iridi

iridi

SiTime Corporation (NASDAQ:SITM) is expanding its revenue line in the IoT automotive end market where it can use its precision timing solutions to create faster, smaller, and better solutions for smart vehicles. The main growth drivers of the stock are:

Since SiTime increased its design wins, the company has more opportunities to acquire customers, and with its single sourcing model, they can keep these customers in the long run to design and manufacture precision-timing solutions for them, and with their expansion in the IoT automotive market, they can enter and disrupt the emerging IoT automotive market, and potentially the EV market as well, which leads me to rate the stock as a Strong Buy.

SiTime Share Price – Seeking Alpha

SiTime Share Price – Seeking Alpha

SiTime has been trading at a relatively low price for the past few weeks, and I think its price for the past year potentially is one of the prime times to enter the trade. At the time of writing, SiTime is currently priced at $86, a 70% decline since November 2021. The share price is close to its lowest low of $73 in its 52-week period, compared to its highest high of $341. Although we’re not in the stock’s lowest price. Its current price of $86 is pretty close to $73, and with the consensus estimates of $120, we’re currently looking at a 30% upside if the street thinks that SiTime will beat these estimates.

In my previous article on SiTime, I talked about each segment and the potential end markets they can capitalize on. The company’s Communications & Enterprise, Mobile, IoT, & Consumer, and Automotive, Industrial, & Aerospace segments have a lot of growth and profitability potential because of the company’s broad portfolio of products with a relatively high CAGR in future years. Specifically, I stated back in August 2022:

“They also have different opportunities in their various end markets. SITM has a chance to hop on the 5G technology, Advanced Driver-Assistance Systems (“ADAS”), and smaller and more compact SoCs for mobile devices trend.”

-SiTime: Expensive And Trading Higher Than Peers

The company’s latest press release proves my point that it can focus on one end market and capitalize on its reputation for precision timing and use that to its advantage, especially in the Advanced Driver-Assistance Systems [ADAS], where its market features a CAGR of 13.83%. Although the company’s valuation shows that it is overvalued (which I’ll get more into depth later in the article), its future growth and profitability are reasonable for its price. So why does the market believe that its price target is $120? Here are the following news and drivers that I consider could push the stock to a higher price once its full potential is realized:

On the company’s recent press release on October 2022, SiTime is delivering precision timing solutions for the Tesla Dojo System that was featured in Tesla’s (TSLA) AI Day 2022. As we all know, Tesla makes super computers to make AI products such as their famous Tesla EV and their bipedal “Optimus” robot need to rely on super computers to make sure that they can calculate and analyze its surroundings to provide better safety in a short period of time. As mentioned by Bill Chang in the AI day 2 presentation on Dojo Computer:

“. . .SiTime’s MEMS clocking technology and system-level knowledge enabled a power module that optimized unprecedented density and complex integration, which in turn, enabled high system performance on Dojo.”

-Tesla’s AI Day 2022

The company has provided Tesla with some high-performance, highly accurate, stable, and reliable clockings for Tesla’s Dojo Computer, ensuring that it works in harsh conditions. This collaboration is a great example of how leaders can work together to advance the future of electronics. This also means that if SiTime is capable of providing Tesla, a leader in autonomous driving, precision timing solutions, this also means that their customers can rely on them, especially in the auto end markets:

On SiTime’s recent earnings call for the third quarter results of 2022, Rajesh Vashist, the company’s CEO, mentioned that they will be introducing 5 significant new product platforms next year, and each will span numerous derivative products. This will continue to expand SiTime’s from about $1 billion last year to $4 billion in 2024. On October 2022, the company had a press release stating that they will expand automotive SAM with new precision timing solutions, featuring the SiT1881 oscillators delivering of 4x better stability, 20% lower power, and 30% smaller size. Since SITM also operates on the IoT Automotive market, they can truly capitalize on this market, since it features a high-single digit CAGR of 9.2% with the Russian-Ukraine war situation included. I think that their focus on the automotive end market is a step in the right direction, think about it, they specialize on precision-timing products. To make safe and fast-reacting ADAS, you need to have fast precision-timing solutions and SITM is able to provide these specs, especially for the emerging IoT automotive market.

