ASML – Leading the Chip Sector to New Frontiers

sankai

ASML – Leading the Chip Sector to New Frontiers

sankai

Let me propose to you a simple analogy: the microchip is to the information economy what oil was to the industrial economy. Move over King Oil, there’s a new regent.

In this article, I will demonstrate that ASML Holding NV (NASDAQ:ASML) is the leading tech company at the core of the most strategic sector of commerce. ASML makes the best machines that allow mass-production of the world’s most valuable goods.

Computers chips, also called microchips or chips for short, are integrated circuits printed on a small wafer of semiconductor material embedded with integrated circuitry. Chips comprise the processing and memory units of the modern digital computer.

The smaller the transistor (or integrated circuit), the more the number of transistors that will fit on a wafer (or chip).

In the oil crisis of the 1970s, the OPEC oil cartel demonstrated the importance of oil to the global manufacturing sector. In 1973, a handful of producers that controlled 90% of global energy supplies effected a political coup by collaborating to regulate and constrain production, instead of competing for market share. This move sent oil prices skyrocketing from $1.82 in 1972 to $11 in 1974.

This oil shock sent major economies of the world reeling in economic pain and chaos. It eventually resulted in the US and Europe entering into a prolonged period of faltering growth and high inflation that lasted a decade.

Today, I would argue that microchips are the new oil. Microchips easily meet and probably surpass oil’s importance in an age where competitiveness is driven more by information and data than by the physical production of goods.

It is getting more and more difficult to find any sector of commerce that does not depend on microchips to run its business operations. Microchips lie at the heart of all business processes. These range from GPS guidance, to RFID tagging, to warehouse management, to product design and distribution, to customer relations systems and of course to communications. The list is endless. In all, microchips are critical.

For businesses, the difference between boom times and bankruptcy increasingly lies in their adoption of advanced microchips in their operations.

In the recent global economic seizure brought on by the COVID epidemic, microchips were even more critical than oil. People could live without their cars. They could not survive without their cell phones and laptops.

In fact, it is largely due to the ability to run an entire business through a network of laptops and cell phones – powered by modern microchips – that the American economy powered through the epidemic as well as it did.

In other times, the almost complete seizure of all transportation and mobility would have provoked a catastrophic drop in national commerce. Yet microchip technology offered us a working alternative: work from home. The hit to productivity was small.

According to productivity research of the Federal Reserve bank, actual mobility of consumers and workers dropped during in epidemic year of 2020 anywhere from 77% in the food and beverage industry to 64 & in air transportation. Guess what? Wholesale trade increased by 19%. The annual decline in GDP in 2020 turned out to be a surprisingly small 3.4 percent, much lower than what might have been expected when half the country shut down for months on end.

What gave the economy its resilience was the ability of modern microchips to enable commonly held laptops and cell phones to easily scan documents, take pictures, enable teleconferencing, and crunch spreadsheets. Not to mention babysit and teach our kids.

But while we all became acutely aware of the benefits of microchip technology, we also became aware of our extreme dependence on them, and the few companies or nations that furnished them.

Despite the greater efficiencies that microchips allowed, global manufacturers were unable to keep up with the boom in demand for microchips that was unleashed by the new work-from-home phenomenon, as well as manufacturer hoarding.

Car manufacturers, home appliance companies and other industries quickly realized the world of just-in-time manufacturing was severely impaired and perhaps permanently dead. Who knew how long the epidemic would rage?

Collectively, manufacturers scrambled to increase existing chip orders to ensure their own future manufacturing ability. This hoarding exacerbated a problem of chip supply by factories already struggling to overcome transportation glitches, border closings and worker COVID-related absences.

This chip shortage hurt American industries in almost all sectors, and many had to close factories and idle factory workers. According to Goldman Sachs, a total of 169 sectors were severely impacted by these shortages. Hardest hit among these was the American automobile industry.

As a consequence of chip shortages, Ford (F) and other manufacturers were forced to shut down entire factories due to insufficient chip supply. New cars at dealers started becoming a rarity and were whisked off lots even before they arrived, with month-long delays on new orders. These cars sold at a significant premium to the manufactured suggested price. Even used cards – especially late years models – shot up in price, often selling for more than their original cost even after a year or two of driving.

