Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold" or the "Company") is pleased to announce that all resolutions were passed at its annual general meeting of shareholders (the "AGM") held in Vancouver on October 20, 2022.

All of the nominees for election as directors of the Company listed in the Company's information circular dated September 6, 2022, were re-elected for the ensuing year and the number of directors was fixed at seven (7). John Proust, Ian Burney, Michael Carrick, Mitsuhiko Yamada, Paul Harbidge, Tanneke Heersche and Murray Flanigan were all re-elected as directors of the Company.

The Company's new omnibus equity incentive plan (the "Compensation Plan") was approved and supersedes the Company's incentive stock option plan. Subsequent to the shareholder approval of the Compensation Plan, the board of directors passed a resolution capping all types of consideration referred to in the Compensation Plan for the next year to a rolling maximum of 10% of the total number of issued and outstanding common shares of the Company on the date of a grant, The Compensation Plan is subject to final approval by the TSX Venture Exchange.

KPMG, LLP were re-appointed as auditor for the Company for the ensuing year.

At a Board meeting immediately following the AGM, Board Committees, consisting of independent directors, were confirmed:

Audit Committee – Murray Flanigan (Chairman), Michael Carrick, Paul Harbidge

Compensation Committee – Michael Carrick (Chairman), Murray Flanigan, Tanneke Heersche

Nomination/Corporate Governance – Tanneke Heersche (Chairman), Ian Burney, Paul Harbidge

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com

For further information please contact:

John Proust

Chairman & CEO

Phone: 778-725-1491

Email: [email protected]

Website: www.japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Source

Click here to connect with Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF), to receive an Investor Presentation

Company Highlights

- First-mover status as an international gold explorer in Japan

- 30 gold exploration projects in the safe and stable jurisdiction of Japan

- Projects host over 40 past-producing mines with high-grade gold mineralization

- Country-wide alliance in Japan with the Barrick Gold Corporation

- Newmont Corporation as a significant shareholder

- Management team with extensive local knowledge

Overview

Japan Gold (TSXV:JG) is a gold exploration company with a vast portfolio of 30 gold projects across the island nation of Japan. Japan Gold's leadership team has long recognized the potential for gold exploration in Japan. When the Japan Mining Act was amended in 2012 for the first time, allowing foreign mineral companies the ability to hold exploration and mining permits, Japan Gold was the first foreign mineral exploration company to seize this opportunity.

Japan Gold is the only foreign mineral exploration company to focus solely on gold exploration in the country and has gathered a large portfolio of projects that collectively host over 40 past-producing gold mines and workings which were all shut down during World War II due to a government moratorium on gold mining.

During February 2020, Japan Gold announced a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan. The Japan Gold-Barrick alliance includes 28 out of 30 projects currently held by Japan Gold.

Japan Gold will continue to advance the Ikutahara Project in Hokkaido and the Ohra-Takamine Project in Kyushu independently guided by the Japan Gold/Newmont Technical Committee. Newmont Corporation has a joint venture right of first refusal on these two projects.

As a first-mover in the country, Japan Gold has also taken the opportunity to establish strong relationships with local universities and industry specialists, incorporating some of these—such as Mitsuhiko Yamada and Takashi Kuriyama—into its management team and board of directors. This first-mover position has also made the company a key resource for other organizations looking to partake in gold exploration in the region.

Japan Gold is led by an exceptional management team with extensive local knowledge and relationships. This team is supported by a knowledgeable board of directors and advisors. As Japan Gold is a spinoff of Southern Arc Minerals Inc (TSXV:SA)—a company that shares many of the same directors—26 percent of the company is held by its predecessor, giving the company a unique share structure.

Over the course of the next 12 months, Japan Gold plans to complete large scale, regional programs under the Japan Gold-Barrick alliance which is expected to include geochemical (BLEG) stream sediment analysis and geophysical analysis over the 28 projects included in the alliance. These programs are guided by the Japan Gold-Barrick Alliance Technical Committee.

In addition, the company plans to fully evaluate and drill permit three prospects on the two projects excluded from the Barrick alliance. Newmont has a joint venture right of first refusal on these two projects. Japan Gold plans to complete drill programs on at least two of these prospects over the next 12 months. These programs are guided by the Japan Gold/Newmont Technical Committee.

