Our regular impact finance bulletin brings you the latest funds, deals and programmes in the world of investing for good. Read on for our selection of impact investment headlines from the past month.

Latin America: Latimpacto and partners launch initiative to support Amazon bioeconomy

Ukraine: $250m fund to back tech startups in Ukraine and Moldova launches

UK: Social investments in UK reach £8bn in 2021 but uncertainty looms, warns Big Society Capital

Global: Circular economy fund investments rocket in 2021 – new report

Global: Direct 1% of world’s wealth to Global South to create inclusive economy, G20 leaders urged

Global: GIIN partners with Paypal and Visa to boost corporate impact investing

Eastern Europe: NESsT and partners commit $3m to deploy ‘power of social entrepreneurship’ for refugees in Poland and Romania

More impact finance news in brief

Latimpacto, IMPAQTO and the Amazon Investor Coalition have launched a partnership to mobilise capital to support the Amazon rainforest’s bioeconomy.

The Pan-Amazon Impact Ecosystem Program intends to use philanthropy, investment and corporate procurement to support decarbonisation, ecosystem regeneration and conservation in the region.

The partners, which together represent thousands of investors in Latin America and around the world, will bring together key organisations in finance and impact, publish reports to highlight new blended finance mechanisms and finance opportunities, and support entrepreneurship and innovation.

The initiative will also produce a “toolkit” to help philanthropists allocate patient capital towards climate action and economic development that drives ecological regeneration.

“The most viable path to outcompete the deforestation economy is to increase the economic competitiveness of forests with community wellbeing at the centre,” said Jonah Wittkamper, CEO and co-founder of the Amazon Investor Coalition.

He added: “Developing a forest-positive Amazon bioeconomy is the highest-leverage climate stabilisation investment opportunity in the world at this time. Together we can ensure that the rainforest is worth more standing and alive, than cut and burned.”

Maria Carolina Suárez, CEO of Latimpacto, said: “This strategic partnership reflects our ongoing commitment to creating new innovative mechanisms that facilitate the strategic flow of capital for impact”

A new $250m fund has been launched to invest in tech startups in Ukraine and Moldova, the first of its kind since the Russian invasion of Ukraine, according to its managing firm.

Backed by The International Finance Corporation (IFC), the European Bank for Reconstruction and Development, and the Zero Gap Fund – an impact investing collaboration between the Rockefeller Foundation and the MacArthur Foundation – among others, the fund has raised $125m on first close.

The fund was launched by Horizon Capital, a Kyiv-based private equity firm that has been investing in growth companies in Eastern Europe since 2006.

Horizon Capital claims this is the first fund of its kind for Ukrainian and Moldovan startups since Russia’s invasion of Ukraine last February.

Moldova is estimated to have hosted more Ukrainian refugees per capita than any other country.

Lenna Koszarny, Horizon Capital’s Founding Partner and CEO, said: “Ukraine needs partners who believe in the country, who stand shoulder-to-shoulder with its people, who are leading the way, and who leave no stone unturned to ensure that investment capital is available right now, not when hostilities end.

“Ukrainians must have access to sufficient resources to lead the economic rebound, renewal and revitalization of their country.”

Dr Rajiv J Shah, President of the Rockefeller Foundation, said: “At a moment when Ukraine is fighting for its freedom, the Rockefeller Foundation is proud to support, through our Zero Gap Fund, the Ukrainian businesses that have proven critical to the nation’s resilience and will prove critical to its future.”

“Given the war’s continued ramifications on global markets, as well as the billions whose access to food has been upended by the crisis, keeping Ukraine running and getting it back up to speed are essential to our institution’s century-long commitment to lifting up humanity.”

