Banks poised to capitalize on projected 50% rise in trade finance revenues

Insight Weekly: Bank boards lag on gender parity; future of office in doubt; US LNG exports leap

Insight Weekly: Job growth faces hurdles; shale firms sit on cash pile; Africa’s lithium future

Street Talk | Episode 99 – Higher rates punish bond portfolios, weigh on bank M&A

Insight Weekly: Loan growth picks up; US-China PE deals fall; France faces winter energy crunch

A commerce-led recovery from the coronavirus pandemic has sparked a rebound in trade finance this year, and the growth trajectory is only set to continue with forecasts of a more than 50% rise in the industry revenue pool by 2030. Banks will have to speed up digitalization efforts and innovate their products and operating models if they are to capture the opportunity as competition from nontraditional providers intensifies.

Revenues from trade finance, which covers financial instruments that support companies’ exports and imports such as letters of credit, performance guarantees and supply chain finance, are set to grow at an average compound annual rate of 3% this decade, bringing the global revenue pool for the industry to $68 billion in 2030, according to a base scenario projection by Boston Consulting Group, or BCG. This will leave an extra $23 billion of revenues up for grabs by trade finance players compared to 2020 levels of $45 billion.

Trade finance is dominated by banks, with HSBC Holdings PLC, Citigroup Inc., Standard Chartered PLC, BNP Paribas SA, JPMorgan Chase & Co. and Deutsche Bank AG being among the largest providers, though the market has attracted a growing number of technology-led platforms and capital market investors in recent years.

While lockdowns and travel restrictions in 2020 took a heavy toll on trade and those that finance it, industry revenues are on track to reach pre-pandemic levels in 2021, according to Coalition Greenwich, an S&P Global-owned analytics company. In the first six months of the year, the world’s 10 largest transaction banks recorded a 6% year-over-year increase in revenues from trade finance, it found.

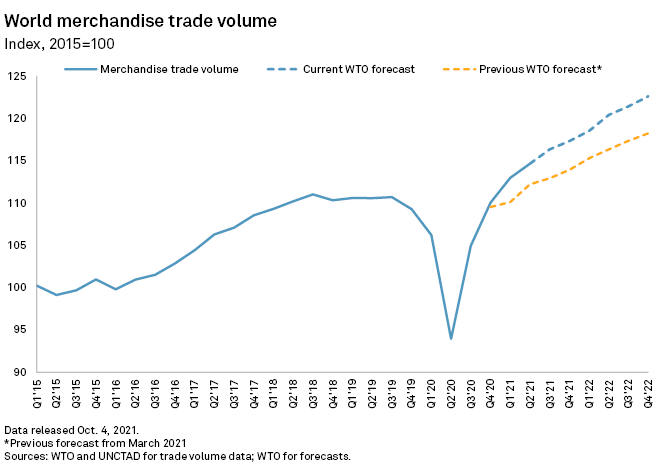

The World Trade Organization has labeled trade “a critical tool in combatting the pandemic” and is now predicting global merchandise trade volume growth of 10.8% in 2021, up from an original estimate of 8.0% in March.

“This is a very trade-led recovery. It’s not capex-led,” said Surath Sengupta, HSBC’s global head of financial institutions, portfolio and distribution, global trade and receivables finance, at the International Trade and Forfaiting Association’s annual conference Oct. 6. HSBC’s trade business in Asia has rebounded particularly strongly, with China the leading market for export growth, Sengupta said.

New sectors are also becoming more prominent in the bank’s trade finance books in light of the pandemic, especially technology-related services, Sengupta said. “You have sectors that were not traditional trade finance sectors, like cloud contracts, but they are now becoming increasingly mainstream for us. Given these trends, we are very, very optimistic about the trade finance business,” he said in an interview following the conference.

Trade finance banks and service providers will play “a very big role” in supporting the recovery, said James Binns, global head of trade and working capital at Barclays PLC, in an interview. Binns is hopeful that this will help to broaden the understanding of the product among companies and sustain its continued growth.

The pandemic has put the resilience of supply chains at the top of businesses’ agenda, meaning that companies now have a greater focus on making sure suppliers have access to the right level of funding through, for example, supply chain finance, said Binns.

