maybefalse

maybefalse

Alibaba Group Holding Limited (NYSE:BABA, BABAF) is one of the most controversial companies when it comes to investor opinion. Many believe it is a great business at a bargain price, whilst others believe the risks mean it is untouchable, even at a significant discount.

Putting the risks aside for a moment, there is a lot to love about Alibaba:

Alibaba’s operating businesses currently trade at a multiple of around 9x owner earnings. And this is at a time when the company is in an investment phase, meaning margins are depressed and the true underlying earnings potential is underrepresented. Modest earnings growth combined with recovery in the valuation multiple could provide investors 30%+ annual returns over the next decade.

Based on these metrics, it is difficult to disagree that the current price represents an attractive valuation. However, the investment decision ultimately relies on the conclusion investors reach on the likelihood and impact of the various potential risks materializing.

When it comes to risks generally, investors can be guilty of ignoring them completely or assuming the worst-case scenario. In the case of Alibaba, we think the latter is true. Whilst there will inevitably be ongoing friction as the US learns to live in a world with a rising China, our view is that the world will ultimately continue to make progress and prosper over the long-term. We believe investors would do well by remaining rationally optimistic.

Even if we put our optimistic worldview aside, we feel that some of the risks are overblown. Only 10% of the company’s external revenue is generated through the regulated businesses held within the VIE structures, and this will only reduce as the company continues to diversify and expand internationally.

As for the potential de-listing from the NYSE, we would hope that agreement can be reached to avert this eventually. However, in absence of cooperation on that issue, the company is pursuing a dual primary listing in Hong Kong which will provide investors with an alternative market in an internationally recognized financial center.

Overall, we feel that the strength of its businesses combined with the significantly discounted valuation compensate for the actual severity and likelihood of the risks materializing. We think it is a clear “Buy” at the current valuation. Should these risks reduce or a long-term resolution be reached, we see reason to upgrade our rating to “Strong Buy.”

With that being said, each investor must consider this in the context of their own investment objectives, risk tolerance and psychological resilience. Bargains are never found in times of comfort and stability. As value investors with a long-term horizon and a deeply contrarian nature, we believe will be handsomely rewarded for the long and potentially rocky journey ahead.

Note from author: This section provides a description of the major services and businesses which are within the Alibaba ecosystem. For those who are already familiar with the operations of Alibaba, we suggest that you skip to the following section.

Alibaba is an e-commerce giant which serves 1.31 billion annual active consumers across the many platforms and businesses in the Alibaba Ecosystem. Total Gross Merchandise Value (“GMV”) transacted in the Alibaba Ecosystem in FY22 was RMB 8.3 trillion ($1.3 trillion), making it the largest retail commerce business in the world, according to Analysys.

Alibaba reports its business across a number of segments: China commerce, International commerce; Local consumer services; Cainiao; Cloud; Digital media and entertainment; and Innovation initiatives and others. We provide an overview of each below.

Alibaba Annual Report FY22

Alibaba Annual Report FY22

Alibaba’s China Commerce segment is primarily Taobao and Tmall. Together, these constitute the world’s largest digital retail business in terms of GMV for the twelve months ended 31 March 2022, according to Analysys.

Taobao is the company’s main commerce platform and is both the starting point and destination portal for many users’ shopping journey. It allows individuals and small businesses to create online storefronts and product listings for free. Alibaba generates revenue through add-ons sold to sellers, such as analytics and marketing. As well as being a shopping platform itself, it acts as a funnel for other platforms in the Alibaba ecosystem.

Tmall is the partner of choice for both domestic and International brands. The platform is essentially a virtual mall, allowing brands and retailers to operate their own unique storefronts. The platform has a wide range of brands, with 320,000 brands and merchants on Tmall, including over 80% of the consumer brands ranked in the Forbes Top 100 World’s Most Valuable Brands for 2021. It is the largest third-party online and mobile commerce platform for brands and retailers in the world in terms of GMV, according to Analysys. The platform differs from Taobao in that it charges retailers and merchants fees for setting up stores and a share of ongoing GMV, in addition to offering value-add services.

There are a host of other platforms and businesses which cater to various markets. These include

The company monetizes its broad user base and insights into customer behaviors through its Alimama platform. Alimama offers paid marketing services to merchants, retailers and promoters allowing them to advertise across its many platforms. This marketing is not confined to the Alibaba ecosystem, with affiliate programs allowing its users to directly market to consumers on other platforms outside of Alibaba’s.

In addition to ads within the Alibaba ecosystem, the company offers wider distribution through the Taobao Ad Network and Exchange (“TANX”), one of the largest real-time online bidding marketing exchanges in China. TANX helps publishers to monetize their media inventories both on mobile apps and web properties, automating the buying and selling of tens of billions of marketing impressions on a daily basis.

Alibaba’s domestic wholesale business, 1688.com, is China’s largest integrated domestic wholesale marketplace in 2021 by net revenue, according to Analysys. Wholesalers pay a fixed annual subscription to sell with no additional fees, but can pay for additional premium features such as data analytics and marketing etc. These additional services account for the vast majority of income from wholesaling.

Alibaba Annual Report FY22

Alibaba Annual Report FY22

Lazada is a leading and fast-growing e-commerce platform in Southeast Asia and serves one of the largest user bases among the global e-commerce platforms. It caters to merchants of all sizes, from individuals to regional and global brands. Lazada also operates one of the leading e-commerce logistics networks in Southeast Asia, with the vast majority of Lazada’s parcels going through its own facilities or first- and last-mile fleet.

AliExpress enables global consumers to buy directly from manufacturers and distributors in China and around the world. It is available in 18 languages and services consumers across many countries including the US and Europe.

Trendyol is a leading e-commerce platform in Turkey in terms of both GMV and order volume in 2021. It offers a large selection of products through e-commerce business as well as instant delivery services for food and groceries, as well as having its own fulfillment and logistics networks.