Mining in Japan

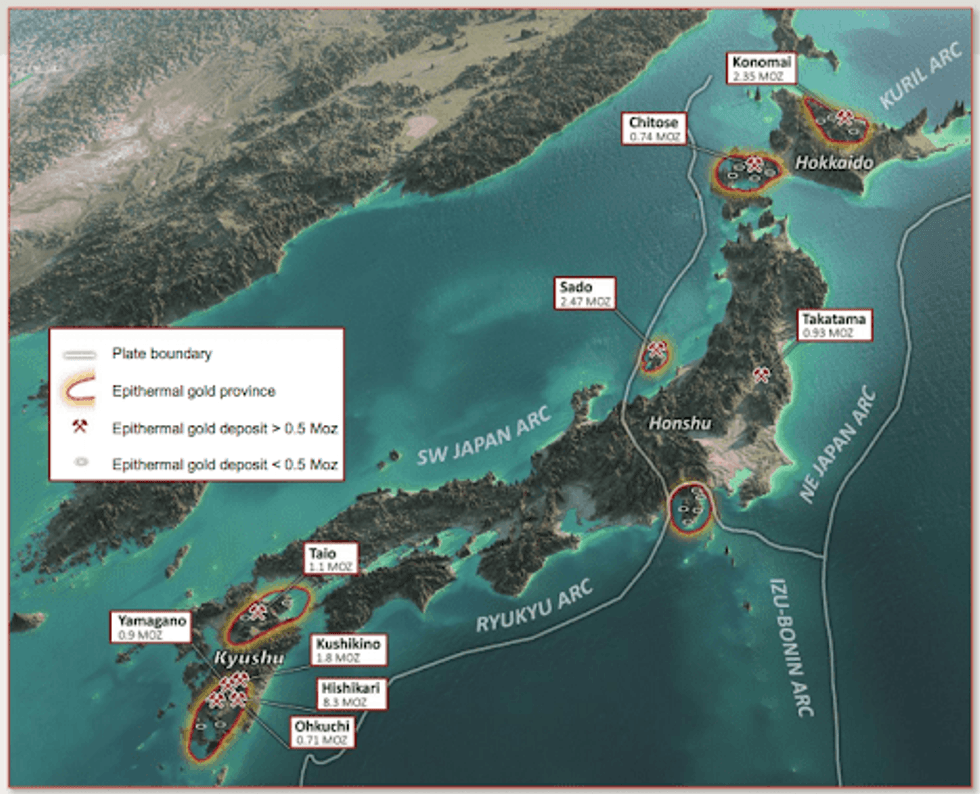

As a safe and stable jurisdiction, Japan hosts 76 known past producing gold mines, including five gold deposits greater than one million ounces.

All of Japan's gold mines were shut down in 1943 as part of a moratorium that was implemented by the government in light of World War II. Following that, there was a short period of small-scale production in the 1960s and 1970s and since then, production has been limited to a handful of mines including the Hishikari mine, which still produces today and is one of the world's highest-grade gold mines. The Hishikari mine has produced over 7.8 million ounces of gold between 1985-2019 at an average grade of 30-40 g/t gold.

Mining in Japan

Understanding the potential for gold exploration in the island nation, Japan Gold has entered the country as a first mover, collaborating with local companies and universities while engaging with local directors and advisors.

Key Projects

The Ikutahara Project – Hokkaido, Japan

The most advanced of Japan Gold's projects is the 205.13 square kilometer Ikutahara project, located in Japan's northern island, Hokkaido. The project hosts 20 historic mines and workings, making it highly prospective for gold mineralization. Based on the results of Japan Gold's review of historical data and validation by its own in-house field programs, a Phase 1 scout drill program was completed in 2019. The surface geochemistry, CSAMT and gravity geophysics collected over the Kitano-o Prospect, along with the Phase 1 drill program results, have refined the company's understanding of the geology of the Kitano-o hydrothermal system and give strong vectors to the eastern side of the prospect. It is now interpreted that the western part of the Kitano-o Prospect represents the 'lateral outflow' of a large epithermal system, developed at depth in the eastern part of the three-kilometer-long prospect.

Kitano-o Gold District

The historic Kitano-o Gold district comprises eight historic mines and workings over an approximate seven-by-four-kilometer area and includes the Kitano-o prospect. The district is highlighted by an extensive co-incident gold-arsenic-antimony mercury anomaly in stream sediment samples over the area.

Kitano-o Prospect

The Kitano-o prospect, which includes the Kitano Mine, is located within a seven-by-four-kilometer gold district which hosts seven additional gold prospects. The Kitano-o mine produced more than 96,000 ounces of gold at an average grade of 5.9 g/t gold primarily from shallow open-pits along a three-kilometer alteration corridor, prior to the government-imposed closure in 1943.

Phase 1 drill testing of the western side of the Kitano-o Prospect was completed in late December 2019 with six diamond drill holes, totaling 2,837 meters. Drilling targeted depth extensions of the western end of a well-defined vein-corridor exposed within extensive shallow open-pits and geophysical anomalies. Significant zones of quartz veining were intersected corresponding to those mapped at surface, however, the low tenor of gold reported from drill core assays does not adequately reflect the over 96,000 ounces of gold mined from the exposed paleosurface sinter deposits in the open pits.

The eastern side of the Kitano-o prospect has now been identified as a key target area for Phase 2 drilling. Gold historically mined at the surface at the Kitano-o Mine is interpreted to have been deposited at the paleosurface during deposition of a silica-sinter apron through lateral outflow. Silica-rich fluids that formed the sinter, also carrying gold, flowed upwards then laterally out from hot spring vents connected to a deep epithermal boiling zone. Rock samples collected from the eastern side of the Kitano-o prospect show high gold and antimony values potentially indicating higher temperatures of deposition and closer proximity to the 'upflow' or 'boiling zone' where gold was precipitating. The figure below represents Japan Gold's current interpreted geological model for the Kitano-o prospect.

