Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Find the solutions you need by accessing our extensive portfolio of information, analytics and expertise. The IHS Markit team of subject matter experts, analysts and consultants offers the actionable intelligence you need to make informed decisions.

Critical analysis and guidance spanning the world’s most important business issues.

Stay abreast of changes, new developments and trends in their industry.

A global team of industry-recognized experts contributes incisive and thought-provoking analysis.

Broaden your knowledge by attending IHS Markit events that feature our subject-matter experts. Find webinars, industry briefings, conferences, training and user groups.

During COVID-19, IHS Markit is offering more online events for the safety of our guests.

IHS Markit will resume our in-person events once it is safe to do so.

Missed an event or webinar? Review the recordings of past online events.

IHS Markit is the leading source of information and insight in critical areas that shape today’s business landscape. Customers around the world rely on us to address strategic and operational challenges.

The experts and leaders who set the course for IHS Markit and its thousands of colleagues around the world.

Sustainability drives the entire IHS Markit enterprise. It’s how we do business by guiding our values and culture on the notion that we can make a difference.

Join a global business leader that is dedicated to helping businesses make the right decisions. Be a part of a family of professionals who thrive in an exciting work environment.

Recognizing that high inflation will not quietly go away, the world’s major central banks are toughening their policies.

Gradualism has given way to super-sized interest rate increases and a clearer resolve to restrain actual and expected inflation, despite adverse economic consequences. The more hawkish rhetoric and policy actions have unsettled financial markets, driving up term yields and risk spreads. In turn, equity prices have fallen in an environment of weak corporate earnings and rising interest (discount) rates. Meanwhile, the US dollar’s exchange value has soared in response to rising US bond yields and investor flight to safety; this is adding to inflation and financial stresses in emerging and developing countries.

With financial conditions deteriorating, the economic outlook for 2023 has dimmed.

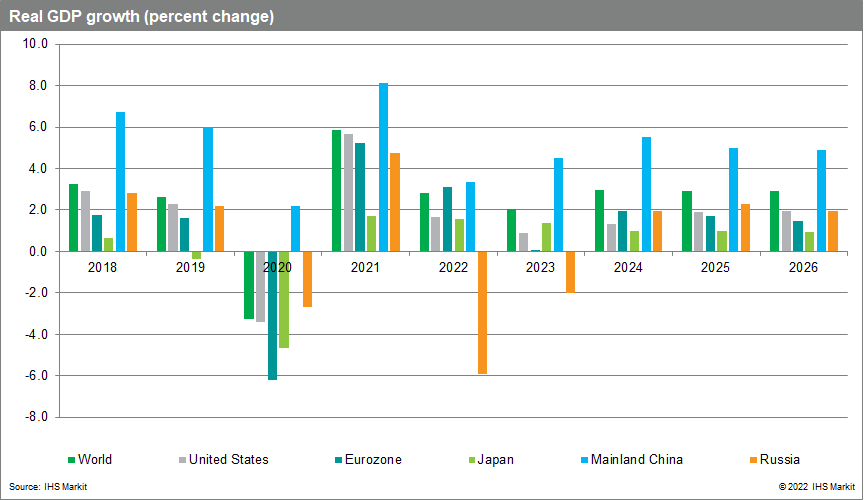

We now project global real GDP growth to slow from 5.8% in 2021 to 2.8% in 2022 and 2.0% in 2023. The 2023 growth rate is revised down 0.3 percentage point from last month’s forecast, reflecting weaker outlooks for the world’s largest economies—the eurozone, mainland China, Japan, and United States. The global situation can be characterized as a growth recession, in which real GDP growth falls short of potential growth (currently near 3.0%) and unemployment rises. The period of weakest growth and highest vulnerability will be in late 2022 and early 2023, when a new major shock could tip the world economy into recession. While our forecast does not anticipate a global recession, parts of the world will experience recessions, including Western Europe and parts of Latin America (e.g., Argentina and Chile).

