Macroeconomic policy support may be needed if there is a deep and rapid correction in the New Zealand housing market, the International Monetary Fund says.

In its latest review of the New Zealand economy, the IMF has had a close and detailed look at the housing market here.

It says that financial stability risks from a sharp downturn in the housing market are limited given high bank capitalisation, “but pockets of vulnerability, particularly amongst recent borrowers, may exist”.

“More broadly, there is likely to be a larger impact on consumption through wealth and sentiment effects. In a scenario of a marked housing correction, macroeconomic policy support may be needed to avoid second round effects and a pronounced downturn.”

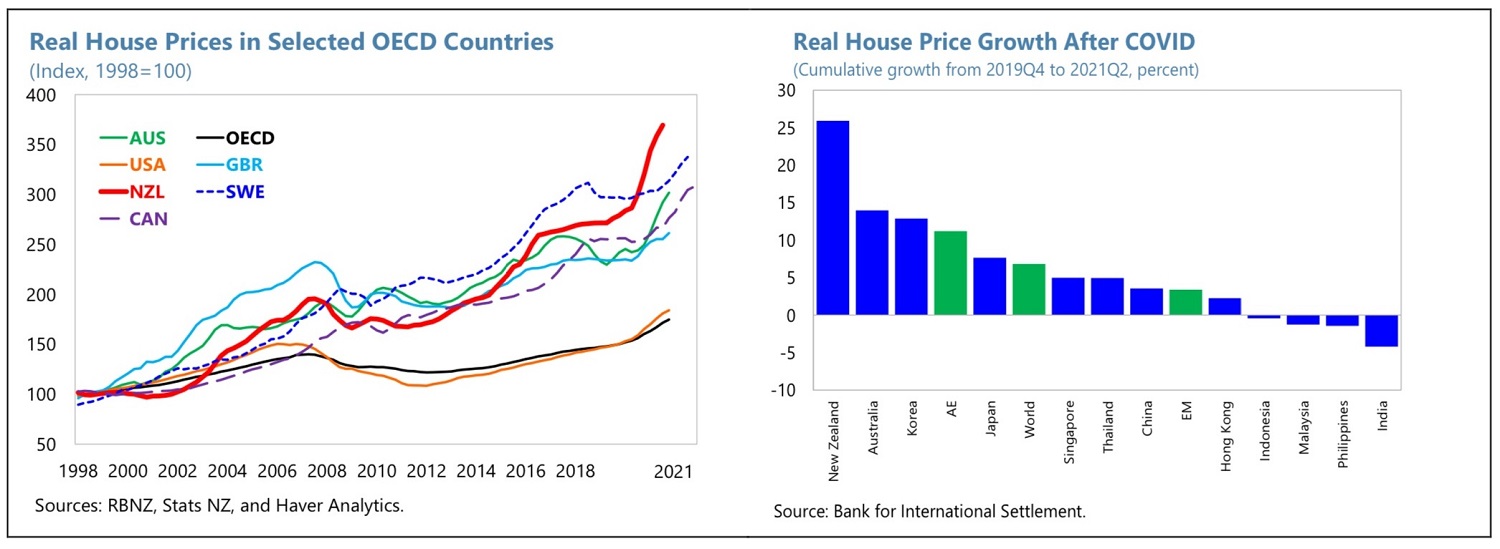

The IMF notes that price increases in New Zealand have been higher than in other advanced economies, particularly in the post-Covid-19 period.

“House prices in New Zealand were already increasing faster than in its peers before Covid-19, and the pandemic accelerated this trend.

“Since 1998, prices in New Zealand have increased by over 250%, almost four times the average increase across OECD countries (around 70%).

“And this trend has continued during the Covid-19 period— from 2019 Q4 to 2021 Q2, house prices in New Zealand increased by close to 26%, compared with around 11% in other advanced economies and less than 7%.”