The auto industry has emerged as a major consumer of microchips in recent years, rivaling the personal-electronics sector. Demand is increasing as more car companies update the tech in their vehicles, decking them out with big, tabletlike displays and other features that consume more computing power than was needed in the past.

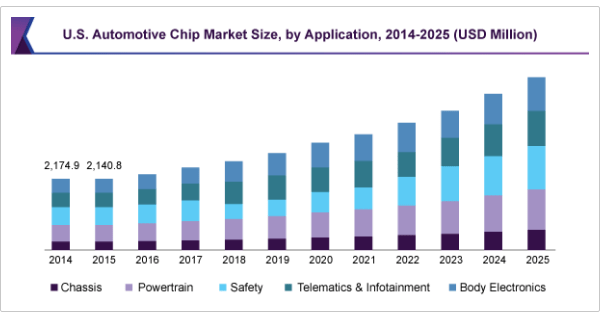

US Automotive Chip Market Size (Grandview Research)

US Automotive Chip Market Size (Grandview Research)

Visitors having the rare privilege of touring a Tesla (TSLA) car factory will be amazed at the multitude of giant robots churning out cars by the hundreds in a single day, and the odd handful of human workers they’ll even see present. All of these are dependent on advanced microchips.

But it’s not just factories. It’s the entire service sector: from coffee baristas, to hotel luggage carriers, robotic concierges, self service stores and supermarkets and of course advanced hospital care.

Even industries considered so specialized that they are immune to the forces of robotics and microchips are becoming susceptible to the new technology.

In the home building industry, microchips are revolutionalizing the industry, though the trend is just in its infancy, with only a microscopic $11 million in sales in 2021. Using only 10 percent of the labor of a conventional home,3D printed structures are printed in meticulously layered concrete to construct foundations, interior and exterior walls, balconies, staircases as well as multiple levels of flooring. Plumbing and electrical works must still be completed manually, but the savings in time and labor are gargantuan.

This chip penetration in the home building sector is just in its infancy, with minuscule global sales of less than $11 million dollars in 2021. Yet the 3D printed sector is projected to grow at over a 100% compounded annual growth rate for the next several decades.

Don’t forget the power of compounding: If that trend holds up it will mean we’ll go from $11 million of revenues last year to over $5 trillion by 2040!

If microchips are essential to a modern economy, the Ukraine war has revealed how critical they have become to national security. Since the invasion by Russia in February 2022, Ukrainian forces have shocked military strategists around the world. They demonstrated the effectiveness of modern NATO weaponry – powered by the latest microchips – to gain a decisive advantage against the much larger Russian foe using more antiquated technology.

Russian armored vehicles costing the Russians up to $50 million each are being destroyed by cheaper drones that can cost as little as $100,000 to produce and deploy.

Meanwhile Russian forces are struggling with latent cell phone communications and interceptible radio communications, while their Ukrainian opponents are benefiting from satellite communications from outer space provided by Elon Musk’s Starlink service.

The nature of war has changed: It’s no longer a case of whether Russia has the bigger army or the most tanks. It’s a question of whose troops have the best communications lines, data centers, electronic guidance systems and high tech drones. It’s guns vs microchips.

As a result, governments across the board are rethinking their trade relationships and supply lines in order to make sure that their ability to defend their borders could not be harmed by a future scarcity of advanced chips.

Factories are being re-shored, technology-transfers are being limited to close allies, critical supplies and minerals are being domestically developed, and technology workers are facing new national restrictions in marketing their services to perceived enemy countries.

Governments of the world are conscious that their national survival depends on the sophistication of their technology, and their ability to deploy it or deny it to their enemies. They understand they need to control their supply of advanced microships.

If microchips dominate technology, ASML today holds the incontestable position of dominance in this sector.

ASML today is the only company in the world with the capacity to build machines that can produce the most efficient and highest-powered chips on the market.

It enjoys a technology lead that experts say will take other competitors anywhere from 5 years to 10 years to replicate. Meanwhile ASML will not stand still.

What ASML has effectively done is to develop a light source with a wavelength of only 13.5 nm, or one tenth the width of that of its competitors at 193nm. Its main competitors in this sector are Canon (CAJ) and Nikon (OTCPK:NINOF)

This technology, dubbed Extreme Ultraviolet lithography (EUV) by ASML, is unparalleled in its power and sophistication. By deploying ASML’s new EUV technology, manufacturers like Taiwan Semiconductor (TSM) or Intel (INTC) can produce transistors at widths of only 3nm as opposed to the smallest previous record size of 5nm.