Alibaba.com is China’s largest integrated international online wholesale marketplace in 2021 by revenue, according to Analysys, serving over 40 million buyers from over 190 countries in FY22. Like its domestic wholesaling counterpart, Alibaba generates the majority of the revenue through this platform for the additional value-add services it offers to merchants.

Company Annual Report FY22

Company Annual Report FY22

The company’s local consumer services business is looking to expand its reach beyond products into consumer services, whether that is at home through its “To Home” businesses or on the go through its “To Destination” businesses.

Ele.me – a leading local services and on-demand delivery platform which enables consumers to order food and beverages, groceries, FMCG, flowers and pharmaceutical products anytime and anywhere.

Fengniao Logistics – an on-demand delivery network which provides last-mile logistics services to orders placed through Ele.me as well as to other businesses in the Alibaba ecosystem including Freshippo, Sun Art, and Alibaba Health.

Taoxianda – an online-offline integration service solution for FMCG brands and third-party grocery retail partners, facilitates the digitalization of retailers’ operations.

Amap – a leading provider of mobile digital map navigation and one-stop access point to services such as navigation, local services and ride-hailing. Amap technology underlies a range of apps both inside and outside of the Alibaba ecosystem, and the company provides map data and navigation software to international and domestic automotive companies.

Fliggy – a leading online travel platform which provides comprehensive services to meet consumers’ travel needs for airline and train tickets, accommodation, car rental, package tours and local attractions.

Koubei – a restaurant and local services guide platform for in-store consumption, provides merchants with targeted marketing solutions, digital operation capabilities and analytics tools and allows consumers to discover local services content on the platform.

Cainiao is a domestic and international one-stop shop for logistics services and supply chain management solutions, data insights and technology to digitalize the entire logistics process and enhance the capabilities of its logistics partners.

It offers parcel pick-up services through a neighborhood logistics solution that operates a network of neighborhood, campus and rural village stations and residential self pick-up lockers. Consumers can also enjoy parcel pick-up at the doorstep and time-guaranteed delivery service through Cainiao.

For merchants, Cainiao has built a full-fledged fulfillment network at provincial, city, and county levels in China, which offers customized fulfillment solutions to merchants across the Alibaba ecosystem. It has a network of assets and partners to support merchants on cross-border and international commerce retail platforms such as AliExpress and Lazada.

Alibaba Group is the world’s third largest and Asia Pacific’s largest Infrastructure-as-a-service (“IaaS”) provider by revenue in 2021, according to Gartner’s April 2022 report. It is also China’s largest provider of public cloud services by revenue in 2021, including PaaS and IaaS services, according to IDC.

Alibaba Cloud offers a complete suite of cloud services, including proprietary servers, elastic computing, storage, network, security, database and big data, and IoT services, serving our ecosystem and beyond. Alibaba Cloud offers computing services in 27 regions globally and served more than 60% of A-share listed companies in China in FY22. As digital transformation accelerates, customers from non-Internet industries have increased their usage of cloud services, with such revenue accounting for half of cloud computing revenue in FY22.

DingTalk is a digital collaboration workplace and application development platform that offers new ways of working, sharing and collaboration for modern enterprises and organizations and is the largest business efficiency mobile app in China by monthly active users in March 2022, according to QuestMobile.

DingTalk provides a comprehensive suite of solutions for enterprise collaboration, including real-time communication, organizational management and various network collaboration tools such as data storage, calendars, workflow management and shared documents. Enterprises can also enjoy convenient access to a broad range of applications, including those offered by third-party service providers, that are seamlessly integrated with DingTalk’s platform.

Company Annual Report FY22

Company Annual Report FY22

In line with the continued expansion into areas beyond product consumption, the group is looking to benefit from media consumption through its delivery platforms as well as through the production and distribution of its own and third-party content.

The first of these platforms is Youku, the third largest online long-form video platform in China in terms of monthly active users in March 2022, according to QuestMobile. The second is Quark which helps young users gain access to a variety of digital content and information for learning and work purposes.

The company also produces, promotes and distributes content through Alibaba Pictures. In 2022, eight movies released by Alibaba Pictures were among the top ten domestic movies in terms of ticket sales. The company also provides ticketing services for live events – concerts, plays, and sporting events – through Damai, and develops and distributes mobile games through Lingxi Games.

In 2019, Alibaba established the DAMO Academy, a global research program in cutting-edge technologies that aims to integrate and speed up knowledge exchange between science and industry. An example of the innovation is the proprietary L4 self-driving vehicle Xiaomanlv used by Cainiao, which has delivered over 10 million parcels within gated communities and university campuses.

Its Tmall Genie product range provides a selection of internet-enabled smart home appliances, including smart speakers, lights and remote controls. The Tmall Genie smart speaker is a leading smart speaker in China in terms of sales units, and provides an interactive interface for our customers to easily access services offered by the company.

In addition to its operating businesses, Alibaba has a portfolio of equity (listed and private) and debt investments with a total value of RMB 239 billion as of 30 June 2022. The company also has a number of investments in which it holds a minority stake (“equity investees”). The most significant of these is the group’s 33% stake in the Ant Group, the parent company of Alipay which provides substantially all of the payment processing and all of the escrow services on Alibaba marketplaces.

Prepared by author. Data from company annual reports.

Prepared by author. Data from company annual reports.

