ayo888/iStock via Getty Images

ayo888/iStock via Getty Images

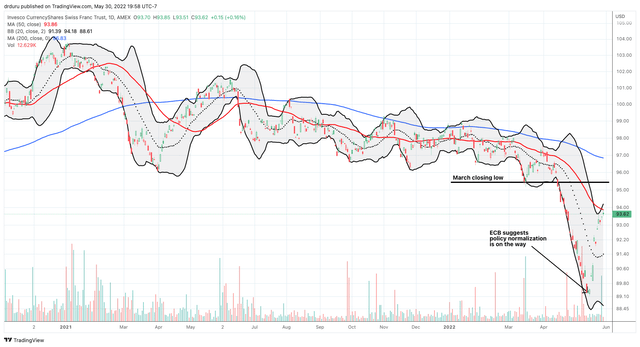

When Mario Centeno, a European Central Bank (ECB) Governing Council member, revealed the ECB finally decided to start down the path of policy normalization, the one-year decline in Invesco CurrencyShares Euro Trust (FXE) seemed to come to an abrupt end. Policy divergence no longer stood out as the dollar’s advantage. Interestingly, this news coincided with (if not outright caused) an end to the dollar’s advance against a host of currencies. The most curious bottom came against the Swiss franc, tradeable as the Invesco CurrencyShares Swiss Franc Trust (NYSEARCA:FXF).

Did the ECB help carve a bottom for the Invesco CurrencyShares Swiss Franc Trust (FXF)? (TradingView.com)

Did the ECB help carve a bottom for the Invesco CurrencyShares Swiss Franc Trust (FXF)? (TradingView.com)

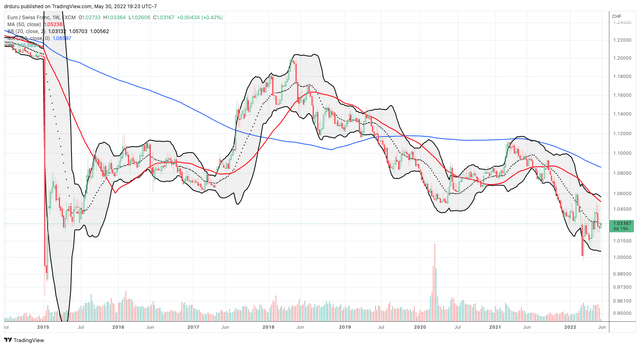

Since the financial crisis of 2008 – 2009, the Swiss National Bank (SNB) has scrambled to make its currency less attractive than the euro. The SNB even established a peg for EUR/CHF for several years. The Swiss franc proved so stubbornly strong that the cost of the peg finally forced the SNB to give up in a calamitous currency event in January 2015. As the ECB sent rates negative, the SNB raced ahead to plumb ever more startling depths of negative rate policy. The current rate of -0.75% sits below the ECB’s -0.5% rate for its deposit facility.

The prospect for higher ECB rates presumably sets the stage for the SNB to follow suit. Yet, as late as the March statement on monetary policy, the SNB sounded like normalization was just about the furthest thing from its mind. For example, the SNB repeated the refrain “the Swiss franc remains highly valued.” Even more importantly, the SNB’s forecast for a return to inflation below the 2% target assumed the -0.75% rate stays in place for the next two years:

“The SNB’s new conditional inflation forecast is therefore above that of December, particularly for 2022… The upward revision is less pronounced over the longer term. The new forecast stands at 2.1% for 2022, and 0.9% for 2023 and 2024… The conditional inflation forecast is based on the assumption that the SNB policy rate remains at −0.75% over the entire forecast horizon.”

In other words, the SNB should be in no rush to hike rates just because the ECB decides to reluctantly edge rates higher by 25 basis points each meeting starting in July.

A move to normalize policy by the ECB might give the SNB some breathing room to reverse the franc’s 4-year trend of strengthening. Clearly, the 25 basis points differential has proven insufficient so perhaps 50 or even 75 basis points could fuel the depreciation the SNB seeks. The weekly chart of EUR/CHF shows the SNB’s problem.

EUR/CHF recently hit parity and remains far below the SNB’s preferred (higher) levels. (TradingView.com)

EUR/CHF recently hit parity and remains far below the SNB’s preferred (higher) levels. (TradingView.com)

Assuming the SNB maintains its goal to weaken the franc, even the pair with the U.S. dollar should soon reverse course. FXF should soon run out of steam and resume its trend lower.

When it comes to currencies, traders must carefully consider the wildcards. The Swiss franc deliver a historic wildcard when the SNB dropped its 1.20 peg for EUR/CHF. For the current case, consider whether the SNB surprises by following ECB in policy normalization. The market could sniff out such a surprise in future SNB speeches. The June 16th policy meeting will be a key test of the potential for surprises. A U.S. Federal Reserve that backs down from its aggressive hawkishness is the big wildcard for the U.S. dollar.

Accordingly, technical levels of resistance present key decision point for a short FXF position. FXF currently sits just under its 50-day moving average (DMA), the red line in the chart above. An extremely conservative stop closes out a short above the 50DMA. A more aggressive stop sits above resistance at the March closing low. Note how the break below this point ushered in an acceleration of the FXF downtrend.

Be careful out there!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in FXF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.