Visualized: The World’s Population at 8 Billion

The Biggest Tech Talent Hubs in the U.S. and Canada

The Inflation Factor: How Rising Food and Energy Prices Impact the Economy

Ranked: The Most Popular Fast Food Brands in America

Ranked: America’s Best States to Do Business In

iPhone Now Makes Up the Majority of U.S. Smartphones

Visualized: The State of Central Bank Digital Currencies

The Evolution of Media: Visualizing a Data-Driven Future

33 Problems With Media in One Chart

The Top Downloaded Apps in 2022

Mapped: The World’s Billionaire Population, by Country

Charting the Relationship Between Wealth and Happiness, by Country

Mapped: A Snapshot of Wealth in Africa

Mapped: The Wealthiest Billionaire in Each U.S. State in 2022

Visualized: The State of Central Bank Digital Currencies

Visualizing the Relationship Between Cancer and Lifespan

Explainer: What to Know About Monkeypox

Visualizing How COVID-19 Antiviral Pills and Vaccines Work at the Cellular Level

Mapped: The Most Common Illicit Drugs in the World

Visualizing The Most Widespread Blood Types in Every Country

Visualizing the Range of Electric Cars vs. Gas-Powered Cars

What is the Cost of Europe’s Energy Crisis?

All Electric Semi Truck Models in One Graphic

The Inflation Factor: How Rising Food and Energy Prices Impact the Economy

Visualizing China’s Dominance in the Solar Panel Supply Chain

Mapped: Countries With the Highest Flood Risk

Ranked: The 20 Countries With the Fastest Declining Populations

Iconic Infographic Map Compares the World’s Mountains and Rivers

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Mapped: The State of Global Democracy in 2022

Mapped: The 10 Largest Gold Mines in the World, by Production

The 50 Minerals Critical to U.S. Security

Visualizing China’s Dominance in Clean Energy Metals

The Periodic Table of Commodity Returns (2012-2021)