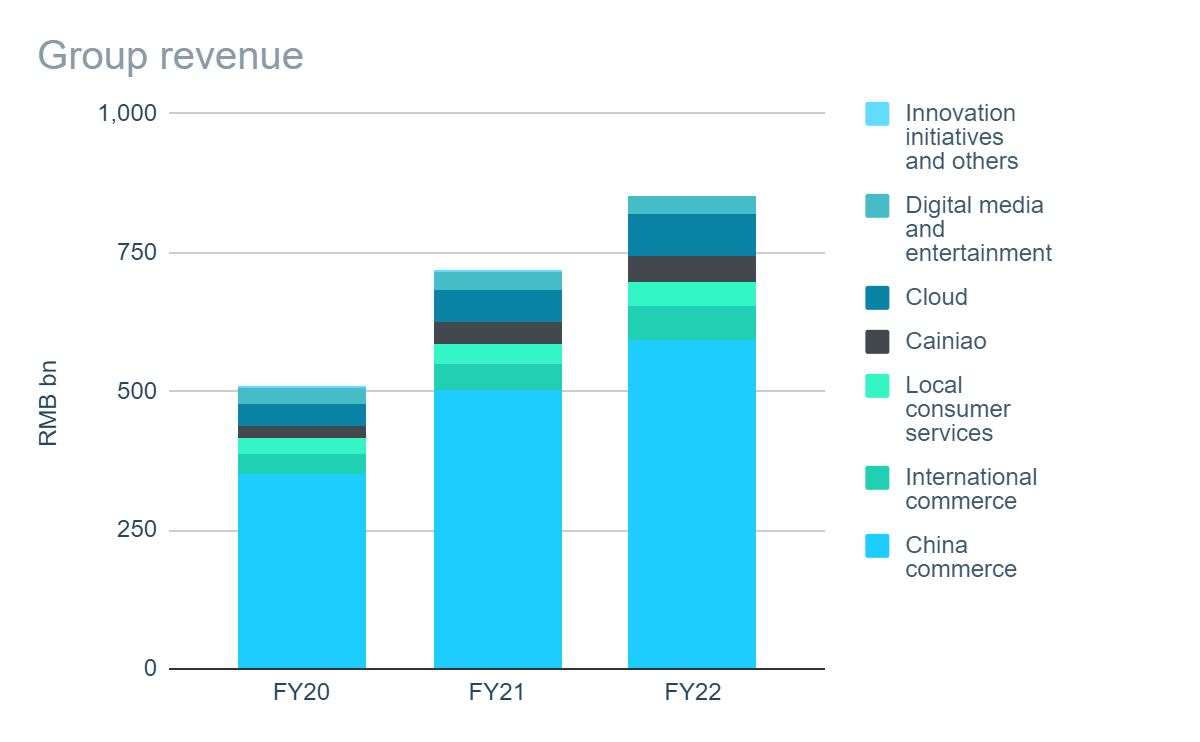

Despite its many operating businesses and international expansion, Alibaba is still predominantly a domestic e-commerce business in China. In FY22, China commerce – which include the company’s domestic retail and wholesale businesses – accounted for almost 80% of the group’s revenue. The next largest segments are Cloud (8% of revenue) and International Commerce (7% of revenue). We consider the performance of these three key segments below.

Prepared by author. Data from company annual reports.

Prepared by author. Data from company annual reports.

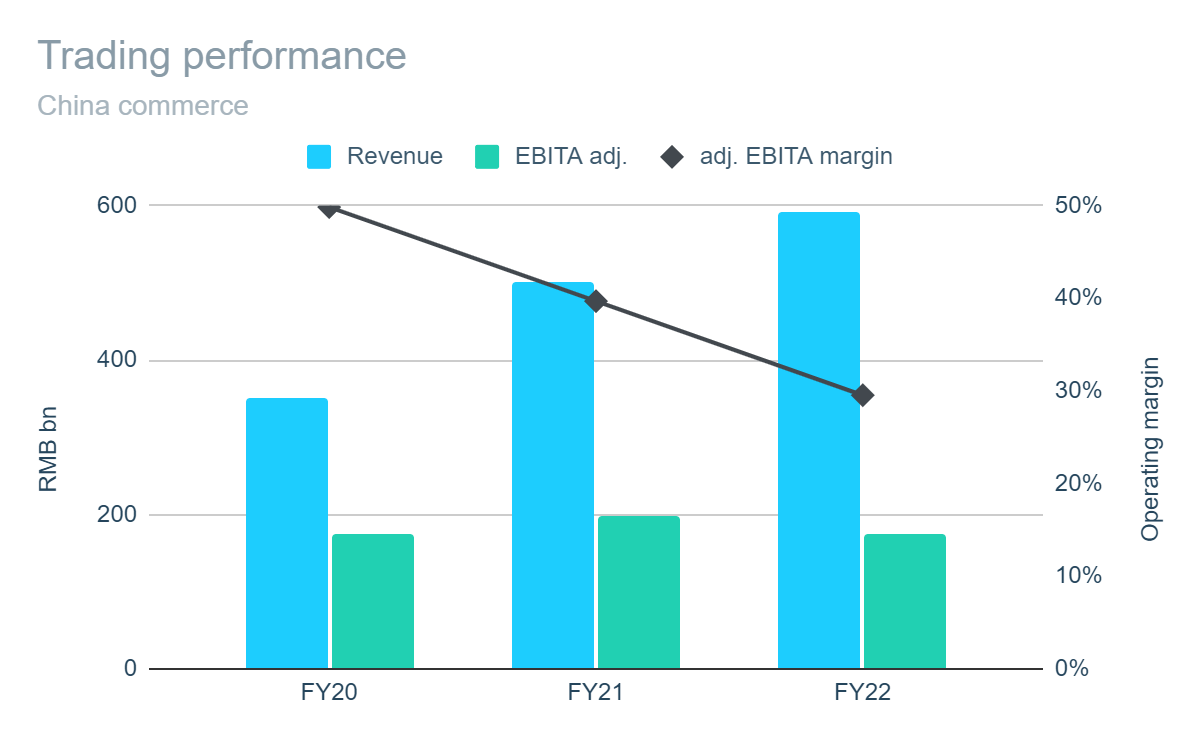

The e-commerce businesses in China continue to grow albeit at a slower rate, with growth slowing from 45% in FY21 to 18% in FY22. The company’s main ecommerce platforms in China – Taobao and Tmall – have seen their revenue growth slow to low-single digits in FY22, with the majority of revenue growth now being driven by the growth of the company’s direct sales businesses – Tmall Supermarket and SunArt.

