By Fat Tail Investment Research

Today’s article tips its hat to our guiding philosophy here at Fat Tail Investment Research of personal freedom and responsibility.

We can’t help but object to the fact that the so-called ‘Super Guarantee’ rose from 10% to 10.5% on 1 July 2022.

It will rise to 11% next financial year. By 2025, it will be 12%.

The finance industry pitches this as a way to secure a healthy retirement for Australia’s workers.

The reality is the government forces you, me, and everyone else to hand our money over to the financial markets, usually via fund managers that rip out billions in fees.

Even if super ‘worked’, philosophically we take issue with the government not only fleecing our wealth through taxes but then telling us what we can do with another 10% it doesn’t steal in the first place.

‘But, but’, some say, ‘super keeps people off the age pension’.

Blah, blah.

What BS.

The Australian Financial Review cited a report on this issue released this year:

‘The PBO modelled a handful scenarios in which superannuation never existed. In most situations, the Commonwealth government would have saved more money if it had never introduced superannuation.’

The tax breaks to the super industry are nearly $40 billion a year.

Mostly due to this, super doesn’t save the government money on funding the pension.

Aussies Lose $30 Billion a Year to This ‘Guarantee’

In 2020, while most of the world was in lockdown, Andrew ‘Twiggy’ Forrest put together a team of 50 staff and travelled the world.

They visited more than 40 countries to talk with politicians, businesspeople, and investors.

All this led Forrest to one conclusion: that there’s a ‘genuine thirst for our green energy.’

As he said back in March last year:

‘I felt a change in the global mood, a shift in belief, that the impossible could be possible.’

As you probably know, this led to Fortescue Metals Group creating a new subsidiary, Fortescue Future Industries (FFI), and setting a 2030 net-zero emissions target.

Yesterday, the company revealed how much they’d be spending on their decarbonisation plan: US$6.2 billion, or around AU$9.2 billion, to switch to renewables.

It’s not just about being ‘green’.

As FMG said, they expect to save US$818 million a year on net operating costs from 2030.

Green hydrogen will play a big role in Fortescue’s ambitious plan.

Along with decarbonising their operations, Fortescue — through FFI — is also planning to produce 15 million tonnes of green hydrogen by 2030, for which they expect to start receiving money as soon as 2024.

It’s interesting, especially as things have been moving for green hydrogen…

Money Flowing into Green Hydrogen

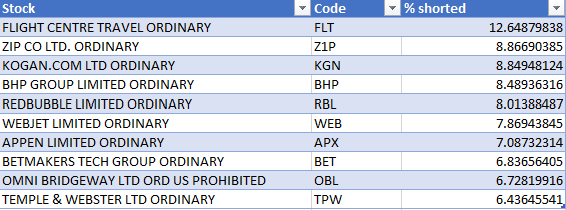

Here are the most shorted ASX stocks as of this time last week.

Flight Centre continues to top the list with popular retail lithium junior Lake Resources coming in fourth.

Lake Resources divulged a dispute with its key technology partner Lilac Solutions last week regarding performance timelines. It will be interesting whether short interest in LKE shares will pick up in the weeks ahead.

Here are the most shorted ASX stocks at the start of the year.

The S&P/ASX 200 sank lower at midday trade on Wednesday as investors look nervously ahead to a big rate hike decision by the US Fed and what precedent it sets for central banks elsewhere in a global fight against inflation.

The worst performers at midday:

Engineering group Monadelphous (ASX:MND) issued a $160 million contracts update on Wednesday.

Monadelphous has secured new contracts and contract extensions worth about $160 million.

One of the contracts involves providing non-process infrastructure services across Fortescue’s Pilbara operations in Western Australia for a three-year period.

Last month, MND released its FY22 results, disclosing revenue of $1.93 billion. Maintenance and industrial services revenue rose 19.4% to $1.17 billion.

MND shares are up 35% year to date.

Immunotherapy developer Imugene (ASX:IMU) is down over 7% in early Wednesday trade.

The fall comes despite Imugene announcing it has dosed the first patient in its Phase 1 metastatic advanced solid tumours (META) study.

The META study is evaluating the safety of IMU’s cancer-killing virus product VAXINIA.

Imugene seeks to recruit 100 patients all up for the study, with patients across the US and Australia.

Imugene MD & CEO, Ms Leslie Chong said:

“I’m very proud of our team and partners on the VAXINIA study who continue to push through the various requirements that come with running a clinical trial. We are eager to see the results from this new route of administration for the drug, in addition to that of the IT arm of the study.”

BNPL stock Sezzle said in an August business update that its “closing the gap to profitability”.

SZL said its cost initiatives are bearing fruit, with the average monthly burn declining from a peak of negative US$8.1 million in 4Q21 to negative US$1.9 million in 3Q22 (quarter to date through end of August).

“In 2022, we have not pursued growth for the sake of growth, and this has been reflected in our recent monthly results, which have shown YoY improvement in Total Income despite lower UMS,” noted Mr. Youakim. “We have had opportunities to pursue significant growth that would be unprofitable, but we believe it is not the right time or environment for us to pursue such activities.”

Graphite producer Syrah Resources (ASX:SYR) entered a trading halt following a “labour-related operational interruption at Balama’, its graphite project in Mozambique.

Syrah expects to make a further announcement to the market before commencing normal trading next Monday.

This labour-related interruption follows SYR suspending staff movements to and from Balama for a week in June

2022.

The halt was a precautionary measure due to insurgent activity in Cabo Delgado, with fellow ASX-listed graphite stock Triton Minerals (ASX:TON) directly affected.

Triton’s Ancuabe site was targeted and two security and caretaker staff perished.

The attacks led Triton to declare force majeure and will remain in place until operations can safely resume.

In its FY22 report, Syrah disclosed that 96% of its direct workforce at Balama are Mozambican nationals. SYR acknowledged that any safety or community concerns risk its Balama operations.

Inability to retain staff has cascading implications beyond the immediate stalling of operations at the site.

In its FY22 report, Syrah explained:

“A limited supply of skilled workers could lead to an increase in labour costs and Syrah being ultimately unable to attract and retain the employees it needs. When new workers are hired, it may also take a considerable period of training and time before they are equipped with the requisite skills to work effectively and safely.”

2:25 pm — September 21, 2022

2:19 pm — September 21, 2022

12:43 pm — September 21, 2022

12:03 pm — September 21, 2022

11:47 am — September 21, 2022

11:29 am — September 21, 2022

11:14 am — September 21, 2022

10:56 am — September 21, 2022

Brought to you by

At Money Morning our aim is simple: to give you intelligent and enjoyable commentary on the most important stock market news and financial information of the day — and tell you how to profit from it.

Our goal is simple: to show you stuff about investing and wealth protection that the mainstream is NOT showing you.

Phone: 1300 667 481

Email: [email protected]

Contact Us

About Money Morning

Whitelist Money Morning

FAQ

Terms and Conditions

Financial Services Guide

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Copyright © 2022 Money Morning Australia | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988