In 2018, rising interest rates that coincided with an extended bull run in U.S. equities for most of the year fueled a strong dollar, tamping down gains for gold. However, when investors got washed in a cycle of volatility that started in the fall and lasted through year’s end, investors were quick to reconsider the precious metal as a safe haven, which helped exchange-traded funds (ETFs) like the Aberdeen Standard Physical Swiss Gold Shares ETF (NYSEArca: SGOL) flourish.

SGOL gained 4 percent during a tumultuous December that saw U.S. equities finish their worst year in over a decade. The Dow fell 5.6 percent, while the S&P 500 lost 6.2 percent and the Nasdaq Composite fell 4 percent.

Meanwhile, SGOL effectively climbed past its 200-day moving average as a risk-off sentiment began to permeate the markets with a scramble for safe havens like gold ensuing.

With the latest Fedspeak sounding more dovish as it now projects two interest rate hikes in 2019 as opposed to three or more, this could be the trigger for gold to return to come back into the forefront, particularly as a safe-haven option in the wake of more volatility. While bonds are typically the default play when U.S. equities go awry, gold is a prime option for diversification as a safe alternative.

“I think moving forward the expectation is not as strong of a dollar,” said Steven Dunn, Aberdeen Standard Investments Head of Exchange Traded Funds. “I think there is some concerns about volatility and does gold come back into play as that safe-haven type of asset.”

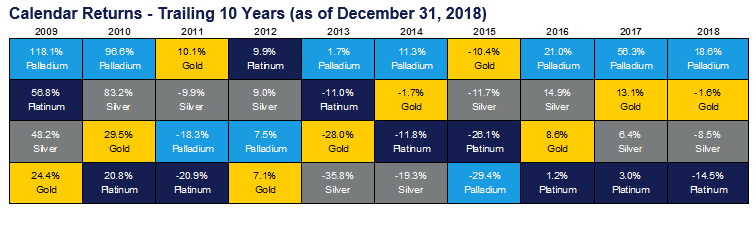

Despite the headwinds of rising rates and a stronger dollar in 2018, some analysts feel that gold has weathered the storm and presents a prime buying opportunity in 2019. For the last 10 years, gold has proven to be a consistent performer, yielding 5.1 percent.

“During this period gold rose over 5% and outperformed US equities on the year by 2.8%,” noted Maxwell Gold, Director of Investment Strategy at Aberdeen Standard Investments. “This recent bout of market volatility may likely have a lasting impression on investors who may seek a potential risk hedge in the form of gold and precious metals.”

SGOL seeks to reflect the performance of the price of gold bullion minus the trust’s expenses. The Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in gold.