Ryuo Prospect

The Ryuo mine, operated prior to 1943, was developed on five vein zones identified within a 1,000-meter by 400-meter NE-SW oriented zoned alteration system, which remains open to the southwest. The Metal Mining Agency of Japan (MMAJ) reported data on the Jinja and Shouei veins and shows workings developed on up to six levels to a depth of 75 meters below the surface. Underground workings of the Jinja veins were re-sampled during the 1950s and some noticeably high-grade samples were reported. Historic channel samples include results that show high-grade shoot development such as 72 meters with average grades of 40.8 g/t gold and 168 g/t silver in addition to 9 meters of 31 g/t gold and 268 g/t silver.

CSAMT and gravity geophysics have been completed in selected areas and a Phase 1 scout drilling is currently being permitted.

Japan Gold's Key Kyushu Project

The Ohra-Takamine Project

The Ohra-Takamine Gold prospect lies within the highly gold endowed Southern Kyushu Epithermal Gold Province and hosts five historic gold mines, the Matsuno, Urushi, Takamine, Ohra, and Aira Yamada Mines, which define a northeast-oriented structural corridor. In excess of 11 million ounces of gold have been produced from high-grade low-sulfidation epithermal gold deposits in the province. Notable producers include the Hishikari Mine with 7.8 million ounces of gold produced to date at average grades of 30-40 g/t gold; Kushikino Mine with 1.8 million ounces at 6.7 g/t gold, the Yamagano Mine with 910,000 ounces at 17.4 g/t gold and the Okuchi Mine with 714,000 ounces at 13.6 g/t gold.

A 35 line-kilometer, grid-based, CSAMT geophysical survey was completed along a 4.2-kilometer portion of the Ohra-Takamine Mine corridor. The CSAMT geophysical survey at the Ohra-Takamine project was undertaken to identify zones of sub-surface electrical resistivity and conductivity, representing silicification and clay alteration related to epithermal vein systems.

Results of the CSAMT survey at Ohra-Takamine are very encouraging and have defined a number of linear kilometric-scale, contiguous resistive zones (CSAMT anomalies), locally extending to depth across the survey area.

Prospect-scale gravity readings were collected over an eight-by-four kilometer area with nominal 60 to 100-meter spacings along access roads and ridgelines and merged with Geological Survey of Japan gravity data to produce a new suite of processed gravity images. The spatial relationship between gravity highs and the major low-sulfidation epithermal gold deposits in the province is well described in the literature, and uplift or doming of the underlying basement, producing gravity anomalies, is interpreted as a key factor in the development of deep-seated fracture pathways for hydrothermal fluid flow and subsequent quartz vein development in these mines.

Geophysical surveys completed to date are expected to add a vital third dimension to the epithermal targets at the Ohra-Takamine Project.

Management Team

John Proust – Chairman and CEO

John Proust has successfully founded and managed a number of resource companies. Mr. Proust has served on the boards and held senior operating positions, and has directed and advised public and private companies regarding debt and equity financing, mergers and acquisitions and corporate restructuring since 1986. Mr. Proust is currently Chairman and CEO of Southern Arc Minerals Inc., Chairman and a director of Canada Energy Partners Inc., and a director of Rise Gold Corp. Mr. Proust has extensive experience in corporate governance, is a graduate of The Directors College, Michael G. De Groote School of Business at McMaster University and holds the designation of Chartered Director.

Dr Michael Andrews, PhD, FAusIMM – Director

Dr. Mike Andrews is a geologist with more than 40 years of research and mining industry experience in gold, copper, coal and iron. He holds an honours degree in Geology from the University of Reading, and a doctorate in exploration geochemistry from the University of Wales. Dr. Andrews is also currently President & COO and a director of Southern Arc Minerals Inc., and a Non-executive Director of Kingsrose Mining Limited. He was a founding director of Kingsrose Mining Limited and played an instrumental role in the discovery, exploration, feasibility and development of its Way Linggo Gold Mine in Indonesia. Dr. Andrews also held the positions of Executive Director and Chief Geologist of AuIron Energy Ltd., Director of Gold Operations for Meekatharra Minerals Ltd., and managed the Teck-MM Gold Indonesian Joint Venture, an exploration portfolio of thirteen gold and copper projects in Indonesia. He also held senior exploration positions with Ashton Mining Ltd, Aurora Gold Ltd., and Muswellbrook Energy and Minerals.

John Carlile, BSc, MSc, FAusIMM – Director

John Carlile is a geologist with more than 35 years of experience in the resource industry. He has held senior executive and director positions with both major and junior resource companies, including as President of Indonesian and Philippines subsidiaries of Newcrest Mining Limited. As a geologist, he has a proven track record of mineral discovery and business building in Asia, most notably as Exploration Manager, Asia for Newcrest Mining Limited when it discovered its Gosowong mine. He has served on the boards of several resource companies, and currently holds the position of director for Southern Arc Minerals Inc. and Non-executive director of Kingsrose Mining Limited. He holds a BSc in Geology from University of Reading, England, and an MSc in Mineral Exploration from the Royal School of Mines, Imperial College, University of London. He is a Fellow of the AusIMM and a Fellow of the Geological Society of London.

