enjoynz

enjoynz

(Unless otherwise specified, the amounts are in Australian Dollar)

On my watchlist of companies I am monitoring closely are several banks – including banks from the United States, from Canada as well as Sweden. And more than two years ago in November 2020 I also covered one bank from Australia – the Commonwealth Bank of Australia (OTCPK:CBAUF).

In my last article about the Commonwealth Bank of Australia I stated that the stock was trading with a premium. Nevertheless, the stock increased about 45% in U.S. dollars and even 55% in Australian dollars since the article was published. And when including dividends, the total return was around 65%. This is not only a great return for a little over two years, but the stock also outperformed the S&P 500 (SPY) which gained about 15% in the same timeframe. And although I probably should have been more bullish in my last article, I will once again be cautious as I still think that the Commonwealth Bank of Australia is trading with an unjustified premium.

Before we provide an update on the business, let’s start with a small business description. The Commonwealth Bank of Australia was founded in 1911 and is mostly operating in Australia and New Zealand. It is the largest bank in Australia (and clear market leader) as well as among the 50 largest banks in the world. The bank also has a presence in the United Kingdom, the United States, China, Japan, Singapore, Hong Kong, Indonesia, and South Africa. And it is operating in six different business segments and for more details see my last article about the business.

Similar to many European companies, the Commonwealth Bank of Australia is reporting results only twice a year – annual results and semi-annual results. On February 15, 2023, the bank will report half-year results, but right now the most recent results are full year results for fiscal 2022 (Commonwealth Bank of Australia’s fiscal year is ending on June 30).

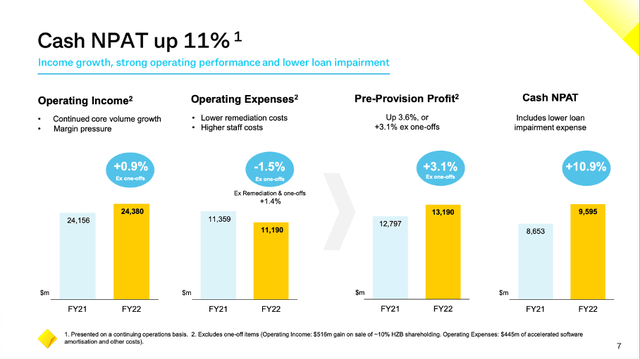

The company could report pretty good results for fiscal 2022. Net interest income increased from $19,302 million in fiscal 2021 to $19,473 million in fiscal 2022 – an increase of 0.9% year-over-year. And total operating income increased from $24,156 million in fiscal 2021 to $24,896 million in fiscal 2022 – an increase of 3.1% year-over-year. And diluted earnings per share increased from 539.7 cents per share in fiscal 2021 to 601.4 cents per share in fiscal 2022 – an increase of 11.4% year-over-year. When looking at earnings per share from continuing operations we see an increase of 15.1% YoY from 470.6 cents in the previous year to 541.5 cent in fiscal 2022.

CBA FY22 Presentation

CBA FY22 Presentation

And when looking at the divisions all four major banking divisions contributed to growth. Cash net profit after tax especially increased for “Institutional Banking and Markets” by 13% year-over-year to $1,050 million. And while “New Zealand” could report 9% year-over-year growth to $1,265 million, “Business Banking” could report “only” 6% growth to $3,001 million and “Retail Banking Services” reported 5% growth to $4,929 million.

One of the most important topics when talking about banks is the stability of the different institutions. Of course, we should take a look at the balance sheet and financial health of other businesses as well, but in case of banks, it is especially important.

