JHVEPhoto/iStock Editorial via Getty Images

JHVEPhoto/iStock Editorial via Getty Images

[Please note that all currency references are to Canadian dollar except if indicated otherwise.]

Canadian Western Bank (OTCPK:CBWBF; $31.79; Banks; Shares outstanding: 89.7 million; Market cap: $2.84 billion) is a relatively small bank headquartered in Edmonton, Canada. The bank’s focus is on small and medium-sized companies.

The bank has a sound track record of steady growth in profits and dividends but has lagged the Canadian majors over the past 7 years as economic growth in its core market, Alberta, stagnated. Diversification into Ontario, much-improved energy and commodity prices, and the specter of rising interest rates all bode well for an improved performance for the bank.

Canadian Western Bank (“CWB”) offers personal banking and business banking services for small and medium-sized companies with a focus on general commercial banking, cash management services, equipment financing, and real estate construction financing.

Interest income is the main source of revenue for the bank, with 88% of the 2021 revenue deriving from that source. Wealth management is the main contributor to non-interest income. Just over 80% of its loan portfolio is extended to corporations, with the balance loaned to private individuals.

Historically CWB generated most of its income from Western Canada but over the past 5 years, the bank expanded its operations in Ontario and other regions of the country. The bank’s loan portfolio is now fairly evenly distributed between clients located in British Columbia, Alberta, and the rest of the country.

The bank operated 40 banking centers and had 2617 full-time employees by the end of the 2021 financial year (October).

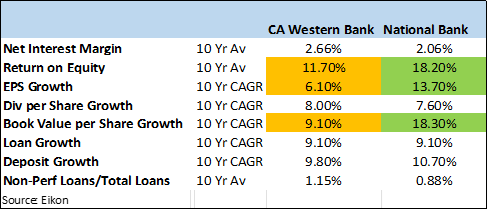

Although the bank managed to grow its profits and dividends at a reasonable rate over the past decade, its performance lagged the major Canadian banks. When compared to the top-performing National Bank of Canada (OTCPK:NTIOF), its annual earnings growth rate per share was less than half, while its return on equity was on average a third lower.

Nevertheless, the bank has performed steadily over the past decade with net income before tax increasing by 110% to $480 million by the end of the 2021 financial year. As the share count expanded the earnings per share increased by only 81% while dividends per share grew by 115%. The book value per share amounted to $33.10 by the end of the 2021 financial year, 138% higher than 10 years ago.

Over the same period, the loan book expanded by 166% to $32.9 billion while deposits increased by 142% to $30 billion.

Source: Eikon

Source: Eikon

The bank’s operating ratio (non-interest expense/revenue) was 50.1% in 2021 and averaged 49.1% over the past decade. The net interest margin (net interest income/total assets) was 2.50% in 2021, somewhat lower than the 10-year average of 2.66%.

Write-offs on loans as a percentage of average loans were on average 18 basis points over the past 10 years with a high of 32 basis points in 2016. The return on equity was 11.8% in 2021 and averaged 11.7% over the past decade.

In its 2021 financial year, revenues increased by 13% to $1.0 billion as net interest income rose by 12% and other income (mainly from a wealth management acquisition) by 26%. Expenses also increased by 17% (mostly labor costs) but a sharp reversal of the loan loss provisions made in 2020 helped lead to a 31% improvement in the earnings per share to $3.74.

The dividend rose marginally to $1.17 for the full year as Canadian banks were restricted by the regulator from raising dividends until late in 2021. The bank has an excellent dividend track record and currently has a payout ratio of only 31% of net income.

In December 2021 the bank said that it expects “double-digit” loan and deposit growth for the 2022 financial year and “low to mid-single-digit” growth in earnings per share. The bank also expects to see non-interest expenses increase “in the low teens” in 2022.

The bank has expanded its operations outside of its home base in Western Canada over the past 5 years. Loans extended to customers in Ontario now cover 23% of the loan book, up from 15% in 2016. This part of the loan book has been growing at 18% per year, well ahead of the bank’s average loan growth of 9.1% per year.

The economy of Ontario is considerably larger than any other Canadian province making up almost 40% of Canada’s gross domestic product. Ontario is also home to 450,000 small and mid-sized companies, which is more than Alberta and British Columbia combined.