Visualizing the Abundance of Elements in the Earth’s Crust

Mapped: Countries With the Highest Flood Risk

Visualizing China’s Dominance in the Solar Panel Supply Chain

All the Contents of the Universe, in One Graphic

Explained: The Relationship Between Climate Change and Wildfires

Visualizing 10 Years of Global EV Sales by Country

Published

on

By

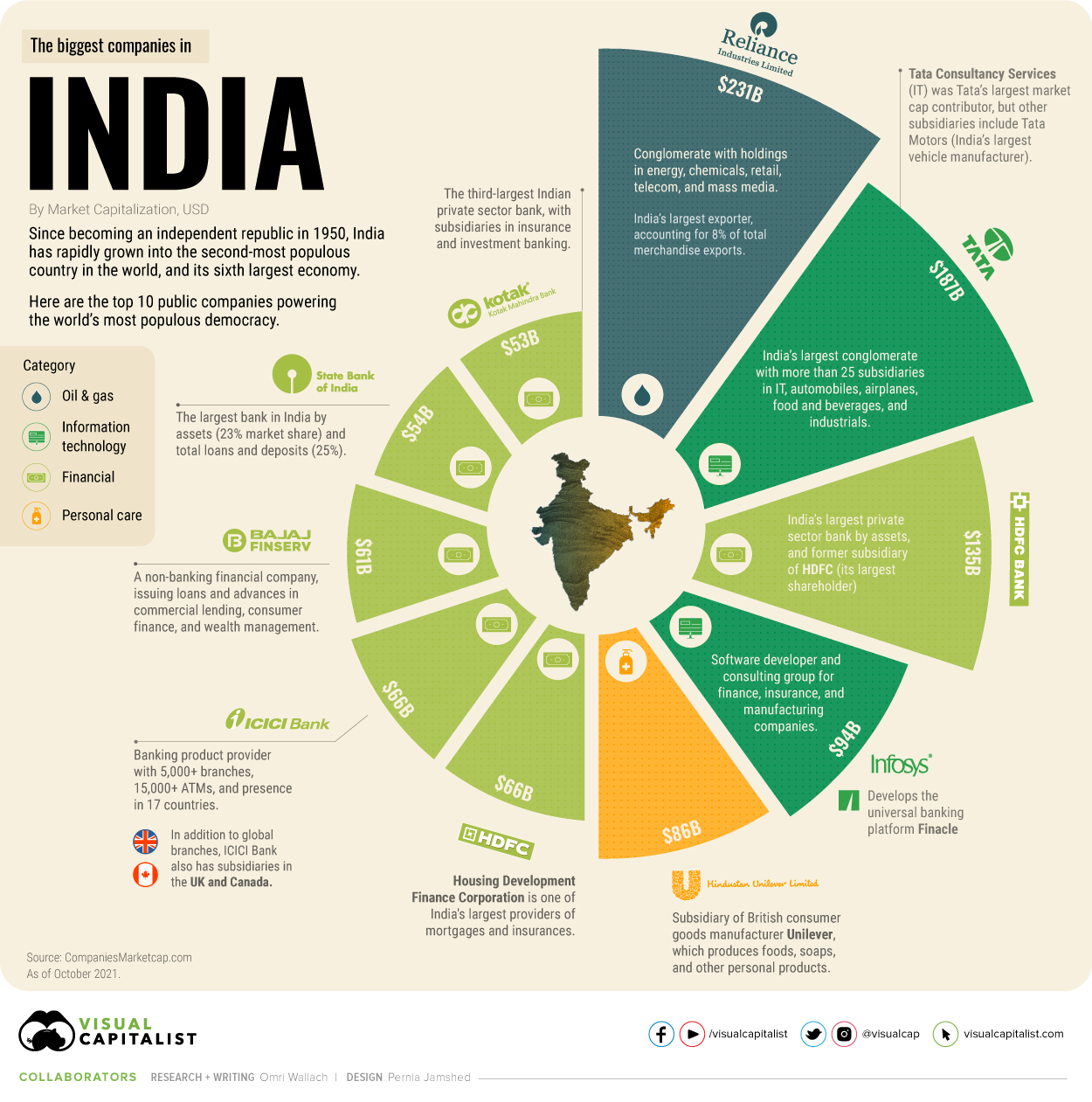

When India hosted the 13th BRICS summit in September 2021, it was the sixth-largest economy in the world with a GDP of $3.05 trillion.

That’s more than double the GDP it had when the country first joined the group of emerging economies in 2009 (alongside Brazil, Russia, China and later South Africa), at $1.3 trillion.

What are the major industries and companies driving this growth in GDP, and rising alongside it? This time we’re highlighting the top 10 biggest companies in India, the world’s most populous democracy.

India’s growth to one of the world’s most powerful economies came extremely quickly, considering it only became a federal republic in 1950.

In 1951, the country was considered relatively impoverished compared to the Western world, with 361 million people, a per-capita income of just $64, and a literacy rate of 17%. By 2021, the population had surged to 1.2 billion, income rose to $1,498, and literacy climbed to 74%.

And most of that growth was fueled internally, as the Indian government was largely protectionist until the 1990s. Today, its free market policies and wide cultural reach help bolster the country’s massive industrial, agricultural, and telecommunications industries.

Here are India’s biggest public companies by market capitalization in October 2021:

Topping the charts are two massive conglomerates, Reliance Industries with a market cap of $231 billion and Tata Group with a market cap of $187 billion.

Reliance started in textile production before a string of oil discoveries and purchases saw it overtake state-owned oil enterprises in revenue. Now the conglomerate also has holdings in petrochemicals, retail, telecom, and mass media, making chairman and largest shareholder Mukesh Ambani the richest person in Asia with a net worth of $100 billion.

But India’s largest conglomerate is Tata Group, with more than 25 subsidiaries in IT (its largest income source), airplanes, food and beverages, and industrials. Tata Motors is India’s largest vehicle manufacturer, and the owner of South Korea’s Daewoo and the UK’s Jaguar Land Rover.

Outside of major conglomerates and a well-known subsidiary, India’s top 10 biggest companies are concentrated in the financial sector.

One of those is HDFC Bank with a market cap of $135.1 billion. An offshoot of the #6 ranked company Housing Development Finance Corporation, HDFC Bank is India’s largest private sector bank by assets.

In total, financials make up six of India’s 10 biggest companies. In addition to HDFC, they include banking provider ICICI Bank (which also has subsidiaries in the UK and Canada), commercial lending company Bajaj Finance, and banks Kotak Mahindra Bank and State Bank of India (the country’s first national bank and its largest).

