FotoLesnik/iStock via Getty Images

FotoLesnik/iStock via Getty Images

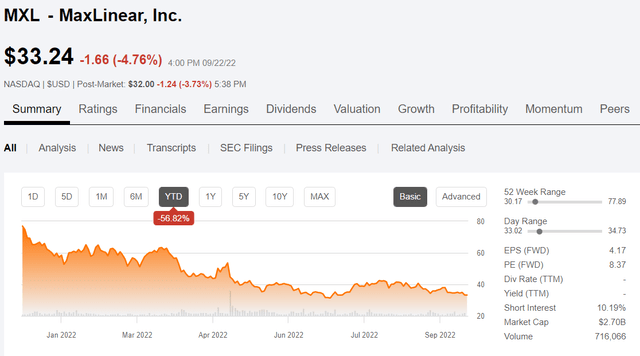

When it comes to merger arbitrage opportunities in investing, timing is everything. Unfortunately for MaxLinear Inc., (MXL) the timing could not have been much worse for the announcement on May 5 of their intent to acquire Silicon Motion Technology (NASDAQ:SIMO) for $3.8 billion. Immediately after the deal was announced the share price of MXL plunged from $53.61 on May 4 to $43.27 and is now down another -23% since then and is still falling post-market.

MaxLinear YTD share price (Seeking Alpha)

MaxLinear YTD share price (Seeking Alpha)

But the deal is still on, so for investors (or traders) who hold shares of SIMO there is still an opportunity to make a substantial profit, whether the merger is eventually consummated or not. And for those who own MXL or might like to, the company is now trading at a much better valuation and should be worth the investment if the deal does go through, trading at a forward P/E of only 8.37.

On August 31, MaxLinear refiled the application for approval by the China State Administration for Market Regulation, as is the “normal procedure” in these types of merger reviews. The length of time to complete the review is unknown, however, the companies are now expecting a decision by the 2nd or 3rd quarter of 2023, or possibly later depending on what happens with US-China relations in the interim.

And while the share price of MXL has declined significantly since the merger announcement, shares of SIMO have also come back down. After reaching a high of $95.16 right after the announcement was made shares are now trading for about $70, closing at $70.04 on 9/22/22.

According to the terms of the merger agreement, if the deal goes through SIMO shareholders will receive about a 50% premium for their shares. At today’s share prices the deal would give SIMO shareholders $93.54 + $12.90 (0.388 * $33.24) or $106.44 per ADS. That price is a bit lower than it was on August 31 when the refile application was announced.

Pursuant to the deal, Silicon Motion (SIMO) holders will receive $93.54 in cash and 0.388 shares of MaxLinear (MXL) common stock per ADS, for total consideration of $114.34.

While the shares of both companies could trade lower still, the time is right to buy SIMO, whether the merger is approved or not. Silicon Motion is a global leader in developing NAND flash controllers for SSD and other solid-state devices, eMMC and UFS (mobile storage) controllers, and customized specialty SSD solutions for PC, mobile, data center, automotive, and industrial applications. They manage NAND and IC components including upcoming generations of 3d flash for high performance SSD storage solutions. The company was founded in 1995 in San Jose, California and now operates from corporate offices in the US (Milpitas, CA), Hong Kong, and Taiwan.

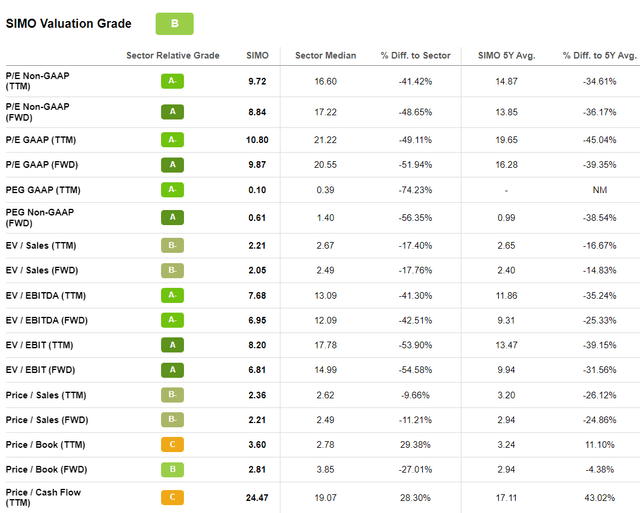

The SIMO stock went public in 2005 and has risen in price by nearly 600% since then, most of that price appreciation taking place in the past 10 years. The price is down -6% over the past 1 year and -26.25% YTD. At current prices, the stock is trading near a 5-year low P/E value at just over 10 TTM, and a forward P/E of about 8.8 despite reporting 14% YOY revenue growth in Q2.

SIMO GAAP P/E (Seeking Alpha)

SIMO GAAP P/E (Seeking Alpha)

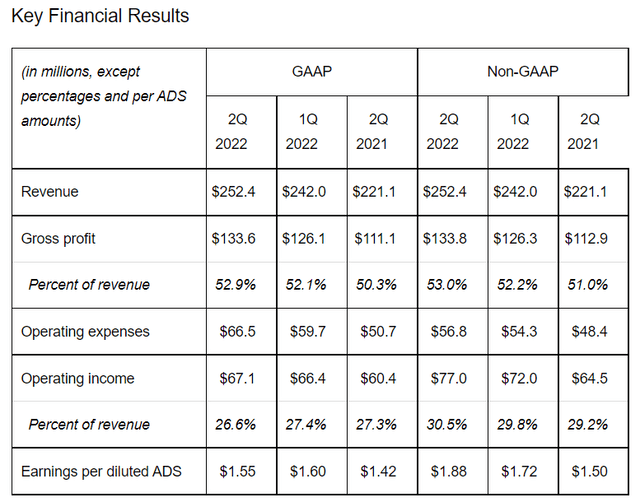

On July 27, 2022, Silicon Motion reported Q2 results for the quarter ending June 30. Non-GAAP net income increased to $1.88 per ADS, from $1.72 in the first quarter. Sales grew 4% from the previous quarter and 14% YOY. SSD controller sales declined slightly in the quarter, but other areas of the business made up for the slowdown with a 5 to 10% Q/Q increase in eMMC/UFS controller sales growth, and 25 to 30% Q/Q growth in SSD Solutions sales.