In theory, you’d thing this would allow the ASML’s machines to place 15 times more transistors on any given layer of a wafer. However, things are not so simple.

Chips are often comprised of 100-150 layers on one single silicon wafer, with complex factors guiding the communications and isolation between layers. In fact, since the size of an atom is 0.1nm, at 0.3nm the small size of this chip starts to leave little space of the atom to move and can cause the entire circuit to become unstable.

In most EUV chips deployed by manufacturers, only the most complicated layers are made with EUV machines, while more simple layers being constructed with DUV (Deep Ultraviolet) machines and other tools.

This complicates making definitive conclusions in comparing the advantages of EUV chipsets vs the older DUV chipsets.

How much this will give ASML produced chips a leg up on any competitors is a matter of some debate. It is certainly not 15-fold – as some early enthusiasts claimed – or simply proportionate to transistor size.

But according to an in-depth review of EUV technology, it appears to be that the overall frequency of the EUV chip has improved somewhere in the 10 to 20 percent range, while its performance has improved by 35% and its power consumption by around 40%. This efficiency will vary based on the exact mix of technologies deployed by the manufacturers.

Those are still significant improvements and will confer big advantages to chips that feature EUV transistors.

Offsetting that, is the much higher cost of EUV chips. This may cause chip manufacturers to continue to use a less efficient technology that is much less expensive to produce. That and the fact that only a handful of manufacturers of chips have chosen to embrace this new technology at the time of this writing. Samsung (logic + NAND), TSMC (logic), Intel (Logic), SK Hynix (NAND) and MU (NAND) have all bought the machines.

This has caused a number of analysts to question the economic significance of this technological breakthrough for ASML’s growth prospects. After all they argue, what good is the best technology if nobody buys it?

That argument, I think, is shortsighted. A new technology creates its own new demand. When the first PC’s emerged to compete with IBM mainframes, investors also pointed to a lack of demand and usage of the product in private homes. How much more wrong could they have been? I believe that the same phenomenon will occur with the smaller transistor sizes. New software and technologies will emerge that take advantage of the new format which could not even have existed with the larger transistor sizes.

Then, as more and more manufacturers embrace the technology, Wright’s law will come into play, and the greater volumes will drive down manufacturing costs.

Finally, it should not be ignored that ASML continues to market tools that produce the older DUV (Deep Ultra Violet) technology, based on the 193nm wavelength. So while ASML has placed the lion’s share of its marketing efforts on the new EUV technology – as I believe the company should – this does not make it completely dependent on a product that could fail to gain fast user adoption.

The semi-conductor industry is notorious for its cyclicality. According to data compiled by Euler Hermes, the past 30 years have seen a market slump every 4-5 years, each of which lasted ~12-15 months, on average.

With the recent boom caused by the emergence of new technologies and the COVID induced boom, we’ve recently seen an all time high. I agree with the following summary, that the time is ripe for a downward cycle.

According to an article from the Business times, If history is a guide, then a glut is in on the way. The only question is when. Soon, many analysts think. Demand for smartphones may be cooling, especially in China, the world’s biggest market. Sales of PCs, which boomed during Covid-19 lockdowns, also seem poised to weaken, says Alan Priestley of Gartner, a research firm. A survey by Morgan Stanley found that partly thanks to the shortages, 55 per cent of chip buyers were double-ordering, which artificially inflates demand. High inflation and looming interest-rate rises could hit economic growth – and chip demand with it.

Penn expects the cycle to turn in the second half of 2022 or in early 2023.

Despite this likely slowdown, ASML appears to have a steady sales pipeline that should carry it well into 2024 and beyond. However, the pace of its sales growth is likely to decline. I invite the reader to review the excellent analysis by Khaveen Investments on these same SA pages.

For reasons described there, revenues are likely to continue growing, but at a lesser rate of 12% a year, way down from the heady 48-51% ranges of the last few years. Profit margins meanwhile, should hold steady.

The war in Ukraine and the concomitant hardening of geopolitical ties between China and the West is the biggest disruptive factor that could negatively impact ASML’s sales.

In 2021, TSMC of Taiwan was ASML’s largest customer, accounting for $7327 of $9390 million of total sales. (source Statista) This was a whopping 74% of ASML’s sales.