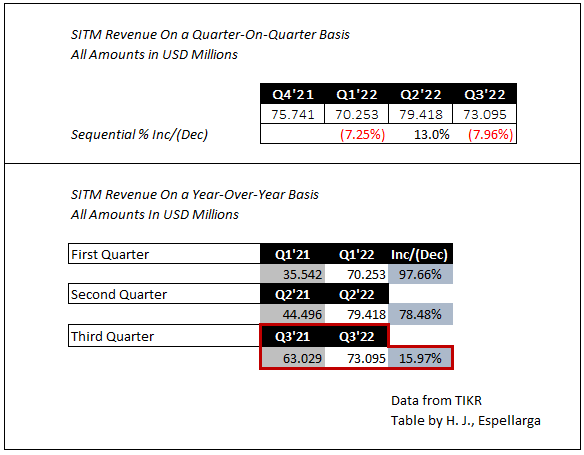

Data from TIKR – Table by Author

Data from TIKR – Table by Author

For starters, SiTime has been beating EPS estimates for 9 quarters in a row, and on its recent Q3’22 earnings, the company had an EPS of $0.97, beating estimates by $0.12, and revenue of $73.10 million, which beats estimates of $75,000. To put things in perspective, the company hasn’t really been growing much in a sequential basis. However, on a quarter-over-quarter basis, the company has been doing fairly well, and it adds to my thesis on why I think that SiTime is a growth stock and is profitable in the near future. SiTime’s revenue tremendously grew in the first quarter with a 97.66% growth, 78% growth in the second quarter, and a 15.87% growth in the third quarter.

So, the company’s revenue grew a lot, great! But what does it mean? Aside from a stronger dollar, and making moves in the auto space, SiTime also has been able to secure more design wins. According to Rajesh Vashist, SiTime’s CEO,

“In Q3 2022, we doubled the number of design wins over the same period last year. Not only is our number of design wins and dollar value significantly higher than in 2021, our focus segments, automotive, comms, aerospace, defense, constitutes the large majority of these design wins. We expect that these design wins will start generating revenue in 2023 and beyond.”

-SiTime Q3’22 Earnings Call Transcript

Design wins are basically engaging with a customer to sell a product to them. Now that we know that the company has secured a lot of design wins in Q3’22, that begs the question, are they able to maintain its customers? Are customers going to stay with them for the long-term? Well, for me, there’s no sure answer to that. However, management did mention that one of their strengths is their single-source business, 80% of SiTime’s business is now single-source, this means that customers will only buy SiTime designs and solutions from SiTime themselves. This adds to their long-term strength since the company’s single-source position exists with its customers.

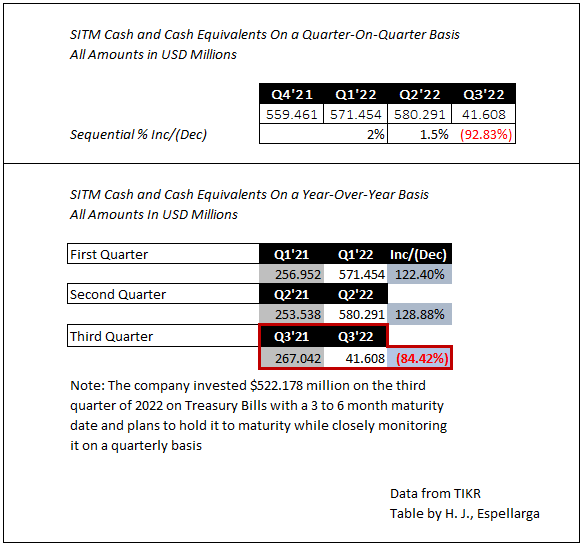

Data from TIKR – Table by Author

Data from TIKR – Table by Author

Looking at the balance sheet, SiTime has $41.608 million in cash and cash equivalents on the company’s third quarter results. The company featured a strong balance sheet over the few quarters, with an average of $570 million in cash and cash equivalents for the past three quarters. The company’s cash also had increased its cash on a year-over-year basis by 122% in the first quarter, 128.88% in the second quarter, however, the company has lesser cash on its third quarter with an 84% decrease in cash, why is that? That’s because SiTime entered into treasury bills with a 3 to 6 month maturities and plans to hold until maturity. This is risky, right? Well yes, but no, if the correctly reacts to the interest rates, then we should expect this investment to be doable. Besides, the maturity period is a short time. Does the market value SiTime the way I do? Here’s why I think it’s a growth stock and a profitable company, the combinations you want as a long-term investor:

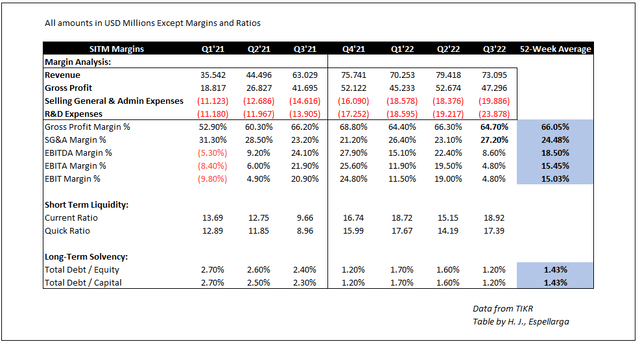

SITM Margins, Liquidity, and Solvency – Data from TIKR – Table from Author

SITM Margins, Liquidity, and Solvency – Data from TIKR – Table from Author

By analyzing SiTime’s past margins and performance, we can determine the actuals and assumptions we can make of the company, by setting past performance as the current company standard. Why do I use historicals? I use it to get a broad idea on how a company’s margins should look like, year-to-date. With using the picture above, we can say that the company has been maintaining its gross margins pretty well, with an increase from 23.20% in the third quarter results of 2021, to its current 27.20% gross margins in the third quarter results of 2022.

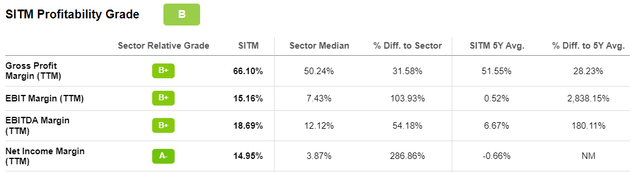

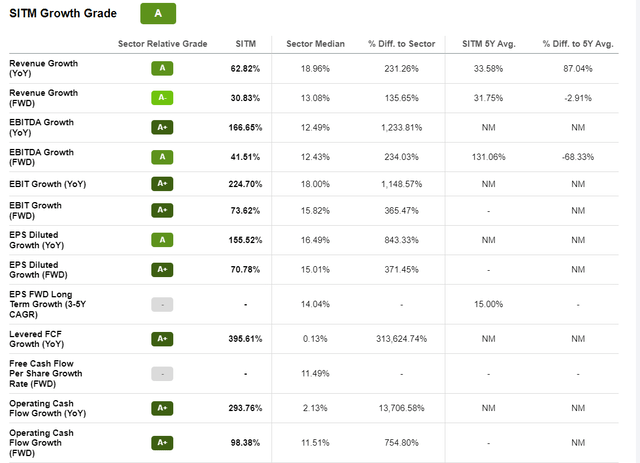

SITM Growth Metrics – Seeking Alpha

SITM Growth Metrics – Seeking Alpha

Now compare that with the sector median that SiTime operates in, there’s a 10% difference between the sector median’s TTM gross profit margins of 50%, and SiTime overall has better EBIT, EBITDA, and Net Income margins which further proves my point that the company is profitable, and by taking a look at its business model, is also sustainable in the long-term. However, we did see a decline in its EBITDA margins and EBIT margins, why is that? That’s because the company’s operating expenses have been increasing, while its gross profits haven’t. The $4 million increase in R&D and $1.5 million increase in SG&A while operating at a gross profit decline hugely affects the margins of the company. The sequential decrease in top line performance, affects the company’s margins from top to bottom.

SITM Growth Metrics – Seeking Alpha

SITM Growth Metrics – Seeking Alpha

Now heading over to the company’s growth and profitable metrics, we have to determine its growth drivers. The first growth driver I can think of is its expansion in the IoT automotive market, having more design wins in Q3’22, and its single-source position with its customers. So what does these growth drivers mean? It means strength in the top line, and with top line strength, comes better margins, and with better margins, comes better growth, better profitability, and better value. As you can see in the image above, the company’s performing really well when compared to the sector median. Comparing its forward revenue growth of 30%, compared to its 13% sector median revenue growth signifies top line strength that SiTime possesses, and again, a stronger top line will mean better gross margins, and EBITDA margins, even if the company prudently increases its operating expenses.