But there were two non-financial companies bigger than most of India’s banks; Financial software developer and consultant Infosys and personal products company Hindustan Unilever, a subsidiary of British consumer goods giant Unilever.

India is also an agricultural powerhouse—the world’s largest producer of milk and second largest of tea—but most of it is consumed internally by its sizable population. Agriculture accounts for 18.1% of the country’s GDP, behind services at 55.6% and the industrial sector at 26.3%.

With more rapid economic growth on the horizon, India’s biggest companies list might shift over time. What other companies or industries do you associate with India?

Visualized: A Global Risk Assessment of 2022 and Beyond

Companies Gone Public in 2021: Visualizing IPO Valuations

Visualized: The World’s Population at 8 Billion

What is the Cost of Europe’s Energy Crisis?

The Biggest Tech Talent Hubs in the U.S. and Canada

Visualizing China’s Dominance in the Solar Panel Supply Chain

Ranked: Top 10 Countries by Military Spending

Visualizing Major Layoffs At U.S. Corporations

This interactive graphic shows a breakdown of how average Americans spend their money, and how expenses vary across generations.

Published

on

By

In 2021, the average American spent just over $60,000 a year. But where does all their money go? Unsurprisingly, spending habits vary wildly depending on age.

This graphic by Preethi Lodha uses data from the U.S. Bureau of Labor Statistics to show how average Americans spend their money, and how annual expenses vary across generations.

Overall in 2021, Gen X (anyone born from 1965 to 1980) spent the most money of any U.S. generation, with an average annual expenditure of $83,357.

Gen X has been nicknamed the “sandwich generation” because many members of this age group are financially supporting both their aging parents as well as children of their own.

The second biggest spenders are Millennials with an average annual expenditure of $69,061. Just like Gen X, this generation’s top three spending categories are housing, healthcare, and personal insurance.

On the opposite end of the spectrum, members of Generation Z are the lowest spenders with an average of $41,636. per year. Their spending habits are expected to ramp up, especially considering that in 2022 the oldest Gen Zers are just 25 and still early in their careers.

While spending habits vary depending on the age group, there are some categories that remain fairly consistent across the board.

One of the most consistent spending categories is housing—it’s by the far the biggest expense for all age groups, accounting for more than 30% of total annual spending for every generation.

Another spending category that’s surprisingly consistent across every generation is entertainment. All generations spent more than 4% of their total expenditures on entertainment, but none dedicated more than 5.6%.

Gen Zers spent the least on entertainment, which could boil down to the types of entertainment this generation typically enjoys. For instance, a study found that 51% of respondents aged 13-19 watch videos on Instagram on a weekly basis, while only 15% watch cable TV.

One category that varies the most between generations and relative needs is spending on healthcare.

As the table below shows, the Silent Generation spent an average of $7,053 on healthcare, or 15.8% of their total average spend. Comparatively, Gen Z only spent $1,354 on average, or 3.3% of their total average spend.

However, while the younger generations typically spend less on healthcare, they’re also less likely to be insured—so those who do get sick could be left with a hefty bill.

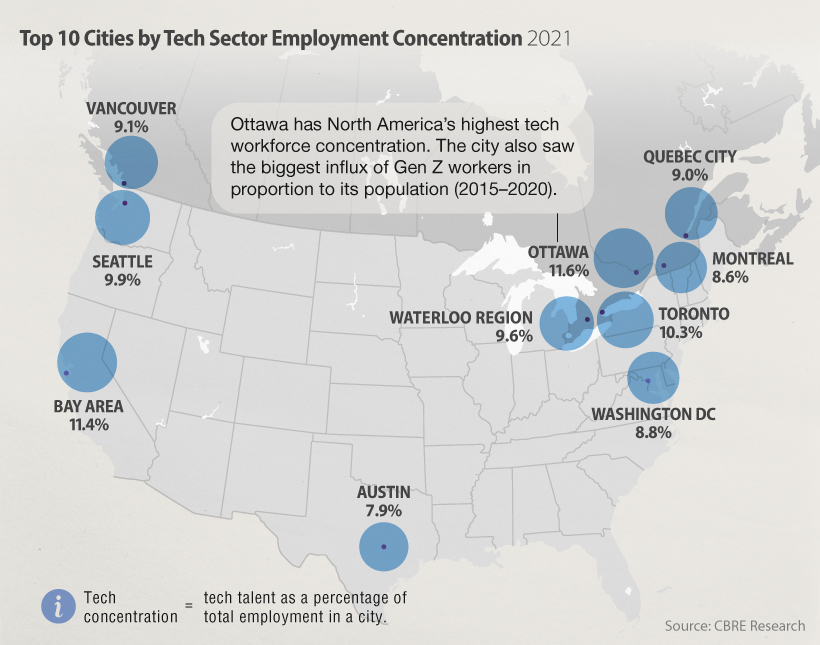

6.5 million skilled tech workers currently work in the U.S. and Canada. Here we look at the largest tech hubs across the two countries

