Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Find the solutions you need by accessing our extensive portfolio of information, analytics and expertise. The IHS Markit team of subject matter experts, analysts and consultants offers the actionable intelligence you need to make informed decisions.

Critical analysis and guidance spanning the world’s most important business issues.

Stay abreast of changes, new developments and trends in their industry.

A global team of industry-recognized experts contributes incisive and thought-provoking analysis.

Broaden your knowledge by attending IHS Markit events that feature our subject-matter experts. Find webinars, industry briefings, conferences, training and user groups.

During COVID-19, IHS Markit is offering more online events for the safety of our guests.

IHS Markit will resume our in-person events once it is safe to do so.

Missed an event or webinar? Review the recordings of past online events.

IHS Markit is the leading source of information and insight in critical areas that shape today’s business landscape. Customers around the world rely on us to address strategic and operational challenges.

The experts and leaders who set the course for IHS Markit and its thousands of colleagues around the world.

Sustainability drives the entire IHS Markit enterprise. It’s how we do business by guiding our values and culture on the notion that we can make a difference.

Join a global business leader that is dedicated to helping businesses make the right decisions. Be a part of a family of professionals who thrive in an exciting work environment.

Seed systems have an important role to play in Africa because agricultural productivity remains extremely low, and the use of improved varieties is highly limited. African farmers are deprived of the benefits of modern plant breeding, both to them directly as producers, and ultimately to the consumers they serve.

The early 1990s saw a dramatic change in economic policy in SSA as it was argued that markets and private companies were more efficient in all areas of economic activity, including seed production. Seed laws and regulations were liberalized as public seed enterprises were privatized in many countries and in this more favorable climate, private companies started to enter the seed business.

Most of the new private companies in Africa have built a business around trading and distributing seed but few have invested in R&D to develop their own locally adapted varieties. There is still little breeding of vegetables or other crops for the domestic market in sub-Saharan Africa despite the entry of several multinational seed companies. Most of the vegetable seed is still imported from outside the continent, while local companies continue to produce seed of open-pollinated, rather than hybrid varieties.

One of the major shortcomings of the African vegetable seed sector is the paucity of R&D investment. With only a handful of seed companies doing vegetable research in Africa, it is estimated that only about USD 5 million is spent on vegetable R&D by the private sector in sub-Saharan Africa. This would be 0.5% of global investments while the sub-continent accounts for 14% of world population.

Some countries such as Tanzania, Kenya, and Uganda mandate that all seed produced domestically is certified by a seed certification agency. This can significantly increase the cost of domestically produced vegetable seed and create an incentive to import seed. Few countries have the capacity to provide an efficient certification service for vegetable seed so it may be better to rely on minimum seed quality standards and not to require seed certification.

Counterfeit seed is also a severe problem in SSA countries. It appears that regulatory agencies and law enforcement authorities in these countries give low priority to counterfeiting in vegetable seed as these are not considered strategic crops. Various sources indicate that fake vegetable seed represents 20-25% of seed sowed.

And, without proper mechanisms to address this threat, seed companies will be reluctant to invest and prefer to do business in countries where they are better able to protect their brands.

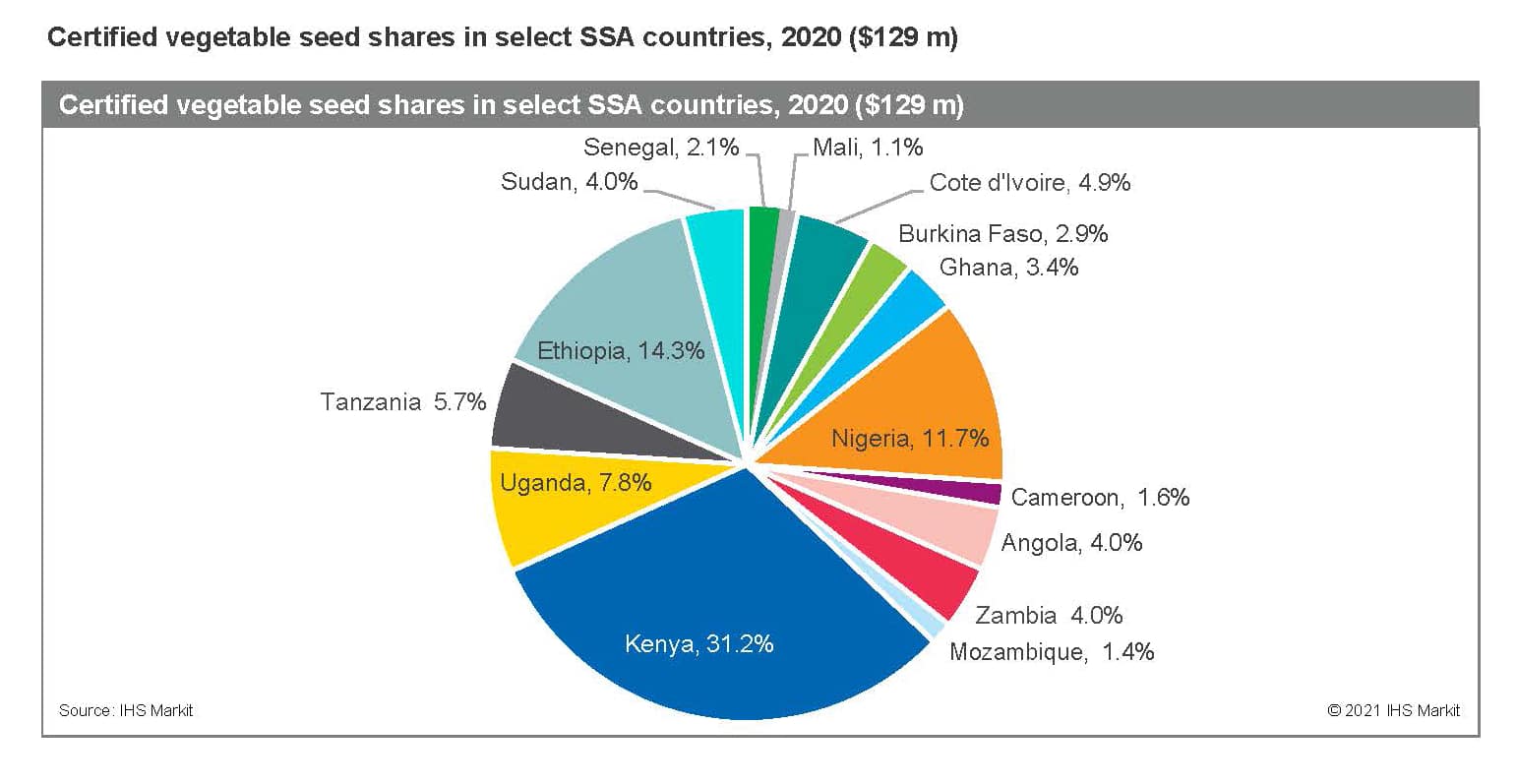

The certified vegetable market stood at $129.4 million in 2020 of which 64% refers to Eastern-Southern Africa.

In our new agribusiness special report, Africa Seed Profiles 2021, Agribusiness experts examine the countries, crops and companies involved in the seed sector in African countries. The analysis of each country includes background and context, profiles for key food commodities and seed markets, the industry players and competitive landscape.

Go here to download free sample data and analysis and to request more information on the full report.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

We’re expanding our core capabilities and evolving new ways to partner with you. Make sure you follow us at… https://t.co/g1VkE0UlKB

@RichardDShute Hi Richard, thanks for reaching out. Can you please send us a DM and let us know what information yo… https://t.co/Sx0CAcXArj

RT @SPGlobal: Many nations have set #NetZero Emissions by 2050 as their climate goal. Will there be enough minerals to meet the requirement…

RT @SPGlobal: Many nations have set #NetZero Emissions by 2050 as their climate goal. Will be enough minerals to meet the requirements? Joi…