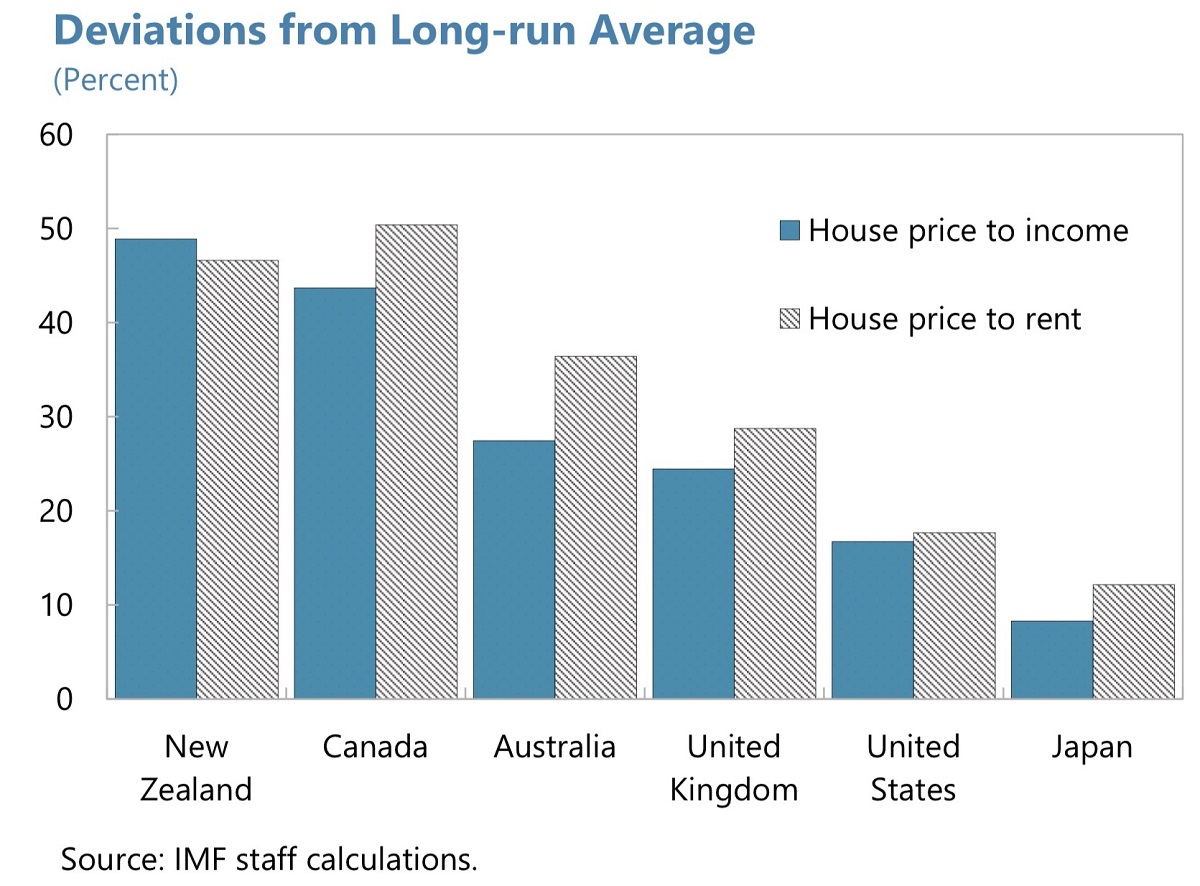

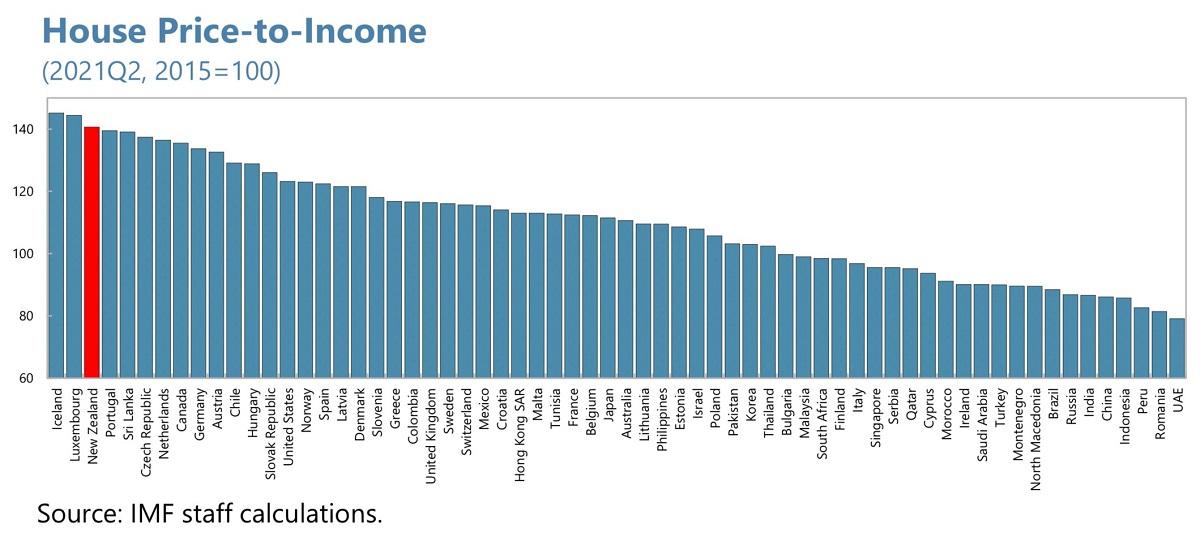

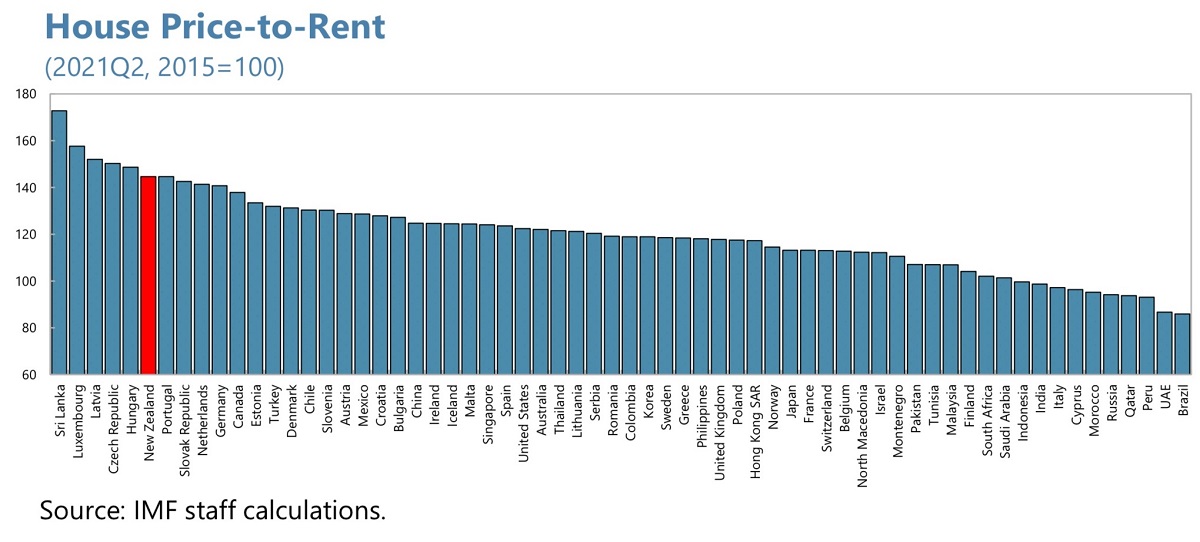

A similar trend is observed for affordability metrics, with New Zealand impacted more strongly than most other OECD countries, the IMF says.

“Comparing across countries is challenging given vastly different starting points and heterogeneity in quality of housing. However, we can focus on changes in these metrics to assess whether affordability has improved or deteriorated over time. New Zealand ranks highest in the Asia-Pacific region and is near the top among OECD countries in terms of increases in house-price-to-income and house-price-to-rent ratios since 2015.”

The IMF says macroprudential measures in NZ to alleviate the impact of the pandemic eased housing credit attainability, including for investment, “further increasing demand”.

“The temporary removal of loan-to-value (LVR) restrictions during the pandemic resulted in an increase in high LVR and high debt-to-income (DTI) lending.

“A large contributor to overall demand was investor appetite, driven in part by easy attainability of high LVR mortgages for investors.

“Until recent policy action, including macroprudential tightening and tax policy changes, a rapid increase in high-LVR investor loans fueled demand.

“This was particularly the case because mortgage interest payments as a share of rents were also low, resulting in lucrative opportunities for investors. However, this increase in investor demand might have helped check the increase in rental prices to some extent.”

Now the IMF says a moderation of prices has set in, “but there are macroeconomic risks in both directions”.

“The timing and depth of the turnaround in the housing market remains uncertain, as house prices have proven difficult to predict (house price expectations pointed to a decline during the pandemic, which did not take place). House prices could quickly stabilise or decline sharply. A sudden and deep correction would likely have significant spillovers to the rest of the economy.”

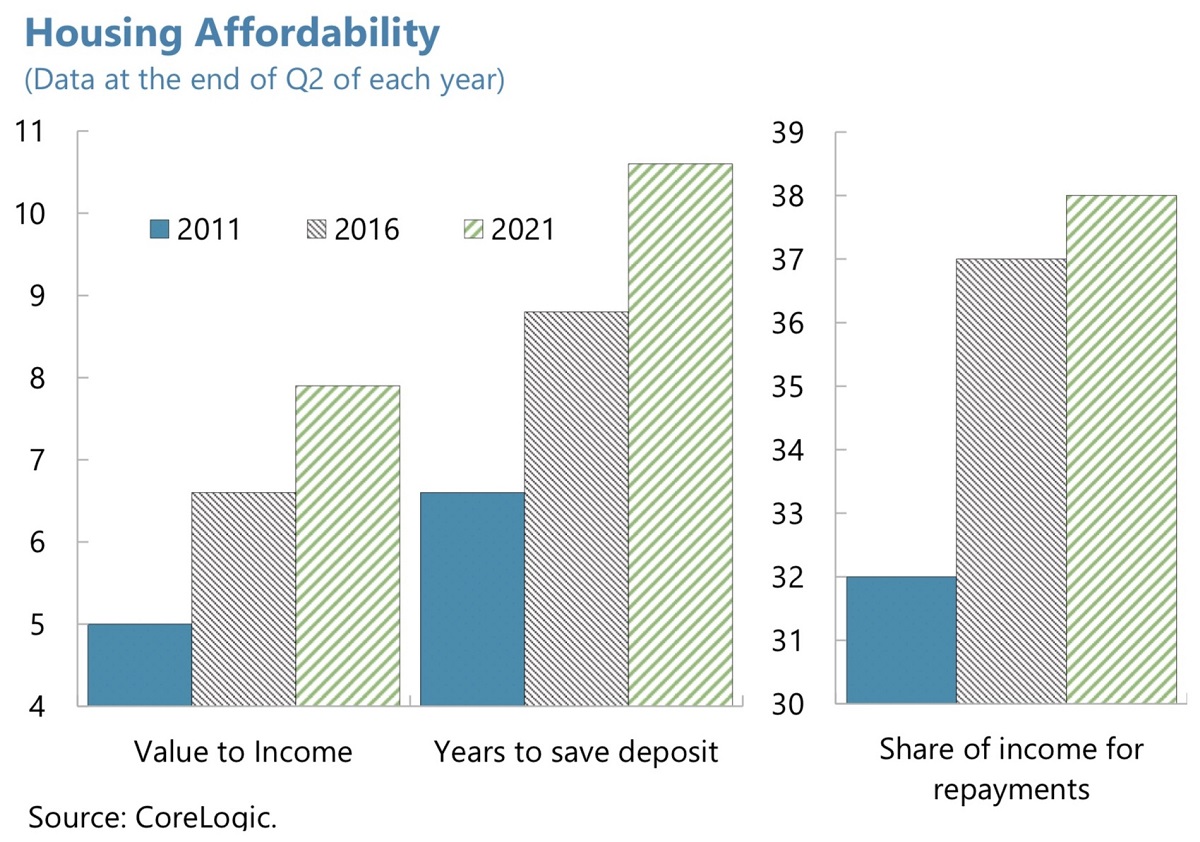

Rising mortgage rates are set to “further dent” housing affordability, the IMF says.

“We can measure affordability using a borrowing capacity approach based on the maximum size of a mortgage loan attainable by a household to finance a home purchase given its income, the prevailing mortgage rate, and leverage requirements.