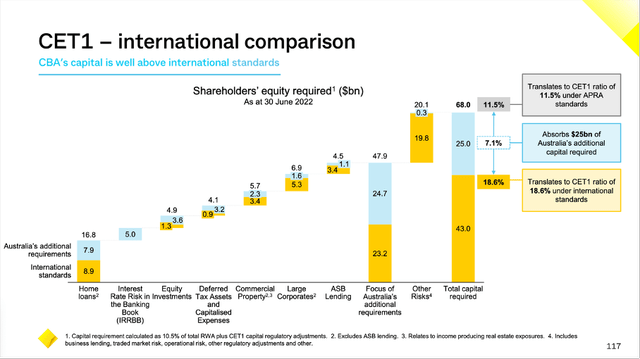

And when looking for a reason why the Commonwealth Bank of Australia might be trading for a premium compared to many other banks in the United States, Europe or Canada is the stability of the Australian banking system, which is considered to be one of the safest in the world. When looking at the CET 1 ratio, the Commonwealth Bank is reporting a ratio of 11.5% right now, which is solid but only seems to be in line with other banks in North America. However, we must point out the higher standards of the Australian Prudential Regulatory Agency (APRA) and when “translating” the CET 1 to international standards, the Commonwealth Bank of Australia would have a CET 1 ratio of 18.6%.

CBA FY22 Presentation

CBA FY22 Presentation

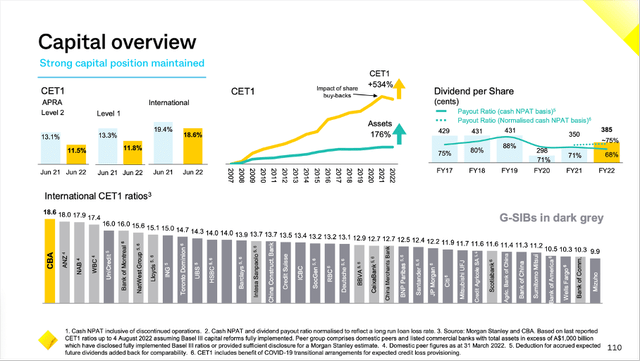

And such a CET 1 ratio is much higher than almost all other banks around the world. And as we can see in the following chart, the Commonwealth Bank of Australia is presenting itself even more stable than the major Canadian banks.

CBA FY22 Presentation

CBA FY22 Presentation

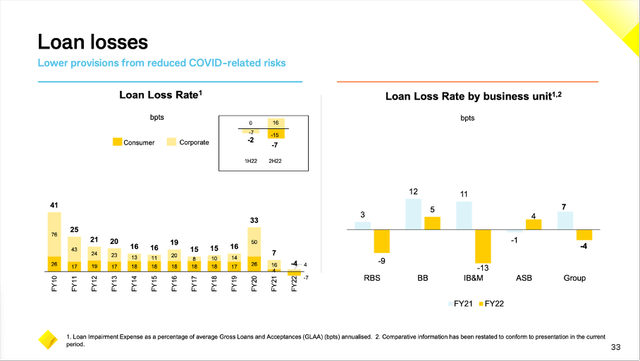

Similar to the United States, Australian banks are subject to regular stress tests, but – in contrast to the United States – the Australian authorities demand higher capital and liquidity buffers. As a result, the Australian banks performed much better during the Great Financial Crisis than its U.S. counterparts. Similar to Canadian banks, defaults were limited and most banks – including the Commonwealth Bank of Australia – could withstand the economic crisis quite well. And when looking at the loan losses in the last decade, we see extremely low numbers.

CBA Fixed Income Investor Presentation

CBA Fixed Income Investor Presentation

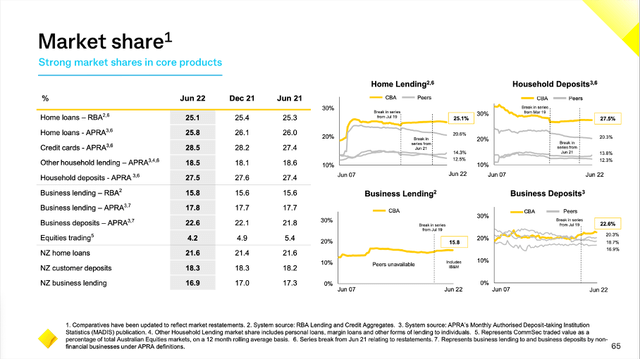

We already mentioned above that the Commonwealth Bank of Australia is market leader in Australia, which is leading to some competitive advantages – especially cost advantages as several expenses are fixed and with additional clients or larger deposits or higher credit volume, the bank will be more profitable. And the Commonwealth Bank of Australia is leader in almost every category.