Given the size of the Ontario market, it seems likely that CWB will be able to continue growing it business in this province and further improve its regional diversification.

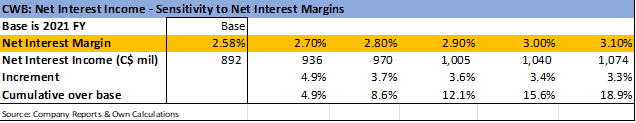

Almost 90% of CWB’s revenue is derived from interest income – the bank’s profitability is therefore sensitive to the net interest margin. As banks are normally able to improve their margins when interest rates rise, CWB should be a prime beneficiary if the Canadian central bank undertakes multiple interest rate increases, as expected, in 2022-23.

The bank’s net interest margins (“NIMs”) fluctuated between 2.16% and 3.04% over the past 15 years. The sensitivity of the bank’s net interest income (“NII”) is indicated in the table with the 2021 earning assets and margin considered as the base case. Keeping all other variables constant, the bank would be able to increase its NII by 8.6% should it be able to improve its NIM to 2.80%.

Source: Company reports and contributor calculation

Source: Company reports and contributor calculation

Higher oil and commodity prices support economic activity in Alberta where mining, energy, and agriculture contribute directly more than a third of the gross domestic product. These sectors are doing very well at the moment, which will contribute to faster loan growth for the bank.

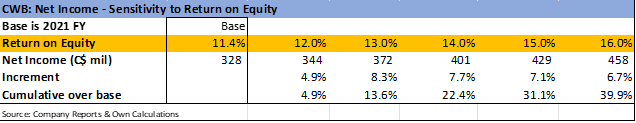

During previous energy and commodity booms, the bank managed to increase its return on equity (“ROE”) to over 15% (2007-2012). The table below indicates the sensitivity of the bank’s net income for a higher return on equity. With 2021 as the base, and keeping all other variables constant, an improvement in the ROE from the current 11.4% to 14% will lift the net income by 22%.

Source: Company reports and contributor calculation

Source: Company reports and contributor calculation

By the end of the 2021 financial year, the bank had a common tier 1 capital ratio of 8.8% and a total capital ratio of 12.4%. In both cases, these ratios are well above the regulatory minimum requirements. CWB is not considered a systematically important bank and therefore not subject to the 100-basis point additional capital requirement.

Funding is largely provided by bank branch deposits and term loans from brokers, which jointly make up 78% of the current funding complement.

Alberta, where growth is dependent on high commodity prices, remains an important market for the bank. Although the bank has reduced its dependence on Alberta over the past 5 years, energy and commodity price weakness will continue to impact the performance of the bank.

The high correlation between the price of the bank’s stock and the price of oil is also very noticeable. This is, in our opinion, not a fair reflection of the diverse nature of the bank’s business, but it remains a risk that investors link the performance of the bank to the unpredictable price of oil.

Despite the struggles that the bank experienced over the past few years in its home market, Alberta, it managed to grow mainly through diversification into the Ontario market. CWB has not performed as well as some of its peers, but it seems poised for a much-improved performance for the next few years.

The bank will continue with its expansion in Ontario and increasing interest rates should help its net interest margin. Should the current healthy energy and commodity prices last, the bank could perform strongly for years to come.

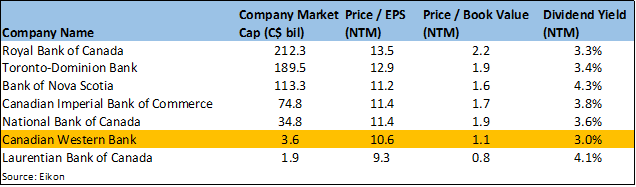

Given the stock’s current price and consensus estimates for the next 12 months, the company is valued on a price-to-earnings ratio of 10.6 times, and a price-to-book ratio of 1.1 times.

source: Eikon

source: Eikon

We consider the current valuation as undemanding for a good business that has the potential to grow its profits considerably over the next 2-3 years. Should the bank succeed in lifting its return on equity to something closer to the peer group average, the stock would also rise accordingly. In our view, this leaves attractive upside potential with limited downside risk.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. Business relationship disclosure: By Deon Vernooy , CFA, for TSI Wealth Network