A takeover by China would likely cause a suspension of TSMC’s operations in Taiwan and a possible permanent loss of this market to ASML for many years. While the leadership of TSMC and its management would inevitably reorganize and set up shop in friendlier Western shores, a process they’ve already begun, this would cause an inevitable delay of 3 to 5 years for the new fabs to be built. Other companies would not immediately be able to pick up the slack. so the impact to ASML’s bottom line would be debilitating. It could result in a drop in sales of as much as 50%.

While not fatal to the company, it could propel ASML into multiple quarters or possibly even several years of losses.

So how likely is such an invasion?

For the last 40 years, the possibility of China invading Taiwan to restore its historic sovereignty over a wayward region has been an issue largely discussed by aging academics debating in dusty university lounges. Most military tacticians and government leaders considered it a very remote possibility.

Today, the tensions in the world have increased to such a point where the issue of a Chinese invasion of Taiwan is front and center of NATO and Chinese military planning. It seems that every other week we see a headline about this in the major Western and Chinese press.

It was even brought up by the Chinese leader himself at the recent party Congress, when Xi Jinping emphatically proclaimed:

“Complete reunification of our country must be realized, and it can, without doubt, be realized!“

Pure political posturing? The Taiwanese don’t think so.

For obvious reasons, Taiwan’s population and government follow this issue very closely. The Washington Post recently interviewed one of Taiwan’s leading experts on the issue, Chang Wu-ueh, a professor focusing on cross-strait relations at Tamkang University and an adviser to Taiwan’s government

Chang Wu-ueh’s take: “He [Xi] doesn’t regard it as just a slogan. It’s an action plan that must be implemented, Before, leaders talked about unification as something to be achieved in the long run. Now, it’s number one on the agenda.”

According to US military leaders, China will feel it has the military strength to impose this solution at the latest by 2027. According to congressional testimony last year provided by the then-commander of the U.S. Indo-Pacific Command, Philip Davidson, by 2027, the Chinese military may be capable of launching a full attack on Taiwan despite a US commitment to defend the island.

With the means at hand and the popular backing of most mainland Chinese on the issue, I think the Chinese dictator will make a cool assessment of the pros and cons. He will weigh how much international opprobrium he is likely to face over such an invasion. How much would this reduce his export markets, so important to China’s economy? On the other hand, how much would the move boost his domestic stature in China? What would be the long term economic gains to China from the seizure?

I believe the Chinese Premier will await the ultimate outcome of the Ukraine war and the term of the final settlement that eventually occurs. Will Putin remain in power? Already Xi has seen the enormous weakening of the Russian state and the crumbling of the Russian economy as a result of this war. This should dissuade him from imitating Putin’s bellicose ways in Taiwan.

Will the West settle with Putin, allowing the leader to remain in power and possible even retain portions of Ukraine? If that were accompanied by the promise that Ukraine will never be part of NATO – another Russian goal – that could be sufficient for Putin to spin this as a victory to his population and remain in power.

If the West then rekindles relations and relaxes sanctions on Russia, this may cause the Chinese premier to mark down the risks of a Chinese invasion of Taiwan.

So in other words, a “bad” outcome for Ukraine and a “good” one for Putin would spell big trouble for Taiwan. Conversely, a bad outcome for Putin would be good for Taiwan’s continued independence.

Moreover, China is still in the process of swallowing up and digesting Hong Kong. This will take another year or so, although the process has gone on with hardly a whimper of protest from Western countries. This experience could encourage China to pursue similar goals in Taiwan, first with a process of increasingly active political and social manipulation, accompanied by economic pressures, and if those fail, ultimately with an outright invasion.

A big factor will be the domestic economic situation in China itself. The country is facing a huge economic crisis, combining a 60% collapse of the stock market and a meltdown in the real estate sector, which makes up 25% of GDP.

The Chinese Communist Party has built its legitimacy around the fact that it has successfully grown the Chinese economy at a phenomenal pace for the last 40 years. A stall and reversal of that growth could foster huge waves of popular discontent.

During the recent 20th Party Congress, Xi Jinping consolidated his power over Chinese politics, and effectively isolated any political rivals from their last strongholds of power. His policies have become more and more politically strident. He’s shown no hesitation to pursue hardline policies to bolster the state’s role in economic affairs, at the expense of private industry and the core real estate sector underpinning 30% of China’s economy.