CBA FY22 Presentation

CBA FY22 Presentation

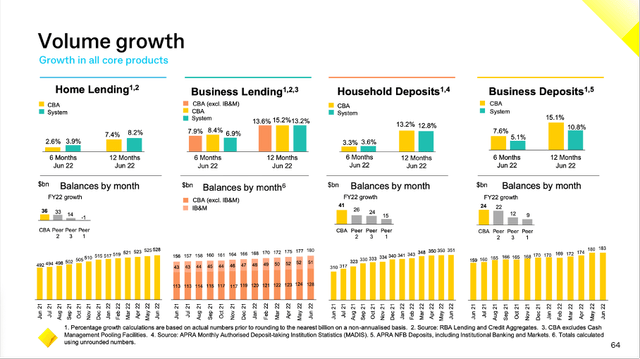

And the bank could also report solid volume growth in all core products – including home lending, business lending, household deposits as well as business deposits.

CBA FY22 Presentation

CBA FY22 Presentation

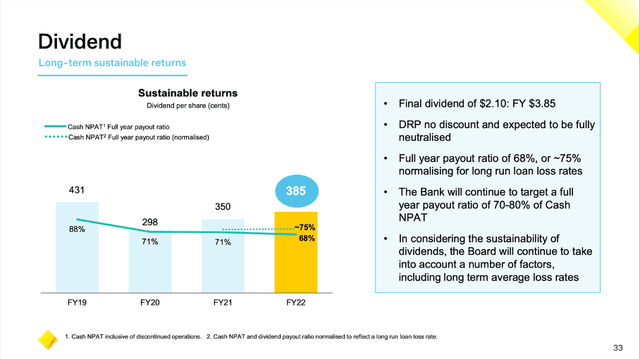

Like most other banks, the Commonwealth Bank of Australia is interesting for its dividend. And in the last two years, the bank increased its dividend at a high pace – with a CAGR of 13.7% from 298 cent to 385 cent right now. This is resulting in a dividend yield around 3.5% and a payout ratio of 69%. When looking at the company’s dividend policy, this is actually at the lower end of the target range. The Commonwealth Bank of Australia will pay out between 70% and 80% of earnings in any given year and therefore we can expect increasing dividends in the coming years.

CBA FY22 Presentation

CBA FY22 Presentation

We should also mention that the Commonwealth Bank of Australia had to cut its dividend in fiscal 2020 due to the COVID-19 crisis. Not only was management rather cautious and cut the dividend to preserve capital, but the Australian Prudential Regulation Authority (APRA) had also requested that Australian banks will either suspend or reduce the dividend (we saw a similar policy in many other countries). And while the bank increased the dividend again, we still haven’t reached pre-crisis levels. In fiscal 2019 and fiscal 2018 the dividend was $4.31.

