Tharushi shocks seniors, breaks own record and sets world-leading time

After Big Match duties Sineth, Tharupathi guide Sri Lanka U19s to big win

New Zealand seal 2-0 whitewash despite Sri Lanka’s lower order resistance

Dominant Delhi Capitals dethrone Mumbai Indians from top spot

Harris, McGrath power UP Warriorz into playoffs

CSE expected to maintain growth momentum in the wake of brighter IMF bailout hopes

“Surfing Through the Crisis”

Participants of Raid Amazones 2023 arrive from Paris on SriLankan Airlines

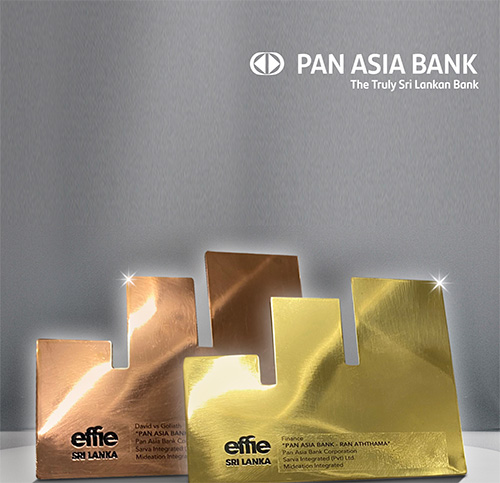

Pan Asia Bank crowned with Gold at Effies

SLT-MOBITEL ‘BizLife’ Packages support businesses to develop

Published

on

By

Leveraging its strong brand identity as the Truly Sri Lankan Bank, Pan Asia Bank won a Gold and a Bronze award at the 2022 Effie Awards. The Bank walked away with a Gold award in the Finance category and a Bronze under a Business Challenge Category (David vs Goliath). The Effie Awards Sri Lanka, organized by the Sri Lanka Institute of Marketing (SLIM), the apex body of marketing profession, is a coveted event that is highly anticipated and celebrated by advertising agencies and marketers, both locally and globally, as the most distinguished honour in the industry. Naleen Edirisinghe – CEO designate of Pan Asia Bank said, “We are honoured to record our win at the prestigious Effie Awards! We are thrilled to win two key awards, which reflect the efficacy and precision of our creative campaigns for our pawning product, ‘Ran Aththama’. We are grateful to our creative partner, Sarva, for executing our vision creatively, and Mideation, our media management partner, for effectively reaching out to our valued customers and target audience. In recent years, Pan Asia Bank has embarked on strategic brand building and these 2 major wins at the Effie Awards demonstrates that we are on the right path.”

Naleen Edirisinghe – CEO designate of Pan Asia Bank said, “We are honoured to record our win at the prestigious Effie Awards! We are thrilled to win two key awards, which reflect the efficacy and precision of our creative campaigns for our pawning product, ‘Ran Aththama’. We are grateful to our creative partner, Sarva, for executing our vision creatively, and Mideation, our media management partner, for effectively reaching out to our valued customers and target audience. In recent years, Pan Asia Bank has embarked on strategic brand building and these 2 major wins at the Effie Awards demonstrates that we are on the right path.”

As a bank that prides itself on its truly Sri Lankan spirit, Pan Asia Bank undertook rebranding to be perceived by the Sri Lankan masses as a brand that held a completely Sri Lankan identity with the new tagline – ‘The Truly Sri Lankan Bank’. This served as a strategic advantage for the pawning rebrand in a market dominated by other established brands. The integrated campaign ‘Ran Aththama’ enabled Pan Asia Pawning product and portfolio to become one of the largest in terms of the growth and number of new customers in the banking and finance industry.

Participants of Raid Amazones 2023 arrive from Paris on SriLankan Airlines

SLT-MOBITEL ‘BizLife’ Packages support businesses to develop

Pan Asia Bank partners with Amana Takaful Life to serve different customer segments

Pan Asia Bank enhances customer-centric skills of its credit card team in partnership with Mastercard

Pan Asia Bank welcomes 2023

Naleen Edirisinghe assumes duties as Chief Executive Officer – designate of Pan Asia Bank

Pan Asia Bank facilitates much-needed banking facilities for thousands of tourists from The Mein Schiff 5 cruise ship

Pan Asia Bank bestowed with ‘Employee ESG Program of the Year Sri Lanka 2022’ at the Global Banking and Finance Awards

Your email address will not be published. Required fields are marked *

Published

on

By

By Hiran H.Senewiratne

The CSE will be able to maintain its growth momentum with IMF bailout prospects brightening this week. Consequently, foreign inflows to the CSE will improve in the future, Head-Market Development, CSE, Niroshan Wijesundara said.

“To date the CSE has been able to register a 14 per cent growth and with the IMF bailout approval we could expect more foreign inflows into the market, Wijesundera told the Island Financial Review.

Amidst these developments the market ended on a positive note at the end of yesterday. Initially there were mild profit- takings but this did not negatively impact the overall performance of the market.