“Until recently, low mortgage rates meant that median house prices in New Zealand were about 26% higher than house prices attainable under a 30% debt-service-to-income ratio (DSTI).

“But the rise in mortgage rates at the end of 2021 and its projected path in 2022 are set to increase this gap to over 60% by June 2022 if house prices remain at the December 2021 level. This raises serious affordability concerns.”

Borrowers are vulnerable to rising interest rates, the IMF notes.

“New Zealand’s household debt, most of it housing-related, is high, having increased from 158% of disposable income at end-2019 to 169% in June 2021.

As interest rates rise, homeowners, particularly those who have taken out mortgages recently with high home values, will face higher interest payments relative to their incomes as their mortgages reprice.

“While there has been a trend towards taking out longer fixed-term mortgages, especially in 2021 when rates were at an all-time low, a vast majority of mortgages in New Zealand are at a floating rate or fixed for less than one year, with only 5% of owner occupier mortgages fixed for three or more years.

“Estimates suggest that during 2022, almost NZ$215 billion worth of mortgages will have to be rolled over at sharply higher interest rates.”

Higher interest payments will be a drag on private consumption and economic growth, the IMF says.

Although stress tests by banks suggest that most borrowers are likely to be able to afford this increase in mortgage rates, limiting financial stability risks, interest payments as a share of disposable income are expected to increase significantly.

“Since their trough in June-2021, implicit interest rates on housing—calculated as the ratio of households’ interest payment on housing loans over total housing loans outstanding—increased from 3.2% to 4.2% at the end of December 2021, and are expected to increase (based on our baseline projection for policy rates) to 4.7% and 6.1% by June 2022 and 2023 respectively.

“Rising interest payments will likely constitute a drag on household private consumption and overall economic growth.

“The magnitude will depend on the elasticity of private consumption to disposable income, which can vary widely depending on the nature of the income shock (temporary vs permanent) and household characteristics (income distribution, savings etc.), but could range from 0.3% to 0.5% of GDP in 2022 and 0.6% to 1.3% of GDP in 2023. However, rising deposit rates could help offset some of this increase by increasing income from financial assets, though the distribution of assets and liabilities are likely to be skewed amongst households.”

The IMF notes that rents have increased less and rent as a share of income has remained stable, “but the rental burden is high”.

“…Data on the price of actual rentals for housing available from the household living costs price indexes show that the increases have been somewhat higher for lower income quintiles, which also have a higher weight of rents in their overall cost price indices, suggesting an increasing burden for poorer households.

“The same holds true for Māori communities, which have seen higher increases in rental prices.

“To put this in context, comparing with other OECD economies, the rental burden in New Zealand is relatively high, particularly for the bottom 20% of the income distribution.

“In addition, survey data suggests that housing satisfaction in New Zealand is relatively low compared with the rest of the OECD, while homelessness is high.”

The IMF says tackling housing imbalances requires a comprehensive approach, and recent initiatives will help address these imbalances. Achieving long-term housing sustainability and affordability depends critically on freeing up land supply, improving planning and zoning, and fostering infrastructure investments to enable fast-track housing developments and lower construction costs. Recent amendments to the RMA and the easing of zoning restrictions to permit medium-density housing in all of the country’s major cities represent a major departure from the systems in place from the 1980s that encouraged low-density detached single-family housing.

“Increasing the stock of social housing also remains important. While increasing overall housing supply is critical, given high homelessness and rental burden particularly in the lower income quintiles, it is also necessary to take into account distributional issues.

“Even with a large correction in prices, low-income New Zealanders are unlikely to be able to enter the housing market in the near term. Housing costs for low-income New Zealanders have doubled as a proportion of their income since the 1980s, and homeownership rates have fallen while household debt has increased substantially. This highlights the need to increase the stock of social housing.”

Your access to our unique and original content is free, and always has been.

But ad revenues are under pressure so we need your support.

Supporters can choose any amount, and will get a premium ad-free experience if giving a minimum of $10/month or $100/year. Learn more here.

become a supporter

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don’t welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.

The charts confirm New Zealand as world leading housing basket case.

It’s best to find something more interesting to do with your life until it sorts itself out.

✈️✅

… no no … not world leading , we’re only 3’rd worst in the world … those other economic power houses Luxembourg & Iceland are ahead of us …

Only third in the OECD

Whats your point? At least in non-OECD nations, living in a tent might be acceptable as opposed to being forced to partake in a rigged housing system that intends to enrich those who are already well off at the expense of those who are not.

LOL. This is so true.

It’s a shocking indictment of policy and decision makers in NZ over successive decades. The adjustment will be painful. I hope it won’t all fall on those at the bottom end of the wealth and income distribution is is the usual way here in New Zealand. The 1930s legislation giving mortgage relief to borrowers underwater hasn’t been repealed. We could pull that out and look at doing something similar.

Mortgagors and Lessees Rehabilitation Act 1936: https://www.legislation.govt.nz/act/public/1936/0033/latest/whole.html#…

Things will get a lot worse between now and the next election.

Labour has cemented a slave class. The non-elite climate bangers will soon wake to desperate poverty and homelessness.

Why do you say that?

[ casual racism and personal insults removed, not needed here. Adult criticism please. Ed ]

Once again we have a govt that pushing through things that they did not campaign on. I was brought up a labour voter, and labour will never get my vote ever again . National have more brains even if they let school kids starve. Bring back Roger nomics and get rid of this not so we’ll being budget

Shine a light and the cockroaches start scurrying

Shocking indictment indeed. It was one thing to lower interest rates during the onset of the Covid pandemic, however, the tap of cheap money kept flowing and flowing (thanks Mr Orr). Savers were going backwards earning less than 1% interest – what did Mr Orr expect that they would do with their money? The last straw for me was hearing from our PM that she believed people expected home prices to increase.

what did Mr Orr expect that they would do with their money?

Buy Bitcoin and HODL

But seriously, he would probably prefer you to keep it in the bank. Most NZers are living paycheck to paycheck anyway: 50% of ASB accounts have < $1,000 and about 2/3 <$10,000.

I know you love this statistic. But I’m not sure how useful it is. We have a slew of of ASB accounts, some of which have $0 in, but it’s not worth the bother to close them. Quite possibly those statistics apply to our accounts as a whole, in fact, but you would be very wrong to assume that it means we are living paycheck to paycheck.

I know. It’s the only research I can find. The interesting thing is that it’s consistent with other cash savings profiles across popns across the Anglosphere. You can split hairs and not take the research seriously, but it should not really be dismissed that readily.

The underlying conclusion may be correct. I don’t know. But I don’t think you can really say from those stats.

OK. Across the Tassie, the ME Financial Comfort Report has been run for many years. It reports that only 22% of h’holds have <$1,000 in cash savings. 43% have <$10,000.

But this research is done at the h’hold level in a survey methodology. The ASB data is at the individual level (savings accounts). 2/3 of h’holds could only hang on for 3 months if they lost their income.

https://www.mebank.com.au/getmedia/9f212517-8d7e-4990-97cd-9dcc36a39a4b…

Length of time to build houses is blowing out now as the materials shortages bite, we will be 3 and a half years, most likely for ours, if we can ever actually start. Took around 5 months to get consent, 6 months for engineering, 6 months for design work… etc etc. Build time has now gone from 6 months to “expect it to take a year, at least” according to the builder… so if there is a housing supply issue (which I am sceptical about), its not going away anytime soon.

Also the resource consent process is ridiculous “Oh you want to move about 30m3 of dirt around? Resource consent please!”, which involved engaging engineering firms who “know how to do it” and about $12k later, you are allowed to move 30m3… but it takes 2 months. Don’t worry though, this will be “solved” with the new Startegic Planning Act right? RIGHT??

What are the council staff who determine the validity of said dirt movement going to do? Redundant? Unlikely. Your unlikely to get better outcomes by changing the role titles of the same staff.

Most people could see this was going to end badly. House price’s will fall quickly and end up in a place where average wage couple can buy so anyone who purchased in last 5 too 6 years will have a shock if haven’t already sold a lot of these people made huge amounts on way up this has to happen or more people will be living in cars or government supported accommodation. Most places in Auckland are seeing crime surge society is crumbling poverty is increasing and a huge part of this is because of housing affordability the government will have work cut out with this and if they start bailing the house owners because of their bad decisions this divide will become bigger between rich and poor.