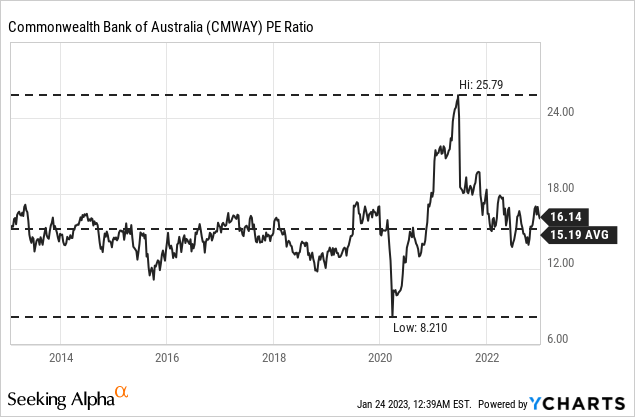

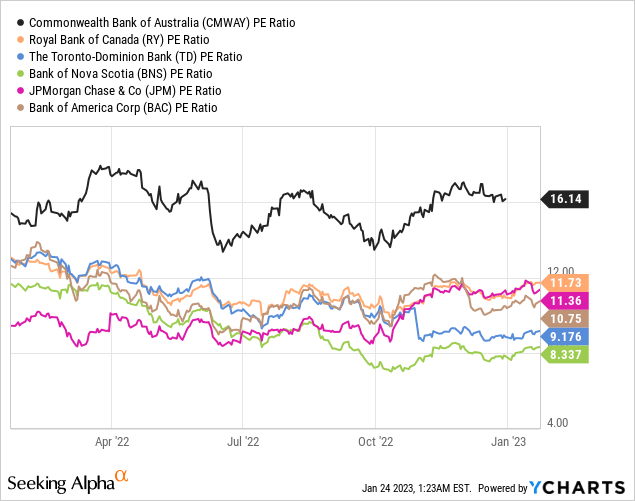

In my opening section I already stated that the Commonwealth Bank of Australia is still trading for a premium. And in my opinion, the stock is just a bit too expensive to be a good deal. Right now, the stock is trading for 16.14 times earnings. Such a P/E ratio is not high on an absolute basis and is also more or less in line with the 10-year average P/E ratio of 15.19.

When using a discount cash flow calculation and taking the net income of fiscal 2022 as basis, the company must grow about 5% annually till perpetuity to be fairly valued (assuming 10% discount rate). And while I don’t want to claim that the bank is not able to grow 5% annually, we at least must point out that the average growth rate in the last 10 years was lower. Summing up, I see the Commonwealth Bank of Australia a little overvalued and not as a good investment at this point.

And while the Commonwealth Bank of Australia is certainly not expensive when comparing the valuation multiple to several other industries, the bank is rather expensive when comparing it to its peers. Most major banks in different countries around the world are trading for much lower valuation multiples and therefore I still think the Commonwealth Bank of Australia is trading for an undeserved premium.

We can especially compare the Australian bank to the different major Canadian banks. While one can argue that the Commonwealth Bank of Australia deserves a premium compared to several European or U.S. banks as the bank is safer and must follow higher regulatory standards that argument is not necessarily true for Canadian banks, which can also be described as safe.

And when comparing the Commonwealth Bank of Australia to the three major Canadian banks – the Royal Bank of Canada (RY), the Toronto-Dominion Bank (TD) and the Bank of Nova Scotia (BNS) – the Australian bank doesn’t look like a good deal. Not only does it have the highest P/E ratio – it also has a much higher P/E ratio than most of the U.S. banks – but it is also reporting the lowest growth rates in the past (only when looking at the 3-year EPS CAGR, it doesn’t take the last spot). And the combination of highest P/E ratio and lowest growth rates is usually not speaking for a great deal.

Commonwealth Bank of Australia

Royal Bank of Canada

The Toronto-Dominion Bank

Bank of Nova Scotia

P/E ratio

16.14

11.73

9.18

8.34

10-year EPS CAGR

3.40%

8.42%

10.85%

4.39%

5-year EPS CAGR

1.47%

7.91%

11.48%

4.32%

3-year EPS CAGR

8.67%

8.12%

14.86%

6.28%

Now one might argue that the Commonwealth Bank of Australia is interesting for its dividend and therefore deserves a premium. But once again, all three Canadian banks seem to be a better deal. Among these four banks, the Commonwealth Bank of Australia has the lowest dividend yield combined with the highest payout ratio.

Commonwealth Bank of Australia

Royal Bank of Canada

The Toronto-Dominion Bank

Bank of Nova Scotia

Dividend Yield

3.56%

3.68%

4.34%

5.92%

Payout Ratio

69%

45%

41%

51%

For geographical diversification it would make sense for me to also own assets in Australia – and the Commonwealth Bank of Australia certainly seems like a well-run bank and a good asset to have in one’s portfolio. However, I am not willing to pay the current price and premium – especially compared to other banks like the Royal Bank of Canada or the Toronto-Dominion Bank.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.