Wachiwit

Wachiwit

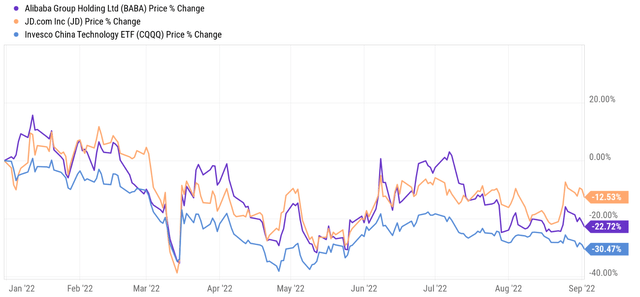

The thesis of this article is really simple: the stock price of Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF) has recently become disjointed with business fundamentals. As such, it has become a good opportunity to buy a good business on the operation table. As to be detailed later, there is no double that it faces a number of risks, and its profitability is no longer as strong as it used to be. But I will argue that these risks are more than priced in already. The profitability is still remarkable when contextualized, but the valuation is so compressed by the negative sentiment that the rebound potential far outweighs the risks. Before I dive into more details, here I will first encapsulate the gist of my thesis into two bullet points.

First, a simple comparison between BABA and JD.com, Inc. (NASDAQ:JD) is sufficient to illustrate the current market absurdity. JD.com trades at a significant valuation premium in comparison to Alibaba (and also to the broader market) despite comparable profitability, lack of diversity in its revenue streams, and also lack of high-growth areas.

Seeking Alpha

Seeking Alpha

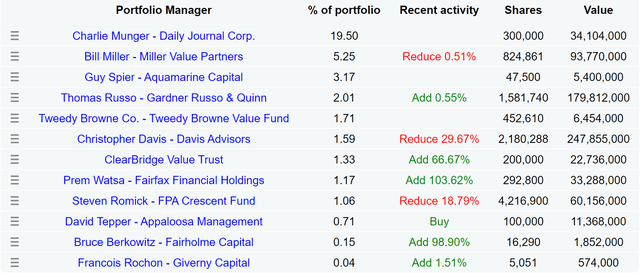

And secondly, for unusual stocks like BABA at unusual times like ours, it is much better to follow independent thinkers like Charles Munger than the overall market. As you all know, Munger doubled his stake in Alibaba twice during 2021 and then reduced it by about a half recently in May 2022. Despite the reduced position, his Daily Journal Corporation (DJCO) still holds the largest BABA position among super investors tracked by Dataroma.com, as you can see from the first chart below. Currently, the BABA position stands at more than $34M and represents more than 19% of DJCO’s equity portfolio.

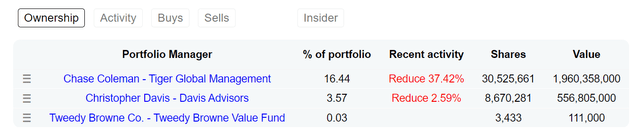

Furthermore, Munger is not the only one who has been buying BABA lately. The chart below shows the top 12 super investors who have placed the largest position on BABA in terms of its weight in their portfolios. As you can see, only 3 of them reduced their position during the most recent 13F disclosure. Three of them maintained their exposure. And one of them initiated a new position and five of them increased their exposure. Out of the two who increased their position, two almost doubled (Prem Watsa and Bruce Berkowitz). The activities on JD from the super investors are a completely different picture as you can see from the second chart below.

Of course, super-investors do not always place the right bet at the right time. And I do not suggest you follow them blindly (I do not). But after studying several of them in depth (Charles Munger, Guy Spier, and also the Tweedy Browne lineage), I can speak responsibly and confidently that they tend to be more original and critical thinkers, and they all follow very disciplined investment approaches.

With this, let’s attempt to reengineer their reasons.

Super Investor Activities on BABA

Super Investor Activities on JD

Super Investor Activities on BABA

Super Investor Activities on JD

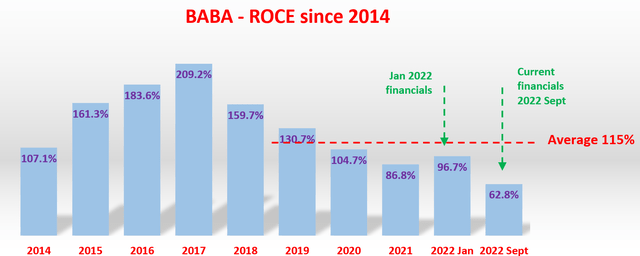

There is no doubt that BABA’s profitability is no longer what it used to be after the recent regulatory crackdown on techs in China. The following chart shows its return on capital employed (“ROCE”) in recent years with a highlight of this year. ROCE measures the return of capital ACTUALLY employed in a business, and it is the important and fundamental profitability measure in my mind as detailed in my blog article here. As seen, BABA was able to maintain a remarkably high level of ROCE in the past: it has been above 100% till 2020 with an average of 143%. However, its ROCE began to decline substantially after the crackdown started. Even just during the past few months, its ROCE has declined from 76.7% based on TTM financials as of Jan 2022 to the current level of 62.8% based on TTM financials as of Sept 2022.

