Scan to Download iOS&Android APP

By Fitri Wulandari

Edited by Alexandra Pankratyeva

Updated

Thermal coal prices surged to a fresh record in early September as the energy crisis in Europe worsened after Russia’s energy giant Gazprom indefinitelystopped gas supplies to Europe via Nord Stream 1. The stoppage intensified concerns about energy availability for winter heating.

As of 29 September, the Asian benchmark Newcastle coal index (NEWC) listed on the Intercontinental Exchange (ICE) has eased from the peak at $457.8 on 5 September, but remained above $400/tonne.

Supply is expected to remain tight on projected stronger European coal demand as the region diversifies its energy sources away from Russian coal and gas. The prospect of rebounding demand from China, which is reeling from fresh Covid-19 outbreaks, was also expected to further spike the price of power-station fuel.

What will be the direction for thermal coal prices this year and for the long term? In this article, we discuss the factors driving the coal market as well as the most recent coal price forecasts from analysts.

Coal serves many functions, the most important of which is to generate electricity. The fossil fuel was formed millions of years ago from the remains of dead vegetation that were buried beneath layers of the earth and decayed into peat land.

There are four types of coal based on their heating value, according to the United States Geological Survey. The top rank is Anthracite, also known as hard coal. It contains a high percentage of fixed carbon and a low percentage of volatile matter.

Next is bituminous coal, which has a high heating value and can be used for steel making. Third is low-to-moderate heating value subbituminous coal. Fourth is the lowest grade, lignite, which has low-heating value and high moisture content. Subbituminous coal and lignite are both used for generating electricity.

Thermal coal or power-station coal accounts for 79% of the global coal trade. The remaining is metallurgical coal, according to the International Energy Association (IEA).

There are three key benchmark prices in coal trade:

Prices vary in each region but the Newcastle price has remained the bellwether, as China and India account for two-thirds of global consumption. Trends in the global coal trade are determined largely by these two countries.

In the physical market, traders also watch closely the annual negotiation for supply contract between Australian miners and Japanese electricity generation companies. The supply contracts typically for the Japanese financial year which runs from April to March.

Coal is just as important as oil and gas for traders because fuel is the largest source of electricity generation and the second-largest source of primary energy. The swing in coal prices affects the economy, just as changes in oil and natural gas prices.

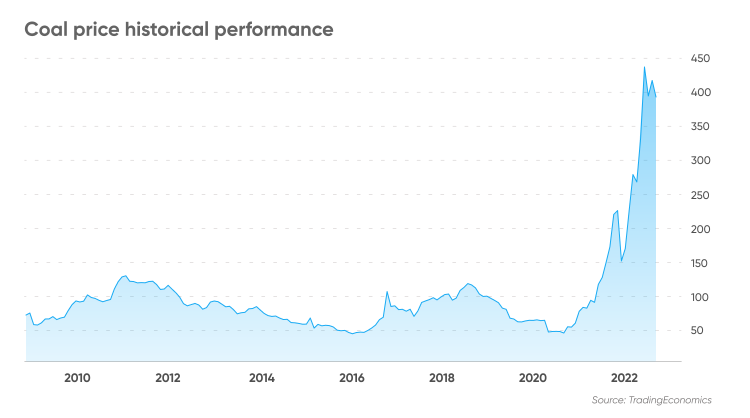

Power-station coal enjoyed a period of elevated prices up to mid-2018, with the Newcastle coal price touching $120.8 per tonne in August 2018. Prices then began to slide due to ample supply and continued well into 2019. Weaker electricity demand, lower liquefied natural gas (LNG) prices and import restrictions in China in the last quarter of 2019 added pressure to coal prices.

In Europe and the US, capacity at coal-fired power plants sank to a level unseen in decades on rising renewables and low LNG prices.

By the end of December 2019, the Newcastle coal price was hovering around $64 per tonne – about 47% below the highs in August 2018. It plummeted to $48 per tonne in September 2020, the lowest price in 2020, as Covid-19 restrictions crushed energy demand. According to IEA, global coal demand declined by 4% in 2020, the biggest drop since World War II.

The coal prices started to recover in the last quarter of 2020. A strong rebound in coal demand continued over 2021 as the global economy gradually recovered with more countries lifting restrictions.

A cold snap in northern Asia and rising demand from Europe which saw soaring natural gas prices due to problems with Russia’s gas supply accelerating coal prices in 2021.

Russia’s invasion of Ukraine on 24 February propelled the Newcastle spot coal price to $239 per tonne, from $161 in early January 2022. It soared to a record price of $435 on 7 March on heightened concern about Russian coal. Russia is the world’s third-largest coal producer.

The coal price chart showed it plunged to $260 level at the end of March and April as China faced a new wave of Covid-19 outbreaks, forcing some cities to go into lockdowns. But the price gradually rebounded, trading at above $400 a couple of times in May and July.

Flooding in Australia hampered production and transportation, and reports that China planned to end its unofficial ban on Australian coal imports also pushed up coal prices in the beginning of the second quarter.

Oil – Brent

Oil – Crude

Silver

Gold

In early September, the Newcastle coal price repeatedly hit record highs on expectations of surging Europe demand. On 4 September, Russia stopped gas deliveries via Nord Stream 1 following a three-day maintenance. Russia has gradually cut gas supplies to Europe to retaliate against Western sanctions over its invasion of Ukraine.

Strike threat from US railway workers in mid-September to seek better welfare also heightened concerns about tight supply as it might affect US coal exports.

At the time of writing (30 September), Newcastle coal spot price retreated to $435.75 after the President Joe Biden and railway workers reached a tentative labour agreement on 15 September.

