My Account

Follow us on:

Powered By ![]()

Discover 5000+ schemes. Track your portfolio 24X7

Invest Now

MC30 is a curated basket of 30 investment-worthy

mutual Fund (MF) schemes.

Invest Now

Powered By ![]()

The new age digital currency to diversify a portfolio.

Invest Now

Visit this section to access live price and charts.

Invest Now

Learn and stay informed about cryptocurrency in India.

Learn More

Powered By

Learn, discover & invest in smallcases across different types to build your long term portfolio.

Invest Now

Explore from India`s leading investment managers and advisors curating their strategies as smallcases.

Invest Now

Powered By ![]()

Diversify your portfolio by investing in Global brands.

Invest Now

Pre-configured baskets of stocks & ETFs that you can invest

in with a single click. Developed by hedge funds, global

asset management companies, experienced wealth

management firms and portfolio managers.

Invest Now![]()

AMBAREESH BALIGA

Fundamental, Stock Ideas, Multibaggers & Insights

Subscribe

CK NARAYAN

Stock & Index F&O Trading Calls & Market Analysis

Subscribe

SUDARSHAN SUKHANI

Technical Call, Trading Calls & Insights

Subscribe

T GNANASEKAR

Commodity Trading Calls & Market Analysis

Subscribe

MECKLAI FINANCIALS

Currency Derivatives Trading Calls & Insights

Subscribe

SHUBHAM AGARWAL

Options Trading Advice and Market Analysis

Subscribe

MARKET SMITH INDIA

Model portfolios, Investment Ideas, Guru Screens and Much More

Subscribe

TraderSmith

Proprietary system driven Rule Based Trading calls

Subscribe![]()

![]()

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Explore

STOCK REPORTS BY THOMSON REUTERS

Details stock report and investment recommendation

Subscribe

POWER YOUR TRADE

Technical and Commodity Calls

Subscribe

INVESTMENT WATCH

Set price, volume and news alerts

Subscribe

India’s ban on SEA Group’s gaming title Garena Free Fire has sparked concern on the fate of its e-commerce business Shopee in the country.

Several sellers are wondering if they should take inventory off Shopee amid mounting uncertainty. They fear an overnight ban on Shopee, similar to the one clamped on Chinese etailers Club Factory and Shein in 2020.

Last week, the Indian government banned 54 Chinese apps including the gaming platform of Singapore-based SEA Group, which also runs e-commerce firm Shopee in India.

SEA is not based in China, but has come under fire for a combination of reasons–its founder Forrest Li is of Chinese origin, the group counts China’s Tencent as a key investor and Shopee allegedly used Tencent Cloud to store data.

The Indian government has not expressed any specific concerns around the company’s operations in India, but offline traders’ associations are demanding an immediate ban.

“Once a ban happens, our payment and inventory gets stuck. Everything will become zero,” a Delhi-based seller of mobile accessories told Moneycontrol on condition of anonymity.

He said he lost Rs 5.5 lakh when Club Factory was banned.

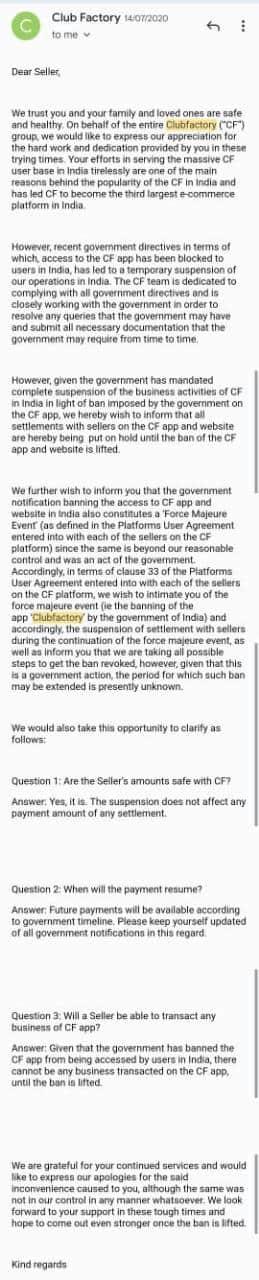

“Suddenly companies stop replying to calls and mails. Jab operations hi band ho gaya (when the business is shut), who are they answerable to,” he asked, adding that he was contemplating pulling his inventory off the site. Copy of the e-mail Club Factory sent its sellers in 2020

Copy of the e-mail Club Factory sent its sellers in 2020

Club Factory precedent

The seller, who has been on Shopee for one-and-a-half months, said he had sold goods worth Rs 15 lakh so far and is currently selling 1,500-2,000 products on Shopee daily.

Another seller said he had Rs 24 lakh still stuck with Club Factory and has no clue if he will ever get the money back.

“The employees who spoke to us have now shifted to other companies. We can’t question them. We never had the contact number of their Chinese counterparts,” said Surat- based Pratik Bajaj who sells budget western and winter wear.

Once bitten twice shy, he has pulled out most of his inventory off Shopee following rumours around a potential ban on the company’s operations in India.

“I have just left Rs 20 lakh worth of inventory on the site. These are mostly old inventory which we have to liquidate. The rest we have pulled out,” he said, claiming that until last week he had over Rs 70 lakh worth of products on Shopee.

Soon after the ban in 2020, Club Factory sent an email to its sellers in India that all settlements with sellers were being “put on hold until the ban of the CF app and website is lifted.”

“We can’t file a case against the company as they didn’t say they will not pay. But we have no idea when or even if our payment will ever come or not,” Bajaj said.

The Confederation of All India Traders Association (CAIT), an offline traders’ lobby, is demanding a ban on Shopee. Sellers who retail products on the site claim that Shopee had given them phenomenal business.

The company, which doesn’t charge shipping costs from merchants, has been growing at a rapid pace since it launched operations in India less than six months ago.

In December, Singapore’s transport minister said that Shopee had roped in 20,000 sellers in India. According to people with knowledge of the matter, the company receives 350,000-400,000 orders daily.

Most of these are low-ticket-size items with a focus on Tier 2, 3 and 4 cities, vying with the likes of Amazon, Flipkart and Meesho.

“CAIT keeps saying they are concerned about domestic traders. But what are we? Online me jo sell kar raha hai wo bhi desh ka ek chota vyapari hai (someone selling online is also a small domestic trader),” said another seller. “These guys have given a seller like me really good business and there are hundreds like me. If my opinion matters, I would say they should not be banned.”

Moneycontrol has also seen social media conversations between group of sellers sharing their concerns and mapping out a plan of action in case the government clamps an overnight ban on the app.

TikTok, Free Fire

India started banning China-related apps in 2020 following military tensions between the two countries on the Ladakh border. Apps that have been banned include the short-video platform TikTok.

Last week, Garena’s battle royale mobile game Free Fire made it to the list under Section 69 A of the Information Technology Act. Garena is the gaming arm of SEA Ltd that also owns Shopee. Chinese tech giant Tencent is one of its key investors with an 18.7% stake.

Free Fire, which interestingly benefited from a ban on PUBG (Player Unknown’s Battlegrounds) Mobile in September 2020, was the highest-grossing app across Google Play and Apple’s App Store in 2021.

It clocked about $34.3 million in app spending last year, according to estimates by app intelligence firm Sensor Tower shared with Moneycontrol.

Copyright © e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.

Copyright © e-Eighteen.com Ltd All rights resderved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.