Climate Week NYC 2022 recently convened climate leaders across government, business, civil society, and science under the theme of “Getting It Done.” The event, now in its 14th year, covered a wide swathe of topics, including energy, nature, transport, environmental justice, food, and finance. The conversations related to climate finance reiterated the urgency of climate change but with a ray of light due to improvements in climate data and recent policy. The world may not be reducing emissions fast enough, but sustainable finance leaders expressed that investors should remain positive. Realignment to achieve emissions targets can accelerate in the right direction quickly. Global X attended this year’s event hosted by UN PRI, MSCI, and S&P Global, and in this piece, we highlight some of the most noteworthy developments.

At an event co-hosted by UN PRI and MSCI, it was stated that “Climate is the new beta.” Traditional beta refers to how an individual asset moves compared with the broader market as a measure of systemic risk, which cannot be diversified away. Climate change is now a systemic issue and climate is a public good that investors and society must aim to protect. This mentality can shift one’s perspective towards portfolio allocation, and investment consultants committed to net zero are incorporating climate transition indices into client portfolios more as a result.

Portfolio considerations used by investors who value net zero include minimizing fossil fuel exposure, portfolio transparency, reducing carbon emissions, engaging to drive real world change, and investing in solutions. Climate transition indices can be integrated in client portfolios and Climate Value-at-Risk tools can be used to understand where emissions are in a portfolio, as opposed to brute divestment of hard-to-abate sectors.