However, the price was hovering near record highs on th persistent gas crisis in Europe after explostions caused gas leaks in the Nord Stream 1 and Nord Stream 2 undersea pipelines. The North Atlantic Treaty Organization (NATO) claimed the leaks the were the result of “deliberate, reckless and irresponsible acts of sabotage” by Russia, according to the BBC. Russia has dismissed the accusation.

Wood Mackenzie on 20 September projected Europe seaborne thermal coal demand to increase 14% or 12m metric tonnes to 98Mt in 2022 due to the current energy crisis.

However, Woods believed Europe’s jump in coal demand will be a short-lived bump and companies were unlikely to make major investment to expand infrastructure or long-term output as global demand was expected to decline.

The International Energy Agency (IEA) in its coal market update in July 2022 estimated the EU’s coal demand to increase by 7% year over year (YoY) to 476 million tonnes (Mt) in 2022 as EU countries are reducing gas consumption amid uncertainty over Russian gas supplies.

The IEA expects global demand to rise by 0.7% from 2021 to 8 billion tonnes in 2022, owing to slower economic growth in China, which weakened significantly in the second quarter due to renewed Covid-19 restrictions.

Coal consumption in China, which accounts for more than half of global coal consumption, was estimated to have dropped by 3% in the first half. With sluggish economic growth in the first six months of this year, the IEA forecast China’s coal demand to remain stable at 4.2bn tonnes.

“While an unexpected surge in demand has been a key driver of thermal coal prices, it is also worth noting that supply has significantly lagged too,” Bank of America (BofA) said in a note on 8 July.

“Most other coal producers from Indonesia to Russia to Australia are likely to see a net contraction in supply relative to last year, with huge variations in output in both 2021 and 2022 as our seaborne thermal coal supply and demand balances suggest,” it added.

BofA forecast that Indonesia, the world’s largest thermal coal exporter, is likely to produce 349 million tonnes of coal in 2022, up from 344 million tonnes in 2021. Australia’s coal output is estimated to drop to 196 million tonnes, from 199 last year. Russia’s coal output is also expected to fall to 130 million tonnes, from 153 million tonnes in 2022.

Fitch Solutions, in a long-term coal price forecast on 8 August, revised its coal price forecast for 2022 to average $320 per tonne, from the previous forecast of $230. The price is expected to drop to $280 in 2023 and $250 in 2024. Fitch Solutions’ coal price forecast for 2025 predicted the power-station fuel to trade at $200 in 2025, edging lower to $180 in 2026.

In its coal price predictions, Bank of America (BofA) Global Research saw the fuel averaging $375 for the fourth quarter of 2022, the bank said in a note on 29 August. It forecast the power-station fuel would average $312 in 2022 and $300 in 2023.

ANZ Research forecast Newcastle coal price to increase to $400/tonne in December this year from $375 in September. In a note on 23 September, ANZ expected that Newcastle coal could average $353 in 2022, falling to $334 in 2023 and $135 in 2024.

Economic provider Trading Economics forecast thermal coal to trade at $461 by the end of this quarter, rising to $550 in 12 months’ time.

Fitch Solutions, ANZ Research, BofA, and Trading Economics did not provide coal price forecasts for 2030.

When looking for thermal coal price predictions, it’s important to remember that analysts’ forecasts can be wrong. This is because their projections are based on a fundamental and technical study of the commodity’s historical price movements. Past performance is no guarantee of future results.

It is essential to do your own research and always remember your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never trade money that you cannot afford to lose.

Analysts mentioned in the article estimated coal price could increase by the end of the year, before dropping in 2023 and the coming years. However, whether coal is a suitable asset for you depends on your personal goals and the judgement drawn from your own research.

It’s important to always draw your own conclusions about a commodity’s prospects and the prospects of it meeting analysts’ goals. Remember that past performance does not ensure future returns. Furthermore, never trade money that you cannot afford to lose.

The coal price direction will be determined by the impact of the ongoing Russia-Ukraine conflict on Russia’s coal supply and the ability of coal producers to lift their production to meet demand. Long-term coal price movements will be determined by global economic growth, particularly China’s economy and the global transition to clean energy.

Like many commodities, coal prices are affected by supply and demand. The prices of the power station fuel are driven by electricity demand, and supply in major mining countries such as China, Australia, Indonesia and Russia. Economic activity has an impact on the consumption of coal as it can drive up or reduce electricity use.

Energy transition is also increasingly playing a role in affecting coal prices. More countries are reducing the portion of coal in their primary energy sources to generate electricity, and adding more renewables, such as wind and solar power.

Weather can affect demand for heating and cause supply disruptions. Geopolitical tensions can also affect trade flows.

Your decision to invest in coal should depend on your risk tolerance, investment objectives, portfolio composition and experience in the markets. You should conduct your own research. And never trade with money you cannot afford to lose.

Rate this article

Rate this article:

Share this article

Comment

Rate this article

Rate this article:

Share this article

There are currently no responses for this story.

Be the first to respond.

Most traded

Most traded

Most traded

Most traded

Most traded

Most traded

Join the 455.000+ traders worldwide that chose to trade with Capital.com

Also you can contact us: call +44 20 8089 7893 • [email protected]

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.40% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Risk Disclosure Statement

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

Risk warning: сonducting operations with non-deliverable over-the-counter instruments are a risky activity and can bring not only profit but also losses. The size of the potential loss is limited to the funds held by us for and on your behalf, in relation to your trading account. Past profits do not guarantee future profits. Use the training services of our company to understand the risks before you start operations.

Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. Capital Com SV Investments Limited, company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus.