alexsl/iStock Unreleased via Getty Images

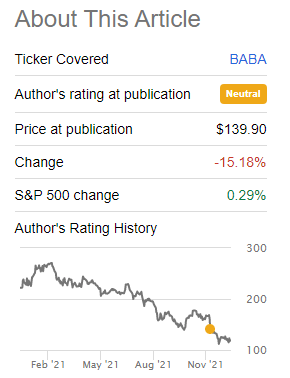

When we first covered Alibaba Group Holdings Limited (NYSE:BABA) we gave a unique reason for not jumping in on the bull express.

If the time for the bubble is up, then China’s retailers might disappoint for a long time. BABA remains a direct play on China’s growth and we see a period of adjustment here as investors come to grip with the new normal. The Chinese mega caps also are likely targets for large tax increases as Beijing will look to run higher fiscal spending in a budget neutral manner. We agree that the stock has potential on longer timelines, but the road ahead is still bumpy.

Source: It Ain’t Beijing, It’s The Bubble

Discretion is often the better part of valor and so far the decision to not jump in front of this train wreck has proved wise.

Source: It Ain’t Beijing, It’s The Bubble

We update the key thesis underpinning our neutral decision and tell you why a bounce is now almost inevitable.

There are plenty of articles on Seeking Alpha which will cover the VIE structure. There are others about how a path for BABA to reach (insert your own upside number here) by 2030 is in the works. We won’t talk about either. Instead we want to update on the key reason we stayed out. The real estate bubble that is deflating in China. In the last one month, many other firms have joined Evergrande’s (OTCPK:EGRNF) distress.

Kaisa Group Holdings Ltd. has suspended stock trading in Hong Kong amid growing concern over the Chinese developer’s ability to service its debts as distress in the nation’s property sector spreads.

The company faced repayment on a $400 million dollar bond that came due Tuesday after it failed last week to win approval for a debt swap that would have extended its repayment deadline.

Source: BNN Bloomberg

10 firms smaller than Kaisa, have defaulted on offshore or onshore bonds since summer. Even official numbers are being forced to acknowledge that housing prices are coming to grips with reality. December saw a third consecutive month of price declines.

Source: BNN Bloomberg

Let’s all keep in mind that this bubble is approximately 10X the size of the US housing bubble at the time of the subprime crisis and nobody really knows for certain how it will play out.

China’s November 2021 retail sales came in at a 3.9% year on year growth. We don’t buy that official version one bit. Even if you do accept the number and adjust that for inflation, the sales growth is remarkably weak. What is happening here is that consumer confidence is taking a hit as an asset class that was never supposed to go down is suddenly falling. What is worse is that there is a direct amount of liquidity being sucked out from property developers not paying suppliers and that chain reaction has to yet completely manifest.

The defaults and slow-moving crises of companies in China’s property sector isn’t just hurting bond-holders and people waiting for their apartments – thousands of small suppliers of everything from tiles to cleaning services are waiting to get paid by the likes of China Evergrande Group.

The 36-year-old says his advertising company is owed $200,000 by property developers including Evergrande, with those unpaid debts pushing him to the brink of bankruptcy. Feng said he is still waiting for the 489,500 yuan ($77,000) that the troubled developer — once the country’s biggest — has owed him since August.

He also claims Guangzhou R&F Properties Co., another major developer, has owed him around 800,000 yuan in payments for two years, and last month posted photos on Weibo of the contracts he signed with R&F and commercial acceptance bills Evergrande gave him in 2020 instead of immediate payment.

Source: Yahoo Finance

S&P expects more defaults on bonds maturing in 2022 and the biggest risk remains a spillover effect into Chinese financial institutions.

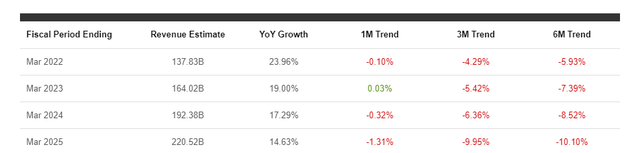

As the largest retailer in China, BABA faces twin headwinds of high inflation and low retail sales growth. Most retailers were expecting far better times at this point and are now very actively competing for the same volume of sales. BABA’s sales estimates are down about 10% in the last 6 months for two fiscal years ahead.

Source: Seeking Alpha

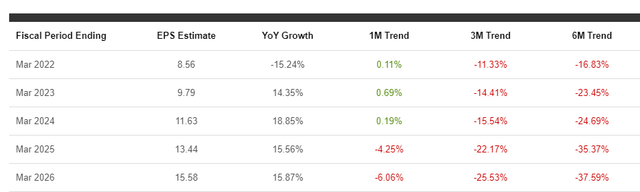

At the same time earnings estimates have been decimated.

Source: Seeking Alpha

In fact, anyone looking at this situation logically can easily acknowledge that BABA has not become cheaper as the stock has fallen. In case you have doubts, the next chart should fix that.

There are multiple headwinds here for BABA and no, we are not referring to Mohnish Pabrai selling his stake. Investors are seizing on the low multiples and forgetting that as long as earnings estimates don’t bottom, the stock won’t either. While that holds true for a longer term outlook, the stock is now 37% below its 200 day moving average and we think a bounce, albeit a short term one is highly probable.

The best way to play that in our opinion, would be a call spread. While multiple expirations and strikes are possible and it is not possible to discuss them all, we like the idea of buying the $130 strikes for March 2022 and selling the $150 strikes for the same month. This results in a $4.80 cost per share, or $480 per spread trade. Call spreads can of course lose all capital you put in but we like the limited loss setup with a maximum value of this trade is $2,000 per spread. That will come to pass should BABA close over $150 at March expiration. The breakeven is the strike plus the net debit cost ($130+$4.80) $134.80. At the same time, we are not risking a lot of capital to control 100 shares and the best case is more than 3X that of the worst case. While we expect a bounce, longer term, a lot of work needs to be done to resurrect the BABA bull thesis.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Cash Secured Put and Covered Call Portfolios are designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations and low bonds yields have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We “lock-in” high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.