However, even if growth and profitability, what are the valuations saying about the stock? The company operates on a P/E ratio of 18.46, compared to the sector median of 16.18 which is higher than it should be. Forward P/E estimates of 22.46 is also higher compared to the sector median of 17.68. This brings up the question, is SiTime overvalued? Why is it trading higher than the median? Since we’ve already determined that SiTime is a growth stock and can continue to remain profitable in a long-term perspective, there are two things we can learn from its valuations: either it’s severely overvalued or severely undervalued. Why can I say this? If investors think that the company can generate huge returns in the future, then investors will think that it should be priced higher than what it’s currently trading at. This means that if we determine and commit SiTime as a growth stock and a profitable company, then its valuations should be above its sector median, as investors expect this business to generate high returns.

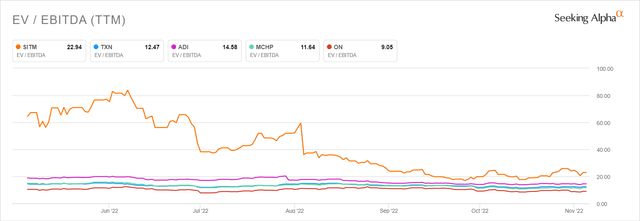

SITM EV/EBITDA Peer Comparison – Seeking Alpha

SITM EV/EBITDA Peer Comparison – Seeking Alpha

With the help of the EV/EBITDA ratio for the past 6 months, we can determine that a few months ago, SiTime was priced relatively high and is overvalued. This can be proven since the share price have fallen by 55% over the last 6 months. However, as you can see in the most recent months, the company has been trading at a relatively close EV/EBITDA ratio compared to its peers like Texas Instruments Incorporated (TXN), Analog Devices (ADI), Microchip Technology Incorporated (MCHP), and On Semiconductor Corporation (ON).

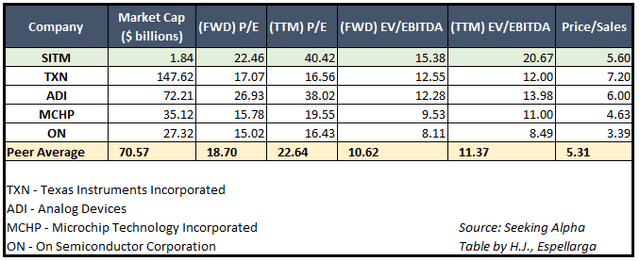

Seeking Alpha – Table by Author

Seeking Alpha – Table by Author

Even if we look at the companies at a peer basis, SiTime is currently trading at a higher valuation and I acknowledge that. The company is being compared to different peers with different market caps but operates in the same sector. Regardless, I think that the price is still reasonable, considering that the share price has declined 70%. This makes me think that the market is putting SiTime at a high valuation by expecting high returns in the future, through its growth segments and profitable business model.

Since the company heavily relies on top line strength to determine the company’s future margins and profitability, I can think of three main risks that can affect the company. These risks will not only compromise the company’s momentum, but also affect the long-term growth of the company.

These are the three risks that the company is prone to and investors should take note of these risks since I believe that SiTime currently depends on its top line performance, and if top line weakens, margins weaken and profitability decreases, we won’t want that to happen.

Overall, I believe that it is the time for SiTime to shine at the current price it is trading at. I consider SiTime to be a growth stock and its profitable long-term growth drivers will help the company remain profitable. From expansion into the IoT automotive end market that’s expected to grow at a high CAGR, its single source position for its customers, and having more design wins will help the stock excel near-term and long-term. The stock is in a great path of growth, which leads me to rate the stock as a Strong Buy. I’ll be closely monitoring the stock and make sure to create updates if significant news has been released.

Thank you for reading, and have a great day!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have written this article myself and am not a financial advisor. My articles are opinions and are not suggesting you to buy or sell securities. Perform your own due diligence.