The recent developments of Alibaba (NYSE:BABA) stock remind me of American Express (AXP) during the salad oil scandal in the 1960s, which became a defining event in the career of Warren Buffett. This article shares my thoughts on the similarities between these two situations. There are many similarities as the remainder of this article will elaborate on later. And a key similarity is that both businesses face horrendous uncertainties, but their core businesses are intact and remain popular or even essential.

In the salad oil episode, American Express faced a potential loss of $150M due to a fraud committed by one of its customers (to put it under perspective, the company’s annual sale was about $118M at that time). The stock price fell by more than 50% from its pre-fraud level. However, the key that Buffett saw was that the company’s core traveler checks business remained intact.

The current BABA situation is quite similar. BABA too faces large uncertainties – though probably not as large that those faced by American Express during the salad oil fraud as we will detail later. And the stock price also fell by about 50% from its peak value within a year. But again, the key here is that BABA’s core business remains intact and still essential.

In the remainder of this article, I will detail other similarities and also some differences between these two situations. And most importantly, this article will also reflect on the way Buffett approached the salad oil situation to provide guidance on the current situation.

Note that I am not aware that Buffett has formerly expressed any particular view for or against Chinese stock in general or BABA stock in particular. He has owned/is holding various Chinese stocks (such as Chinese oil company PetroChina and Chinese electric automaker BYD). Judged by his positions and the Q&A he made during a shareholder meeting, he seems to be guided by his usual value-driven approach. For example, when responding to a shareholder who asked him for his views on buying Chinese companies in one of his annual shareholder meetings, Buffett said the following:

“Well, I don’t know that much about them. But if I could buy companies that were earning 20% on equity and had the promise of being able to continue to do that while reemploying most of the capital, and they were selling at five times earnings, and I felt good about the quality of the earnings, you know, I would say that would have to be an interesting field.”

In this article, we will see that BABA is not selling at five times earnings (at least not yet). But the companies have indeed been earning 20% on equity and way more than 20% on capital employed as to be seen later.

A very brief recap for readers who are not familiar with this episode. In 1963, American Express was supposed to have $150 million in salad oil as collateral from one of its clients. However, the client’s actual inventories were only worth $6 million. After the fraud was exposed, the share price of American Express fell by more than 50% even though the situation was very uncertain. For one thing, it is unclear whether American Express was responsible for 100% of the shortfall.

After our grandmaster, Mr. Buffett learned about it, he quickly did his investigation (he has been impressed with the business before already) and concluded that the business’ core traveler checks business remained intact. He then acted very decisively and bought as many shares as he can – he could not buy anymore because his position already hit the 40% limit – as discussed in his shareholder letter a few years later in 1968:

“Last year I referred to one investment which substantially outperformed the general market in 1964, 1965 and 1966 and because of its size (the largest proportion we have ever had in anything – we hit our 40% limit) had a very material impact on our overall results and, even more so, this category. This excellent performance continued throughout 1967 and a large portion of total gain was again accounted for by this single security. Our holdings of this security have been very substantially reduced and we have nothing in this group remotely approaching the size or potential which formerly existed in this investment.”

In a nutshell, he paid the equivalent of less than $1 per share for the stock and sold in the $5 range within a few years. From hindsight, the salad oil episode provided a – if not the – defining opportunity in the career of Buffett.

With the above background, now we can see these two situations are similar in several ways.

First, the magnitudes of the uncertainties are indeed both quite large and consequential relative to the size of the businesses. In the salad oil episode, American Express faced a potential loss of $150M, compared to the company’s annual sale of $118M.

In BABA’s case, it was recently slapped with a $2.8 billion fine from China’s antitrust regulator earlier in the year. Then BABA disclosed early this month that it will invest $15.5 billion into China’s common prosperity fund over five years ($3.1B per year). More details of how I interpret this disclosure will be elaborated on in a later section. And further actions from the regulators are still unfolding. Even for a business like BABA, which earns about $30B per year in recent years, these developments are quite large and consequential relative to the size of the business.

