Helping Traders Thrive

This is a guest post by Saloni Bogati of quantinsti.com.

Latest technological phenomena like ML and AI transform businesses, industries, and their scope of growth. The finance industry is notorious for using the latest technologies and solutions to achieve objectives.

Trading has also seen its fair share of advancements in recent years and has yielded the abilities of these technologies. There is also a significant increase in the use of AI and ML techniques to build trading systems using data. Further, Artificial Intelligence and Machine Learning enhance trading efficiency by using innovative solutions.

Hence, in this article, we will learn:

Artificial Intelligence or AI is a computer science stream that develops machines capable of imitating the human mind. In other words, it enables devices to think and react like humans to perform specific tasks without human intervention.

For example, virtual assistants like Siri, Alexa, and Google Assistant are a part of our daily lives. Virtual assistants often use data history, voice technology, and other features to make our lives easier.

Machine Learning is a subject of Artificial Intelligence that enables software solutions to make decisions based on accurate and calculated information. It develops machine capabilities to use algorithms to duplicate the way humans learn.

It also progressively enhances reliability and accuracy by analyzing historical data to procure desired results. Moreover, ML makes the machines more “human” by training the devices with the “ability to learn and develop.”

The evolution of trading defines the development and journey of humans. Trading denotes the system of equally exchanging products, services, and money to gain specific ownership. Earlier, the barter system was a popular method of determining exchange. Further, with the inception of coins and money, the manner of exchange evolved. Soon, trading evolved as coins and currencies emerged to define the value of products, commodities, and services. Automated Trading accounted for about 70% of US equities in 2013. Algorithmic trading accounted for a third of the total volume on Indian cash shares and almost half of the book in the derivatives segment. Hence, trading has evolved from the early days of yore to the recent technological development. Therefore, terms like algo trading are now gaining momentum as the present leads the lives of future traders.

AI and ML have a tremendous impact on trading. Therefore, the reasons why AI and ML are pivotal in Trading:

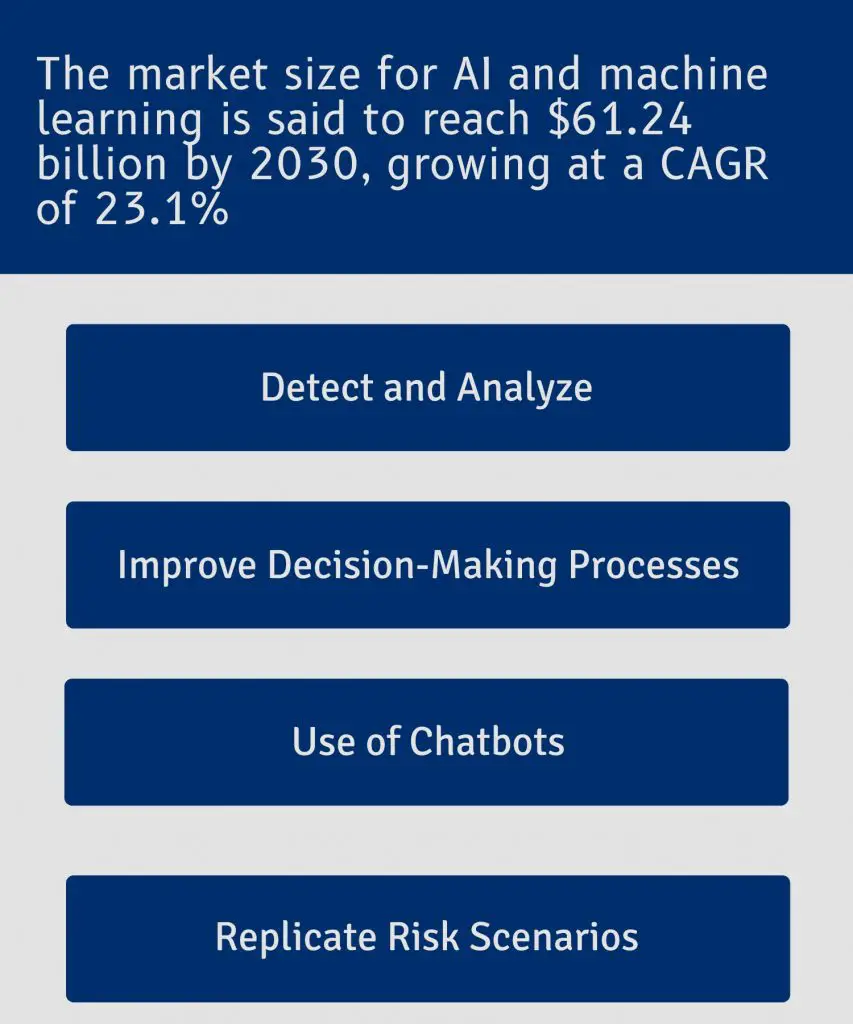

According to a report by Allied Market Research, “The global AI and advance machine learning in BFSI market size was valued at $7.66 billion in 2020, and is projected to reach $61.24 billion by 2030, growing at a CAGR of 23.1% from 2021 to 2030.”