Accordingly, shares edged up in mid-day trade yesterday while investors adopted a wait- and -see approach as the country looked forward to IMF approval on the Extended Fund Facility towards the end of this week.

“Investors are on a wait- and- see approach as the IMF is likely to approve the US$ 2.9 billion dollar loan, market analysts said. “Selling pressures have eased and now buying sentiments are improving, analysts said.

“Selling pressures have eased and now buying sentiments are improving, analysts said.

The ASPI went up by 29.54 points, while the most liquid S&P SL20 index rose by 15.7 points. Turnover stood at Rs 1.8 billion with three crossings. Those crossings were reported in Hemas Holdings, which crossed three million shares to the tune of Rs 199 million, its shares were quoted at Rs 65, Hayleys 738,000 shares crossed for Rs 59.8 million, its shares traded at Rs 31 and JKH 290,000 shares crossed for Rs 42 million, and its shares fetched Rs 141.

In the retail market top seven companies that mainly contributed to the turnover were; Browns Investments Rs 209 million (30.8 million shares traded), JKH Rs 84.6 million (584,000 shares traded), Access Engineering Rs 79.5 million (4.9 million shares traded), LOLC Finance Rs 75.4 million (10.9 million shares traded), Union Bank Rs 62.9 million (6.7 million shares traded), Expolanka Holdings Rs 60 million (420,000 shares traded) and SLT Rs 57.5 million (687,000 shares traded). During the day 98.7 million share volumes changed hands in 20000 transactions.

Top gainers during mid- hours were Commercial Bank, Browns Investment and Access Engineering. Access Engineering is an unusual top contributor and this is because interest had been generated in it after assurances had been given on the IMF deal and there is an assumption that multilateral projects are likely to begin with the IMF restructuring process coming to a close, market analysts said.

Sri Lanka’s growth will be contained at a negative 3 per cent in 2023 after a 12.4 per cent shrinkage in the fourth quarter of 2022 and is expected to turn positive from next year, State Minister of Finance Ranjith Siyambalapitiya said. Siyambalapitiya told reporters on March 18 that Sri Lanka can expect a “positive economy” in 2024.

Yesterday the rupee opened stronger and was quoted at around Rs 330/338 to the US dollar, stronger from Friday’s close of Rs 337/345 to the US dollar, dealers said.

Published

on

By

EY Sri Lanka, is scheduled to host a discussion ‘Debt Restructuring Implications to the Financial Services Sector’, on March 22, from 08:45 am to 12:30 pm at The Kingsbury Colombo. The session branching under the theme, ‘Surfing through the Crisis’, is designed specifically for CEOs, CFOs, and CRO of the financial sector, as well as the chairpersons of the Audit Committee and the Board Integrated Risk Management Committee. The event hopes to create value for Sri Lanka’s financial sector amidst the prevailing economic challenges. As the largest service providers to the financial sector in terms of audits, tax, consultancy, and strategy & transaction, EY Sri Lanka feels compelled to assist the financial sector as they navigate the challenges of the economic crisis.

Despite the expected positive outcomes of debt restructuring, the process itself can be painful for the country, financial institutions, debtors and creditors. To the financial services sector specifically it could bring several challenges to capital management, financial reporting, Credit Risk and Liquidity Risk management strategies.

This session will explore these implications, under two technical segments, from Risk Management and Accounting lenses, and the mechanisms required for an effective transition. From a Risk Management perspective there will be several simulations on how it affects the financial institution’s capital and profitability whilst the accounting perspective will include discussions relating to how the debt restructuring process shall be accounted for in line with SLFRS 9 Financial Instruments.

The event will be conducted by Manil Jayesinghe, Country Managing Partner of EY Sri Lanka and Maldives, and Rajith Perera, Partner Financial Accounting Advisory Services EY Sri Lanka. To register for the session, or for further inquiries please contact Nurani Rajapaksha ([email protected])

Published

on

By

The participants of the adventure trail ‘Raid Amazones 2023’ arrived at Bandaranaike International Airport on SriLankan Airlines’ flight UL 564 from Paris. SriLankan Airlines is the Presenting Partner of Raid Amazones and extended a warm welcome with a traditional flare to the arriving group.

The group boarded the Udarata Menike train from the Gampaha Railway Station shortly thereafter for a scenic journey to Kandy, where the trail will unfold from 22 – 28 March.

Raid Amazones is the world’s only itinerant women’s adventure race. Nearly 250 female athletes will be participating in the 21st edition of the trail in Kandy.

Dickwella – a monster the selectors created

Earth’s Greatest Rivalry

Credit Suisse slump renews fears of global banking crisis

All praise for Lanka’s saviours!

A middle path for Sri Lankan agriculture: Sustainable intensification – PART I

Underworld figures flown to Colombo from Madagascar

Sri Lankan recognized as a Fellow by Society of Architectural Historians

Smash glass ceiling