This expansion into direct sales (i.e. traditional retailing) is unlocking new areas for growth, but at the cost of significantly lower margins. The company has also increased investment in its platforms and increased spending for user growth and on merchant support, further depressing margins.

As a result, EBITA margin has declined from 50% in FY20 to around 30% in FY22, offsetting the impact of the growth in revenue. The company expects margins to continue to be affected by this trend as direct sales account for an increasing share of revenue.

Please note: The EBITA reported by management excludes share-based compensation expenses. While we understand that it can be a useful metric on this basis, we have adjusted it to include the share-based compensation expense as this is a true cost to the company. Any reference to EBITA throughout this article is on that basis.

Prepared by author. Data from company annual reports.

Prepared by author. Data from company annual reports.

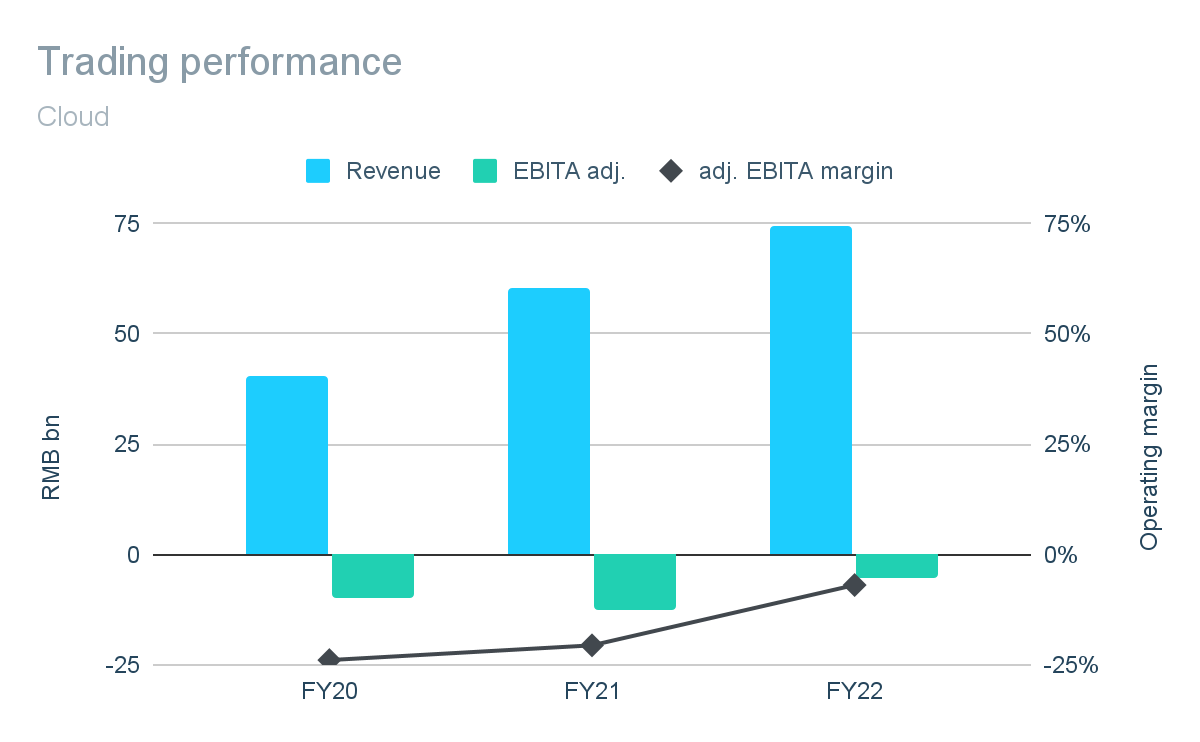

The trend of slowing growth is not confined to ecommerce, with the Cloud segment also seeing growth slow to 25% in FY22. The slowing growth was due to the loss of a significant customer as well as slowing demand from customers in China’s internet industry.

The slowdown in FY22 follows a year where revenue grew by a little over 50% and has grown by 85% since in the past 2 years. In addition, excluding the impact of the customer loss, the underlying business actually grew by 29%.

The continued top-line growth is contributing to improving operating margins, albeit the Cloud business remains loss making. If share awards are excluded, however, Cloud has actually grown beyond its break-even point generating an EBITA margin of 2% in FY22. Due to the operational leverage of these types of businesses, further top line growth should start to result in improving margins.

Prepared by author. Data from Company Annual Report.

Prepared by author. Data from Company Annual Report.

