Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Crude Oil Prices Set To Finish Week With Major Gain

Find us on:

Putin’s war in Ukraine has…

Oil prices climbed on news…

Germany needs to significantly cut…

Alex Kimani

Alex Kimani is a veteran finance writer, investor, engineer and researcher for Safehaven.com.

More Info

As Europe continues to grapple with a daunting energy crisis, European energy markets still face a liquidity disaster, with financial institution exposure to fossil fuels and record levels of margin calls sounding the alarm bells. According to Norway’s Equinor ASA (NYSE: EQNR), European energy trading is under severe strain by margin calls of at least $1.5 trillion, putting extra pressure on governments to provide more liquidity buffers.

Aside from fanning inflation, the energy crisis is sucking up capital to guarantee trades amid wild price swings. Energy prices have been fluctuating over such a broad range that many firms are now struggling to manage margin calls, making them demand additional collateral to guarantee trading positions while also forcing traders to secure multi billion-euro credit lines.

“Liquidity support is going to be needed. This is just capital that is dead and tied up in margin calls. If the companies need to put up that much money, that means liquidity in the market dries up and this is not good for this part of the gas markets,” Helge Haugane, Equinor’s senior vice president for gas and power, has told Bloomberg. Haugane has noted that derivatives trading is where support will be needed, and added that the $1.5 trillion estimate is actually a conservative one.

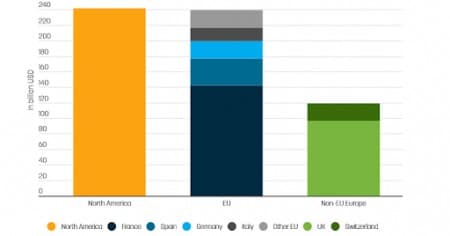

A report by the Brussels-based NGO Finance Watch reveals that the 60 largest banks in the world have fossil fuel exposures of ~$1.35 trillion with more than half of this total exposure on the books of Asian banks. However, the report notes that the 22 European banks featured in the analysis account for $239 billion of credits doled out to finance fossil fuel activities, with North American banks carrying a comparable amount.

Related: The U.S. Is Preparing Its Response To The “Short-Sighted” Strategy Of OPEC+

Finance Watch has also calculated how much additional capital these banks would need to properly account for the risk of these fossil fuel exposures becoming stranded assets. The report says that although EU and North American banks have about the same amount of fossil fuel exposures, EU banks would need significantly more capital to cover the risk since they are backed by significantly less equity.

But will European banks be able to step up to the plate? Finance Watch has argued that banks should back fossil fuel exposures with additional capital. The NGO advocates for a risk-weight of 150%, meaning that every loan given to companies for existing fossil fuel activities would have to be backed by 12% of capital.

Back in September, the European Banking Authority (EBA) issued a response to the European Commission regarding current high levels of margin calls and excess volatility in the European energy markets. The European Commission had asked the European Banking Authority (EBA) to consider, among other questions, ‘‘…any other possible measures to minimize the liquidity challenges currently faced by energy companies, including ways to improve the transparency, volatility and predictability of margin calls, in particular intraday.’’

To which the ECB’s response was:

‘‘The EBA has not identified any potential changes to the prudential framework, which can effectively help alleviate the current situation. This reflects the fact that most of the binding constraints that the EBA has identified stem from existing internal risk management limits and constraints decided upon by banks and/or central clearing counterparties (CCPs) as a result of their risk appetites and sustained flows of business with customers and counterparties. Banks are, however, facing significant liquidity draws–including in USD–in some cases with quite short notice when there are significant market movements. Efforts to provide more transparency around margin calls would, therefore, be welcome.’’

Looks like more European countries might have to go the German way with governments directly stepping in with subsidies and other relief measures, something that has not gone well with many of its neighbors.

Fossil Fuel Exposure of Top Banks in Europe and North America

United Response

About a week ago, the German government announced that it would ditch earlier plans for a gas levy on consumers and instead will instead introduce a gas price cap to curb soaring energy bills, with German Chancellor Olaf Scholz setting out a €200 billion ($194 billion) “defensive shield” to protect companies and consumers against the impact of soaring energy prices.

“The German government will do everything in its power to bring [energy] prices down. We are now putting up a large defensive umbrella … which we will endow with €200 billion,” Scholz said at a press conference in Berlin, which he attended virtually due to a Covid-19 quarantine.

So far, Germany has introduced the biggest scheme in Europe to backstop companies affected by the energy crisis, setting aside 7 billion euros in loans to be made available to companies facing liquidity issues. German energy giant Uniper SE has sought an extra 4 billion euros after fully using a 9 billion-euro existing facility, while Austria extended a 2 billion-euro credit to cover the trading positions of Vienna’s municipal power utility. Meanwhile, Finland and Sweden have announced a $33 billion emergency liquidity facility to utilities through loans and credit guarantees.

But not everybody is happy with Germany’s massive handouts to energy firms.

French finance minister Bruno Le Maire as well as Italian Prime Minister Mario Draghi have not pulled any punches, warning that such a move increases the risk of fragmentation of the eurozone.

On Wednesday, Commission president Ursula von der Leyen took up the criticism, “To avoid serious fragmentation, we need a united and common European response. We need to preserve a level playing field, without distortions of the single market and act together in a spirit of strengthened solidarity,” she wrote in her letter to European leaders ahead of the European Council in Prague, hinting that the generous subsidies would put the rest of Europe at a disadvantage.

Meanwhile, French and Italian commissioners Thierry Breton and Paolo Gentiloni have called for a pan-European response in an op-ed published in newspapers.

The German government has previously rejected a common fiscal response by the EU, which might be understandable considering how heavily Europe’s largest economy relied on Russian gas.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

Back to homepage

Alex Kimani is a veteran finance writer, investor, engineer and researcher for Safehaven.com.

Only One EU Member Is Still Receiving Russian Natural Gas

Biden’s Options To Counter OPEC+ Are Limited

The U.S. Is Preparing Its Response To The “Short-Sighted” Strategy Of OPEC+

Oil Prices Jump 5% As Bullish Catalysts Mount

The OPEC+ Cut Is A Disaster For President Biden

© OilPrice.com

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

Merchant of Record: A Media Solutions trading as Oilprice.com