Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Find the solutions you need by accessing our extensive portfolio of information, analytics and expertise. The IHS Markit team of subject matter experts, analysts and consultants offers the actionable intelligence you need to make informed decisions.

Critical analysis and guidance spanning the world’s most important business issues.

Stay abreast of changes, new developments and trends in their industry.

A global team of industry-recognized experts contributes incisive and thought-provoking analysis.

Broaden your knowledge by attending IHS Markit events that feature our subject-matter experts. Find webinars, industry briefings, conferences, training and user groups.

During COVID-19, IHS Markit is offering more online events for the safety of our guests.

IHS Markit will resume our in-person events once it is safe to do so.

Missed an event or webinar? Review the recordings of past online events.

IHS Markit is the leading source of information and insight in critical areas that shape today’s business landscape. Customers around the world rely on us to address strategic and operational challenges.

The experts and leaders who set the course for IHS Markit and its thousands of colleagues around the world.

Sustainability drives the entire IHS Markit enterprise. It’s how we do business by guiding our values and culture on the notion that we can make a difference.

Join a global business leader that is dedicated to helping businesses make the right decisions. Be a part of a family of professionals who thrive in an exciting work environment.

Unlike the seemingly bipolar divides of the Cold War period, major economies – not least India, China, Brazil, South Africa, and Indonesia – now have significantly greater economic and diplomatic agency. These major economies are likely to be keen to capitalize on cleavages between the US and China for their own diplomatic, economic and security benefit.

States will co-operate and develop issue-specific partnerships across spheres of mutual interest (interlinked supply chains, multidimensional challenges like the climate agenda and energy transition) and contest across spheres of national security elsewhere (sanctions regimes, dollar supremacy, at-risk commodities, critical minerals). We accordingly expect that the global political system, including trade and security alliances, will become more fluid and flexible.

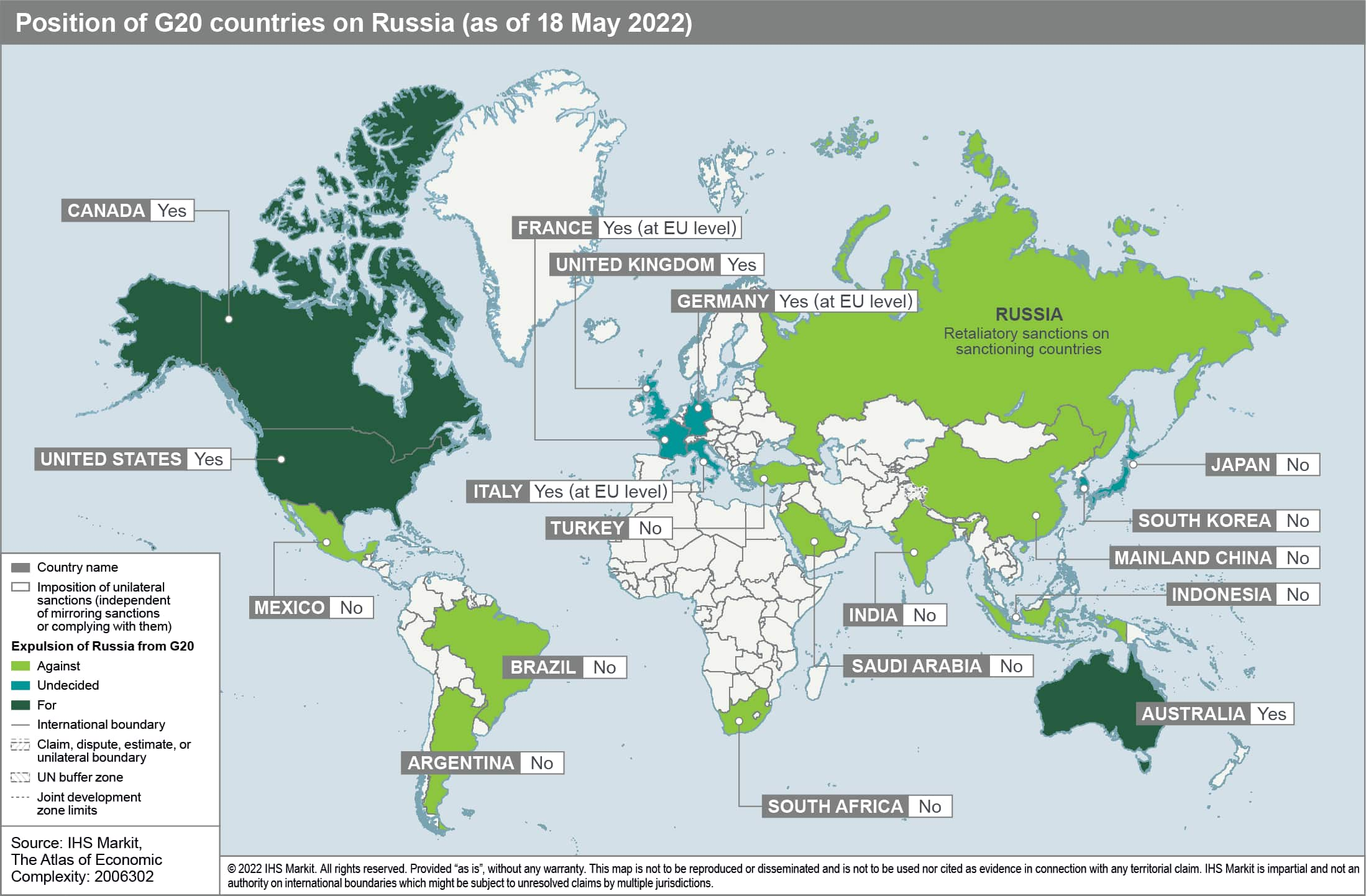

Russia’s expulsion from the G20 is unlikely, with most members either against removing Russia from the group or undecided on the matter. Only the US, Canada and Australia support Russia’s expulsion. G20 members are likely to maintain their positions, driven by national interest considerations.