Second, in both cases, the market reacted dramatically before the uncertainties were resolved (which is something the market always does). In the salad oil fraud, the share price of American Express fell by more than 50% even though it is unclear whether American Express was responsible for 100% of the shortfall. The eventual settlement of this fraud actually cost American Express “only” about $30 million. The BABA situation, so far, is much less severe than the American Express situation. The fines and pledges are only about 10% of BABA’s annual net profit. But the market already reacted by a 50% stock price crash.

Third, and this is the key here, both companies’ core business remains intact and still essential during the uncertainties. In American Express’ case, their core traveler check business was still popular and essential after the news of the fraud broke out. Buffett observed himself that the customers of the company still have full faith in their traveler check business. They kept using this service as the salad oil fraud never happened.

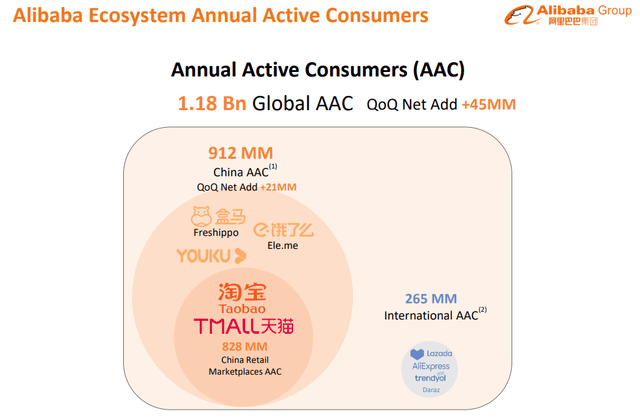

It is the same in BABA’s case now. I have traveled extensively in China and used many of BABA’s services extensively. And my observations are that BABA has reached a status too big to fall, and also at the same time, too good to fall. As seen from the chart below, despite the ongoing uncertainties, the BABA ecosystem boasts 1.18 billion Annual Active Consumers (AAC). And about 0.9 billion of them are from China itself, the remaining 0.26 billion are international users. From firsthand observation and what my friends – both in China and outside – are telling/showing me, they are using BABA’s service just the same as before. No one is making any conscious effort to stay away from BABA’s services because of the uncertainties perceived by the stock market.

Source: BABA earning release

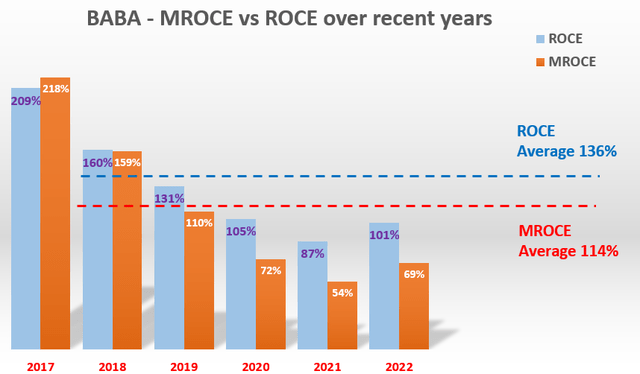

Now let’s revisit Buffett’s comment about buying a business with a 20% return on equity (“ROE”) to further gauge BABA’s strength. BABA has been indeed earning on average 20% ROE in the past. Here, I will also use two more fundamental metrics than ROE: return on capital employed (“ROCE”) and marginal return on capital employed (“MROCE”). As in BABA’s case, there has always been a significant amount of cash on its balance sheet and ROE does not accurately reflect its profitability. To me, ROCE and MROCE are the two most important metrics for analyzing a business. They reveal the two most fundamental aspects of the same central issue of profit sustainability. ROCE tells us how profitable the business has been or is so far. And MROCE sheds insights into which direction the profitability is likely to go.

The next chart shows the MROCE and ROCE for BABA over recent years. As seen, the ROCE has been on average 136% in recent years, and the MROCE has been on average 114%. So, this result suggests that BABA has been showing signs of diminishing return in recent years – and this is not a surprise at all for a mega business at BABA’s scale. The surprise to me is that the magnitude of MROCE is actually quite close to the average ROCE itself (114% vs 136%). If this level of MROCE continues, BABA’s ROCE will continue declining but eventually converge and stabilize at 114%. And a ROCE of 114% is still an enviable level of profitability.

Source: Author and Seeking Alpha data.