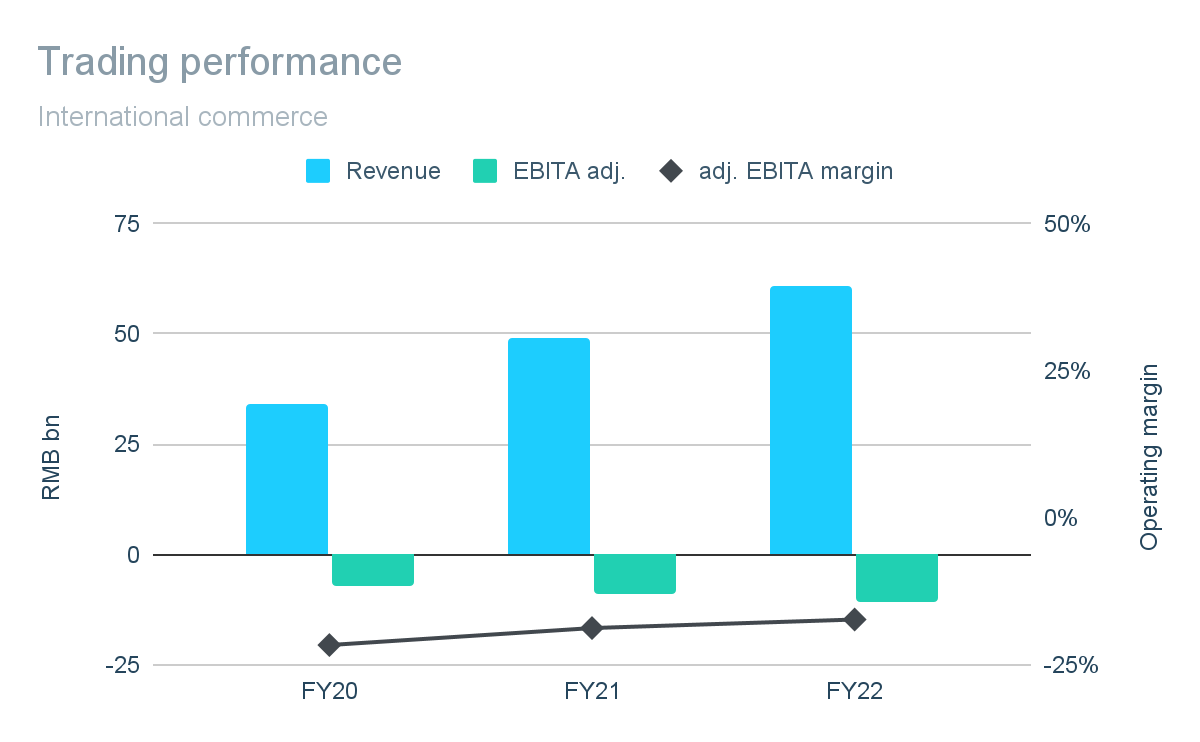

The theme in International commerce is similar. Revenue growth slowed to 25% in FY22, following a strong FY21 which saw revenue grow by 44%. The slowdown has in part been due to various headwinds faced by AliExpress and Trendyol, which have been key growth drivers of growth in recent years.

Trendyol has been affected by high inflation in Turkey and the weakened Turkish Lira, whilst AliExpress sales have been affected by the removal of the EU VAT exemption for low value foreign imports. The Russia-Ukraine conflict has also resulted in supply chain and logistics disruptions.

The International commerce segment as a whole continues to be loss making, with the profits from the wholesaling business not enough to outweigh the losses from the retail side. The loss actually increased in FY22 due to increased promotional spend and user acquisition costs in respect of Lazada and the cost of investments in Trendyol at a time when it is suffering from the economic situation.

Prepared by author. Data from company annual reports.

Prepared by author. Data from company annual reports.

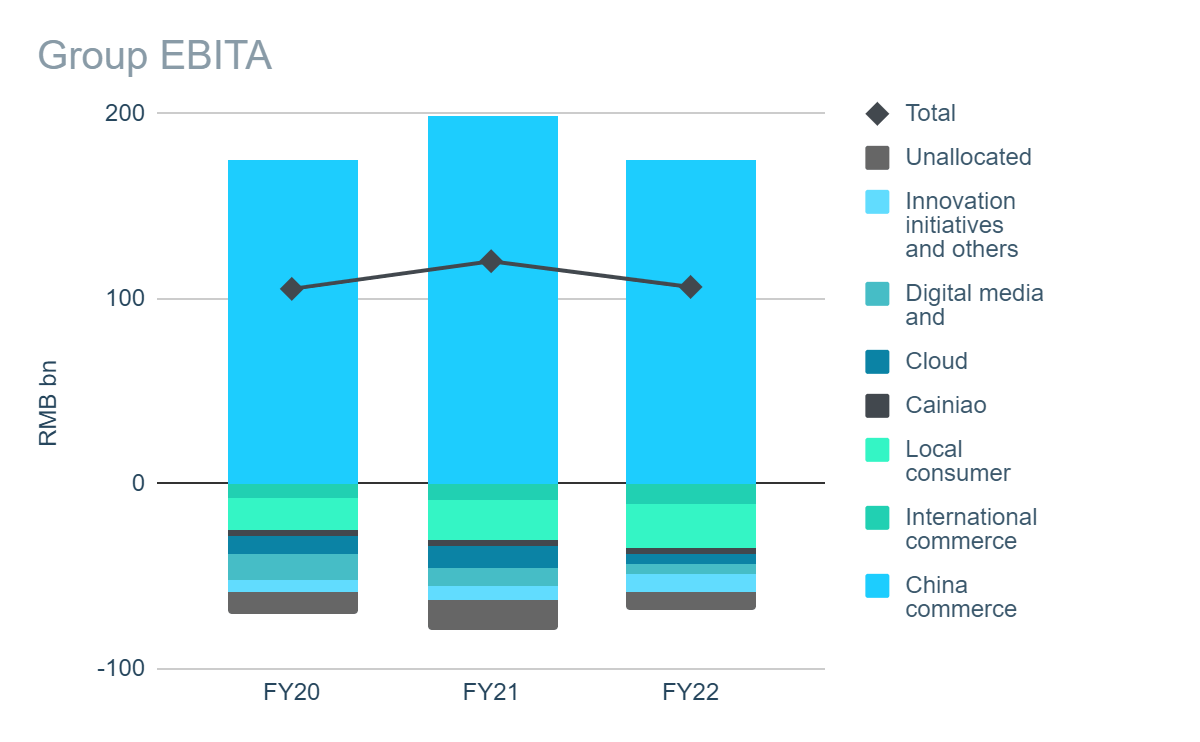

Whilst Alibaba operates numerous individual platforms, they all combine to create the “Alibaba ecosystem.” At first glance, Alibaba operates a profitable e-commerce business in China which it uses to subsidize a host of other unprofitable ventures. However, it is too simplistic to look at Alibaba in this way.

