Guang Niu

Guang Niu

Alibaba’s (NYSE:BABA) (OTCPK:BABAF) shares are down over 50% in the last year and many investors are getting tempted to buy. The general rationale is that the stock has fallen enough already and that it should only rally on from here on out. While that might have been a compelling contrarian argument till a few weeks ago, it’s now rife with problems, speculation and stretched assumptions. In this article, I’ll explain why investors may want to avoid the value trap that Alibaba is gradually turning out to be. Let’s take a closer look at it all.

Let me start by saying that Alibaba’s shares are trading at just 2.1-times its trailing twelve-month sales. This is quite low, especially when considering that the stock used to trade at over 24-times its sales back in 2015. Given this steep discount compared to its own prior levels, contrarian investors have been arguing that the stock is attractively valued and that it doesn’t have much downside potential left from current levels.

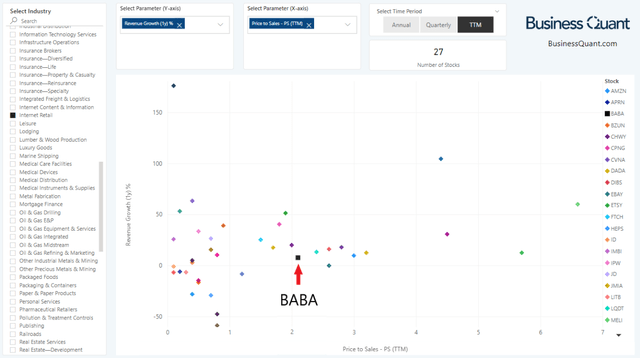

While that sounds like a compelling argument, the problem here is that industry comparables are trading at even more attractive multiples. The chart below should put things in perspective. The X-axis plots the Price-to-Sales (or P/S) multiples for over 25 internet retail stocks that are listed on US bourses. Note how Alibaba is horizontally positioned slightly towards the right, indicating that its trading at levels that are marginally higher than the industry average.

BusinessQuant.com

BusinessQuant.com

Now, let’s shift attention to the Y-axis, which plots the revenue growth rates for the same set of companies. Note how Alibaba is vertically positioned much lower than a broad swath of its other listed peers. This suggests that the stock is valued slightly higher than the industry average but its revenue growth rate is lower than most its peers in general. This implies that Alibaba’s shares have room to correct further, in order to justify its subpar growth rate.

There are at least 14 other stocks classified in the internet retail industry, that are growing faster than Alibaba but trading at lower P/S multiples. This disparity is all the more prominent when we consider that Alibaba’s US-listed shares offer an ownership only in a shell company floated in Cayman Islands, whereas its other attractively-priced US-based peers offer ownership in actual companies. Because of this difference in the nature of securities, Alibaba’s shares should ideally be trading at a discount compared to its US-based peers in the first place, but it’s actually trading at a slight premium instead. This should encourage contrarian investors to reconsider their thesis for the e-commerce giant.

Moving on, the Chinese government hasn’t hiked its interest rates in recent months, unlike the US. This suggests the Chinese economy will continue growing at a relatively faster pace and companies operating there should, at least in theory, thrive while other global economies stagnate and/or go into recession. This industry tailwind should indeed boost Alibaba’s growth prospects and it’s admittedly a silver lining in the whole contrarian narrative.

But there’s a problem here as well. A number of macroeconomic issues relating to China have come to light in recent weeks:

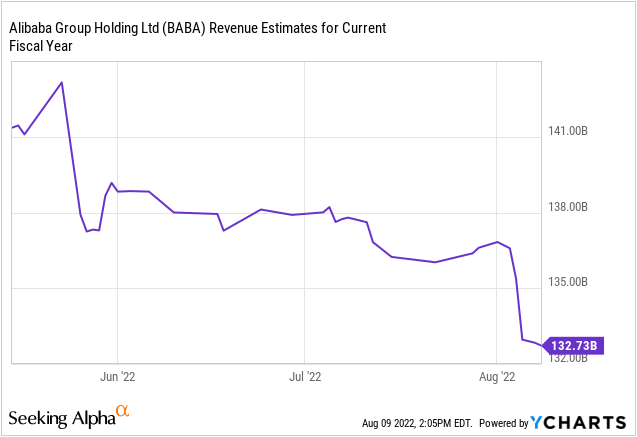

In light of these events, consumer confidence in China has taken a hit and it’s likely to hinder consumer spending in Q3. This may very well trigger a more profound slowdown for Alibaba and other similarly positioned Chinese e-commerce companies, negating the positives of low interest rates in the country. This is gradually reflecting in the Street’s forecasts – note how analysts have been gradually lowering their revenue estimates for the company in nearly every passing week.