If the Chinese economy were to fail and go into a severe recession, it will be Xi and Xi alone that will be blamed. In such a situation, I think it’s highly likely that Xi will reside to the tried and proven tactic of distracting the population by appealing to national pride in a jingoistic war to reconquer Taiwan.

Moreover, as East-West tensions rise, China may have less and less to lose. Domestic politics in the US have solidified in their anti-Chinese bent. It seems that the only thing Democrats and Republicans can agree upon is their mutual dislike of the current Chinese regime and the threat they perceive from China’s burgeoning economic power. China is now openly proclaimed by leaders from both parties as an enemy of the US that must be stopped at all cost.

Recently, China has been the target of technology bans by the US, first by its dominant and globally leading 5G provider, Huawei, but more recently in the form of a ban of all leading-edge computer technology and software to Chinese companies.

Yet if China already sees itself unfairly attacked and stymied in its plans to promote economic and scientific progress, it will be far less hesitant to start a war. If it’s already the subject of technology bans, what more will it have to lose?

So all told, the risk of an invasion of Taiwan has risen dramatically, in my view. I don’t see anything occurring over the next year, but I would change my mind quickly if events in Ukraine or in the Chinese economy itself were to take the turns described above.

In my mind, the outbreak of COVID and the invasion of Ukraine marked the turning point of global international trade. Though not the only causes, they were certainly the proverbial straws that broke the camel’s back. In my mind, the world order that relied on a global US military presence to ensure peace and permit unfettered trade is a relic of history.

We are approaching a new world, that at a minimum will be divided into an Eastern block vs a Western block or more autocratic vs less autocratic block. More likely, this world will include an unaligned block, which will uncomfortably attempt to maneuver between and avoid siding with either of the other two avowed antagonists.

The Western block consist of the US, Canada, Mexico, most of Western Europe, Japan, Australia, South Korea and a large number of Eastern European countries. The Eastern will consist of Russia, China, Pakistan, North Korea and a handful of displaced client states, like Cuba and possibly Venezuela.

The unaligned block will coalesce around Saudi Arabia, Brazil, Chile, Colombia, South Africa, and India, to name a few. Most African and South Americans and many South Asian countries will flock to this group.

These new trading blocks will feature an attempt to only trade with countries within the preferred trading block, to depend only on countries within these trading blocks for critical raw materials and services that cannot be easily supplied at reasonable cost on a national basis. Technology will be the dominant sector around which these blocks will organize.

ASML, for better or worse, sits reluctantly right fat in the middle of the Western camp. Willing or not, it has already been forced to agree to recent US imposition of technology controls against China.

On October 11, the Biden administration introduced sweeping rules aimed at cutting China off from obtaining or manufacturing key chips and components for supercomputers. Two days later On October 13 of this year, ASML announced all of its U.S. employees must “must refrain – either directly or indirectly – from servicing, shipping, or providing support for any customers in China until further notice, while ASML is actively assessing which particular fabs are affected by this restriction.”

Chinese sales represented about 10% of ASML’s sales. It represented a much bigger chunk of future Chinese sales: SMIC, the Chinese dominant semiconductor leader, was already a customer of ASML and had plans to scale up purchases. So ASML leadership, comprised of non-US management and located in the Netherlands, was very reticent to comply with the new US restrictions. ASML can be expected to fight tooth and nail to lobby against these restrictions.

Ultimately, though, I believe ASML will be forced to choose sides, and the butter is richer on the Western side. Its largest customer, TSMC, is firmly in the Western camp and is already building fabs in the US to mitigate the risk of a Taiwanese invasion.

The recent passage of the CHIPS Act in August of 2022 easily passed the Congress with biparty support. It set aside $52 billion to boost domestic semiconductor research and production. Numerous states have jumped on this trend, creating powerful tax incentives to reward companies that set up new fabs and create high-paying jobs in their states. Just 2 days after passage of the CHIPS act, New York announced a new package of $10 billion in incentives.

The results of these incentive programs and easing of regulations have already had powerful effects. In the past year alone, Intel has announced plans to build a $100 billion fab in Ohio, and in September Micron (MU) announced the construction of a $100 billion fab in New York. Globalfoundries (GFS) and Samsung (OTCPK:SSNLF) have all joined the race as well.

