MENU

At the beginning of the pandemic, computer, consumer electronics and household appliance manufacturers drove demand for microchips extremely high. In the second half of 2022, however, consumer electronics are now experiencing massive declines in demand. This is leading to a drop in sales for many semiconductor manufacturers and an oversupply of newer high-performance chips. On the other hand, older-generation semiconductors with larger chip geometries, which are still widely used in automotive electronics and also in industrial environments, will remain in short supply for the foreseeable future. These are the key findings of the study “Semiconductor shortage: A different kind of trouble ahead” by management consultants Roland Berger.

“We continue to see a structural shortage of analogue semiconductors and microcontrollers that will last for several years. Lower demand for computers and consumer electronics does provide some relief for the semiconductor industry. However, it will make capacity and inventory planning even more difficult for both microchip manufacturers and companies,” says Thomas Kirschstein, Partner at Roland Berger. “We have the unusual situation of shortages, overcapacities and overstocks of semiconductors at the same time.”

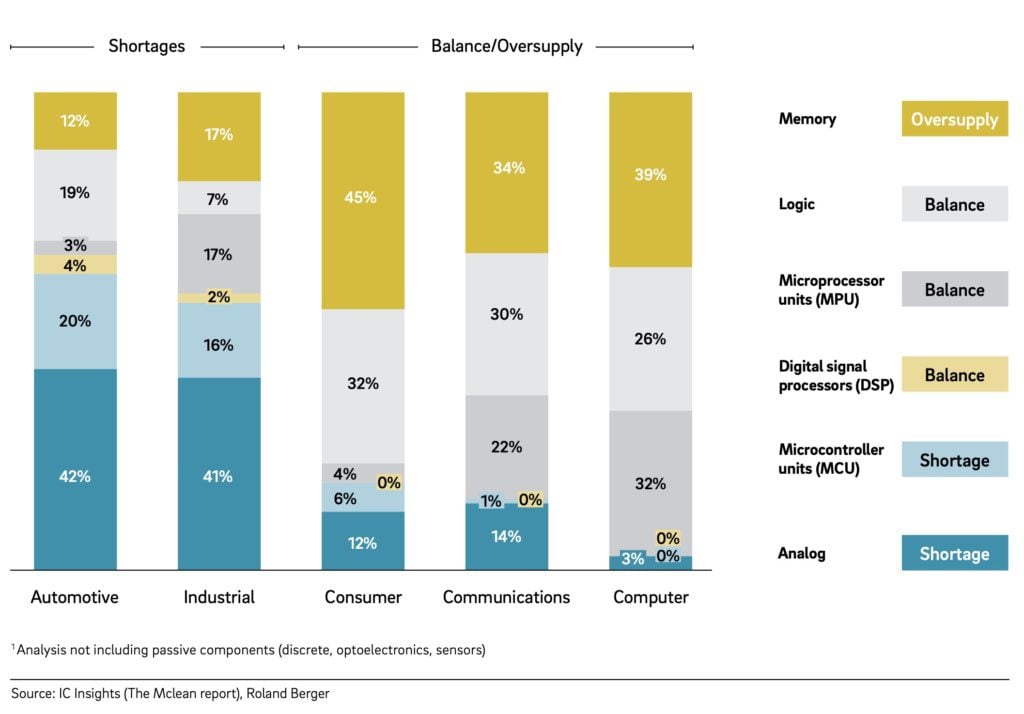

There is currently an oversupply in the market for almost half of the chips needed in consumer electronics, for almost 40 per cent in computers and 34 per cent in telecommunications, according to the Roland Berger study. On the other hand, there is a shortage of analogue semiconductor chips and microcontroller units (MCU), which, however, account for 57 per cent of the chips used in industrial applications and almost two-thirds in the automotive industry.

Manufacturing service providers for electronic components, such as smartphones or televisions, have increased their inventories from a historical average of 16 per cent in the past decade at the beginning of the Corona crisis to 23 per cent (2020-2021). This initially exacerbated the shortage of high-performance chips. Now that global demand for these chips is falling, there is an increased risk of a “bullwhip” effect – where even small changes in end-customer demand can lead to increasingly large fluctuations in order volumes along the multi-stage supply chain. To avoid negative financial impacts or even destocking, these companies need to revise their inventory management.

The recently passed laws to promote domestic semiconductor production in the US (US Chip Act) and in Europe (European Chip Act) do little to change the situation, says the study. This is because the lead times in the semiconductor business are very long, and in addition, the production of older chip generations is virtually not promoted. In the USA, for example, of the 39 billion dollars in subsidies for semiconductor production, only two billion or five per cent flow into chip production of the older generations.

Roland Berger’s experts therefore advise buyers of semiconductors to use the next few months to establish strategic semiconductor management and significantly increase transparency in the supply chain. Automotive suppliers and manufacturing service providers in particular should optimise their inventories as well as their cash and cost management.

“Automotive and industrial companies need to adapt to the market practices of the electronics and semiconductor industry to secure their supply. This includes, among other things, always using the latest generation semiconductors and pursuing a risk-adjusted purchasing policy. Companies must not wait until the shortage of semiconductors is over, but must take very active measures themselves,” Kirschstein summarises.

The study can be downloaded here

www.rolandberger.com

Related articles:

Chip bottleneck continues to thwart auto industry recovery

Automotive industry’s appetite for MCUs drives prices

Chip crisis will persist, experts agree

German, Japanese automotive suppliers lose ground to Chinese ones

All material on this site Copyright © 2022 European Business Press SA. All rights reserved.