A supply chain finance program is typically set up by a corporate buyer with a bank or alternative finance provider to offer suppliers early payment on their invoices. This part of banks’ trade finance business is already going through a significant growth spurt: Bank of America Corp., for one, has seen an increase of roughly 200% in the number of invoices being financed through such programs in the first year of the pandemic, said Baris Kalay, the lender’s head of trade and supply chain finance for Europe, the Middle East and Africa. Not only did the bank increase the number of programs it finances, it also expanded existing ones to cover more suppliers, Kalay said in an interview.

The global revenue pool for buyer-led supply chain finance, also known as reverse factoring, is expected to rise at a 3.2% CAGR through to 2030, while other open account products — which include invoice finance, receivables finance and inventory finance not covered by the former category — will increase at a 3.9% CAGR in the period, according to BCG.

Innovation required

Revenues will be driven both by trade volume growth and an increased penetration of trade finance products over time. “Increasing the access to trade and supply chain finance, particularly digital propositions to the mid-market and lower end-markets, that’s a big area that we expect to grow,” said Ravi Hanspal, principal at BCG, in an interview.

Digitalizing trade finance in order to more effectively serve new markets will be an important driver. Trade finance remains a very paper-heavy and manual business, making it particularly costly for banks to serve smaller enterprises. Yet bankers are optimistic that change will happen, especially as the pandemic has “turbocharged” digitalization efforts across the industry and helped build momentum around standardization initiatives, according to Binns.

Bank of America, for example, adopted “relatively simple but very effective solutions” during the crisis, such as accepting e-signatures on issuance documents and contract amendments, said Kalay. At HSBC, the percentage of trade finance deals it originates electronically has risen to more than 80% from about 40% before the pandemic, according to the bank.

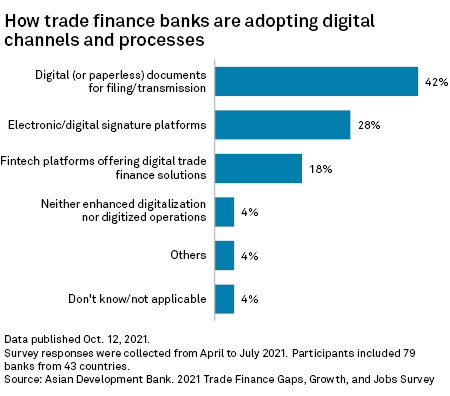

In the Asian Development Bank’s 2021 trade finance survey released Oct. 12, most of the 79 bank respondents said the pandemic had accelerated and will continue to propel the use of digital processes in their operations, including the use of digital documents for filing and transmission as well as embracing financial technology platforms for offering digital trade finance solutions.

However, bringing old trade finance products into a digital format will not be sufficient if banks want to take full advantage of the growing revenue pool, according to BCG. Lenders will need to explore “nontraditional products and nontraditional ways of accessing that,” said Sukand Ramachandran, senior partner at BCG, in an interview.

The “platformification of trade” caused by the growth of business-to-business e-commerce platforms such as Amazon.com Inc., Alibaba Group Holding Ltd. and Walmart Inc.-owned Flipkart Pvt. Ltd. is one development that warrants attention from banks, he said. Such digital marketplaces provide an opportunity for trade finance providers to serve customers on a platform at the point of transaction, similar to what buy-now, pay-later provider Klarna and peers are doing in the consumer space.

On the merchant side, Amazon, Alibaba and PayPal Holdings Inc. have already established lending arms to offer working capital to their own vendors, using sales data to assess performance and manage risk.

“It’s no longer the traditional ‘come to me as the bank and ask me for financing.’ Instead you go to where the customers is, look at their activity and say, ‘Hey, are you interested?'” Ramachandran said.

By 2025, 10%-15% of trade finance and 20%-25% of small and medium-sized enterprise trade finance will be conducted through digital platforms, BCG has estimated. Banks will need to innovate their product design and execution in order to capture this growth, Hanspal said.

“A lot of traditional trade products aren’t designed to be sold at scale and at point of transaction,” he said, giving as an example the letter of credit, which is paper-intensive and can take weeks to execute. “If a transaction can be done in real-time on a platform, then you need to be able to sell a [trade finance] product that can be executed in real-time as well.”