If price inflation diminishes over the next two years, approaching central bank targets, monetary policies will ease and economic growth will revive. We project global real GDP to pick up to 2.9% in both 2024 and 2025. The strongest gains will be in Asia Pacific (4.6% in 2024 and 4.2% in 2025), led by India, Indonesia, Vietnam, the Philippines, and Bangladesh. These countries will benefit from regional free-trade agreements, competitive costs, and efficient supply chains.

Inflation will subside as demand cools and supply conditions improve.

Commodity prices drifted lower in early September in response to rising interest rates, softening global demand, and dollar appreciation. As of mid-September, our Materials Price Index has fallen 23% from its early March peak. The retreat in commodity prices is filtering downstream to intermediate and finished products and will bring some relief to consumers in the year ahead. Meanwhile, rising unemployment will restrain increases in wage rates and prices of labor-intensive services. After picking up from 3.9% in 2021 to 7.6% in 2022, global consumer price inflation should ease to 4.8% in 2023 and 2.8% in 2024.

Western Europe faces a winter recession with high energy costs and limited energy supplies.

After robust, consumer-led growth in the first two quarters of 2022, the eurozone economy stalled in the third quarter. The temporary boost from pent-up demand for consumer services appears to be fading, giving way to headwinds from energy supply and price issues, the ongoing Russia-Ukraine war, tightening financial conditions, and deteriorating confidence. With consumer price inflation approaching 10% y/y this fall, we now expect that the European Central Bank will raise its benchmark policy rate to a high of 2.75% by February 2023 and hold it at this level for a year. We expect eurozone real GDP to decline in late 2022 and early 2023, as households and businesses contend with soaring energy bills and potential energy disruptions. Natural gas supply curtailment would pose risks to Europe’s electric power, basic metals, chemicals, plastics, glass, and ceramics industries. We expect eurozone annual real GDP growth to slow from 5.2% in 2021 to 3.1% this year and 0.0% in 2023 before recovering to 1.9% in 2024.

The US economy faces an extended period of tepid growth and rising unemployment.

US inflation is at a four-decade high following supply chain disruptions, a tight labor market, and fiscal and monetary stimulus during the COVID-19 pandemic. Despite a slight easing since June, consumer price inflation remained high at 8.3% y/y in August. The Federal Reserve is now determined to bring inflation back to its 2% target and will likely raise the federal funds rate to 4% or higher by the end of 2022. The US economy is still expected to avert a recession, as tight labor markets support sustained growth in consumer spending. However, rising financing costs will lead to significant declines in residential and commercial construction. We expect real GDP growth to slow from 5.7% in 2021 to 1.7% in 2022 and 0.9% in 2023 before edging up to 1.3% in 2024. With growth falling short of potential, the US unemployment rate will likely rise from 3.7% in July to 4.7% in 2025.

Mainland China economic growth remains subpar.

After a setback related to COVID-19 lockdowns in the second quarter, mainland China’s economy is expanding again. Industrial production rose 4.2% y/y in August, while services output increased just 1.8% y/y. Growth will likely remain constrained by the government’s dynamic zero-COVID policy, a deep property sector recession, and weakening export demand. The lift from stimulus policies will be limited, as the government remains cautious owing to concerns about high debt leverage. We project real GDP growth to slow from 8.1% in 2021 to 3.3% in 2022 before picking up to 4.5% in 2023 and 5.5% in 2025.

Bottom line

Tightening financial conditions will lead to a further slowdown in global economic growth, putting expansions in vulnerable regions at risk and deepening anticipated recessions in Europe. The combination of subpar economic growth, rising unemployment, and improving supply chain conditions will cause inflation to subside over the next two years.

Posted 22 September 2022 by Sara Johnson, Executive Director – Economic Research, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

RT @WilliamsonChris: Is the #US #economy turning a corner? Consumer confidence and @SPGlobalPMI flash services survey data have lifted hig…

RT @Africeconomist: While many emerging and frontiers are raising their interest rates in line to FED and ECB, Angola went against the odds…

The sharp worsening in financial conditions points to a further weakening in spending that will cause the US econom… https://t.co/zYOV2ZnaBV

Our chief business economist @WilliamsonChris shared these thoughts with @markets: “The challenge facing policy ma… https://t.co/P7PaUZ5i3S