There is an opportunity in every crisis, and Winston Churchill famously said “Never let a good crisis go to waste”. The BABA situation here certainly provided an opportunity.

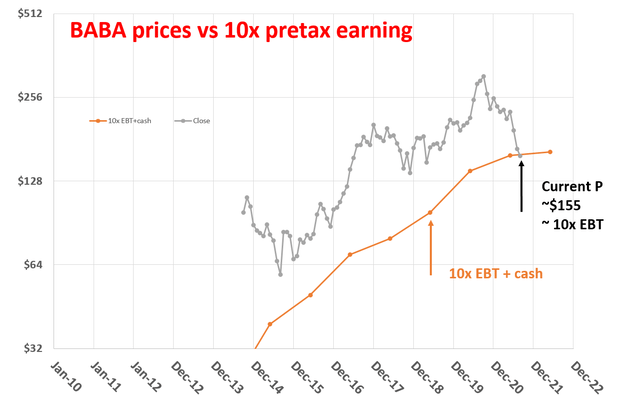

Let’s go back to the wisdom of Mr. Buffett again. If you’re a devout Buffett cultist like this author, you must have noticed or heard that the grandmaster paid ~10x pretax earnings for many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express that we just mentioned, Wells Fargo, Walmart, Burlington Northern, and the more recent Apple investment.

As detailed in my other writings before, it is not a coincidence that most of his best and largest investment success is from buying businesses at 10x pretax earnings, because:

As seen from the chart below, the market now presents BABA as such an opportunity. The following chart shows the price history of BABA and its 10x pretax earnings plus its cash position (since it has a sizable cash position). Pretax earnings are also referred to as “EBT”, Earnings Before Taxes, in this article. As seen, for a business like BABA, the price should be high above 10x EBT, as it has been in the past. But during the recent market overaction, the price now is actually close to the 10x EBT as seen (again correctly for cash).

Source: Author and Seeking Alpha data.

So, in this case, even if BABA stagnates forever, by paying 10x pretax, the investment would already provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. And as analyzed in my earlier analysis, BABA has an excellent prospect to grow because, in the long term, the growth rate is given by:

Growth rate = ROCE * Reinvestment Rate

That is, long term, relies on two things – ROCE and the ability to afford reinvestment of earnings into the business. As detailed in my earlier article, BABA enjoys both. It has a very competitive return on capital employed (“ROCE”) and capital reallocation flexibility. Its ROCE is on average about 140%, on par with Apple’s and better than all the other FAAMG stocks. And it generates plenty of cash, has no debt, and can reinvest flexibly.

With this background, the chart below summarizes the total return for BABA in the long term, consisting of the part from its earning yield discussed in the earlier section and its growth from the reinvestment.

The blue line shows a baseline case assuming the current conditions remain unchanged – for the sake of comparison. As seen, the total return in the long term under this current valuation would be double-digit around 12% or higher for the reasons discussed. The red line in the chart shows the case where BABA loses ½ of its earnings permanently. Now, we would be buying the business at about 20x EBT effectively. In this case, our long-term return is in the upper single-digit or higher (around 9%). Not as good as the baseline, but still a very solid investment.

Given the recent development, reality should be somewhere in between. The green diamond symbolizes the situation with all the information disclosed so far with a twist. It assumes the $3.1B contributions to the China common prosperity fund to be a permanently recurring contribution, instead of for the next 5 years only. In this case, the effective earning would be reduced by $3.1B per year permanently, and we would be buying the business at about 12x EBT. And our long-term return would be back in the double-digit (around 11%) considering both earning yield and growth rate.

Source: Author and Seeking Alpha data.

The recent developments of BABA remind me of American Express during the salad oil scandal in the 1960s, and this article analyzes the similarities between these two situations. And more importantly, this article will also reflect on the way Buffett approached the salad oil situation to provide guidance on the current situation.

In particular, there are at least three key similarities:

As such, the market now presents BABA as a good opportunity, just as the salad oil situation presented American Express. It is an opportunity to buy a good business at its 10x pretax earnings (adjusted for its current cash position). And as Buffett’s experiences have repeatedly demonstrated such opportunities provide very favorable odds for achieving double-digit returns in the long term.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.