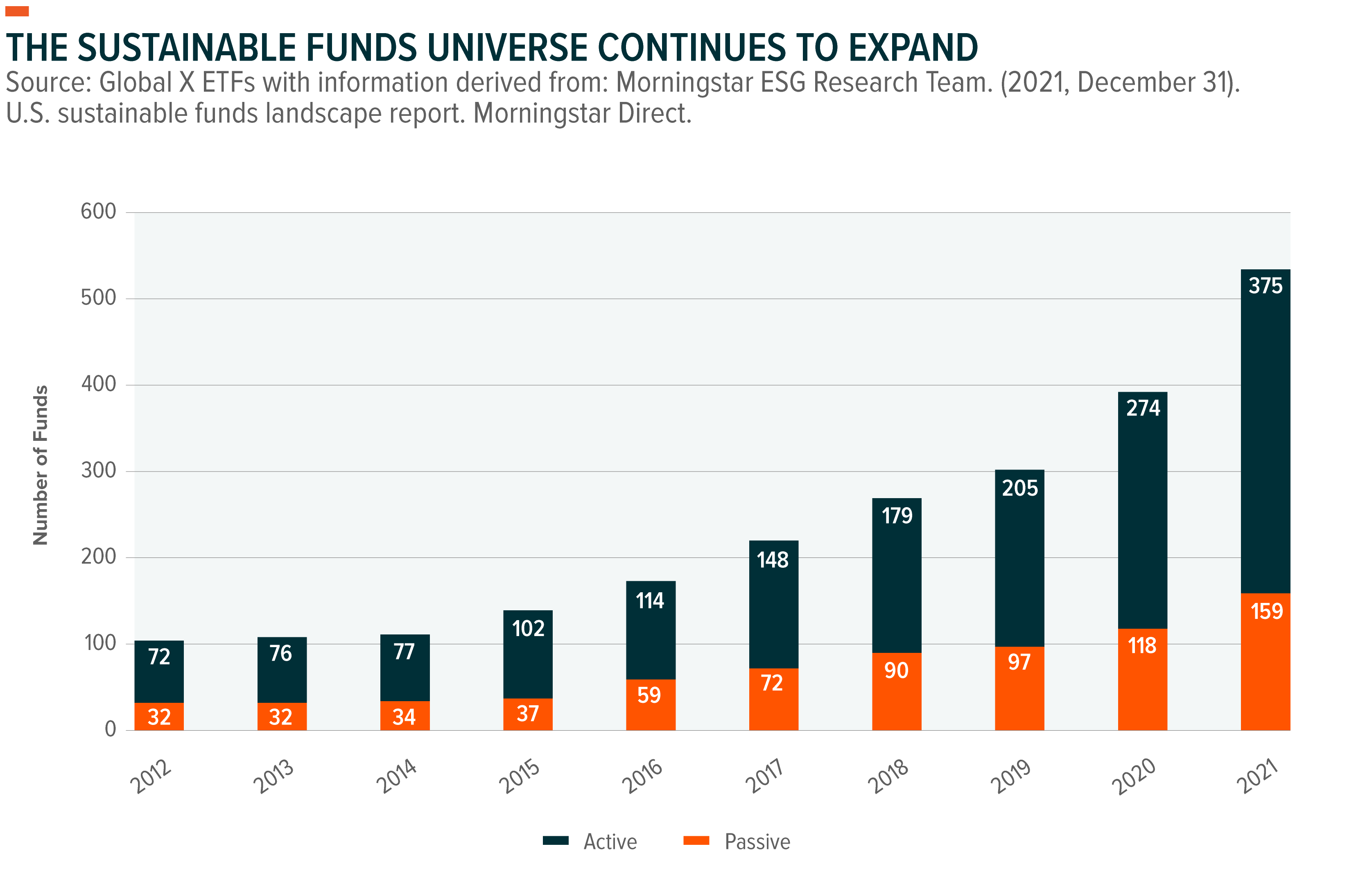

Climate benchmarks and indices will play an important role in the climate transition. The inclusion or exclusion of a company in an index allows index providers to signal what climate-related metrics company managements should prioritize. Also, asset managers are focusing on engaging with companies to provide greater transparency and sustainability reporting to better evaluate a company’s climate action and emissions reduction plan. Assets in both active and passive sustainable investing funds have more than doubled since 2017.

The Inflation Reduction Act and the Infrastructure Investment and Jobs Act give clean technologies the incentives they need to become cost-competitive. The event co-hosted by UN PRI and MSCI highlighted green hydrogen as an area of optimism after the Inflation Reduction Act provided a $3 per kilogram production tax credit for hydrogen produced with an electrolyzer powered by clean energy. The subsidy makes green hydrogen cost-competitive today with blue hydrogen and diesel, even bringing green hydrogen’s cost-competitiveness in line with U.S. natural gas.1