Rising interest rates and initiatives by our Government, have arrested the increase in house prices. The question is whether prices will fall to an affordable level.

I think the other issue is, affordable for whom? The prices will come down due to the cost of interest and the legislative changes but by how much?

One view is that those who bought with large mortgages will have to surrender their properties to others who can afford it. Those with large equity buffers. Not those who want a place to raise a family. Those who are displaced will become renters on a reducing rental pool making the rent go up. Making paying higher house prices more affordable.

Without increasing supply it will be a bumpy ride down the escalator.

The answer to your question is no.

Much of the fate of financial and human capital in this country is tied to housing economy. This means a big price correction could trigger an economic crisis leading to high joblessness, particularly among low-income earners.

The low income earners can only take so much a major housing crash is needed or the only thing going on is a continuation of buy and selling of houses, we need to see a change government should build houses rent them out cheaply bring down rents and house prices put regulations in place so a housing crisis can never happen again.

This report assumes Orr will have the wriggle room to stop a rapid, and appropriate correction. The OCR is now largely out of his control. Other measures are trivial in comparison to servicing huge loans.

“The OCR is now largely out of his control.”

Agree, but if you said that 12 months ago you would have been laughed out of town.

Until quite recently “everybody” believed that RBNZ had full control over the OCR. It was a lie that was promulgated by the RBNZ and pretty much all media.

People were borrowing wild amounts of money, and saying that RBNZ would never “let” mortgage rates rise again.

Yes and everyone should ‘be quick’ as unless you buy now you might miss out for life.

Flash forward 6 months and those who waited will have saved themselves 10% on the average home across NZ which is close to $100,000…..or years upon years of saving for a deposit.

(any idea how many years it takes the avearge young couple to save $100,000 which was about half of the 20% deposit requirement for the average home in NZ?)

Don’t worry, spruikers will make adjustments to the narrative and keep moving the goalposts no matter what.

If you didn’t buy, they’ll point out how much gains you missed out on in the big 2021 rally.

If you did buy and started losing money in 2022, they’ll point out how it’s not really a loss unless you sell and it will surely go up and **instrinsic value!!!!** and all that crap.

You really can’t win against some people.

They are self-serving specufestors whose only interest is in keeping the Ponzi running for as long as possible.

People were borrowing wild amounts of money, and saying that RBNZ would never “let” mortgage rates rise again.

Exactly. And as I have said before, I had people on this site and in my personal life referring to me as financially stupid for not “taking advantage of low rates” because they “won’t be going up any time soon”. Funnily enough those people have gone very quiet and for some reason don’t want to offer me financial advice anymore???

It was a disgusting mindset that many bought into out of pure greed. My reasons for not participating were more from a moral perspective than anything else. Narcissistic behaviour is now common place in NZ and the housing ponzi was the perfect playground.

Narcissistic behaviour is now common place in NZ

During a lunch with coworkers two years ago, property prices came up (as usual). The people who owned were either just very happy that they managed to buy x years ago, or were saying “I wish I bought more”. None of them were worried about the situation, at all. Some on interest-only, because prices always go up and inflation will eat the principal anyway…

Also, my coworker who I’ve mentioned here before due to her financial irresponsibility just bought a brand new ute for $70k a couple months ago. She’s the one who mentioned multiple times that she has zero savings. She had her mortgage refixed in February and she was very surprised that her weekly repayments had almost doubled…

How did she make it through your interview process?

She’s actually great at her job. And no she’s not an economist 🙂

Fair enough

Yes scary stuff but absolutely common place now.

Man, I must have sensible co-workers! All of mine, whether owners or renters have been collectively appalled at the situation, those that own have been like “WTF do you think my house is worth?? There’s no way, plus it’s now impossible for me to move to a better property…” and empathised with those that don’t own. Even my landlord (he is a good one) has been shocked and appalled, he has 3 kids and was like “Will my kids ever be able to afford a house??? Insanity!”.

From my point of view, everyone I talk to (except one or two property investors) believes its a terrible situation… I suspect if I still worked in a bank however, it would be very different.

Happy that I didn’t.

Given that he removed LVR’s last time house prices were predicted to fall….why isn’t he doing this again now?

It would seem like very inconsistent policy setting.

Don’t you want somebody stable and consistent running something like a central bank when the aim is financial stability? But then you have an inconsistent person running the show?

2020: Oh look house prices might fall…..remove LVR’s…..

2022: Oh look house prices are falling……we won’t bother removing LVR’s

Where is the logic and consistency in these policy settings? It doesn’t make any sense.

Removing LVRs is pretty widely accepted as having been a mistake though. Are you saying that the reserve bank should make bad policies for the sake of consistency – that seems like a recipe for bad outcomes.

I must have missed the RBNZ admitting it made a mistake?

No, you didn’t miss it because it never happened.

Were you honestly expecting a mea culpa from a government department? How can ones ass be covered upon admission of wrongdoing?

Wishful thinking huh…..sorry I’ll slap myself and get back in alignment with the reality that we horribly find ourselves living within…..(central bankers misleading society and creating conditions of financial repression).

Interest rates were reduced and LVR removed to support economic activity (& jobs) which had ground to a halt due to lockdowns around the world. That was the right thing to do at the time. The problem in my view was keeping the support measures in place for too long and signalling they wouldn’t be removed anytime soon

They’re not projecting huge price decreases – that’s just most of the people in the comments section.

Plus they’ve got to fight inflation which is their main remit, so no need to reduce LVR’s.

The property parasite class deserves to go broke.

They thought they could drink the blood of the productive population for 50% of their income to feed the capital owning property class. The screaming to be saved from their own mistakes, to socialise the losses when they wanted to privatize the profits, can be heard already.

Why was it justified that renting young people had to save for deposits while paying some corpses’ mortgage and paying for their vacations? You people wanted to enjoy the benefits and not pay the price, now enjoy your just deserts of an economic depression, mass exodus and brain drain while your children are bankrupt in the land their fathers once owned.

The systematic incentives from both the private and public sector, incentivizes rentier capitalism of non-productive landlording over investment in productive industries. The true reform needs to be capital guidance requirements enforcing productive business lending by banks and severely limiting speculative financial lending for financial assets, to prevent these sorts of speculative manias occurring again.

Amen.

Well said VM.

You reap what you sow. And we’ve planted the seeds of a financial crisis through ultra loose monetary settings and weak political leadership.

The younger generation are certainly paying the price of having these property parasites around. Sadly, there are a large number of MPs who own rental properties, so I can’t see them acting very soon to tax these parasites.

Despite those same politicians campaigning on fixing the housing issue, then only to get into power and completely change their view once in power. Been happening for 15 years……..thinking JK right through to Jacinda. And people say that we live in one of the least corrupt socities, and yet we have these blatant inconsistencies in the behaviour of our leaders on something as crucial as a roof over one’s head and we’re looked at as being a model country! What a joke….

Kiwis are being exploited by debt just to put a roof over their head. The banks are making a killing off of us, and exporting that profit. That successive Govts have allowed this to continue this long is shameful.

We need the mother of all resets. Land tax, and Dti of 3x.

… agree 100 % … that successive governments thought that rising house prices was a good thing , shows how frigging clueless they are …

All those 100’s of $ billions of borrowings going into a property ponzi , rather than into productive assets : businesses , infrastructure , education & research …

People forget the price small business pay from this debarcle, whom have to operate from industrial warehouses etc.

Forget the days of buying a reasonable sized building and paying it off in Auckland.

The scenario is more like had to close down company or relocate out of city because the landlord has cashed out to developers or upped the rent 20-40%

How much longer can the West deny reality?:

Neoliberalism impoverishes. Neoliberalism is a class war against labour by finance, primarily, and a class war against industry. A class war against governments. It’s the financial class really against the whole rest of society seeking to use debt leverage to control companies, countries, families and individuals by debt. And the question is, are they really going to be able to convince people that the way to get rich is to go into debt? Or are other countries going to say, this is a blind alley. And it’s been a blind alley really since Rome that bequeathed all the pro creditor debt laws to western civilization that were utterly different from those of the near east, where civilization took off. Link

Rents are continuing to rise in the US. According to realtor.com, February 2022 was the seventh month in a row with a double digit increase in rent prices from the year prior. Rents in February were 17.1% higher than in February 2021. The median rent in the 50 largest metro areas has risen to $1792 a month.