In a time of shrinking global trade ties and manufacturing reshoring, the opportunity to set up shop in the largest market for semiconductors in the world is attractive on its own. Being paid to do so just makes it more compelling.

So if the technological war between the US and China intensifies, as I believe it will, ASML will be unable to avoid choosing a side.

The upshot of this technology race is likely to ultimately benefit ASML, in my view. Yes, it is likely to lose its markets in China, but it should more than make up for this in sales within the Western trade block, as well as to the non-aligned block. ASML will have to maneuver these political waters very deftly. But with its technological lead in the space, it is operating from a position of power.

It is obvious that ASML is a phenomenal company growing in a promising long-term sector of the world economy. But even great companies can be poor stock buys if you overpay to buy them. What then is a fair price for ASML?

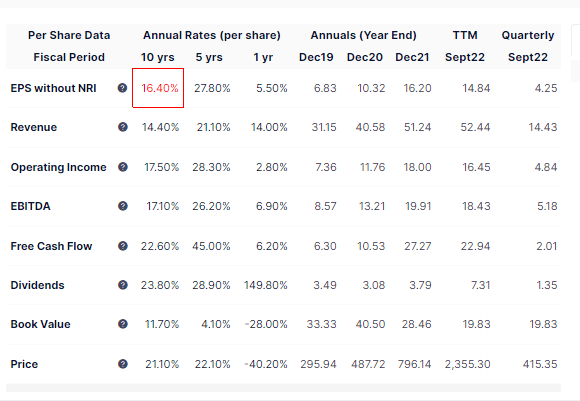

In the last few strong years, ASML has shown formidable growth. Comparing the last 5 years average to the last 10 years, we see in the graph below that EBITDA has jumped from 17% to 26%, Revenues from 14% to 21% and Free Cash Flow from 22% to 45%. Those are phenomenal numbers.

ASML historic stats (gurufocus.com)

ASML historic stats (gurufocus.com)

We can also see the signs of a slowdown in the last year, with those data points dropping by 50% to 70%.

Fair Value is very dependent on what you think the next 10 years average will bring. Secondly, its hugely influenced by the discount rate you apply.

Readers of my articles will know that I’m expecting a five to ten year period of much slower economic growth and persistently high inflation in the 4-6 percent range.

I believe a company like ASML has at least 15 years of fast growth ahead of it, with another 20 years of slow growth as the company matures, the markets change and new competitors emerge.

I would use a projection of 12% over a 10 year period for the fast growth period, followed by 6% for the next 20 years. These assumptions are on the pessimistic side. They may end up much higher.

At a discount value of 10, this gives us a fair price value of $505 today. If you were to lower the discount rate to say a factor of 6, this would raise the Fair Value to $970 with the same growth assumptions.

Why do I choose a discount rate of 10? Because I think 10 year bonds are going to settle into a range of 4% over the next 10 years. And I’m adding another 6% to account for the difference in risk between an equity and a treasury bond, which is considered to be the comparable risk free return. If you think inflation will continue to run hotter, you’ll want to use a higher discount rate, which will lower the Fair Value price more.

Note that this is just a little bit higher than today’s $474 value, so the price is not especially attractive at this level. I would rate it a Hold for the long term investor.

This is a great company, but I’d want to buy it at a discount, and preferably a big one. I’m fairly sure Mr Market will continue his schizophrenic ways, and my patience will be rewarded. Perhaps as a result of a crisis over Taiwan.

To determine what the likelihood of that happening soon, let’s look at the technicals.

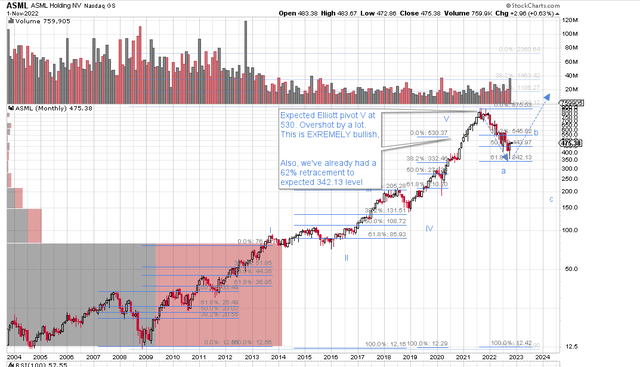

First I’ll have you look at a very long term chart, shown below:

ASML long term prognosis (stockcharts.com)

ASML long term prognosis (stockcharts.com)

Notice that we have completed the expect wave V of an Elliot wave pattern, and in fact greatly exceeded that “normal” high point. When that happens, and it’s an accepted principle of Elliot theory, it means that the predominant wave is extremely strong. In this case it should propel ASML to at least treble in value over the next 20 years, with a projected high of $2380.

