georgeclerk

georgeclerk

Yesterday I wrote an article on the ProShares UltraPro QQQ ETF (TQQQ), which is the triple leveraged ETF tracking QQQ. In that article, I mentioned that Amazon (NASDAQ:AMZN) was the last big tech company I own and explained that the valuation of most of the top 10 holdings was keeping me away for now. This article will cover Amazon in more detail, with a couple recent acquisitions and Q2 earnings coming out since my last dedicated article on the company.

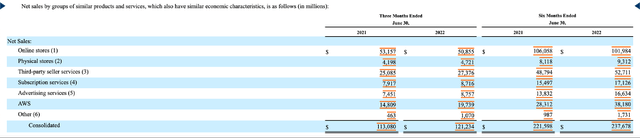

Amazon has been busy in the last couple months. They completed their 20:1 stock split, reported Q2 earnings, and announced a couple acquisitions. The Q2 earnings was a mixed bag, but my focus with Amazon has always been on the AWS segment, and more recently, the advertising segment. As long as these two segments keep growing, I will remain an Amazon shareholder.

While it’s too early for me to write an informed opinion on the recent acquisitions, I am curious to see how the company plans to expand into the healthcare space. Shares have had a nice 20% run in the last month but are still down almost 20% YTD. While the valuation might look expensive on the surface, cash flow is projected to grow significantly in the next couple years. Amazon is my favorite big tech company right now because I think the valuation is attractive, especially for investors with a long-term holding period. A better entry point in the near future is possible given the volatile markets we have had in 2022, so it might be worth waiting to buy shares.

While inflation and higher costs is a hit to the ecommerce side of Amazon’s business, the AWS and advertising segments keep humming along. The advertising segment continues to post double digit growth, with AWS posting over 30% YoY revenue growth. While I like the other segments of the business from the point of view of customer acquisition and retention, AWS and advertising is where I’m going to be focused as an investor because that is where Amazon makes most of their money.

Revenue Growth by Segment (sec.gov)

Revenue Growth by Segment (sec.gov)

I think we will see continued revenue growth for the company, but AWS and advertising will likely outpace the other segments. As they become a larger portion of revenue, margins will improve over the long term. Amazon has also been busy in recent weeks for a couple of acquisitions.

While this is after Q2, Amazon announced two acquisitions in the last month or so. The first one was for One Medical (ONEM) for $3.9B. The company is a health services company based in San Francisco. The other acquisition was iRobot (IRBT) for $1.7B. They make the Roomba robot vacuum and other robotic cleaning products. I don’t really have an opinion one way or another on these acquisitions, and they are really just a drop in the bucket for a trillion-dollar company like Amazon.

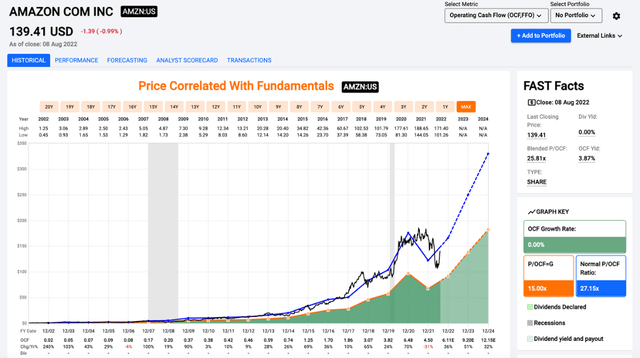

When it comes to evaluating Amazon, I think cash flows are a better valuation tool than price to earnings. This is just my opinion, but there is a reason that the statement of cash flows is the first financial statement in each quarterly report. Amazon is the only company that I have seen that does this. Anyway, back to the valuation. Amazon is trading at 25.8x cash flows, which is slightly below the average of 27.2x.

Price/Cash Flow (fastgraphs.com)

Price/Cash Flow (fastgraphs.com)

While the massive nature of Amazon’s operating segments makes it difficult to project cashflows, I think we will see some of the recent investments start to pay off. The valuation might seem rich at first, but if you look at the projected cash flow growth over the next couple years, I think it will show up in the share price eventually. Amazon has also started to buy back shares, which will help offset dilution and could be the beginning of an impressive capital return program.

While Amazon isn’t anywhere near tech giants like Apple (AAPL) or Microsoft (MSFT) when it comes to buying back stock, they have started to repurchase shares in the first half of the year. They have bought back $6B in the first half of the year and have $6.1B left on the current buyback authorization. While this isn’t enough to offset stock-based compensation, it will slow down the dilution for existing shareholders.

Amazon’s recent Q2 earnings might not have been a blowout quarter for Wall Street, but shares reacted like it. While the bounce could be partially due to the selling pressure shares have experienced so far in 2022, I think the long-term future for Amazon is still bright. Like I mentioned earlier, as long as the high margin segments of AWS and advertising keep growing, I will remain a shareholder.

It will take some time for the recent acquisitions to get sorted out, but I don’t think either will move the needle for a company the size of Amazon. The acquisitions do show that the company will continue to look for growth opportunities, internally and externally. The valuation is still attractive in my mind at 25.8x cash flows, especially with the projected growth in the coming years. While the buybacks are not offsetting stock-based compensation (yet), I think we could see a lot of buybacks in the coming years. I’m still bullish even after the earnings pop, and for investors with a long term horizon, owning shares of Amazon could generate impressive returns as the cash flow is set to increase dramatically in the next couple years.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.