Written by

Published on

3 mins read

Grab made headlines on December 2 when it went public on the Nasdaq. The firm went public via a SPAC merger with Altimeter Growth Corp, in a deal that gave them a valuation close to USD 40 billion. However, Grab performed poorly on the first day of trading as its shares fell 21% to USD 8.75. This means Grab shed one-fifth of its market capitalization, dropping to USD 34.6 billion.

There are many examples of tech companies whose share price tumbled immediately after their IPOs, or performed weakly after acquiring their ticker symbols. For instance, the stock price of Sea Group—Southeast Asia’s poster child for the public market—was flat for more than two years before it rose nearly 400% in 2020. Even though Grab’s first day on the Nasdaq was steeped in red, the company’s IPO marked an important milestone for Southeast Asia’s internet economy, where other major tech firms plan to follow its path to New York in the coming years.

In Indonesia, the share price of Emtek, Grab’s strategic partner, rose last week. This was particularly visible on Thursday, when Grab’s IPO was widely reported in local and regional media outlets. Grab and Emtek hold significant stakes in each other’s businesses.

“The strengthening of Emtek’s share price last week seemed to indicate a positive response to Grab’s IPO on Nasdaq, but this is certainly not the only factor,” Farris Farhan, an analyst at Samuel Sekuritas Indonesia, told KrASIA. He added that other developments in Emtek’s business, such as the potential for establishing a digital bank after the acquisition of Bank Fama, and the recent USD 150 million investment from Beijing-headquartered Affinity Equity Partners in video streaming platform Vidio, also contributed to the climb.

Written by Nikkei Asia

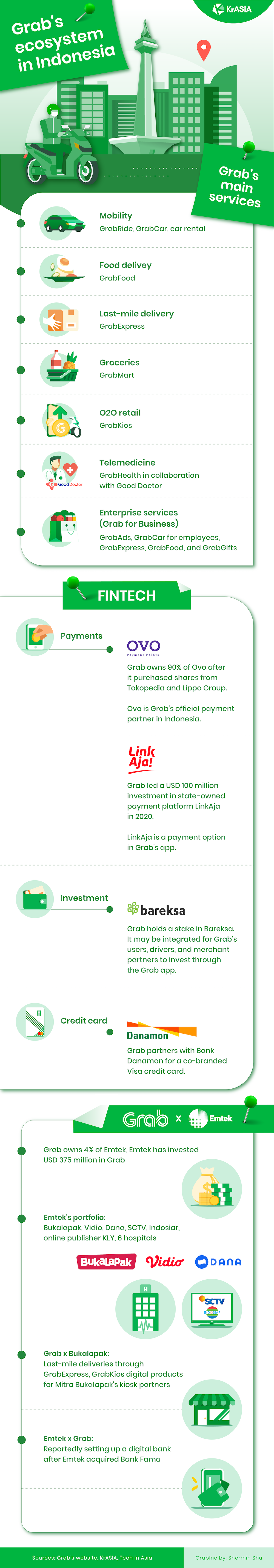

Aside from Grab, Emtek holds significant stakes in e-commerce provider Bukalapak and payments platform Dana.

In April, Grab reportedly spent IDR 4 trillion (USD 274 million) to buy a 4% stake in Emtek. Then, in July, Emtek made a USD 375 million investment in the ride-hailing giant. Along with two other Indonesian conglomerates, Djarum and Sinar Mas, Emtek participated in Grab and Altimeter’s USD 4 billion private investment in a public equity (PIPE).

Ahead of its IPO, Grab has been deepening its presence in Indonesia. In October, the ride-hailing company acquired a 90% stake in Ovo from Tokopedia and Lippo Group. A month later, Grab grew its fintech portfolio by buying part of digital investment platform Bareksa.

Bareksa will be able to tap into Grab’s user base, with payments handled by Ovo, which also invested in Bareksa in 2019. With fresh funds from the public market, Grab will likely continue to expand its ecosystem in Indonesia, the company’s largest market.

These developments bring about tighter competition between Grab and its archival, GoTo, which operates in ride-hailing, e-commerce, logistics, food delivery, and payments. On the fintech front, GoTo seems to be moving faster, as it acquired a 22% stake in Bank Jago in December 2020. Jago has integrated with GoPay, allowing users to open a Jago bank account through the Gojek app.

In November, GoTo landed USD 1.3 billion in the first close of its pre-IPO fundraising. The company has not disclosed any details of its IPO plans, but media reports said that GoTo expects to go public in Indonesia in the first half of 2022, possibly followed by a listing in New York.

Auto loading next article…

Subscribe to our weekly newsletter

KRASIA

A digital media company reporting on the most promising technology-driven businesses and trends in the world's emerging markets.