I know that this hugely exceeds my aforementioned Fair Value calculation. I still would not reject the likelihood it reaches such high numbers. Time and again the market has chosen to overpay and underpay severely above and below Fair Value.

The technicals on this chart are compellingly bullish

As I grow older, I’m supposed to grow more patient. But that’s not the case. So prospects that are 20 years off do not pull on my heart strings. More dear to me is the shorter term prospects of a nice bounce up to $572 by April to June of 2023.

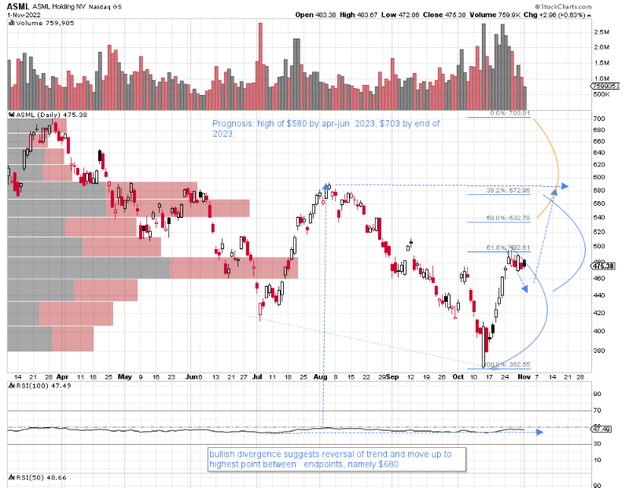

Look at the second graph, which is a shorter time frame perspective using daily candles.

ASML short term prognosis Nov 2022 (stockcharts.com)

ASML short term prognosis Nov 2022 (stockcharts.com)

If you look at the dotted blue trend lines traced on the RSI and the price, you’ll notice a nice bullish divergence happening. This suggests a reversal of trend, with the price moving at minimum to the highest point it reached in that time interval, namely $580. If the recent high is breached, that will form an initial wave up (blue ellipse), whose Fibonacci mirroring would suggest a minimum high of $572 as the next wave high. It’s always nice when two different technical measures point the same approximate price level.

It’s much more difficult to predict time on technicals than price trends, but my crystal ball (cycle line analysis) suggests that point will be reached around April or May of 2023.

Of course the last pivot point at $492 has not yet retraced enough to constitute a bona-fide wave, in my book. So you should wait for a retracement of at least 27% or a longer horizontal consolidation around $580 before looking for new highs.

I’m expecting a drop to $440 at minimum (70% chance) and possibly as much as $400 (10% chance). More cautious investors will want to wait until the recent pivot point at $683 is breached to the upside on decent volume.

If we get the drop to $440 (7% lower than today’s levels), and the rise to $572, that trade represents a nice 60% return on the stock in about 6 months. Not too shabby.

Readers who’ve followed me over the years know I have a preference for options. Using a calendar spread, I can make between 2x and 6x my money for every dollar I put at risk. I can take a position for as little as $250. That’s the position I’ll be putting on this week.

At that point, I should be able to do something similar to the upside. If I put on a June 2023 play right now, I can fashion a trade that pays me 3 to 7 times for each $430 I put at risk, to net me between $1250 and $2800. But if the price moves lower, down to $440, and stalls out there, that trade might pay in the 4x to 8x range. So I’ll wait for that.

Finally, for the more patient investor who loves this stock but wishes to buy it at discount, I’d recommend doing a cash secured put.

Consider selling an October 20 2023 put at $350 to lock in a premium of around $29 or 8% annualized. There’s a good chance you’ll never be filled and never obligated to buy the stock at the 31% discount to today’s Fair Value. But the 8% you get to keep can be an acceptable consolation.

If you wish to be more sure of acquiring the shares but still at a discount, consider selling the $440 strike for a 13% discount off of Fair Value for around $59. If the price never drops that low, you’ll be compensated by an 11% return for the premium you get to keep.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ASML over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am actively trading this stock using options in trades that I describe in the article.