The management commentary from the earnings press release summed up the positive results that were realized despite ongoing global concerns.

“In the second quarter, our revenue continued to grow despite market conditions affected by Covid-19 lockdowns in China, Russia’s invasion of the Ukraine and a slowing global economy,” said Wallace Kou, President and CEO of Silicon Motion. “Growth of our SSD controller sales to customers building PCIe Gen 4 SSDs for PC OEMs remained very strong while sales to channel markets softened. Our eMMC+UFS controller sales to both smartphone and non-smartphone end-markets also grew.”

Other key financial results from the Q2 report also look encouraging for growth investors interested in getting a good value at the current share price. Gross profit as a percent of revenue increased as did non-GAAP operating income.

Q222 Key Financial Results (Q222 earnings report)

Q222 Key Financial Results (Q222 earnings report)

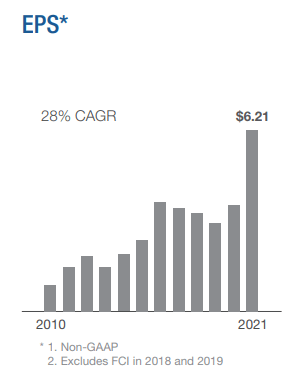

Earnings growth has been fairly consistent over the past 10 years with approximately 28% CAGR since 2010, according to the company Q2 22 fact sheet.

EPS growth (SIMO Q222 fact sheet)

EPS growth (SIMO Q222 fact sheet)

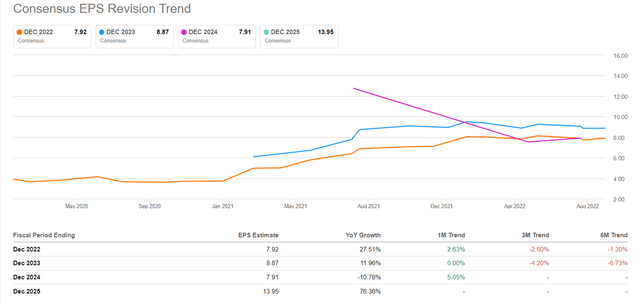

The consensus for future earnings growth remains strong although revisions to those estimates have been reduced slightly in the past 3 months. Even still, the consensus EPS estimates indicate strong growth is expected to continue over the next 3 years. Even if 2023 EPS does not surpass $8, the stock is an excellent value at the current price with a forward P/E below 10 due to investor concerns about future demand for PCs and rising rates putting pressure on operating margins for stocks in the semiconductor industry.

Consensus EPS Revisions (Seeking Alpha)

Consensus EPS Revisions (Seeking Alpha)

Another concern that is impacting both the prospects for a successful merger as well as future growth in earnings is due to the heightened tension between the US and China regarding possible trade restrictions for semis. Although the proposed restrictions are aimed primarily at chip-makers, the news has affected the entire semiconductor industry and has caused prices to drop even further in the past two weeks.

Some of the sources said the regulations would likely include additional actions against China. The restrictions could also be changed and the rules published later than expected.

From the Q2’22 earnings report, the company’s share repurchase plan that was authorized prior to the merger agreement was utilized to repurchase company stock at average prices higher than the current $70.

On December 7, 2021, we announced that our Board of Directors had authorized a new program for the Company to repurchase up to $200 million of our ADSs over a six-month period. During the second quarter of 2022, prior to discontinuation of share repurchases with the announcement of our pending transaction with MaxLinear, Inc. (“MaxLinear”), we repurchased $28.7 million of our ADSs at an average price of $75.58.

In addition, the company has paid a regular quarterly dividend of $.50 per ADS since the $2.00 annual dividend was authorized by the company Board in October 2021. As of May 26, 2022, the company paid out $16.5 million to shareholders for the third annual installment. There will be one additional $.50 quarterly dividend to be paid this year. The dividend yield is about 2.8% on an annual basis.

Global demand for SSD devices and other memory controllers for mobile phones, automotive, data centers, and various industrial applications is likely to continue growing over the next 5 to 10 years, although some short-term slowing in the pace of that demand growth may be expected in the next 3 to 6 months due to inflation, rising rates and ongoing concerns of a recession. While the Fed continues to raise rates and borrowing costs are due to increase, the operating margins may see some compression in the semiconductor industry.

The current financial position for SIMO looks strong and growth has been consistent despite the market concerns in the first half of the year. According to the SA quant grades, SIMO gets a B for Valuation and stacks up nicely against other stocks in the sector.

quant grades (Seeking Alpha)

quant grades (Seeking Alpha)

The potential to realize outsize gains due to the pending merger is one reason to buy SIMO. But on its own merits, the stock rates a Strong Buy rating at current prices even if, or perhaps because the merger does not get approved. I hold a long position in SIMO in my No Guts No Glory IRA portfolio.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SIMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.