Indonesia – the G20 president for 2022 – invited Russia to attend this year’s summit, to be held on 15-16 November, and extended a one-time invitation to Ukraine, which is not a G20 member. The Russian and Ukrainian presidents confirmed their planned attendance.

Their presence at the November summit suggests that the likelihood of Russia being expelled is remote. Abstentions by Australia, Canada and the US are more likely, especially if Russia chooses to escalate the conflict within Ukraine or in neighboring countries.

Several G20 countries are skeptical of both the impact of Russia’s actions on the global world order, and the principle of significant unilateral sanctions as a repeated mechanism of opposition.

Splits within the positions of G20 are an early indicator of increasing fault lines between countries, affecting future political, security and trade relations that would be driven less by ideology-based alignment.

The position of Indonesia is crucial because, procedurally, a country’s expulsion from the G20 must be communicated by the host country. The attendance of officials from all G20 countries plus Ukraine in the Foreign Ministers’ Meeting in July would likely indicate Indonesia’s ability to keep the group together.

The US, UK, Canada, EU, and allies among advanced Asian economies have – with some degree of consensus – positioned the economic campaign against Russia, including the imposition of sanctions and export controls principally across the banking and defense sectors, and against targeted individuals and entities. Together with a wave of corporate self-sanctioning, the government-led restrictions threaten global financial isolation for Russia.

Consensus appears to be increasing against total diplomatic and economic Russian isolation, driven by national interest considerations of countries across regions.

China and India will continue to maintain strategic independence regarding the conflict and are also highly unlikely to support Russia’s expulsion. China has provided political support for Russia across other multilateral fora. A change in China’s position is improbable without significant trade and investment concessions from the US and from the EU around the stalled China-EU investment agreement. India is also unlikely to explicitly condemn Russia given its foreign policy doctrine of ‘strategic autonomy.’

Latin America’s G20 member states – Brazil, Mexico, and Argentina – have been critical of Russia’s action and have accordingly voted against Russia at the UN. However, the three countries have refused to unilaterally impose sanctions against Russia, taking a stance that is not aligned with the US.

The G20 is not the only platform for economic engagement between advanced and emerging economies. Still, prospects of its rupture represent an early indicator of the fault lines likely to shape future security, trade, and diplomatic relations among multiple centers of global influence. These fault lines would further challenge the idea of an international community, with national interests overriding ideology-based alignment.

Posted 23 May 2022 by Anton Alifandi, Associate Director, Country Risk, S&P Global Market Intelligence and

Bibianna Norek, Research Analyst, Europe & CIS, Country Risk, S&P Global Market Intelligence and

Carla Selman, Principal Research Analyst, Country Risk, S&P Global Market Intelligence and

Carlos Cardenas, Director, Latin America Country Risk and Forecasting, S&P Global Market Intelligence and

Deepa Kumar, Deputy Head, Asia-Pacific Country Risk Team, S&P Global Market Intelligence and

Dijedon Imeri, Senior Analyst, Country Risk, S&P Global Market Intelligence and

Jack A. Kennedy, Associate Director and Head of Desk, Country Risk – Middle East and North Africa, S&P Global Market Intelligence and

Jan Gerhard, Senior Analyst Country Risk Europe, S&P Global Market Intelligence and

John Raines, Principal Global Risks Adviser and Head of North America, Economics & Country Risk, S&P Global Market Intelligence and

Jose Sevilla-Macip, Senior Research Analyst, Latin America Country Risk, S&P Global Market Intelligence and

Laurence Allan, Director and Head of Desk for Country Risk Europe & CIS, S&P Global Market Intelligence and

Lindsay Newman, Executive Director, Economics & Country Risk, S&P Global Market Intelligence and

Natznet Tesfay, Executive Director, Research Advisory Speciality Solutions, S&P Global Market Intelligence and

Nezo Sobekwa, Africa Country Risk Analyst, IHS Markit and

Theo Acheampong, Senior Analyst Country Risk – Sub-Saharan Africa, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Latin American countries will probably present water concerns as an umbrella problem at #COP27, linking it to globa… https://t.co/l0Kwu7k7Ol

Alternative data, which includes night-time lights or “luminosity” data, is a critical resource for understanding t… https://t.co/BPWE04AwWX

We estimate a 0.6% increase for total #CPI October, and 0.4% increase for core CPI. Read more in our US Weekly Ec… https://t.co/Ou5kPsp7vm

RT @IHSEViews: EViews 13 patch! https://t.co/bgZXwE3aaj