Takashi Kuriyama, B.Eng. – General Manager, Exploration

Takashi Kuriyama, a geology graduate of the Mining and Geology Department of Akita University, served in increasingly senior roles with Sumitomo Metal Mining Co., Ltd. (“Sumitomo") from 1974 until his recent retirement as General Manager of its Global Exploration and Development Department. During his career at Sumitomo, Mr. Kuriyama had the role of Exploration and Geology Manager at Sumitomo's Hishikari world class gold mine in Kyushu, Southern Japan, and subsequently held senior exploration positions in Africa, Australia, Mexico, Canada and the United States of America. In the roles of Executive Vice President of Sumitomo Metal Mining America Inc. and Managing Director of Sumitomo Metal Mining Oceania Pty Ltd., he oversaw the development of the Northparkes copper-gold porphyry copper mine and the Pogo gold mine in Alaska. During his career with Sumitomo, he was seconded to Japanese Government Organizations serving as Councilor at the Metals Exploration Group of the Japan Oil, Gas and Metals National Corporation (JOGMEC) and Director at the Joint Venture Exploration Division for the Metal Mining Agency of Japan (MMAJ). Mr. Kuriyama also served as a Director of Teck Resources Limited from 2006 until 2016.

Dr. Kotaro Ohga, PhD – Chief Engineer

Kotaro Ohga held the position of Associate Professor at Hokkaido University in the Graduate School of Engineering. With a PhD in Mining Engineering, Dr. Ohga has extensive experience with permitting and drill programs in Japan. As Chief Engineer, Dr. Ohga is the main point of contact between Japan Gold and the Japanese Government, offering invaluable insight and expertise as Japan Gold advances its properties.

Andrew Rowe, BSc, MAusIMM – VP Exploration, Japan Country Manager

Andrew Rowe comes to Japan Gold through his previous position with Southern Arc Minerals. He joined Southern Arc in 2006 as a Senior Geological Consultant and was soon promoted to Chief Geologist and then Executive Vice President, leading Southern Arc's exploration programs from grassroots exploration through to completion of the first resource estimate at the Company's West Lombok Project. He planned and implemented large-scale exploration programs, managing both the technical and administrative aspects of the projects. He briefly left Southern Arc in December 2014, and then rejoined the Company as a consultant in August 2015 to continue with Southern Arc's exploration projects in Japan. He graduated with a Bachelor of Applied Science degree in Geology from the University of Technology, Sydney, Australia. He is a Member of the Australasian Institute of Mining and Metallurgy and a Fellow of the Society of Economic Geologists. He has experience in mineral exploration and project management in Australia and various countries in Southeast Asia including Thailand, Indonesia, Mongolia, China and Laos. During this time he held exploration positions with Renison Goldfields, Normandy Anglo Asia, Phelps Dodge, Aurora Gold and Ivanhoe Mines. Immediately prior to joining Southern Arc he was the principal geologist for Pan Australian Resources Ltd (Laos) and part of the team responsible for successfully bringing the Phu Kham Cu-Au porphyry deposit through to bankable feasibility.

Vincent Boon, CPA, CA – CFO and Corporate Secretary

Mr. Boon is a chartered accountant with over ten years of professional accounting experience with private and public companies focusing on financial reporting, regulatory compliance, internal control and corporate finance activities. Mr. Boon's experience includes financial reporting for both Canadian and U.S. listed companies with international subsidiaries, strategic planning, tax planning, corporate governance, equity financings and due diligence for acquisitions. As an employee of J Proust & Associates, an organization providing public company management and venture capital to start-up and junior companies, Mr. Boon is also the CFO of Southern Arc Minerals Inc., Canada Energy Partners Inc., and Rise Gold Corp. Mr. Boon holds a Bachelor of Science degree from the University of British Columbia and is a Chartered Professional Accountant, CPA, CA.

Mitsuhiko Yamada, BA – Director

Mitsuhiko Yamada is a mining business professional with international experience overseeing all aspects of mining projects from exploration through to production. He earned his degree in International Economics at Keio University and spent his career with Sumitomo Corporation. He worked around the globe for Sumitomo, managing various mining projects and overseeing joint venture relationships with some of the world's biggest mining companies, including Newmont, Phelps Dodge, Teck, Xstrata, Rio Tinto and Sherritt. He held increasing senior roles with Sumitomo, ultimately achieving the position of Executive Officer and General Manager of Mineral Resources. He retired from Sumitomo Corporation in 2012 and is currently a Lecturer of English at the Department of Industrial Engineering & Management at Kanagawa University.

Robert Gallagher, BApSc – Director

Bob Gallagher has more than 40 years of experience in the mining industry and is a Mineral Engineer with a specialty in mineral processing. Currently Mr. Gallagher is a director for Yamana Gold Inc., Southern Arc Minerals Inc., Capstone Mining Corp., and BC Hydro. Most recently, he held the position of President and Chief Executive Officer at New Gold Inc. Previously, Mr. Gallagher held increasingly senior management roles at Newmont Mining Corporation over a seven-year period, including Vice President Operations, Asia Pacific; Vice President, Indonesian Operations; and General Manager, Batu Hijau. Earlier in his career, Mr. Gallagher worked at a number of operating mines located throughout the Americas and Asia in various engineering, metallurgical, and mine management roles, including most notably 15 years at Placer Dome Inc. Mr. Gallagher has considerable project development and operational experience. He has been recognized by industry associations for his contributions throughout his career, most notably in 2013 he accepted the Prospector & Developer Association of Canada's Viola R. MacMillan Award for Company or Mine Development on behalf of New Gold Inc., and in 2014 he was jointly recognized by the Association for Mineral Exploration British Columbia with the E.A. Scholz Award for excellence in mine development.