Businesses which are currently loss-making, may still contribute positively to the overall strength and profitability of the wider ecosystem. The more services and platforms the company has, the greater the network effects and switching costs become for consumers and merchants.

Not providing such services could result in a loss of consumers and merchants to competitors, where the long-term impact would be greater than the cost of offering the service at a loss. On the other hand, if any loss-making business is not beneficial to the rest of the ecosystem, we would expect that it ultimately be wound down or disposed of.

Many of the loss-making businesses were also only acquired or started in recent years and have yet to reach a critical mass. Take the Cloud business, for example. This is a business which requires a lot of investment and has a largely fixed cost base, meaning it needs to reach a certain size to break-even. Any growth beyond that should be rewarded with very high margins.

Prepared by author. Data from company annual reports.

Prepared by author. Data from company annual reports.

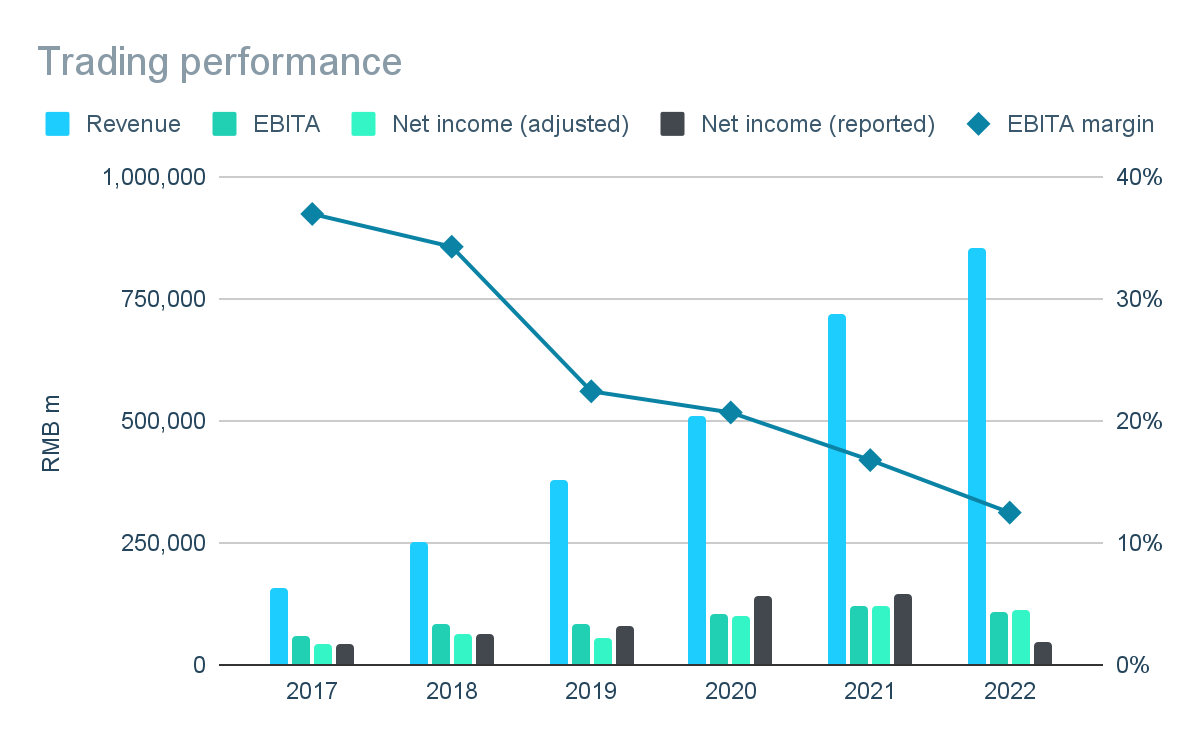

Looking at the Alibaba group as a whole, the theme of strong but slowing growth holds true. Again, it is important to view this in the context of the group growing its top line more than 5 times since 2017 – equivalent to a compound annual growth rate of 32%.

Since 2017, growth has come at the expense of profitability, with EBITA margins falling from almost 40% to less than 15% in FY22. If this decline in profitability had occurred whilst the operations of the group had remained constant, then we would see it as reason to be concerned. However, the key reason for the declining margins is the company’s expansion which will form the basis for the company’s future growth.

Whilst some of the decline in margin is structural as a result of expansion into lower margin business such as traditional retail and logistics, we do expect margins to improve as the company continues to grow and its businesses benefit from advantages of scale.

Any management team which is willing to put long-term success ahead of short-term profitability should be commended. The culture at Alibaba appears to be geared towards this. The legal structure – which essentially gives shareholders zero control over the management of the company – also means management is less likely to be concerned by the short-term demands of the market or shareholders.

The overall profitability of Alibaba is not solely dependent on its operating businesses. Significant fluctuations in the company’s investment portfolio can also have a significant impact on net income. In both FY20 and FY21, the company recognized gains of over RMB 70 billion, equivalent to more than 90% of the company’s operating income in each of those years. However, in FY22, the value of the company’s listed portfolio declined by over RMB 15 billion – wiping out almost 25% of the company’s operating income.

The performance of equity method investees – particularly Ant Group – can also materially impact overall profitability. Alibaba’s share of profits from equity investees has improved from a loss of RMB 5 billion in FY20 to a gain of RMB 14 billion in FY22. Performance in FY22 was boosted by gains in investments recognized by Ant Group rather than improvements in the underlying business, meaning future profits may not be so high.

