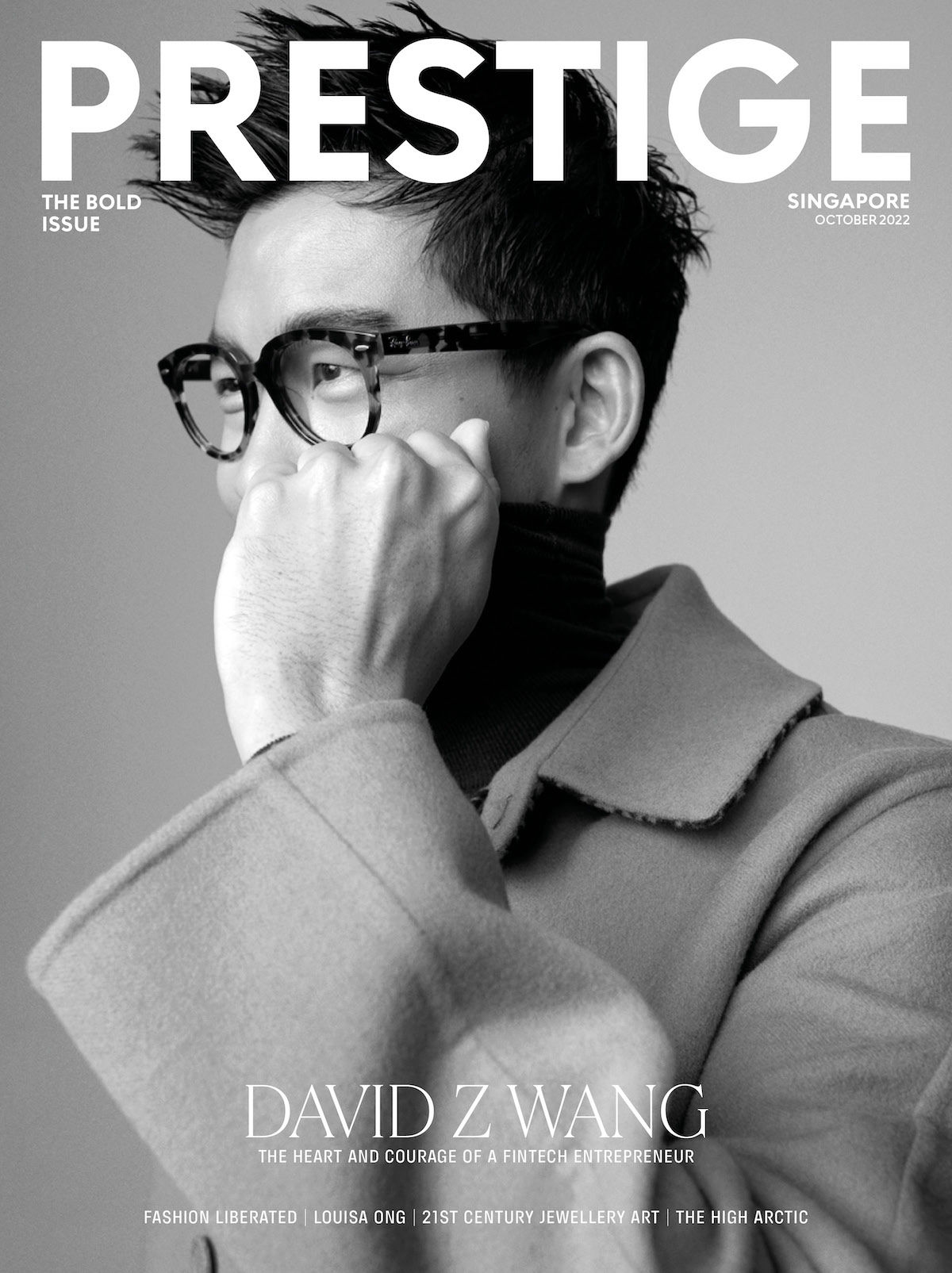

In just four short years, local fintech investment firm Helicap has grown from transacting $1 million to more than $200 million in deal volume. David Z Wang tells Crystal Lee how he got there and where he is headed.

I’m sitting alone in a glass room in the Helicap office when a man with big hair slides open the door and calls my name. It’s not David Z Wang — the CEO I’m supposed to meet, but his co-founder and COO Jeremy Tan. “Dave’s caught up with something but he’s on his way in. Come, let’s go to our office,” he ushers me.

David and Jeremy share what seems to be the biggest room in the company’s headquarters; their tables side-by-side with each other. Jeremy gestures for me to get comfortable in the lounge area they’ve carved out inside their office. I ask how they met. “We were in NUS Business School. I know him well – maybe a little too well,” he says with a chuckle.

Their camaraderie is palpable when they’re together. David, who’s affable and gregarious at first encounter, goes on to tell me how he likes to work with friends. “I know it’s weird, but I believe in open communication. Quentin (Vanoekel), Jeremy and I are good at different things and we complement each other.”