This is why the United States cannot industrialize as long as the house prices absorb this high a rate of income, and as long as the banking sector is supporting this, and as long as the political parties say we will not tax real estate so that all of the rising land value will be able to be pledged to banks to pay interest instead of to pay taxes. Essentially, it’s the (lack of) taxing of real estate in the United States that has subsidized the increase in housing prices, because housing prices are worth whatever a bank will lend to buy a house. If you have to go to a bank, and if they lend more and more and this money isn’t taxed away, the price is going to go up. So you have the government policy, the bank policy, all trying to promote this high diversion of income into paying land rent. Again, this is the exact opposite of what Adam Smith and John Stuart Mill and classical economics and the whole 19th century had advocated. This has priced American labor and industry out of world markets.

If you have to pay 43 percent of your income for rent, then even if the government were to give you all of your goods and services for nothing, all of your food, all of your clothing, all of your transportation for nothing, you’d still have to pay so much money for rent and for health care that you couldn’t compete with labor in Asia or the Third World or even Europe. And so this is what has essentially excluded the United States from having a successful empire. It’s the greed of the financial sector, basically, and the takeover of the government by the financial sector here as happened under Margaret Thatcher in England and then Tony Blair. You’ve had both countries essentially enter permanent austerity programs, and the only way to cure this is for housing prices to go down. But if the housing prices go down, then the banks will go broke. That’s why Obama said he had to support the banks: because if he’d actually lowered the housing prices to realistic levels, that would enable America to survive, but the banks would go under. Until you’re willing to restructure the banking system, you’re not going to be able to industrialise the American economy. – Link

This sums it up very well Audaxes….

I’m not sure how much longer we can pretend the status quo is working, or is going to work into the future.

Feels to me that its on very thin ice at present and at any point it could collapse.

The Fed, I believe, have two options coming up:

1. Allow asset prices to reset, which will cause widespread debt defaults and possible depression.

2. Print more money and risk even higher inflation – but likely cause severe political/social instability.

Either way, they’ve backed themselves into a very bad corner that is going to be almost impossible to come out of without something/someone in the economy getting hurt.

Take a look at where Ireland sits in the graph. That’s after 15 years of ‘recovery’, so I reckon we’re headed somewhere below that.

Ireland is tied to ECB rates decisions because it’s in the Euro. That was half of what caused the last crash they had, their interest rates settings where totally inappropriate.

NZ is competing to be on top on all the charts with wrong reasons.

Thanks to leadership who pushed kiwis to this mess and converting NZ into nothing more than real estate company.

As I have said many times before, buying family homes and turning them into rentals so the poor can pay the mortgage is modern slavery.

Nah its called ‘getting ahead’….

Pretty sad that “Getting ahead” in life means the total opposite to you. I guess your a “Glass half full” kind of person who sits on his bum expecting others to do it all for you. Housing is what it is, conditions existed that allowed people to take on large debts and take the risk and it has clearly paid off for most. Its now to late for “Idealistic” views, its 2022 and we left living in caves that got provided for free a long time ago.

Why does ‘getting ahead’ mean to you Carlos?

I won’t answer that. I might get banned.

There is an ‘a’ in the word ahead!

What getting ahead means to Vladimir Putin …

… firstly , you get a KGB mate to decapitate someone who’s pissing you off …

Then , he presents it to you , on a silver platter … must be silver , gotta do these things with a degree of panache …

It means a commitment to do well at school, get some post school education, get a job, any job to start with and then begin to slowly slowly work your way up. Pretty sure that is what “Getting ahead” means to most people. Its about you doing well in life, it doesn’t mean you have to trample on others in the process. Eventually it pays off but only if you have the right attitude and set realistic goals. If all you do is sit round and play the victim card, your life is going to be shit. Reality is that if I have to explain what “Getting ahead” means to you you are already in trouble.

Oddly our landlord class don’t want people to ‘get ahead’ as you describe above, because it would mean they would be self sufficient and could provide/survive themselves. They wouldn’t be stuck in the poverty trap of paying rent and never being able to save a $ to get themselves out of the rut they find themselves in.

Landlords need to repress one part of society in order to exploit them for their ow financial gain.

A change towards what you describe would be catastrophic for their ‘get ahead’ strategies of buying rental properties and turning another person into a long term renter who can’t get out of that situation (while they collect accommodation supplements from them).

Living by oneself in Tauranga in a large house

Housing is what it is, conditions existed that allowed people to take on large debts and take the risk and it has clearly paid off for most

OK, but housing ‘is what it is’ not because of fate, or nature, or anything like that, but because successive governments made choices. It’s not that ‘conditions existed’ – it’s that people in power deliberately created the set of conditions which caused housing to be in the state it is. It seems odd to think that it is ‘idealistic’ to believe that governments shouldn’t pursue policies that create extremely bad outcomes for large parts of the population, as well as increase inequality, and shift costs onto the education, health and welfare system. Whether it has paid of ‘for most’ is at the very least debatable. Are most people really better off because our housing prices and rental costs are extremely high? Sure we left caves that were provided for free a long time ago – the reason people are upset is not because housing isn’t being provided ‘for free.’ It’s that it’s prohibitively expensive for many younger people. There is a lot of room between the average house being free and the average house being $1mil.

conditions existed that allowed people to take on large debts and take the risk and it has clearly paid off for most.

Yeah a bit like the synthetic cannabis debacle a few years ago. Dairy and store owners, suppliers claiming they are doing nothing wrong as it’s not “against the law” even when the massive social harm was clear for everyone to see.

I get it that it’s their choice and that’s all good, just like it’s my choice to view many of them as narcissistic greedy pricks. Don’t expect a financial excellence award for taking advantage of a situation at the expense of others.

Ever seen The (ChCh) Wizard’s map of The World?

And National want to re-instate tax deductibility to ensure we stay in bronze medalists position

https://www.newshub.co.nz/home/politics/2022/05/revealed-the-number-of-properties-each-new-zealand-mp-owns.html

But it is for the good of the squeezed middle. It has nothing to do with the property holdings of National MPs and their buddies.

… the tax deductibility is a legitimate business expense … Robbo showed how clueless he is to ban it … any good tax expert , Terry Baucher for example , will attest to this ….

What did house prices do after Labour banned foreign buyers ? … they went up , up alot … and after Labour banned tax deductibility ? … house prices kept going up …

It’s a tricky one. In reality interest is a cost of debt capital (i.e. financing) not a business expense like insurance or agency fees. And it is not symmetrical i.e. why should the state subsidise debt financing if it doesn’t subsidise dividends to shareholders? Anyway, a real can of worms.

… in any business borrowing , except for houses , interest payments are deducted as a legitimate expense , before profit …

Shareholders dividends are mostly imputed for tax , no extra tax to pay …

yes, because they actually build something with that business, something that wasnt there before…

once you start going to your rental and working on it 8 hours a day on it, making it from a 2 bed apartment to a multi-family home, every week and then employ people to keep the business running then i’ll come to your side, but putting your hand up in an auction and then letting it out is not grounds for tax deduction imo… especially when FHB dont get that benefit

..you miss the point.

That being the home owner cannot claim so the investor can always pay more.

So cancel the ability to or allow homeowners to.

You have a problem with that??

And to be really fair, don’t tax the interest on a non home owners first home savings – because we don’t tax the return on a home owners investment now do we?.

Technically you’re probably right.

Interest deductibility is a knee jerk reaction to out of control housing, so it should be reinstated, but investors should be charged business interest rates, more like 11-12%. And be subject to a proper CGT, not a glorified bright line.

This would level the playing field with first home buyers.

After all, homes should never be a commodity, but something everyone at least has the opportunity to own if they are prepared to work hard. Not forced to head out of their own country.

Landlords would then try and pass that expense onto their customers…..which would then end up being measured in CPI, which would result in even higher recorded inflation and then mortgage rates.

I think removing interest only loans for investors (and in general) should be done asap as well as forcing landlords to buy houses with the same restriction as FHB’s….that is they need a cash deposit….non of this equity rubbish…..using paper money from past gains, to buy even more houses, gives our housing market the characteristics of a ponzi. Buying a house with earned income in the real economy as a FHB does, removes that paper equity/ponzi characteristic.