Artificial Intelligence and machine learning in trading offer financial industry solutions that help streamline various processes. It also helps in optimizing decisions in quantitative trading and manages financial risks. Hence, the solutions and services offered by AI and ML help automate processes in trading and reduce manual and repetitive tasks. Hence, here are different ways in which AI and ML contribute to the world of trading:

AI and ML often use abilities like neural networks and other learning models to detect and analyse factors that influence stock prices. That is to say; the factors act as predictors or features that help determine the future of stocks. For instance, AI can help detect technical, social, economic, demographical, and other factors to gain desired results. Therefore, traders can use these insights and knowledge to develop robust ML algorithms, strategies, and models to trade.

Artificial Intelligence uses automated systems that perform tasks based on facts and the accuracy of the information. On the other hand, humans may make specific errors based on emotions, cloud judgments, agendas, etc. Therefore, AI’s fact-based decision-making process offers optimum results for participants.

AI in trading also increases the need for human management as an organisation is now looking for experts in Mathematics, Computer Programming, etc., to develop strategies. As a result, AI improves decision-making processes while experts develop ML strategies for various trading agendas.

Chatbots are virtual assistants that enable traders to find easy solutions. It also mitigates the use of agents for mundane queries. Moreover, traders can access chatbots anytime in the day as it does not require human intervention and assist questions using automated responses.

AI helps predict stock prices using the factors that influence the market. Therefore, it can use similar elements and data to anticipate risks and enable ML algorithms to avoid scenarios or mitigate actions that may lead to the risk. Further, AI can process large sets of data rapidly and accurately. Machine Learning can help replicate the scenarios within the models and learn various techniques to optimize the results. Hence, AI can be the brain of the operation, and ML is the limb that follows instructions while learning and developing its abilities.

Artificial Intelligence and Machine Learning play a pivotal role in trading by offering rapid and simplified solutions. The technologies enhance the processes of innovating and modernizing the various concepts in trading. Therefore, the following are some revolutionizing applications of AI and ML in trading:

Sentiment Analysis is a general application of Machine Learning in the financial market. It helps analyze larger volumes of data related to assets and other investment information. Machine learning also leverages NLP (Natural language processing) in trading to rapidly and accurately analyse various data sets. Therefore, it is critical to have a comprehensive understanding of Sentiment analysis in Financial markets.

Machine Learning also helps improve sentimental analysis in the following categories according to requirements:

Traders often inquire about the estimated results of their trades. Although it is tedious to predict an accurate outcome, ML can help understand the factors that may affect the desired result. Therefore, traders can use these estimates to analyze possible results using research insights and probability.

Data fuels the engine for AI and Machine Learning. It is vital to have large volumes of data sets to develop ML algorithms and models. Therefore, another ML application in trading is developing synthetic data. Moreover, Generative Adversarial Networks (GANs) can help counter challenges like data scarcity, data privacy, data costs, backtesting overfitting, etc.

According to Coherent Market Insights, “Global algorithmic trading market was valued at US $10,346.6 Mn in 2018 and is expected to exhibit a CAGR of 10.7% over the forecast period to reach US$ 25,257.0 Mn in 2027.”

Therefore, the expanding market demands AI and ML-based solutions to meet the expectations. Machine learning can improve the speed of search for efficient Algo Trading Strategies. It also helps traders optimize their desired results and simulate risks while trading. ML and AI can also integrate their abilities with various algorithmic trading platforms to help investment professionals. For instance, multiple techniques employ ML and AI to enhance algorithms, including neural networks, deep learning, linear regressions, etc., often covered in machine learning courses.

Traders often analyze the opportunities and risks associated with trading stocks. They also want to predict the future value of specific stocks. Therefore, AI and ML strategies enable systems to make estimations based on real-world data. The strategies analyze various scenarios and factors affecting the desired outcome and provide information based on the calculations.

Moreover, a trader must always hope for the best yet prepare for the worst-case scenario by identifying and assessing the risks. ML algorithms can analyze large data sets and offer insights based on calculations and impact.

Programming Languages like Python in Trading

Machine Learning and Python have become widespread integration into algorithmic trading. Moreover, Python codes are easy to read and comprehend with extensive libraries. As a result, including programming languages in AI and ML strategies opens up several avenues for trading. It also offers robust computing power to enable scalability. Therefore, programming languages simplify processes by using comprehensive libraries for trading.

In the world of trading, AI and ML are actively used in Algorithmic Trading by various organizations and retail investors. Moreover, the concept help develops algorithms that comprehend market conditions, learn from past data, make calculated decisions, etc.

The use of AI and ML in trading is algorithmic or automated solutions that integrate AI analysis, self-developing algorithms, managing tasks according to trading agendas, etc. Therefore, it can create an environment for traders and investors to use solutions that offer optimum results optimally. As technology evolves, traders and investors must upgrade their skills to the leverage abilities of technologies. An algorithmic trading course guides traders and investors with the help of industry experts and updated training modules.

You can follow QuantInsti on Twitter here an check out more information on their website at quantinsti.com.

Steve Burns:

After a lifelong fascination with financial markets, Steve Burns started investing in 1993, and trading his own accounts in 1995. It was … Read More

The information provided through the Website and our services is intended for educational and informational purposes only and not recommendations to buy or sell a specific security. Read More…

Helping Traders Thrive

Proudly powered by WordPress | Theme: Newsup by Themeansar.