Overall, adjusted net income – which excludes changes in the value of investments described above, as well as certain one-off or non-cash costs – has been broadly flat in the three years through FY22 in the range of RMB 100 billion to RMB 120 billion.

Prepared by author. Data from company annual reports.

Prepared by author. Data from company annual reports.

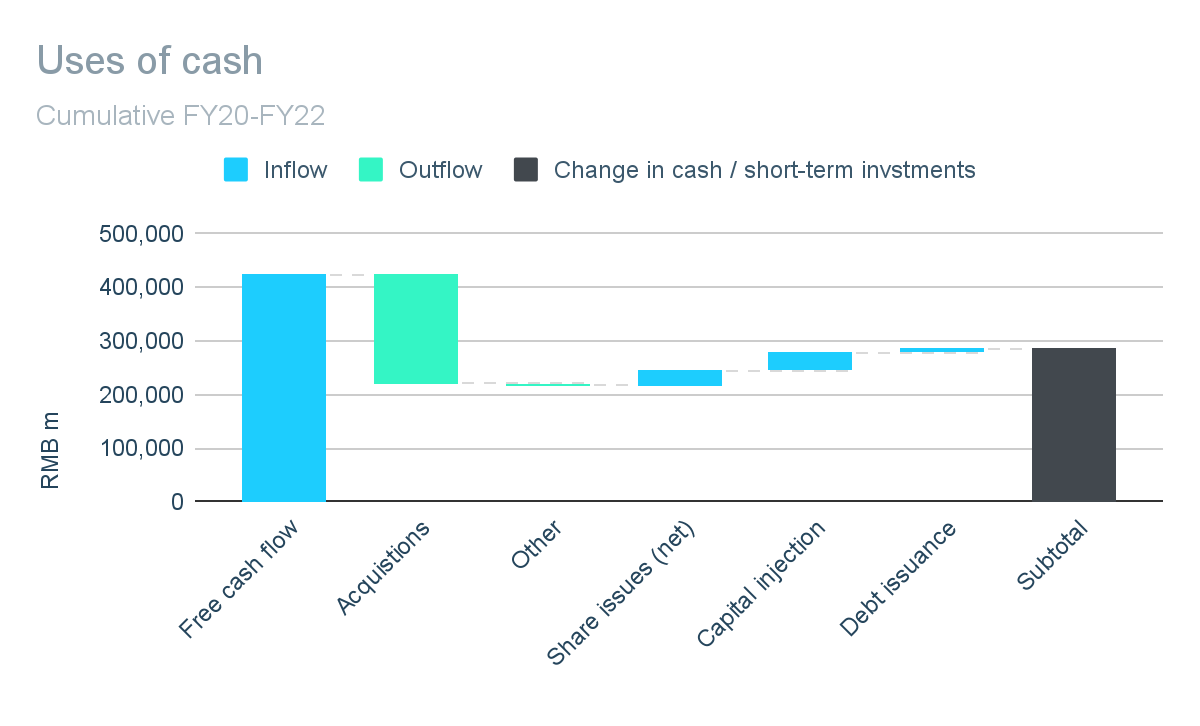

Essentially all of the company’s net income translates into free cash which can be used to fund acquisitions or returns to shareholders.

In the three years through FY22, the company has generated over RMB 400 million in free cash flows. The main use for this cash flow has been acquisitions, with the company investing around 50% of its cumulative free cash flow on new or additional investment in equities, business combinations or non-wholly owned subsidiaries.

The company does not and has never paid any dividend, but does have a share repurchase program of up to $25 billion (RMB 103 billion). As of 30 June 2022, there is a further $12 billion (RMB 81 billion) still to be completed by 2024, equivalent to around 5% of outstanding shares at the current price.

The strong cash generation of the business is reflected on its balance sheet, with a net cash position of RMB 378 billion as of 30 June 2022.

Note: The FCF metric reported by management excludes the acquisition of land use rights and construction in progress relating to office campuses. Whilst these do not relate directly to the revenue-generating segments, they are still a true cash outflow from an investor’s perspective. As such, we have adjusted management’s FCF metric to include these outflows.

Prepared by author. Data from Q1 FY23 trading update.

Prepared by author. Data from Q1 FY23 trading update.