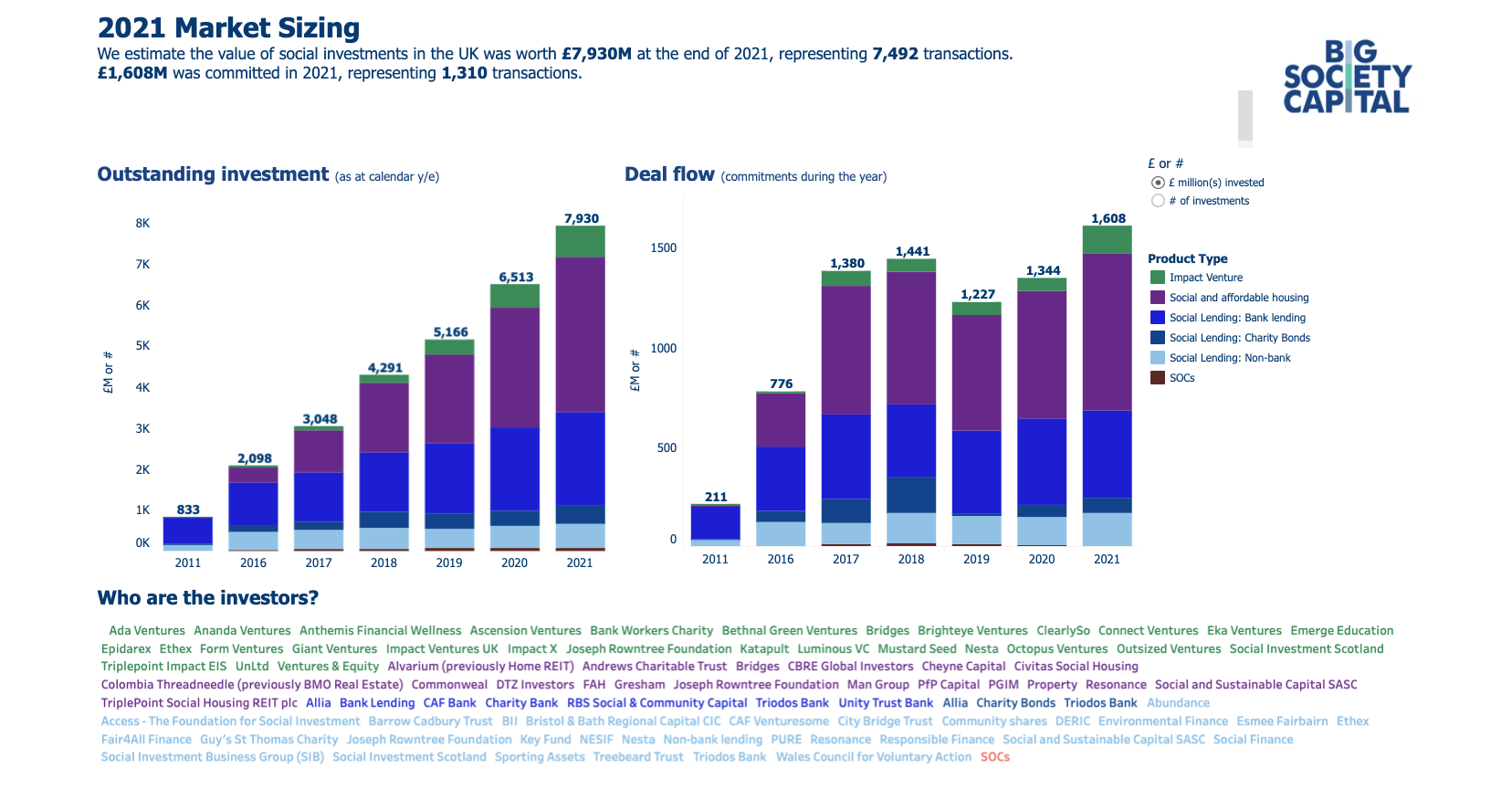

Social investments in the UK have grown by 22% to a total of nearly £8bn in 2021, “on track” to reach Big Society Capital’s target of scaling the market to between £10bn and £15bn by 2025. However, the UK’s “wholesale social investor” acknowledged that economic uncertainty made it hard to predict future growth.

The latest social investment market sizing report produced by Big Society Capital shows the market has grown nearly tenfold in ten years, from £830m in 2011 to £7.9bn in 2021. In 2021 alone, approximately 1,300 social investment deals were agreed, for a total of about £1.6bn.