Dr. Sally Eyre, PhD – Director

Dr. Sally Eyre is a mining finance professional with extensive experience in global resource capital markets and mining operations. During 2011 to 2014 she served as President & CEO of Copper North Mining and prior to that she served as Senior Vice President, Operations at Endeavour Mining, responsible for a portfolio of exploration, development and production projects throughout West Africa. She also served as President & CEO of Etruscan Resources Inc. (now Endeavour Mining Corp.), a gold company with producing assets in West Africa. She has served as Director of Business Development for Endeavour Financial Ltd. and has held executive positions with a number of Canadian resource companies. She was appointed Senior Vice President, Corporate Development of Petro Rubiales Energy Corp. (now Pacific Rubiales Energy) and also served as Vice President, Corporate Affairs of UrAsia Energy Ltd. (now Uranium One). In 2003 she served as President & CEO of TLC Ventures Corp. (now Calibre Mining Corp.). She has a PhD in Economic Geology from the Royal School of Mines, Imperial College, London. She is a member of the Society of Economic Geologists (SEG) and a former Director of the SEG Canada Foundation.

Murray Flanigan CPA, CA, CFA – Director

Mr. Flanigan is a management consultant providing financial advisory services to a number of public and private oil and gas, mining and technology companies in North America and abroad. Mr. Flanigan is a Chartered Accountant and a Chartered Financial Analyst with expertise in corporate finance, mergers and acquisitions, international taxation, risk management, banking, treasury, corporate restructuring and accounting, and has served as Chief Financial Officer for various public and private companies. Mr. Flanigan is currently a Managing Principal of Kepis & Pobe Financial Group Inc. and a key member of its executive management team responsible for the negotiation and closing of numerous recent large scale oil & gas transactions in West Africa, offshore Guyana and the Middle East. Prior to founding his own consulting company, Mr. Flanigan served as Senior Vice President, Corporate Development and CFO of Qwest Investment Management Corp., where he was responsible for regulatory reporting and corporate filings for over 15 private and publicly listed companies and limited partnerships in Qwest's portfolio, as well as arranging and closing numerous equity and debt financings. Mr. Flanigan also served as VP Corporate Development for Adelphia Communications Corporation, overseeing the company's financial restructuring and ultimate sale to Time Warner Inc. and Comcast Corporation for approximately US$18 billion.

Ian Burney – Director

Mr. Burney was the Ambassador of Canada to Japan from 2016 to 2021. Mr. Burney is an accomplished, high-performing public service executive and diplomat with over 30 years of experience in international affairs, particularly in the area of global economic issues. Mr. Burney graduated in 1985 from McGill University, Montreal, with a Bachelor of Arts with honours in Political Science, and in 1986 from University of Toronto, with a Master of Arts in International Relations. Mr. Burney joined the Department of External Affairs in 1987 and has held a range of positions in Ottawa and diplomatic postings overseas.

Michael Carrick – Director

Mr. Carrick is currently Chairman of RTG Mining Inc. and has been responsible for the development of seven major gold mines in five countries around the world including the development of the largest gold mine in the Philippines. That mine was merged with B2 Gold of Canada in a US$4.5 billion merger. Mr. Carrick is a Chartered Accountant with over 30 years of experience in the resources sector. He holds a degree in Commerce from the University of Natal, and an Accounting and Finance degree from the University of the Witwatersrand, and is a member of the Institute of Chartered Accountants both in South Africa and in Australia

Tanneke Heersche – Director

Ms. Heersche is a partner in the Global Mining Group at Fasken Martineau DuMoulin LLP and is the head of the firm-wide ESG Steering Committee. Prior to Fasken, Ms. Heersche was a partner at White & Case LLP where she was co-Chair of the Global Metals & Mining Practice Group and executive managing partner of its Johannesburg office. Ms Heersche is a highly regarded expert and strategic advisor in the natural resources industry with over 25 years of international industry experience. She has a particular emphasis on project development, investment agreement negotiations and the integration of ESG into development frameworks. Ms. Heersche holds an LLB from the University of Toronto and a BSc (Physiology) and BA (German Literature) from Western University .

Japan Gold (TSXV:JG) is a gold exploration company with a vast portfolio of 30 gold projects across the island nation of Japan. Japan Gold's leadership team has long recognized the potential for gold exploration in Japan. When the Japan Mining Act was amended in 2012 for the first time, allowing foreign mineral companies the ability to hold exploration and mining permits, Japan Gold was the first foreign mineral exploration company to seize this opportunity.