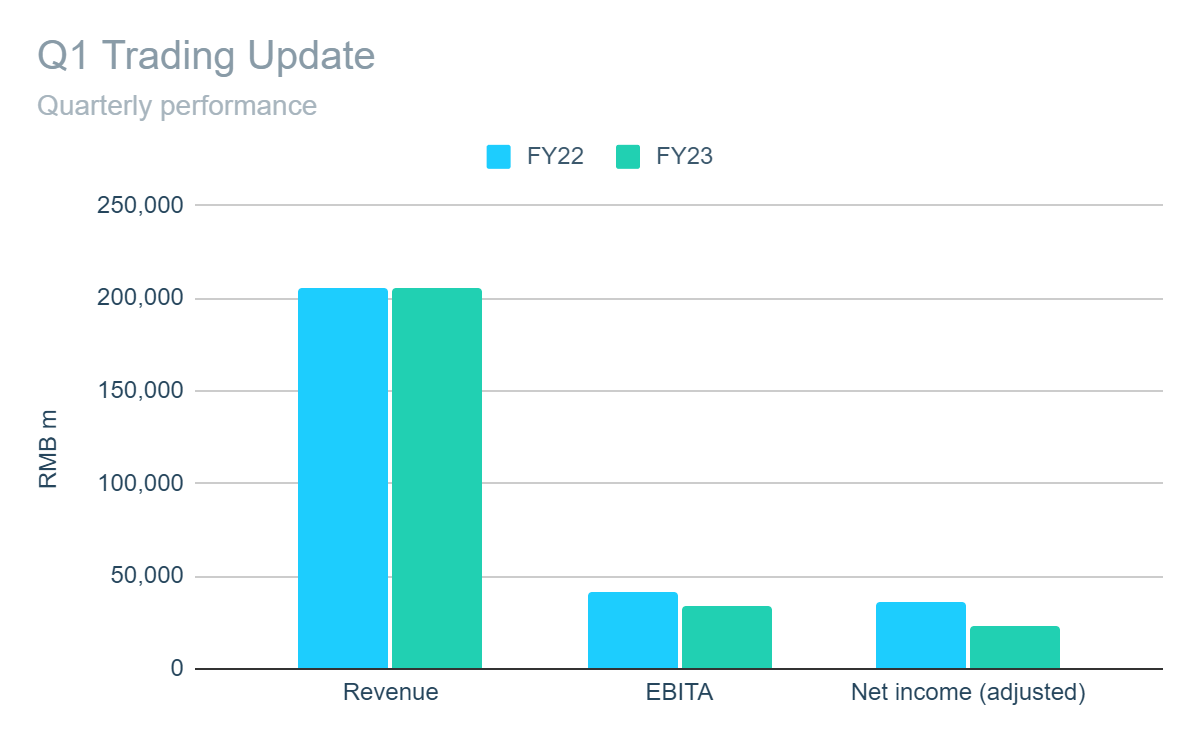

On 4 August 2022, the company released their results for the first quarter of FY23. A further slowdown with revenue flat on the same period in the prior, albeit management reported that a slow April and May had been offset but a recovery in June.

China commerce revenue fell by 1% as GMV fell by a single-digit percentage and order cancellations increased as a result of the Covid-19 resurgence. This was partially offset by modest single digit growth in International commerce, Local consumer services and Cainiao. Cloud was the stand-out performer with revenue up 10% on the prior year. Despite stable revenues, earnings of the operating business were down by almost 20% as EBITA margins fell from 17% to 11%.

The company operates a number of businesses in which foreign ownership or investment is restricted or prohibited. To ensure the company remains compliant, the businesses which are subject to these restrictions are carved out in separate legal entities which are not owned directly or indirectly by Alibaba, with control and economic benefit provided by way of contracts. Should the law (or interpretation thereof) change, there is a risk that Alibaba could be required to sell or cease operations in some of its businesses in China.

There is a conflict between what the PCAOB in the US requires of auditors of US-listed companies and what auditors in China are allowed to disclose under Chinese law. Without cooperation on this issue, Alibaba may be prohibited from trading on the NYSE or other U.S. stock exchange by 2024 under current laws.

In early 2016, the SEC initiated an investigation into whether the company has violated any federal securities laws in relation to its accounting practices. The investigation is ongoing and it is unclear what, if any, consequences the company could face.

Management does not provide any medium-term guidance or targets in respect of the company’s financial performance. However, its growth strategy revolves around the following three key trends.

Consumption is a key driver of company performance. With the 1 billion active users on its e-commerce platforms in China, the company already has deep penetration of the domestic market. However, there is scope to grow through further penetration of less developed regions and capturing a larger proportion of existing users’ spending.

Digitalization of the economy, particularly through cloud computing, represents a huge area of new business opportunity. China’s cloud computing industry is still at a nascent stage of development and is forecast to increase by 400% by 2025.

The company also hopes to capitalize on globalization. The initial focus is on expansion in Southeast Asia, through localized and cross-border offerings. Alibaba is already the largest IaaS service provider in Asia Pacific, and it continues to expand its international cloud infrastructure, with data centers in 27 regions globally, including Singapore, Indonesia, Malaysia, the Philippines and Thailand.

Alibaba has two major components to it: its operating businesses (including its subsidiaries, VIEs and equity method investees) and its investment portfolio.

As of 16 August 2022, the company’s ADRs (equivalent to 8 ordinary shares) trade at around $92, giving a total market capitalization of c.$244 billion (RMB 1,653 billion). Excluding the company’s significant net cash position (including short-term investments) of RMB 453 billion and its investment portfolio with a value of RMB 234 billion, this implies a valuation of RMB 966 billion for the operating business alone.

Our approach to valuing the operating businesses centers around determining the true underlying earnings power of the business or “owner earnings.” In the case of Alibaba, we will use Non-GAAP net income – which excludes amortization of intangibles, gains/losses in respect of investments and one-off non-recurring items such as fines – as our basis. Owner earnings in FY22 were around RMB 112 billion, equivalent to a price-to-earnings ratio of 9x for the operating businesses.

Due to the number of operating businesses and the limited information available in respect of each, we have not attempted to value each individually. Rather, we have applied high level assumptions at the group level to consider the implied potential returns under various hypothetical scenarios in reaching a conclusion on the attractiveness of the current valuation.

The assumed growth in earnings of 3% at the lower end and 7% at the upper end are low by historical standards, with historical growth in adjusted net income of 18% in the period FY17-FY22. We also assume that the company has to retain and reinvest 75% of its earnings to achieve this modest growth in net earnings, which is high by historical standards and may well be a lot lower in practice. We also make no allowance for any growth in the value of the company’s investment portfolio.

Even under these scenarios, which we feel provide for a significant margin of safety, the implied 10-year compound annual return ranges from 22% on the lower end to 34% on the higher end – a total return of between 5x and 16x in 10 years.

There are two equally string but conflicting components when it comes to Alibaba as a prospective investment: the strength and prospects of the company’s operating businesses versus the inherent uncertainty of investing in businesses with significant operations in China.

Where you come out on the balance between those two will ultimately determine whether you see it as an absolute bargain or a complete no-go. As long-term contrarian value investors, we feel the business strengths, discounted value, and prospective returns on offer are too attractive to ignore. For that reason, we consider it a “buy” and have allocated a significant proportion of our portfolio to it at the current price.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.