Yet you will find that interest is not consistently deductible globally for businesses. In the US it is at least capped i.e. a leverage test. And imputation only exists in NZ and Australia (which just negates double taxation but does not subsidise equity finance, whereas interest deductibility does). So all I am saying is don’t be so sure you are on solid footing there, it is more a historical precedent of our tax code rather than one based on irrefutable logic.

ok treat residential rental houses as businesses. Triple their council rates…., Criminal liability for the landlords, ACC contributions, I’m sure councils would not complain?

Maybe, but it’s knocked the hell out of the profitability of leveraged residential property investment, and in the absence of taxes on capital it’s the best we’ve got.

I won’t ever vote National while they have a policy to repeal that legislation.

.. Yes , removing tax deductibility has reduced profitably … leading to fewer rentals available … leading to higher rental prices …

Rents and house prices are going down, also because of that (not only of course).

It is a good thing

I keep seeing this old trope about less rentals causing harm to rental prices. This would be true if the actual stock of housing was reduced, but if the houses aren’t demolished by the landlords in a fit of pique, those houses will be sold to first home buyers (who would otherwise be renters) and reduce demand for rent leading to lower prices. Anyway, it’s not clear cut.

The other argument you often see is that because rentals tend to have much higher occupancy levels, a home switching from being a rental to being owner occupied increases housing demand. But it turns out this is a bit of a myth – what people ignore is that owner occupied homes tend to have lower occupancy rates because owner occupiers are generally older – a 25 year old is not likely to live in a 2 or 3 bedroom home by themselves regardless of whether they own or rent, but plenty of 65+ year olds do. This post is a good explanation:

https://blog.andrewduncan.co.nz/property-investors-impact-on-housing-si….

Exactly, selling a rental to an OO does not reduce housing stock.

The FHB who can afford to get into the market and pick up the rental is likely at the higher end income-wise of the rental market. Therefore the remaining pool of renters will have a slightly lower median income with each FHB purchase. The supply and demand may change if houses of 4 renters made up of two couples then purchase two separate ex-rentals, but they may choose to rent a room out. So it’s really impossible to tell.

Demand for rental properties is increasing at a faster rate than supply of rental properties, resulting in an increasing waiting list for emergency accommodation.

The reason for this is that private landlords own the vast majority of rental properties.

’The government’s specific attack on private landlords by increasing their costs means that some will not be able to afford to stay in the game.

Interest deductibility is being phased out over 4 years. So far it has had minimal impact because some interest expenses can still be deducted for many landlords but each year going forward 25% less interest expense is allowed to be deducted as a rental expense.

With increasing interest rates also hurting landlords, an increasing number of private landlords will dispose of their most risky rental properties, typically in the lower quartile.

Many first home buyer live at home with their parents, so are not renters that pay a bond. These first home buyers are exacerbating the problem because every time they purchase a rental property they reduce the rental supply.

The other type of first home buyer that was previously renting also adds to the problem because on average there are slightly more people living in a rental property than in a first home buyer property.

As a result rental demand will continue to grow faster than rental supply.

Economics 101 would suggest rents will continue to rise at a faster rate over next couple of years. The will be predominantly caused by private landlords increasingly selling their rental properties.

Many first home buyer live at home with their parents, so are not renters that pay a bond.

This might have been true a long, long time ago. Corelogic reported in May last year that the average age of first-home buyers was between 34 and 35. Many of them would have young families of their own (considering a women’s fertility declines rapidly after 35, so she should generally have had her kids by the age of 35 – 40).

So the question is, how many young families do you know that still live with their parents?

The same argument probably applies for your second point: older first-home buyers come with bigger families than first-home buyers of, for argument’s sake, 22 or 23. So if you say “there are slightly more people living in a rental property than in a first home buyer property”, is that still true for the current generation of first-home buyers? Unless this is maybe swung by the scenario of 30 poor immigrants renting in the same house?

To me, private landlords increasingly selling their rental properties sounds like part of the solution to our housing crisis.

The thing is, we all generally believe what we want to believe. So guess we’ll all have to try and be a bit patient and see how it all plays out. Good luck to all!

There is a “household” for every 2.6 people in NZ.

It’s correct that over crowding happens in lower income households, which tend to be rental properties. It’s just as easy to consider the issue to be people who own multiple houses rather than a FHB who would likely buy a home for their family and almost never buy alone (based on recent affordability).

Agree GBH, the legislation is a copy of part of the attack in the uk on landlords in 2017, now fully implemented over 4 years, results are shortage of rentals (some have been sold or gone over to Air BnB) & sky high rent prices. And the strange thing is local councils are appealing for homes from private landlords to house their massive housing waiting list.

How about we reinstate the tax deductibility but scrap the accommodation supplement. Let property prices reset to what people can afford to pay in rent from their own incomes. Without a government subsidy. We wont have to worry about a capital gains tax then either.

Removing tax deductibility seemed to be an imperfect replacement for a CGT. But the shrieking of those who would rather bludge off productive society put paid to a CGT.

CGT is a foolish idea … it’s too easy to subvert … a simple LVT is easier & cheaper to implement , raises regular revenue from the richest people , is impossible to delay or evade , and incentivises efficient land use … CGT does the opposite …

I completely agree re LVT Mr Gummy

Tax deductibility on interest paid over rental houses are a huge advantage for landlords over FHBs.

Changing that rule was a good thing.

Rules make something legitimate or not. Houses are a delicate asset with widespread impact, a diverse tax treatment is fully justified.

Nat will lose the election just for this.

I don’t like labour, but this was a good move, and reversing it is a shameful ambition.

I get that other businesses can deduct interest expenses but it’s not like the principals of tax law are some sacred text that must be held sacrosanct, it’s all just made up by society on the fly. Why is it a bad thing that interest deductability has been removed, what negative effects is the removal causing?

There’s plenty of things you can’t claim costs for or are limited. We have a hideous entertainment regime for businesses. Limiting deductions is nothing new and people who complain it breaches some sort of unheralded tax principle either don’t know any better or just cooked.

Whenever I see Christopher Luxon on TV I cringe

He wants to remove the bright line tax and the interest deductibility, he wants to lower taxes

Where are the leaders with some vision for the country , I have seen nothing from National or Labour that will begin to address the countries woes

Unaffordable housing,

A health system that is in crisis

Mental Health support is in crisis

Our motels are full of homeless

Our infrastructure needs a massive upgrade

Out of control crime

and I could go on and on

A elderly man I know suffers from depression ,last week he felt suicidal and rang the help line to be told he was 18th in the queue

He actually had a laugh at that and felt better that he wasn’t alone in feeling depressed

Also what do all the 1000s of government servants actually do, I tried ringing Land Transport but was told they were having very long delays and suggesting that I email which I did to get an automatic reply that all going well my email would be answered within 15days.

Mind you I see Australia is lacking any leaders with a vision as well

The leaders of the western world/anglosphere are completely lost…….there is no vision, just more of the status quo….which is dividing people and causing social and financial instability.

If you read the 4th turning, you’ll realise this is all part of a process that should be resolved in 5-6 years….but it could be a bumpy ride!

We can agree on that IO, the West is in decline.

Here’s a fun fact you will never read anywhere. The Russian Rouble, after all the economic and travel sanctions, asset confiscations, the relentless media criticism (and rightly so), stories that Russia have run out of bullets etc etc, is now 20% stronger than the GB Pound (for example) than before war broke out. This is because Russia is a non-financialised hard asset currency with only 18% Debt to GDP.

It’s an absolute farce, the West is in decline – broke and in hock up to our eyeballs.

Yes completely agree TK.

And yet we also like to look down with moral superiority on the likes of Putin (or anyone in a non-western country).

The US is trying to bully everyone with its reserve currency status but I think at some point people are going to realise that the US is broke and they only have two options going forward:

1. Debt defaults.

2. Print more money.

They will eventaully chose number 2 and its going to cause absolute chaos around the world (worse than now) as other nations can’t devalue their currencies at the same rate as the US without hyperinflating…so you will end up with more countries trying to do what Russia has done and de-couple themselves from the US led monetary system.

What does this mean – global instability and possibly war as countries try to establish a new world order and establish a new Bretton Woods system (and for non-wester nations, one that isn’t controlled by the US).

See, we can agree on something….

Were you losing hope?

So you look up to the morals of Putin?

Haha I didn’t say that……I just don’t think we can sit on our moral high horse in the west and look down on Putin, especially about invading countries and needlessly killing civilians. But we still do it….