Source: author and Seeking Alpha.

Source: author and Seeking Alpha.

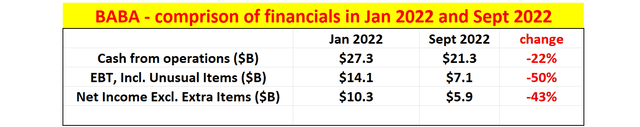

In absolute terms, the profitability has also suffered sizable declines as shown in the table below. Again, these numbers are based on the TTM financials as of Jan 2022 and Sept 2022. To wit, operating cash flow has decreased by about 22%. In terms of earnings before taxes (“EBT”) and net earnings, the finances decreased even more than the operating cash flow. Earnings before taxes decreased by about 50% and the net earnings decreased by about 43%. Going forward, the business also has remaining installments on the contributions to the common prosperity fund and also will be subject to higher tax rates.

Source: author based on Seeking Alpha data.

Source: author based on Seeking Alpha data.

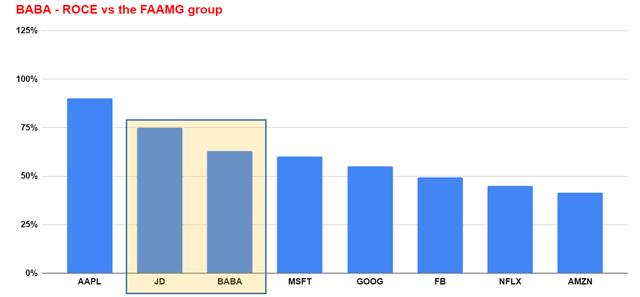

Here I want to put the above profitability into perspective. Its ROCE is a lot lower when compared to its astronomical past, but it is still highly completive when compared to other businesses as you can see from the chart below. This chart compares the ROCE of a few other highly profitable stocks such as AAPL, JD, et al. And as seen, BABA’s current ROCE of ~63% ranks 3rd even among this group of overachievers. JD’s ROCE current is about 75%, higher than BABA’s. But as I will argue later, I do not see how such a narrow lead in ROCE can justify the enormous valuation premium the marketplaces on JD.

Source: author and Seeking Alpha.

Source: author and Seeking Alpha.

BABA’s capital allocation picture used to be really simple not that long ago (say 2020). It earns a load of cash organically from its operations but does not need to spend much. It is financial position and capital allocation flexibility have admittedly weakened somewhat by now. However, the operative word is again relative. It is weakened relative to its own past, but still quite strong when compared to other businesses.

To wit, it generated more than $21B of operating cash TTM as aforementioned. It is effectively debt free considering that its debt interest expenses are merely $0.5B. And its total long-term debt is about $20B while its total cash position is about $69B. And its depreciation is only about $4.1B, less than 20% of its operating income.

So overall, it is still a business that generates plenty of cash but does not require too much cash to maintain and grow. In the long term, the growth rate is given by:

Long-term growth rate = ROCE * Reinvestment Rate

With a ROCE on the order of 63%, even if BABA only reinvests 10% of its earnings back into the business, it can grow by about 6.3% per year (long-term growth = 63% ROCE * 10% reinvestment rate = 6.3%). And it can afford to reinvest a lot more than 10% as analyzed above. In contrast, JD’s ROCE is about 75% and assuming a 10% reinvestment rate, the growth rate would be about 7.5%. It is higher, but not nearly enough to justify the valuation premium as detailed next.

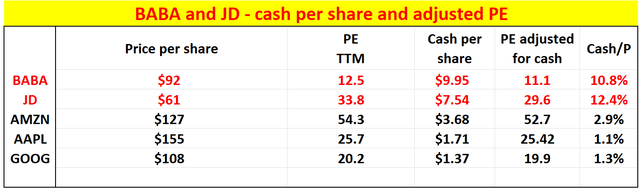

The chart below shows BABA’s P/E multiple adjusted for cash compared to a few other similar stocks such as JD, Amazon (AMZN), Apple (AAPL), and Alphabet (GOOG, GOOGL). All the cash per share data, P/E data, and price data were taken from SA as of Sept 5. As can be seen, all the businesses have a positive cash position behind their shares. And in the case of BABA and JD, both have a large cash position at $9.95 and $7.54 per share, respectively. Such a cash position represents about 10.8% and 12.4% of their current share prices.