Japan Gold is the only foreign mineral exploration company to focus solely on gold exploration in the country and has gathered a large portfolio of projects that collectively host over 40 past-producing gold mines and workings which were all shut down during World War II due to a government moratorium on gold mining.

During February 2020, Japan Gold announced a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan. The Japan Gold-Barrick alliance includes 28 out of 30 projects currently held by Japan Gold.

Japan Gold will continue to advance the Ikutahara Project in Hokkaido and the Ohra-Takamine Project in Kyushu independently guided by the Japan Gold/Newmont Technical Committee. Newmont Corporation has a joint venture right of first refusal on these two projects.

As a first-mover in the country, Japan Gold has also taken the opportunity to establish strong relationships with local universities and industry specialists, incorporating some of these—such as Mitsuhiko Yamada and Takashi Kuriyama—into its management team and board of directors. This first-mover position has also made the company a key resource for other organizations looking to partake in gold exploration in the region.

Japan Gold is led by an exceptional management team with extensive local knowledge and relationships. This team is supported by a knowledgeable board of directors and advisors. As Japan Gold is a spinoff of Southern Arc Minerals Inc (TSXV:SA)—a company that shares many of the same directors—26 percent of the company is held by its predecessor, giving the company a unique share structure.

Over the course of the next 12 months, Japan Gold plans to complete large scale, regional programs under the Japan Gold-Barrick alliance which is expected to include geochemical (BLEG) stream sediment analysis and geophysical analysis over the 28 projects included in the alliance. These programs are guided by the Japan Gold-Barrick Alliance Technical Committee.

In addition, the company plans to fully evaluate and drill permit three prospects on the two projects excluded from the Barrick alliance. Newmont has a joint venture right of first refusal on these two projects. Japan Gold plans to complete drill programs on at least two of these prospects over the next 12 months. These programs are guided by the Japan Gold/Newmont Technical Committee.

As a safe and stable jurisdiction, Japan hosts 76 known past producing gold mines, including five gold deposits greater than one million ounces.

All of Japan's gold mines were shut down in 1943 as part of a moratorium that was implemented by the government in light of World War II. Following that, there was a short period of small-scale production in the 1960s and 1970s and since then, production has been limited to a handful of mines including the Hishikari mine, which still produces today and is one of the world's highest-grade gold mines. The Hishikari mine has produced over 7.8 million ounces of gold between 1985-2019 at an average grade of 30-40 g/t gold.

Mining in Japan

Understanding the potential for gold exploration in the island nation, Japan Gold has entered the country as a first mover, collaborating with local companies and universities while engaging with local directors and advisors.

The most advanced of Japan Gold's projects is the 205.13 square kilometer Ikutahara project, located in Japan's northern island, Hokkaido. The project hosts 20 historic mines and workings, making it highly prospective for gold mineralization. Based on the results of Japan Gold's review of historical data and validation by its own in-house field programs, a Phase 1 scout drill program was completed in 2019. The surface geochemistry, CSAMT and gravity geophysics collected over the Kitano-o Prospect, along with the Phase 1 drill program results, have refined the company's understanding of the geology of the Kitano-o hydrothermal system and give strong vectors to the eastern side of the prospect. It is now interpreted that the western part of the Kitano-o Prospect represents the 'lateral outflow' of a large epithermal system, developed at depth in the eastern part of the three-kilometer-long prospect.

The historic Kitano-o Gold district comprises eight historic mines and workings over an approximate seven-by-four-kilometer area and includes the Kitano-o prospect. The district is highlighted by an extensive co-incident gold-arsenic-antimony mercury anomaly in stream sediment samples over the area.

The Kitano-o prospect, which includes the Kitano Mine, is located within a seven-by-four-kilometer gold district which hosts seven additional gold prospects. The Kitano-o mine produced more than 96,000 ounces of gold at an average grade of 5.9 g/t gold primarily from shallow open-pits along a three-kilometer alteration corridor, prior to the government-imposed closure in 1943.

Phase 1 drill testing of the western side of the Kitano-o Prospect was completed in late December 2019 with six diamond drill holes, totaling 2,837 meters. Drilling targeted depth extensions of the western end of a well-defined vein-corridor exposed within extensive shallow open-pits and geophysical anomalies. Significant zones of quartz veining were intersected corresponding to those mapped at surface, however, the low tenor of gold reported from drill core assays does not adequately reflect the over 96,000 ounces of gold mined from the exposed paleosurface sinter deposits in the open pits.

The eastern side of the Kitano-o prospect has now been identified as a key target area for Phase 2 drilling. Gold historically mined at the surface at the Kitano-o Mine is interpreted to have been deposited at the paleosurface during deposition of a silica-sinter apron through lateral outflow. Silica-rich fluids that formed the sinter, also carrying gold, flowed upwards then laterally out from hot spring vents connected to a deep epithermal boiling zone. Rock samples collected from the eastern side of the Kitano-o prospect show high gold and antimony values potentially indicating higher temperatures of deposition and closer proximity to the 'upflow' or 'boiling zone' where gold was precipitating. The figure below represents Japan Gold's current interpreted geological model for the Kitano-o prospect.

