Robert Way/iStock Editorial via Getty Images

Robert Way/iStock Editorial via Getty Images

The recent developments of Alibaba (NYSE:BABA) stock remind me of American Express (AXP) during the salad oil scandal in the 1960s, which because a defining event in the career of Warren Buffett. Many of us surely know about the scandal. However, probably not many of us would know that the scandal also coincided with the assassination of JFK. The events transpired during that weekend not only impacted American Express but also nearly crippled the New York Stock Exchange.

Considering these specifics, this article shares my thoughts on the similarities between the BABA situation and the AXP situation. There are many similarities as the remainder of this article will elaborate on later. And some of the similarities are:

History does not necessarily repeat. But it certainly rhymes. And you will see why the Buffett method worked in 1963, and why I expect it continues to work for Munger now.

Dataroma.com

Dataroma.com

A very brief recap of some of the key events for the salad oil episode, as summarized visually on the chart below. In a nutshell, it was one of the biggest corporate scandals of the 1960s, and it nearly destroyed the famous American Express and crippled the whole New York Stock Exchange. Some specifics:

thereformedbroker.com

thereformedbroker.com

With the above background, now we can see these two situations are similar in several ways. And the key events surrounding BABA are summarized below.

Yahoo Finance and Author

Yahoo Finance and Author

It is the same in BABA’s case now. I have traveled extensively in China and used many of BABA’s services extensively. And my observations are that BABA has reached a status too big to fall, and also at the same time, too good to fall. As seen from the chart below, despite the ongoing uncertainties, Alibaba generated revenues of $242.6B Chinese Yuan in its most recent quarter (which is equal to $38.1B). And the reported revenue figure represents a 10% revenue growth year over year. It is admitted slower than expectations. But I would consider any double-digit growth for a business at this scale to be not only healthy but also excellent.

BABA earnings release

BABA earnings release

There is an opportunity in every crisis, and Winston Churchill famously said, “Never let a good crisis go to waste”. In the AXP episode, Buffett, our old master of value investing, realized that its core business remained sound. He started buying shortly after American Express’ stock price fell by 50% between the breakout of the fraud. He eventually placed nearly $1.3 billion on the company.

He actually bought as many shares as he can – he could not buy anymore because his position already hit the 40% limit – as discussed in his shareholder letter a few years later in 1968:

“Last year I referred to one investment which substantially outperformed the general market in 1964, 1965 and 1966 and because of its size (the largest proportion we have ever had in anything – we hit our 40% limit) had a very material impact on our overall results and, even more so, this category. This excellent performance continued throughout 1967 and a large portion of total gain was again accounted for by this single security. Our holdings of this security have been very substantially reduced and we have nothing in this group remotely approaching the size or potential which formerly existed in this investment.”

The rest is history now. As you can see from the chart below, the stock price went up more than 10x a few years later. And yet Buffett kept holding. Today, AXP remains as one of Berkshire Hathaway’s “big four” positions worth about $24B.

thereformedbroker.com

thereformedbroker.com

In the BABA episode, the actor switches to Buffett’s like-minded partner, Charlie Munger. As you can see from the chart below, he doubled his stake in Alibaba first in 2021 Q3 and he doubled it again in 2021 Q4.

There are certainly good reasons for Munger’s decision. As mentioned above, the market reacted too quickly based on perception (just like in the AXP episode). As a result, even though BABA’s core business is intact, its valuation is too compressed now. Its FW PE is only about 12.6x. When adjusted for the sizable cash position on its book ($77B in total or about $29 per share), its FW PE is only 9.2x. It is a valuation that is for a terminally cheap and stagnating business. Not for businesses that are still growing at double -digits rates.

Yahoo Finance and Author

Yahoo Finance and Author

Investment in BABA does have a high-risk-high-return flavor.

The risks associated with BABA in general (VIE, delisting, et al) have been detailed in my earlier article and won’t be repeated here. Here, I will focus more on the following risks more directly related to this current discussion:

The recent developments surrounding BABA resemble the American Express situation during the salad oil scandal in the 1960s in many ways. In particular, there are at least four key similarities:

By analyzing the similarities between these two situations and reengineering Buffett and Munger’s actions, we can learn a valuable lesson and gain insights into where BABA is headed next. History does not necessarily repeat. But it certainly rhymes. The Buffett method worked in 1963, and I expect it continues to work for Munger now.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 2x in-depth articles per week on such ideas.

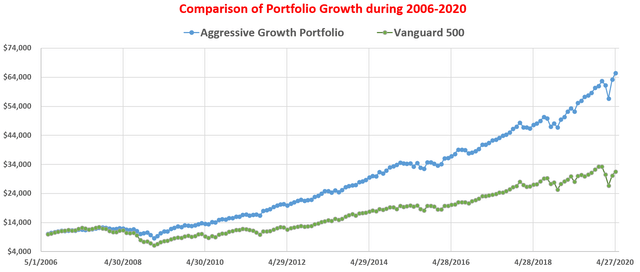

We have vetted and perfected our methods with our own money and efforts for the past 15 years. For example, our aggressive growth portfolio has helped ourselves and many around us to consistently maximize return with minimal drawdowns.

Lastly, do not hesitate to take advantage of the free-trials – they are absolutely 100% Risk-Free.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.