Or do you disagree?

I may not understand you, but Putin is a fiend, how can we not look down on his behavior, it is morally reprehensible. As for the Russian people, they just have to suck up the repression, and for some groups, persecution.

Honestly, for all the failings of the west, we’re streets ahead of these autocracies.

Light-years ahead.

This factoid is superficially correct.

When you dig a bit deeper into the measures that the Russian state has had to take to stabilise their currency it doesn’t look so rosy.

The factoid is a fact Brock. Yes, they have declared that gas and oil purchases have to be in Rouble, but that’s only because they are locked out of the West Banking payments so cannot sell US$. If snything, the Rouble could get stronger. The West cannot afford Net Zero and the tech is slow, expensive and unreliable. The current inflation is 75% Net Zero and going to put us in recession 28 years before the target date….

It is partly because of our social networks these days where most people seem to get their news from, therefore their view of the world. Combine this with all of our natural and many of our built systems under stress and we end up with populist leaders that don’t plan anymore, instead just lurching from crisis to crisis.

If the West implodes, our inability to regulate social media will be a major factor in our demise. We should, and could quite easily, regulate social media so that popular shared/viewed posts are fact checked or deleted and so that individuals can sued for defamation (or the users at least de-platformed), just like what used to happen with news papers/magazines etc. Yes, the internet won’t be as free, but we can still have rational debate while being correctly informed. “I think therefore I am” <> “I believe therefore I am right”.

How does the saying go, believe half of what you see, and non of what you read. Especially on social media.

Luxon will lose the election on his housing and tax policies for sure – his policies appeal only to the top percentage of elite/wealthy voters who are cashed up, own multiple properties and are shielded from the social issues and crime because of their money and lifestyles. People he should be convincing to contribute more – so as to leave a great country for all our kids.

Would be great to see a leader with a long term vision for NZ that we can all buy into…

I tend to agree. I cannot go back to Nat on the basis they unwind the efforts made re tax policy on rentals etc. Leave that alone and do be so anti environment (I’m talking water quality and factory cows rather than climate here) and it would bring me back to the fold.

The socialism of labour is something I don’t like voting for, so its difficult.

We have a great nation, where we have party’s like:

On one hand we have party full of drumheads, who don’t have clue what’s going on ground and live in a fairy tale world by changing country in nanny state.

On other hand we have party lead by cunning property investor.

Can anyone tell us who can do less harm?

It’s all based on ” the bigger fool theory ” … you have a group of political parties infront of you … weigh them up , rank them on your internal ” fool-o-meter ” …

… vote for the least foolish one … the unfoolest party of the current crop of motley fools …

Well if it all turns to shit, Robo can ask for an IMF bailout, they cannot say they were not aware of the problem ! LOL

Call me stupid….but hasn’t it been macroeconomic support (the IMF thinks we will need) that has created this mess in the first place?

So how is more of the same thing, going to be the solution…..sounds like advice from people who have lost their minds.

It would appear to me we have the blind leading the blind and wondering why things are getting worse, not better.

I also don’t get it. The article states:

The IMF says macroprudential measures in NZ to alleviate the impact of the pandemic eased housing credit attainability, including for investment, “further increasing demand”.

But also:

“More broadly, there is likely to be a larger impact on consumption through wealth and sentiment effects. In a scenario of a marked housing correction, macroeconomic policy support may be needed to avoid second round effects and a pronounced downturn.”

So are they saying NZ should do more of what caused this mess to spiral out of control?

We’ve got the point in the long debt cycle (read Dalio) that economists are completely lost and if you read any of their statements, you realise they are full of paradox and cognitive dissonance.

We’re at the point where unless we print more money at some point soon, we will see widespread debt defaults. But by printing more money, we just make the situation worse at a later date…..so noting gained, but just delayed, and pain level increased at that later date.

… so , basically , central banks & governments have painted themselves into a corner … and by defacto , us too …

May as well draw up a chair , grab the popcorn , and wait for the show to begin …

Been stocking popcorn for years.

Yes, if there is a marked decrease. The gist is, houses are expensive and totally out of whack, they might have a decline and then be steady or they might have a big decline. If it’s a big decline, QE may then be required.

IMF says NZ government should not let NZ house price fall?

Honest question here (I don’t work in any finance-related profession, so consider me totally clueless): what does the IMF mean?

Are they saying those with too much debt should be bailed out by the government, somehow..? Or should the government fiddle with the OCR to keep mortgages down to protect the asset-rich? Or what?

RBNZ can open a refinancing/ residential mortgage operation to offer 2% mortgages to everyone that settled a sale after their emergency measures were put in place. They sucked them in, then doubled the cost ,so RBNZ can directly pick up the tab on the fiendish and stupid action.

Just limit it to owner occupiers, specuvestors can swing in the wind.

That’s, perhaps, not a bad idea.

As RBNZ is so fully staffed ,it would be nice to see them rostered on to fill in and process the applications ,in person,from the recently caught homebuyers. Ah ,Can you picture it,in your minds eye, RBNZ new floor plan of densely packed ,hastily erected cubicles ,where anxious distressed homebuyers sit face to face with RBNZ staff ,from Orr downwards, tie off ,sleeves rolled up,processing refinancing applications ,in haste and in person,on a 12 hr ,6 day a week roster. Practical ” community work sentence” for indiscretions on a grand scale, and until such time as permitted to resign.

Not a bad plan, although the tab would of course be picked up by the taxpayers (homeless or not)) on behalf of the RBNZ.

Overseas banks then flee the country

Can I have my super topped up as well then,I invested in the long term in good faith.

Google is your friend

https://en.wikipedia.org/wiki/International_Monetary_Fund

They are not vested in the NZ economy so are not scared of losing votes, commissions, or ‘wealth creation’ by calling it exactly how it is… a basket case.

In short, they’re saying our economy has fallen from the knife edge and it’s now all going to end in tears thanks to NZ being good at nothing except swapping houses with each other.

The IMF is the vampire squad sent to keep Vassals of the American Empire in line. These people should be ignored. They are fundamentally evil and exist only to ensure American banks earn their profits on loans to foreign firms.

Yeah essentially another agent to ensure USD global dominance and the existing post WW2 world order.

Sorry, I should have phrased my question better. I know who the IMF is (and know better than to overestimate their advice, so-called), but I’m trying to figure out what kind of “macroeconomic policy support” they are referring to? So what do they mean when they say the following:

In a scenario of a marked housing correction, macroeconomic policy support may be needed to avoid second round effects and a pronounced downturn.

Are they in effect saying that those who bought houses in the past 2 years should be bailed out or advantaged in some way above those who didn’t?

I think the government should pay for the finance on the Real Estate agents’ Audi’s, no-one warned them that this could happen in NZ, they are the victims in this situation.

I’m trying to figure out whether what you are saying here is basically part of the IMF’s advice to NZ!? Seems to be the case!

I don’t think that there would be macroeconomic policy support aimed specifically at those that bought in the last 2 years, rather the support would be general, for the entire population. The term “marked housing correction”…what does that mean or can it be defined further with a % correction range. If this correction does occur, my interpretation of the statement is that the correction should not be so significant that it turns into a severe recession or depression. Macroeconomic policy support could be a number of things, such as reducing taxes that enable workers to survive day to day living and ability to pay the debt, it could mean lowering the OCR that puts $ back into your pocket to survive day to day living and ability to pay debt. Could the major banks commit to allowing customers facing hardship to switch from P&I loan payments to I only payments for a period and/or mortgage holiday – again to enable customers to survive day to day living and the ability to pay debt? Some say that a significant correction is long overdue that should be allowed to occur, however, the IMF appears to not support this. Rather the NZ Government/economy to mitigate this (if needed) and carry on, although at an idle pace and importantly not seize up.

Thanks, NZBilly, for the thorough explanation. Appreciated. Will be interesting to see how this all will play out.

The secondary effects they are talking about are things like people defaulting on mortgages due when they can’t afford repayments with rising interest rates, which may be secured against a business, so suddenly businesses go broke. Unemployment goes up, spending stops etc.

The trick, I think, is to let housing fall as much as they need to to get rid of the non-valued-added rentier waste in the system, but not allow the secondary factors to kick in so it affects the wider economy.

