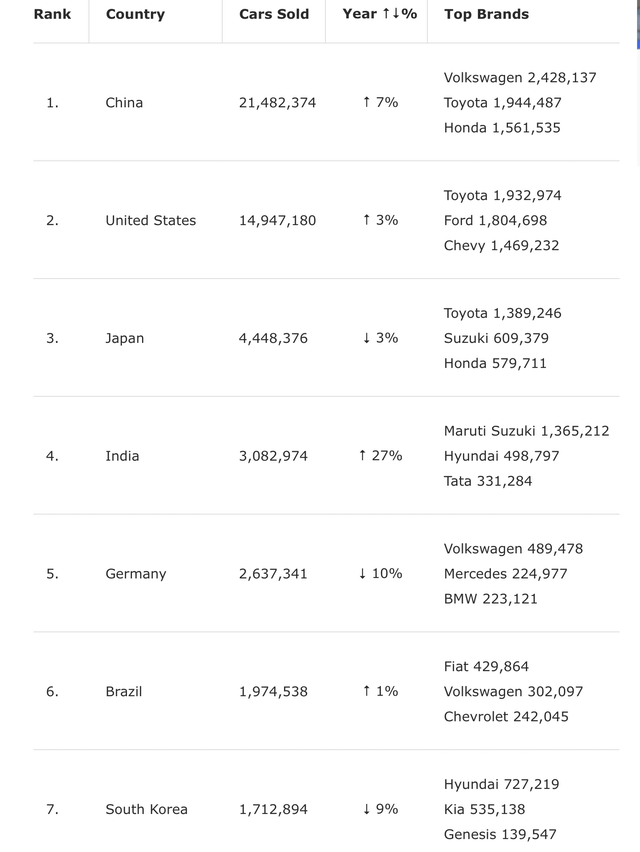

As per figures produced by Factory Warranty Asia is the place to be for growing car sales:

Factory Warranty

Factory Warranty

Below these top countries, other Asian countries are coming up fast. Australia grew 13% to over 1 million vehicles, Indonesia grew 67% to 887,196 vehicles and Thailand grew 7% to 734,389 vehicles. So those three countries alone, for instance, are similar in size to traditional markets such as Germany or the U.K.

It has been reported that the company is hiring for positions in Thailand right now. Thus it is likely that they will be launching sales there shortly. Historically Thailand is an important car assembly location. It is not impossible that Tesla could one day build a plant there. India has often been cited as being of rich promise for Tesla. In my opinion its backward infrastructure and often opaque modes of transacting business make it a difficult fit for Tesla.

Asia is also the place to be when one surveys fastest-growing economies. A recent World Bank report on growing economies in coming years highlights this. Amongst the top ten they had India at No.2, Singapore at No.4, China at No. 5, Japan at No. 6, Thailand at No. 7, and South Korea at No. 8.

On the back of this China, Japan and India currently comprise about 25% of world GDP.

* Australia.

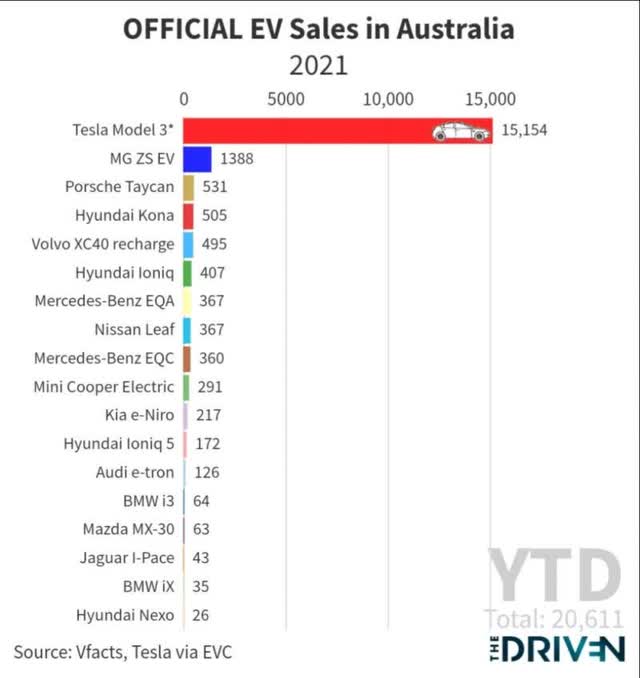

Tesla is far and away the leading EV supplier in the country, where EV sales are just starting to take off.

This chart below reported by Alex on Twitter illustrates the point well:

Alex Voigt

Alex Voigt

In the latest month of August the Model 3 became the best-selling model of any type of vehicle with 2,380 units (the Model Y chipped in with 1,017) units. Australia is set to be a significant market for the company. Tesla has a strong position there already in energy storage products and the country is well placed for the Tesla model with a high proportion of houses having solar energy.

However there may be a lull coming up for the rest of the year. It seems the Shanghai factory is having trouble allocating sufficient time for RHD Model 3s and in particular Model Ys. Customers are being quoted lead-times well into 2023 right now.

* New Zealand.