Without adjusting for the cash position, BABA’s current TTM P/E is about 12.5x, compared to 33.8x for JD. So, JD is valued at a premium almost 3x higher than BABA (2.7x to be exact). When adjusted for cash, BABA only trades at 11.1x and JD at 29.6x. The premium is a bit lower because of JD’s large cash position, but still, 2.6x higher. As aforementioned, I see such a premium as absurd given the very similar ROCE (63% vs 75%), let alone the higher growth initiatives at BABA such as its cloud and the possible revival of its Ant Group IPO as detailed in my other article.

Source: author and Seeking Alpha.

Source: author and Seeking Alpha.

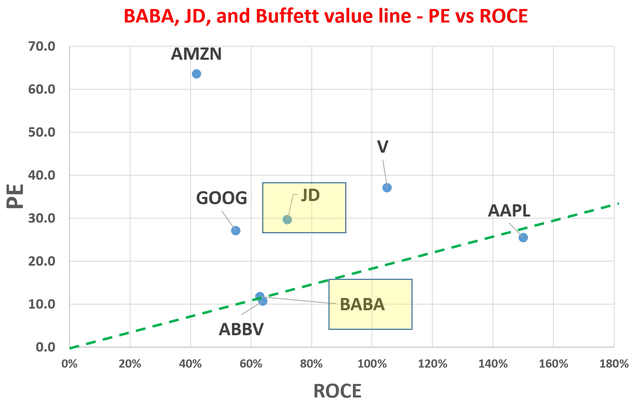

The next chart puts the valuation in a more visual and also more revealing format. Instead of comparing P/E only, it compares both the P/E and ROCE of BABA against a few stocks that are large holdings in the BRK equity portfolio (V, AAPL, AMZN, et al). And the green line is what I call a Buffett value line because it’s a line linking: A) the origin (a business that has 0 ROCE should be worth 0x P/E); and B) Buffett’s largest holding AAPL (which happens to have the highest ROCE among this group of stocks as shown earlier).

So intuitively, there is no point to own anything far above this line. Because stocks above this line represent a worse tradeoff between the valuation of the business (as reflected by P/E) and quality of the business (as reflected by ROCE) than stocks on or below this line.

And as you can also see, BABA happens to be on this line. And it is very close to AbbVie (ABBV), showing that they have similar valuation when adjusted for profitability despite their totally different line of business. And JD is far above this line, because of its marginally better ROCE compared to BABA but far lofty valuation.

Source: author and Seeking Alpha.

Source: author and Seeking Alpha.

To summarize, admittedly, there has been negative development both in BABA’s profitability and also its financial position. However, such negative developments are largely comparative to its own historical track record. When compared horizontally to other highly profitable businesses like JD or AMZN, BABA’s current profitability remains highly competitive. Yet, its stock trades at an absurdly compressed level. When compared to JD, its P/E of 11x ~ 12x is only about 1/3 of JD’s despite the fact of similar ROCE (63% vs 75%) and its high growth segments such as the cloud business. For unusual stocks like BABA at unusual times like ours, it is much better to follow independent thinkers like Charles Munger than the overall market.

The risks surrounding BABA have been detailed in other SA articles (and some of my own). These risks include the VIE risk, delisting risk, and also the all-encompassing “China” risk. And I won’t go into further details here. To me, these risks only add to the market absurdity when JD is considered. From every angle that I can think of, JD is subjected to all these same macroscopic and geopolitical risks. Yet it is still trading at a premium valuation, not only in relative terms when compared to BABA but also in absolute terms. An immediate risk that I see is the new resurgence of COVID cases in Chengdu (a key city in China), the possibility of extended lockdown, and the potential impact on BABA, JD, and also the overall Chinese economy.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

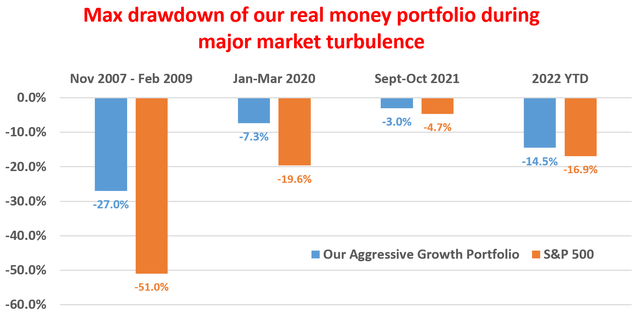

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.