MichaelBlackburn/iStock via Getty Images

MichaelBlackburn/iStock via Getty Images

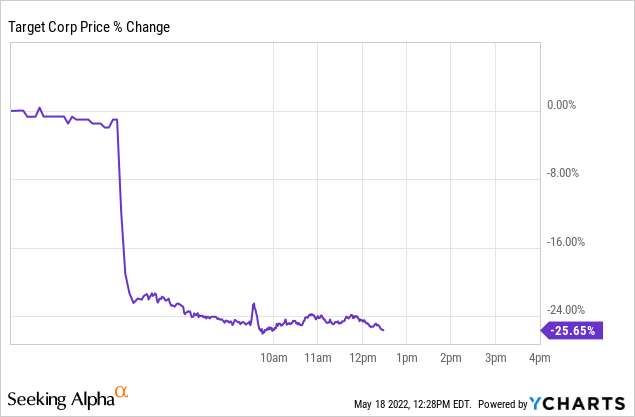

Dead on Target. Get it?

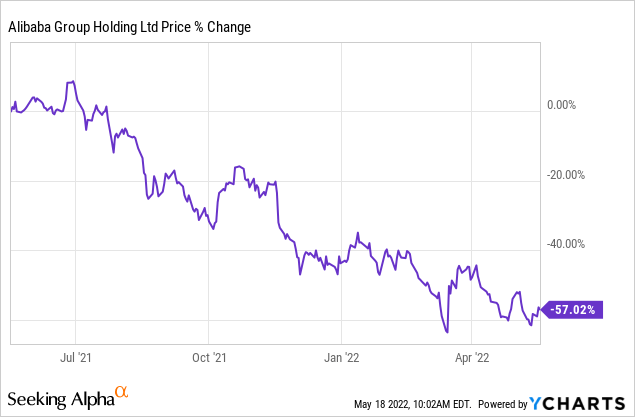

Sentiment may be important in the short term, but fundamentals carry the day in the end. In the case of Alibaba Group Holding Ltd. (NYSE:BABA) there is no doubt a plethora of evidence to show that investors are viewing the stock and company negatively. From the company’s trouble with the government regulators to the general distaste for Chinese equities and technology, BABA has had the perfect storm. But while it is easy to blame the company’s issues on sentiment and market mood swings, the bears have really dominated where it matters.

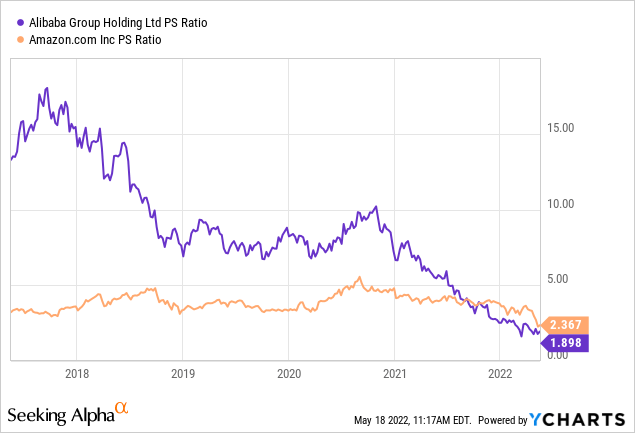

One reason that bulls have kept saying that BABA is worth buying is that they have compared the earnings multiples to technology companies like Amazon (AMZN). This is an incorrect way of looking at things because you will always find something in the market that justifies your purchase. We saw the same thing with investors purchasing Disney (DIS) in 2021, because they thought it was cheaper than Netflix (NFLX). The irony is that DIS is down 45% and is now more expensive than NFLX.

Leaving that way of valuation aside, bears have been overwhelmingly right on the direction of earnings. In fact, they have been so right that it is making BABA fit the definition of a value trap. Let us show you what we mean by that.