Ycharts

Ycharts

This deteriorating macroeconomic environment in China should again encourage investors to rethink their rationale for Alibaba.

Lastly, contrarian investors are hopeful that delisting fears pertaining to Alibaba are exaggerated and not really a matter of concern. However, the risk is very real. The SEC published a yet another list about 10 days ago, noting that Alibaba and 270 other Chinese companies will be forcefully delisted from US bourses if they don’t open up for audit inspections.

Chinese regulators had reassured investors earlier this year that they’re going to work with the SEC and comply with their audit requirements, in order to prevent mass delisting of Chinese stocks from US bourses. But I’ve been warning investors that the regulators haven’t been making any progress and the risk remains. The prospect of such progress seems even more unlikely now, considering how diplomatic relations between the US and China have rapidly deteriorated over the past week.

One might argue that Alibaba is listed on Hong Kong bourses so a delisting in the US won’t make a difference. But it will. The prospect of Alibaba’s shares getting delisted in the US, is likely to prompt a mass selloff by institutional investors that have mandates to invest in only US stocks. Besides, the financial cost of owning Hong Kong-listed stocks is far higher for US citizens, so retail investors are likely to sell their shares too in large numbers.

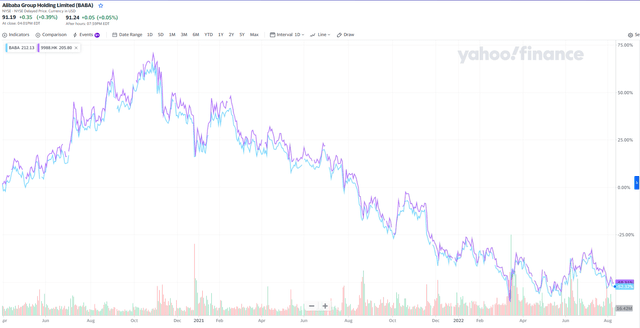

Moreover, it’s not like Hong Kong-listed shares have been performing any better than their US-listed shares. Both the stocks have continuously declined for the better part of the past year and I expect the downtrend to continue in Hong Kong listed shares going forward as well, given the deteriorating growth prospects for Alibaba as a company and its stretched valuation in general.

Yahoo Finance

Yahoo Finance

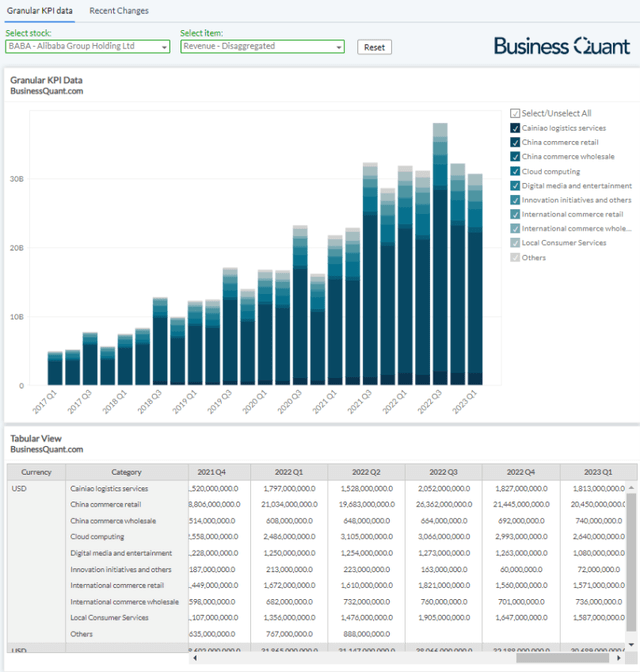

There’s no denying that Alibaba has grown its top line at a rapid rate in the past decade. The company has expanded its operations over time and its different revenue streams have all continued to grow over the years. This is a commendable feat and an enviable position to be in.

BusinessQuant.com

BusinessQuant.com

However, there are now several risks associated with investing in Alibaba, namely decelerating revenue growth, the risk of getting delisted from US exchanges and its relatively pricey valuations in general. So, risk-averse investors may want to avoid investing in Alibaba for the time being at least. The stock seems tempting at current levels, but it’s rife with issues.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.