This is a small niche market which could well become a new Norway for Tesla. It was recently calculated that Tesla has sold 90,000 cars in Norway, a country of just 90,000 people. New Zealand is of similar size, affluent and with a pro BEV government policy.

Sales rose to just 3,200 units last year. Under the country’s NZ Clean Car discount policy, the EV numbers will rise exponentially. Two leading suppliers in the country historically are Ford and Toyota (NYSE:TM). It is noticeable that both are short of BEV offerings there and noticeable that the NZ Government has been ignoring their lobbying to discourage BEV incentives.

In August this year, Tesla sold 745 Model 3s and 581 Model Ys out of total EV sales of about 2,500. As usual, Tesla was the leading brand by some way.

* Japan.

I wrote in detail about this market last year. It seemed to be ideal for the BEV model and its own domestic producers are not producing BEVs. Rather they are focusing on hybrids and the somewhat discredited unsuccessful hydrogen fuel cell model. It was thought that the smaller Model Y would be more attractive to the Japanese small car model than the larger Model 3. Tesla held a big event this month to mark the arrival of the first shipments of the Model Y into the country, as illustrated below:

tesla twitter

tesla twitter

However Japan seems to remain somewhat of a sleeping giant for the BEV model. Tesla’s sales there so far seem to be quite insignificant. It will be interesting to see whether the Model Y can make an impact or not.

* Taiwan.

This is still a slow adopter of EVs but Tesla is the clear leader. In August in fact the Model 3 was the second best selling car of any type with 1,774 units sold, behind the Toyota Corolla. It is expected that Tesla will sell about 10,000 cars there this year

Taiwan illustrates another point about Tesla in Asia. Brand-conscious young Asians see it as a sign of success and cool (similar to Apple in many ways). The picture below of a day out from the Taiwanese Owners Club illustrates this:

Tesla Owners Club in Taiwan

Tesla Owners Club in Taiwan

* South Korea.

This is a strong market for Tesla. It was one of the first they focused on in Asia. In the first 6 months of the year they sold 6,746 cars. This represented 52% of all imported EV’s. The Model Y is the best-selling imported car. Their market share did however decline in the first 6 months of the year. More companies have come into the market including strong domestic offerings. The country is forging ahead with the change from ICE vehicles to EVs and is estimated to be the world’s 7th largest market for BEVs. It should remain a strong long-term market for Tesla.

* Singapore.

This is one of the niche markets which Tesla can dominate. Again, it is a small affluent country with opportunities similar to Norway and New Zealand. For instance in 2021 the Model 3 alone sold 924 units, which represented 53% of the total EV market. The number will be substantially higher this year, despite the crazy price of cars in the country. Singapore is listed as the most expensive country in the world by the Economist Intelligence Unit. You can see why when you note that the entry level Model Standard Plus sells for approximately S$245,000 (US$174,000).

—————-

Many of these Asian markets are starter markers for BEVs. In virtually every instance, Tesla is the best-selling product. With North America now being handled by U.S. factories and Europe by Brandenburg, the Shanghai factory can now give more attention to Asian countries outside of China.

Tesla is likely to get more focused on Asia outside of just cars. Other investments around the continent are likely. This could be in the field of raw material sourcing and batteries.

In Indonesia, the country’s President Joko Widodo held talks with Tesla earlier in the year. He has followed this up recently with comments how he would like to see Tesla manufacture cars and batteries in the country. Tesla is thought to have already tied up contracts to purchase very substantial quantities of nickel from the mines in Sulawesi. Quite a few companies in the sector have been investing in Indonesia recently. This includes the world’s largest battery company CATX and LG Energy Solutions. They are both setting up new battery plants there.

In July, Tesla centered its management of Asia Pacific away from the USA to Shanghai as the number of offices in the region continued to increase.

There have been reports of discussions in India and the Philippines concerning investments by Tesla. By the nature of such things these are not likely to be pre-announced. It seems clear though that India has been rejected for the time being. This is partly due to the difficulties for a company subject to U.S. law to do business there. Additionally it seems the Indian government was making demands which were not possible for Tesla to meet. It is known that Elon Musk has been looking at various Asian countries for another Gigafactory. This would accord with its access to growing markets there and proximity to supply chains.

Sceptics will continue to say that companies such as Apple and Tesla will meet their day of reckoning when China invades Taiwan. Indeed such an event would be a severe blow to them. However the point is that it would decimate the stock price of virtually every major company. If you do not want to invest in Tesla because of the risk of such an event, then you do not want to invest in NYSE and NASDAQ stocks in general.

In 2021, according to the 10K-SEC filing, Tesla reported revenue in China of $13.84 billion. This compared to $23.97 billion in the USA. However the pace of growth in China is astonishing. Revenue has risen from $2.97 billion in 2019 to $6.60 billion in 2021. It seems certain to continue to rise sharply. Manufacturing production and sales revenue are on a strong upward curve.

Future manufacturing requirements and future growth in the country’s auto market point only in one direction. Demand elsewhere in Asia will reinforce this process of hugely increased production and sales. Macro economy conditions further support this internal company trend. The importance of Asia to the company is set to rise in coming years.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TSLA AAPL BYDDF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.