The Ryuo mine, operated prior to 1943, was developed on five vein zones identified within a 1,000-meter by 400-meter NE-SW oriented zoned alteration system, which remains open to the southwest. The Metal Mining Agency of Japan (MMAJ) reported data on the Jinja and Shouei veins and shows workings developed on up to six levels to a depth of 75 meters below the surface. Underground workings of the Jinja veins were re-sampled during the 1950s and some noticeably high-grade samples were reported. Historic channel samples include results that show high-grade shoot development such as 72 meters with average grades of 40.8 g/t gold and 168 g/t silver in addition to 9 meters of 31 g/t gold and 268 g/t silver.

CSAMT and gravity geophysics have been completed in selected areas and a Phase 1 scout drilling is currently being permitted.

The Ohra-Takamine Gold prospect lies within the highly gold endowed Southern Kyushu Epithermal Gold Province and hosts five historic gold mines, the Matsuno, Urushi, Takamine, Ohra, and Aira Yamada Mines, which define a northeast-oriented structural corridor. In excess of 11 million ounces of gold have been produced from high-grade low-sulfidation epithermal gold deposits in the province. Notable producers include the Hishikari Mine with 7.8 million ounces of gold produced to date at average grades of 30-40 g/t gold; Kushikino Mine with 1.8 million ounces at 6.7 g/t gold, the Yamagano Mine with 910,000 ounces at 17.4 g/t gold and the Okuchi Mine with 714,000 ounces at 13.6 g/t gold.

A 35 line-kilometer, grid-based, CSAMT geophysical survey was completed along a 4.2-kilometer portion of the Ohra-Takamine Mine corridor. The CSAMT geophysical survey at the Ohra-Takamine project was undertaken to identify zones of sub-surface electrical resistivity and conductivity, representing silicification and clay alteration related to epithermal vein systems.

Results of the CSAMT survey at Ohra-Takamine are very encouraging and have defined a number of linear kilometric-scale, contiguous resistive zones (CSAMT anomalies), locally extending to depth across the survey area.

Prospect-scale gravity readings were collected over an eight-by-four kilometer area with nominal 60 to 100-meter spacings along access roads and ridgelines and merged with Geological Survey of Japan gravity data to produce a new suite of processed gravity images. The spatial relationship between gravity highs and the major low-sulfidation epithermal gold deposits in the province is well described in the literature, and uplift or doming of the underlying basement, producing gravity anomalies, is interpreted as a key factor in the development of deep-seated fracture pathways for hydrothermal fluid flow and subsequent quartz vein development in these mines.

Geophysical surveys completed to date are expected to add a vital third dimension to the epithermal targets at the Ohra-Takamine Project.

John Proust has successfully founded and managed a number of resource companies. Mr. Proust has served on the boards and held senior operating positions, and has directed and advised public and private companies regarding debt and equity financing, mergers and acquisitions and corporate restructuring since 1986. Mr. Proust is currently Chairman and CEO of Southern Arc Minerals Inc., Chairman and a director of Canada Energy Partners Inc., and a director of Rise Gold Corp. Mr. Proust has extensive experience in corporate governance, is a graduate of The Directors College, Michael G. De Groote School of Business at McMaster University and holds the designation of Chartered Director.

Dr. Mike Andrews is a geologist with more than 40 years of research and mining industry experience in gold, copper, coal and iron. He holds an honours degree in Geology from the University of Reading, and a doctorate in exploration geochemistry from the University of Wales. Dr. Andrews is also currently President & COO and a director of Southern Arc Minerals Inc., and a Non-executive Director of Kingsrose Mining Limited. He was a founding director of Kingsrose Mining Limited and played an instrumental role in the discovery, exploration, feasibility and development of its Way Linggo Gold Mine in Indonesia. Dr. Andrews also held the positions of Executive Director and Chief Geologist of AuIron Energy Ltd., Director of Gold Operations for Meekatharra Minerals Ltd., and managed the Teck-MM Gold Indonesian Joint Venture, an exploration portfolio of thirteen gold and copper projects in Indonesia. He also held senior exploration positions with Ashton Mining Ltd, Aurora Gold Ltd., and Muswellbrook Energy and Minerals.

John Carlile is a geologist with more than 35 years of experience in the resource industry. He has held senior executive and director positions with both major and junior resource companies, including as President of Indonesian and Philippines subsidiaries of Newcrest Mining Limited. As a geologist, he has a proven track record of mineral discovery and business building in Asia, most notably as Exploration Manager, Asia for Newcrest Mining Limited when it discovered its Gosowong mine. He has served on the boards of several resource companies, and currently holds the position of director for Southern Arc Minerals Inc. and Non-executive director of Kingsrose Mining Limited. He holds a BSc in Geology from University of Reading, England, and an MSc in Mineral Exploration from the Royal School of Mines, Imperial College, University of London. He is a Fellow of the AusIMM and a Fellow of the Geological Society of London.