Stephen Muers, CEO of Big Society Capital, told Pioneers Post he was “pretty pleased” by the figures that showed the social investment market was “on track” to reach the target set last year.

But the cost of living crisis, added to the economic volatility in the UK following the government’s fiscal announcement on Friday, made it difficult to know how the market would behave in the next few years.

Read more on Pioneers Post.

Capital committed to circular economy impact funds worldwide launched in 2021 reached a record €12.7bn, nearly four times 2020 figures, according to a new report from impact investing consultancy firm Phenix Capital.

Meanwhile, the number of new circular economy funds launched each year has grown five-fold between 2018 and 2021, going from 8 to 40. Between 2015 and 2018, the number of such funds launched each year averaged nine.

The recent interest in circular economy funds – impact funds investing in companies promoting reuse and recycling, a sustainable use of resources and waste reduction – is likely to be linked to rising investor appetite for impact investing generally, and for environmentally-focused funds in particular, Phenix Capital investment consulting analyst Maria Gil told Pioneers Post.

Read more on Pioneers Post.

At least 1% of global wealth – more than $500tn – should be directed towards Global South countries to help them recover from the Covid-19 pandemic and meet the 2030 UN Sustainable Development Goals, the world’s heads of state have been told.

Earlier this month, the Global South Impact Community, a network of leaders from public, private and philanthropic institutions, primarily from developing countries, published a statement ahead of the G20 annual summit in Bali, Indonesia, in November.

The statement called for the world’s leaders to create a new, more inclusive global economic model which removes the imbalance between developed and developing countries.

Read more on Pioneers Post.

The Global Impact Investing Network (GIIN) has partnered with PayPal, Visa Foundation and the TELUS Pollinator Fund for Good to get more companies involved in impact investing around the world.

The Global Impact Investing Network (GIIN) has partnered with PayPal, Visa Foundation and the TELUS Pollinator Fund for Good to get more companies involved in impact investing around the world.

The GIIN’s corporate impact investing initiative will help companies keen to meet environmental and social goals to use their financial assets to invest in impact. The “multi-year effort” will include working groups and research intended to inform and develop corporate impact investing. In particular, the initiative will produce “a landscape report on the use of impact investing vehicles and partnerships as a means to pursue corporate environmental and social objectives”.

Amit Bouri (pictured), CEO & co-founder at the GIIN, said the initiative was “dedicated to re-defining ‘business as usual’ when it comes to corporate investing and asset management.”

Read more on Pioneers Post.

Two corporate foundations are teaming up with impact investing specialist NESsT to help enterprises in Poland and Romania create more jobs for refugees.

Ikea Social Entrepreneurship and Cisco Foundation are joining NESsT, which has been active in central and eastern Europe for 25 years, to launch the NESsT Refugee Employment Initiative. This will provide finance and business support to 15 organisations, aiming to benefit more than 5,000 people.

The partners have made an initial commitment of US$3m. Eligible for the programme are social enterprises and small and medium-sized businesses that provide refugees with career training and job opportunities, and “wraparound” services such as mental health support, language classes and childcare.

Read more on Pioneers Post.

Top picture: the Amazon forest in Ecuador, credit: Jay via Wikimedia Commons

Thanks for reading our stories. As an entrepreneur or investor yourself, you’ll know that producing quality work doesn’t come free. We rely on our subscribers to sustain our journalism – so if you think it’s worth having an independent, specialist media platform that covers social enterprise stories, please consider subscribing. You’ll also be buying social: Pioneers Post is a social enterprise itself, reinvesting all our profits into helping you do good business, better.

PLUS: BlueMark raises $3.75m; electronics repair unicorn BackMarket reaches $5.7bn valuation, and more: our regular impact finance bulletin brings you the latest funds, deals and programmes in the world of investing for good.

PLUS: JPMorgan Chase commits £1.2m to Fair4All Finance to improve financial inclusion; IIX launches coalition to develop first gender-lens ‘asset class’; UK impact investments estimated at £58bn; and more.

PLUS: LeapFrog reaches 5% of low-income population; philanthropists back maternal and child healthcare fund in Asia; BlueOrchard launches financial inclusion fund; and more.