However, by doing this, it could stop house prices from falling as much as they need to. Maybe they could come up with a cunning plan to ringfence bad debt so banks don’t foreclosure on people’s property, and those losses can be repaid back over a longer timeframe, so they aren’t let off the hook per se and the rest of the economy is protected.

In parallel they should change land and house use policies to make it unattractive for speculators wanting to buy at the bottom of the market, ie no superprofit capital gains would be possible.

BUT it takes a lot of skill to catch falling knives, and given they never had the skills to stop them from falling in the first place, I don’t see them being effective in anything they do.

Thank you, good explanation and some good points.

“House prices in New Zealand were already increasing faster than in its peers before Covid-19, and the pandemic accelerated this trend.

This could be considered a job performance review on Mr Orr.

How does he still have a job?

Who is going to fire him? The property owning MP’s…..(not!)

Many are not ‘investors’. They are ‘bubble speculators’

And the worst part is they don’t even realise that is what they are, because they’ve never been allowed to fail (they’ve been continuously bailed out!)

Talebs turkey comes to mind when thinking about this.

https://nassimtaleb.org/wp-content/uploads/2013/09/turkey.png

We have made our bed. Now we have to figure out how to lie in it. New Zealand mortgage debt is 98% of our GDP. The vast majority of it is on adjustable rates A housing price collapse of 30% will cause a depression in New Zealand on the verge of a retirement cost bubble of 20 billion per year (2025 estimate). Safeguard what is left of the super fund. Sell the 35 billion in overseas equities. Keep the other 25 billion in existing investments. Loan the 35 billion to Kiwibank as capital at 3% rate. Kiwi Bank then can lend it out. One mortgage product only. 5 year fixed rate 4% to owner occupiers only. Max loan cap $800000. Maybe enough to refi 100 billion of the 320 billion of mortgage debt we have.

The government can just create money without any interest owed on it. At the moment, banks create all the money when they create mortgages. The state should spin up several new state owned banks and allow the private banks to go bankrupt. It is the private banking industry which profited from this mess, they should accept their fate and go bankrupt with their borrowers.

Yes that is why I don’t understand why we pay our private bank leaders $1M + wages when ultimately they have no risk……the state just bails them out if the mess things up…..as we witnessed in 2008 and again in 2020….

What a job….million + a year in wages and no worries about the business going under as the taxpayer own your balance sheet if it all turns into a mess.

So the ONLY things a retail bank really does (this is coming from very high ups in banks who have told me this over beers), which a central bank cannot provide is two things:

We are lucky that they still do the latter without the direct, front line knowledge of bail outs (yet). They essentially, on a large scale, balance between providing shareholders maximum profit by lending as much as possible and lending responsibly so they don’t get delinquent loans. If more loans are delinquent then shareholders get angry, share prices drop, people in the bank lose their jobs. It’s a real balancing act, but there are feedbacks to calculating risk inaccurately which pull the internal bank policies into line when they are out of line. Add in the competitive nature of the field and they are all trying to compete on pretty much these two things only.

Now just think about what is being suggested by letting the clearly incompetent RBNZ do either of those things. Could they provide an efficient banking platform? Could they judge risk accurately?

Long story short, it would be a horrific mess and nobody would be responsible/accountable for it. Careful what you wish for.

We were able to print NZD 60 billion and set it on fire to keep ourselves warm in 2020 and 2021 because the US fed gave us a USD 30 b swap line. In other words they had our backs. Also we were printing at the same time as everyone else. That is why we smashed it all out in one go and put some aside for later (gone now). If we try printing now while everyone else is tightening our dollar will crater and our borrowing costs will rise. We are not the USA. We can’t print money at will.

Which is also why we can’t run massive deficits like they do, which I keep reminding people of… we aren’t the US with their petro-dollar and military, though they do somewhat have our backs as natural allies. But being an ally of the US is double edged, they definitely will help you if its in their interests (to support their idea to make it seem like a consensus, for instance, or to defend you if defending you helps them) but will cut you lose if its going to cost them anything.

If you were to view that real house price graph over the 100 years prior to 1990, it is essentially flat (i.e. house prices didn’t rise much above inflation).

I don’t think people realise just how spectacular the gains in property have been the last 30 years relative to inflation.

People who confuse this as being a period of normality might be in for a very painful surprise, when they find out that its been an anomaly, not a norm.

Pushing the cost of debt below the rate of house price inflation for a very long period has been a very silly thing to do…..its like allowing the CPI to sit at 2% while inflation is at 8% and wonder why society starts falling apart as they experience financial repression.

… for most of those 100 years credit was not cheap , and was not easy to get … house prices went up slowly , pretty much aligned to the gradual increase in materials & builders wages …

Does that mean that property historian and soothsayer Ashley Church is wrong? Perhaps his history books only go back to 1990?

1990 feels about right as that’s probably where our economy and consumer spending power is heading.

Just imagine if NZ’s house prices had followed the OECD average over the past 20 years… would we be dealing with the enormous social issues we have currently? Hell no…

Bit of humour from Australia after Scotties announcement re super access;

https://www.theshovel.com.au/2022/05/16/woman-relieved-drain-her-super-…

Woman relieved she’ll finally be able to drain her super to help increase house prices

Melbourne woman Ashley Dawson has welcomed the Government’s new election pledge which will finally allow her to f**k up her retirement savings.

“I thought I’d missed my chance to be honest,” Dawson, 34, said after the policy was announced. “I was resigned to the fact that I might never be able to do my bit to push up property prices in one of the world’s most expensive markets. I’m just pleased that there’s a party out there that’s going to give me an opportunity to compromise my future while contributing to the nation’s housing affordability crisis”.

The Melbourne-based physiotherapist said she had recently looked at her superannuation balance and was concerned it was getting too high. “Just last week I was thinking, ‘How can I compromise my future financial security?’ and ‘Will I ever be able to play a part in pushing up the nation’s property prices?’ And now this new policy will allow me to do both.

“At last I have a chance to buy an inflated studio apartment in outer Bendigo which I’ll have to sell down the track to make up for the fact that I’ve got no super”.

Careful, you might give the major parties a new social/housing policy to copy, cough,sorry improve.

Not that most people have been interested in the evidence for the last couple of decades but by almost any metric you want to measure us on in housing, we are almost first, at the wrong end.

IE Median income to house price multiple of about 10x.

The net worth of assets in housing, is approx 65%, China at 67%, and the USA at 35%. ie all our now soon-to-be scrambled eggs in one basket.

Approx. 50% of our total house value is made up of non-value-added costs caused by failed Govt. policy allowing restrictive monopoly rentier speculative behavior. ie our housing could be up to 50% cheaper based its next best economic use. This is the underlying potential fall in value.

Whatever the fall, we need a plan so we don’t get a rinse and repeat.

Would roll back to ~2016 prices if that were the case.

“IMF says any ‘marked’ housing correction in NZ may require macroeconomic policy support“

Now that a monster called Housing Ponzi has been created by RBNZ and Government, IMF advised to keep feeding it to avoid disaster and create a Bigger Monster – no way out.

Market has to correct itself to bring some sanity, it is inevitable and earlier the better.

https://www.news.com.au/national/federal-election/biggest-problem-first…

Excerpt;

Economist Saul Eslake described the Coalition’s superannuation announcement as “a contender for the title of worst housing policy decision in the last 25 years”.

“Although it’s probably not as bad as the reduction in capital gains tax in 1999 or the extension of first homeowner grants to purchasers of established dwellings by the Howard government in 2000,” he said.

“We now have almost 60 years of what I think is incontrovertible evidence which shows that anything that allows Australians to spend more on housing than they otherwise would — first homeowner grants, stamp duty concessions, mortgage guarantees, shared equity schemes, lower interest rates — results in more expensive housing, not more people owning housing.”

Mr Eslake said for all the “crocodile tears” shed about the difficulties faced by aspiring first homebuyers, politicians of all persuasions “keep doing things that make it tougher for them” by pushing policies that continue to drive up house prices.

This is as close as the IMF will ever get to strident criticism of the Reserve Bank, which has a lot to answer for in regards to this housing bust!

Wee Fucd Nah

We noticed that you’re using an ad blocker. Or, your browser is blocking ad display with its settings.

Your access to our unique and original content is free, and always will be.

Please help us keep it that way by allowing your browser to display ads. How?

OR,

Create a SUPPORTER account with no ads here.

If you’re already a Supporter, please use the Supporter Login option here.