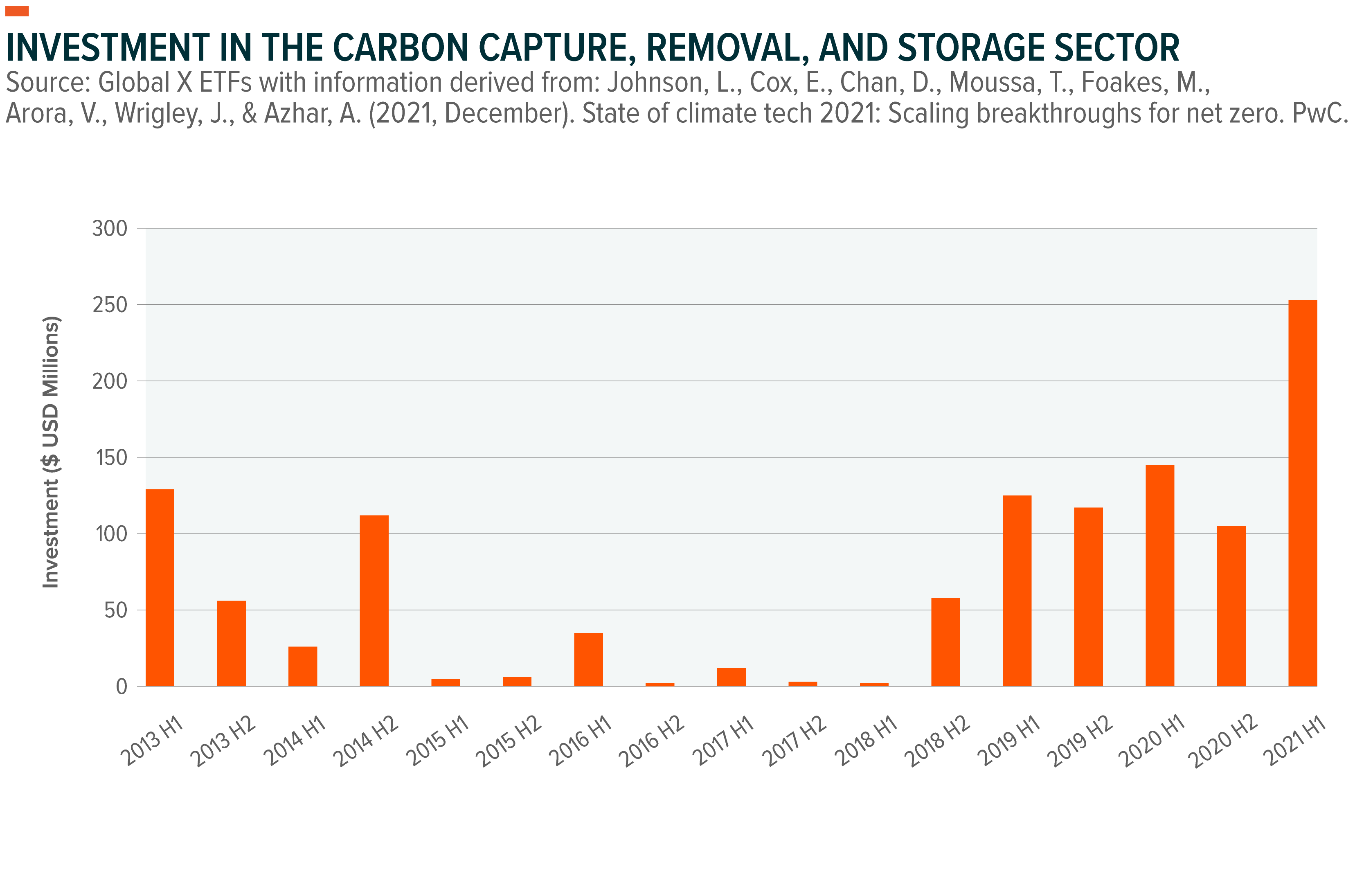

Institutional investors interested in clean technology stated that along with green hydrogen, their focus is carbon capture, utilization, and storage (CCUS) investments and electric vehicles. Institutional investors leading the way in climate innovation investing highlighted the importance of providing both capital and expertise to accelerate the cost-curve decline through economies of scale for CCUS investments. Investors also stressed the importance of exhibiting confidence as first movers investing in more nascent clean technologies. While the benefits of fighting climate change may not be palpable for several decades, their conviction in cleantech will be gradually accepted by a broader set of investors over time. Even 10 years ago, offshore wind was in its early stages, and climate-aware investors envision the same adoption curve will follow for green hydrogen and carbon capture.

One of the primary objectives of ESG shareholder engagement is for companies to set science-based targets to reduce emissions in alignment with the Paris Agreement. Over 3,000 companies have set emissions reduction targets in line with the Science Based Targets initiative (SBTi).2 However, greenhouse gas (GHG) emissions accounting becomes complicated when it comes to emissions financed through the Financial sector through loans and other financial services.

At the UN PRI MSCI event, the Partnership for Carbon Accounting and Financials (PCAF) highlighted their work to develop a standard for GHG accounting to assist financial firms calculate their own carbon emissions. The asset classes currently covered by PCAF include listed equity and corporate bonds, business loans and unlisted equity, project finance, mortgages, commercial real estate, and motor vehicle loans. PCAF launched a public consultation this year measuring financed emissions in the insurance industry as well.3

In addition to financed emissions, PCAF plans on working with service providers to help measure their facilitated emissions, namely how can investment banks take into account their activities to raise capital and what portion of the real economy can be attributed back to them as a service provider. This demonstrates how decarbonization is expanding into every crevice of the financial sector after the April 2021 launch of the Glasglow Financial Alliance for Net Zero (GFANZ) which coordinates decarbonization action across asset owners, asset managers, banks, insurance, and investment consultants.4

Climate Week NYC is significant in that it sets the tone leading up to COP 27 which will take place in November 2022 in Sharm El Sheikh, Egypt. The financial sector has seen a page turned in its attitude towards climate action in the past 2 years with many large financial institutions setting emissions reduction targets or making public commitments to fight climate change. While the world may not be on track with the trajectory of 1.5 degrees, it’s clear that the financial sector is heavily invested in initiatives that will improve its ability to evaluate investments against climate and drive stronger ESG engagement with company management.

Authored by:

Date:

Oct 5, 2022

Category:

Insights

Topics:

Thematic

Download PDF

Share this:

How China Is Transforming the Global Lithium Industry

Thematic ETF Report: August 2022

Is Thematic Growth a Crazy Response to High Inflation?

The Next Big Theme: September 2022

Back to All Entries

1. Penrod, E. (2022, September 27). Growing scale, Inflation Reduction Act subsidies could push green hydrogen prices negative: RE+ panel. https://www.utilitydive.com/news/ira-subsidies-green-hydrogen/632599/

2. Science Based Targets. (n.d.). Homepage. Accessed on September 30, 2022 from https://sciencebasedtargets.org/

3. Partnership for Carbon Accounting Financials. (2022). About. Accessed on September 30, 2022 from https://carbonaccountingfinancials.com/about#our-mission

4. Glasgow Financial Alliance for Net Zero. (2022). About us. Accessed on September 30, 2022 from https://www.gfanzero.com/about/

Our ETFs

Insights

About

Contact

News

Privacy Policy

Subscribe to Updates

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck

Information provided by Global X Management Company LLC.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Private Funds

Subscribe

By subscribing to email updates you can expect thoroughly researched perspectives and market commentary on the trends shaping global markets. Topics may span disruptive tech, income strategies, and emerging economies.

We adhere to a strict Privacy Policy governing the handling of your information. And you can, of course, opt-out any time.

Contact Us

Explore research, content or product pages within our site

Look up individual securities found in Global X ETFs

Select Your Location

You Are Now Leaving the US Website of Global X ETFs

Clicking “Confirm” below will take you to a different website, intended for jurisdictions outside the US. Such links are provided as a convenience. Global X Management Company LLC disclaims responsibility for information, services or products found on the websites linked hereto.

The subsequent website(s) may be governed by different privacy policies, terms and conditions, or regulatory restrictions. Links to these websites are not intended for any person in any jurisdiction where – by reason of that person’s nationality, residence or otherwise – the publication or availability of the website is prohibited. Persons in respect of whom such prohibitions apply should not access these websites.