The three established Helicap in 2018 to fill a US$500 ($717) billion financing gap for the unbanked and underbanked in the region. In essence, the Singapore fintech firm facilitates loans from global investors (both individuals and institutional) to fast-growing micro, small and medium enterprises (MSMEs). Using a proprietary credit analytics technology powered by AI and machine learning, Helicap processes millions of raw credit and performance data to extract meaningful credit rating insights of companies that need capital. These businesses are then curated and positioned as private investment opportunities to a wide network of accredited investors that includes family offices, High Net Worth individuals, impact funds and institutional investors.

Since its founding, Helicap – which houses subsidiaries Helicap Investments, Helicap Securities and Helicap Fund 1 – has disbursed more than $200 million to non-bank financial institutions, in turn improving credit access for millions of underserved MSMEs and individuals. What’s more impressive is its track record of consistently hitting target returns for investors with zero defaults of balance sheet loans, despite Covid-19, high global inflation and the war in Ukraine. Helicap has also raised $15 million in funding, with Tikehau Capital, PhillipCapital and Credit Saison among its equity backers.

Helicap’s flying start is no beginner’s luck. Its founders boast decades of combined experience in banking and investment management at some of the world’s top financial services firms. David alone spent nine years at Morgan Stanley, specialising in global markets multi-asset investing. “Morgan Stanley worked us hard; the hours were long,” he recalls. “Someone once said that you get paid a lot of money to learn a lot about the world with a career in investment. It was fascinating and fun, for me. It was high finance. You get to meet a lot of very different people, from clients to colleagues.”

As well, Helicap isn’t David’s first rodeo. Before venturing into the alternative lending space, he opened 33 Capital, an investment firm with a focus on fintech and consumer-tech startups. (The first, an online platform for entertainment, didn’t work out, but was a necessary lesson in entrepreneurship.)

“It helps that I’ve got a lot of contacts from my banking days and was successful in investing before Helicap. But for people to follow you and believe in you? That’s something I’m thankful for. Running a business is a humbling experience.”

Part of Helicap’s appeal is its co-investment structure, which offers investors access to attractive assets at lower fees – and hence better returns. Having skin in the game was also part of David’s hustle in the early days. “My pitch was that I would put my own money into all of the things I pitch to you,” he says. “That’s what I did in the first year. I still do, but not for all as we have too many deals now.”

The idea for Helicap came about from travelling around the region. “Back at 33 Capital, we covered businesses in Southeast Asia and I realised we’re in an utopia in Singapore and it’s been exacerbated by the pandemic. There is a lot of inequality.”

He adds: “I think the irony is that when you reach a certain level of financial stability and comfort, you realise there are two ways from there. You either keep going and make more money; or you take a step back and ask yourself: ‘Do I have enough? What can I do differently now?’ I want to make a difference. We saw an opportunity to help investors get good ROIs but also make an impact through financial inclusion and providing sustainable finance.”

Right around the time David launched Helicap, he also set up a bursary, the 33 Capital Student Experience Award, at his alma mater to enable students with financial needs to go for exchange programmes overseas. Having spent an eye-opening semester at the USC Marshall School of Business in the US, where he developed a taste for case competitions and an interest in finance, he wanted to give less-privileged undergrads a chance to broaden their minds and expand their horizons. “When we finally won a case, it was the first time I ever won something. That was the turning point for me. That’s how I got into banking and Morgan Stanley,” David explains.

His nurturing spirit has been forged from a young age. Growing up with a father who often travelled for work, David stepped up for his two younger sisters. “I checked their report cards. I analysed their grades and set KPIs for them,” he reveals. “It was difficult not having him around, but I learnt independence, responsibility and discipline. For that I’m grateful because I now know what it’s like to figure things out while being in the deep end – and that helps with running a business.”

At 39, David seems to have it all worked out. While running two growing companies, he picked up a couple of accolades, such as the Top FinTech Leader award by the Singapore FinTech Association in 2019, and was named Singapore Founder Finalist for the MAS FinTech Awards the following year. Yet, success for David is a means to contribute to his family, employees and society at a greater level. “I wanted to succeed on behalf of my dad,” he says, softly, adding that his new office in Bukit Bintang, Kuala Lumpur, is dedicated to the senior Wang, in memory of a music store he opened there in the 1990s.

Despite these accomplishments, there’s no rest in sight for the go-getter. “Our investments have already delivered double-digit returns annually in the first three years, and we can now also think about impact – investing for a purpose. Combining them won’t produce high-return results. Despite this, it will be meaningful and may attract many buyers. The next three years will be dedicated to addressing this challenge. It is our goal to create an enterprise that contributes to society in a sustainable manner.”

Fashion Direction: Johnny Khoo | Art Direction: Audrey Chan | Photography: Joel Low | Fashion Styling: Jacquie Ang | Grooming: Rick Yang/Artistry, using Keune Haircosmetics & Dior | Photography Assistance: Eddie Teo | Fashion Assistance: Frea Darmawan

This story first appeared in the Oct 2022 issue of Prestige Singapore.

Managing Editor

Prestige Singapore’s Managing Editor wonders if she’s better with words or numbers. Some days she thinks she’s terrible at both. But most of the time, she’s pretty good at eating, drinking, admiring beautiful things, and exploring new worlds.

Yes, I agree to the Privacy Policy

Thank you for your subscription.

Subscribe to our newsletter to get the latest updates.

Thank you for your subscription.