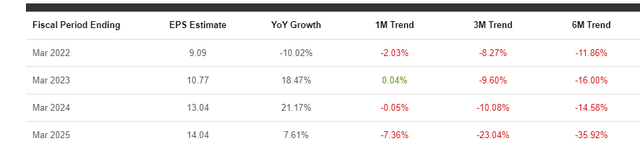

Six months back when we wrote, “It Ain’t Beijing, It’s The Bubble” the earnings estimates for the fiscal year ending in March 2025 were at $14.04.

– (It Ain’t Beijing, It’s The Bubble)

– (It Ain’t Beijing, It’s The Bubble)

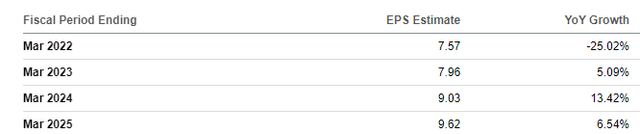

On the right-hand side of the picture, you can see that that number had moved down by 35.92% over six months. So about a year back from now, the earnings estimates were at $21.93 a share. That’s easy math with clear visual evidence. Where do we stand today? Estimates have come crashing down on the earnings side, while revenue numbers have moved only a little bit lower.

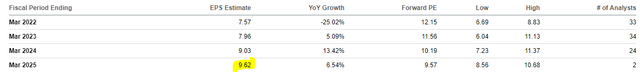

– (Seeking Alpha)

– (Seeking Alpha)

EPS for March 2025 is at $9.62. So earnings estimates have fallen 57% in about one year. If that number seems vaguely familiar to you, it is because of this.

So the fundamentals have deteriorated remarkably and the stock has just held its multiple.

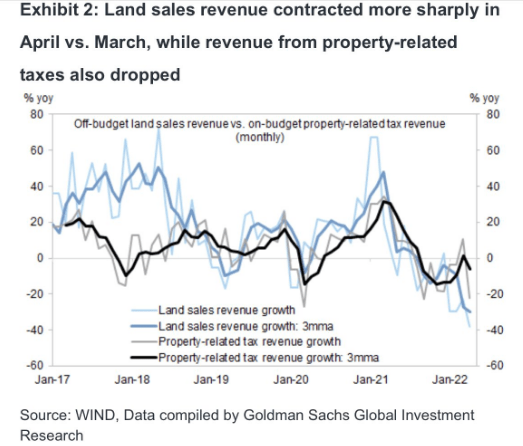

China’s situation is unique today and the combination of massive real estate deflation alongside energy and food inflation, put it in a precarious position. We are seeing real estate bubble deflation impact land sales and revenue from property-related taxes.

Goldman Sachs

Goldman Sachs

This sector, which has been the leading sector for employment, will be a massive headwind to retail sales in the next two years. As energy costs rise and combine with supply disruptions, you can expect BABA’s margins to plummet. This is even if you are ready to look past the short-term disruptions in Shanghai due to the lockdowns.

Around 1800 cargo ships are currently sitting idle in ports around the globe – most of them in China. Many ports are closed because of new Covid outbreaks. This means further delays and inflationary pressures.

A picture says more than a thousand words: Hundreds of container ships and tankers wait here to enter the ports of Shanghai and Ningbo-Zhoushan south of Hangzhou Bay. Ships are lined up side by side on the Yangtze River, which flows into the Pacific near Shanghai.

Source: Linkedin

We see a further compression in margins in the year ahead and BABA will be on the defensive trying to get growth going. Even the current numbers are pricing that the earnings will be a net flat between March 2021 ($10.09) and March 2025 ($9.62).

Seeking Alpha

Seeking Alpha

So if these numbers fall further and we believe they will, is BABA cheap?

BABA is an interesting way to play the intersection of technology and retail. Valuation is getting compelling, at least on a price-to-sales basis.

But in a deflating real estate environment, with spiraling costs, nothing stops this from heading lower to 1.5X or lower. The earnings will always make it look cheap at whatever price you check it at, but they are destined to go lower. We think the upcoming conference call will once again reiterate the challenges of retail when real estate drops and energy pops. We think the stock will remain range-bound until the earnings picture improves. (Alibaba is set to report quarterly and fiscal year-end results on May 26).

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations and low bonds yields have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We “lock-in” high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.