Published

on

By

The tech workforce just keeps growing. In fact, there are now an estimated 6.5 million tech workers between the U.S. and Canada — 5.5 million of which work in the United States.

This infographic draws from a report by CBRE to determine which tech talent markets in the U.S. and Canada are the largest. The data looks at total workforce in the sector, as well as the change in tech worker population over time in various cities.

The report also classifies which metro areas and regions can rightly be considered tech hubs in the first place, by looking at a variety of factors including cost of living, average educational attainment, and tech employment levels as a share of different industries.

Silicon Valley, in California’s Bay Area, remains the most prominent (and expensive) U.S. tech hub, with a talent pool of nearly 380,000 tech workers.

Here’s a look at the top tech talent markets in the country in terms of total worker population:

America’s large, coastal cities still contain the lion’s share of tech talent, but mid-sized tech hubs like Salt Lake City, Portland, and Denver have put up strong growth numbers in recent years. Seattle, which is home to both Amazon and Microsoft, posted an impressive 32% growth rate over the last five years.

Emerging tech hubs include areas like Raleigh-Durham. The two cities have nearly 70,000 employed tech workers and a strong talent pipeline, seeing a 28% increase in degree completions in fields like Math/Statistics and Computer Engineering year-over-year to 2020. In fact, the entire state of North Carolina is becoming an increasingly attractive business hub.

Houston was the one city on this list that had a negative growth rate, at -2%.

Tech giants like Google, Meta, and Amazon are continuously and aggressively growing their presence in Canada, further solidifying the country’s status as the next big destination for tech talent. Here are the country’s four tech hubs with a total worker population of more than 50,000:

Toronto saw the most absolute growth tech positions in 2021, adding 88,900 jobs. The tech sector in Canada’s largest city has seen a lot of momentum in recent years, and is now ranked by CBRE as North America’s #3 tech hub, after the SF Bay Area and New York City.

Vancouver’s tech talent population increased the most from its original figure, climbing 63%. Seattle-based companies like Microsoft and Amazon have established sizable offices in the city, adding to the already thriving tech scene. Furthermore, Google is set to build a submarine high-speed fiber optic cable connecting Canada to Asia, with a terminus in Vancouver.

Not to be left behind, Ottawa has also taken giant strides to increase their tech talent and stamp their presence. The country’s capital even has the highest concentration of tech employment in its workforce, thanks in part to the success of Shopify.

The small, but well-known tech hub of Waterloo also had a very high concentration on tech employment (9.6%). The region has seen its tech workforce grow by 8% over the past five years.

Six out of the top 10 cities by tech workforce concentration are located in Canada.

The post-COVID era has seen a shifting definition of what a tech hub means. It’s clear that remote work is here to stay, and as workers migrate to chase affordability and comfort, traditional tech hubs are seeing some decline — or at least slower growth — in their population of tech workers.

While it isn’t evident that there is a mass exodus of tech talent from traditional coastal hubs, the rise in high-paying tech jobs in smaller markets across the country could point to a trend and is positive for the industry.

While more workers with great talent, resources, and education continue to opt for cost-friendly places to reside and work remotely, will newer markets like Charlotte, Tennessee, and Calgary see a rise of tech companies, or will large corporations and startups alike continue to opt for the larger cities on the coast?

Visualized: The World’s Population at 8 Billion

Charting the Relationship Between Wealth and Happiness, by Country

Mapped: The World’s Billionaire Population, by Country

Mapped: A Snapshot of Wealth in Africa

Mapped: Countries With the Highest Flood Risk

Top 20 Countries With the Most Ultra-Wealthy Individuals

The Biggest Tech Talent Hubs in the U.S. and Canada

Mapped: Which Countries Still Have a Monarchy?

Copyright © 2022 Visual Capitalist