Takashi Kuriyama, a geology graduate of the Mining and Geology Department of Akita University, served in increasingly senior roles with Sumitomo Metal Mining Co., Ltd. (“Sumitomo") from 1974 until his recent retirement as General Manager of its Global Exploration and Development Department. During his career at Sumitomo, Mr. Kuriyama had the role of Exploration and Geology Manager at Sumitomo's Hishikari world class gold mine in Kyushu, Southern Japan, and subsequently held senior exploration positions in Africa, Australia, Mexico, Canada and the United States of America. In the roles of Executive Vice President of Sumitomo Metal Mining America Inc. and Managing Director of Sumitomo Metal Mining Oceania Pty Ltd., he oversaw the development of the Northparkes copper-gold porphyry copper mine and the Pogo gold mine in Alaska. During his career with Sumitomo, he was seconded to Japanese Government Organizations serving as Councilor at the Metals Exploration Group of the Japan Oil, Gas and Metals National Corporation (JOGMEC) and Director at the Joint Venture Exploration Division for the Metal Mining Agency of Japan (MMAJ). Mr. Kuriyama also served as a Director of Teck Resources Limited from 2006 until 2016.

Kotaro Ohga held the position of Associate Professor at Hokkaido University in the Graduate School of Engineering. With a PhD in Mining Engineering, Dr. Ohga has extensive experience with permitting and drill programs in Japan. As Chief Engineer, Dr. Ohga is the main point of contact between Japan Gold and the Japanese Government, offering invaluable insight and expertise as Japan Gold advances its properties.

Andrew Rowe comes to Japan Gold through his previous position with Southern Arc Minerals. He joined Southern Arc in 2006 as a Senior Geological Consultant and was soon promoted to Chief Geologist and then Executive Vice President, leading Southern Arc's exploration programs from grassroots exploration through to completion of the first resource estimate at the Company's West Lombok Project. He planned and implemented large-scale exploration programs, managing both the technical and administrative aspects of the projects. He briefly left Southern Arc in December 2014, and then rejoined the Company as a consultant in August 2015 to continue with Southern Arc's exploration projects in Japan. He graduated with a Bachelor of Applied Science degree in Geology from the University of Technology, Sydney, Australia. He is a Member of the Australasian Institute of Mining and Metallurgy and a Fellow of the Society of Economic Geologists. He has experience in mineral exploration and project management in Australia and various countries in Southeast Asia including Thailand, Indonesia, Mongolia, China and Laos. During this time he held exploration positions with Renison Goldfields, Normandy Anglo Asia, Phelps Dodge, Aurora Gold and Ivanhoe Mines. Immediately prior to joining Southern Arc he was the principal geologist for Pan Australian Resources Ltd (Laos) and part of the team responsible for successfully bringing the Phu Kham Cu-Au porphyry deposit through to bankable feasibility.

Mr. Boon is a chartered accountant with over ten years of professional accounting experience with private and public companies focusing on financial reporting, regulatory compliance, internal control and corporate finance activities. Mr. Boon's experience includes financial reporting for both Canadian and U.S. listed companies with international subsidiaries, strategic planning, tax planning, corporate governance, equity financings and due diligence for acquisitions. As an employee of J Proust & Associates, an organization providing public company management and venture capital to start-up and junior companies, Mr. Boon is also the CFO of Southern Arc Minerals Inc., Canada Energy Partners Inc., and Rise Gold Corp. Mr. Boon holds a Bachelor of Science degree from the University of British Columbia and is a Chartered Professional Accountant, CPA, CA.

Mitsuhiko Yamada is a mining business professional with international experience overseeing all aspects of mining projects from exploration through to production. He earned his degree in International Economics at Keio University and spent his career with Sumitomo Corporation. He worked around the globe for Sumitomo, managing various mining projects and overseeing joint venture relationships with some of the world's biggest mining companies, including Newmont, Phelps Dodge, Teck, Xstrata, Rio Tinto and Sherritt. He held increasing senior roles with Sumitomo, ultimately achieving the position of Executive Officer and General Manager of Mineral Resources. He retired from Sumitomo Corporation in 2012 and is currently a Lecturer of English at the Department of Industrial Engineering & Management at Kanagawa University.

Bob Gallagher has more than 40 years of experience in the mining industry and is a Mineral Engineer with a specialty in mineral processing. Currently Mr. Gallagher is a director for Yamana Gold Inc., Southern Arc Minerals Inc., Capstone Mining Corp., and BC Hydro. Most recently, he held the position of President and Chief Executive Officer at New Gold Inc. Previously, Mr. Gallagher held increasingly senior management roles at Newmont Mining Corporation over a seven-year period, including Vice President Operations, Asia Pacific; Vice President, Indonesian Operations; and General Manager, Batu Hijau. Earlier in his career, Mr. Gallagher worked at a number of operating mines located throughout the Americas and Asia in various engineering, metallurgical, and mine management roles, including most notably 15 years at Placer Dome Inc. Mr. Gallagher has considerable project development and operational experience. He has been recognized by industry associations for his contributions throughout his career, most notably in 2013 he accepted the Prospector & Developer Association of Canada's Viola R. MacMillan Award for Company or Mine Development on behalf of New Gold Inc., and in 2014 he was jointly recognized by the Association for Mineral Exploration British Columbia with the E.A. Scholz Award for excellence in mine development.

Dr. Sally Eyre is a mining finance professional with extensive experience in global resource capital markets and mining operations. During 2011 to 2014 she served as President & CEO of Copper North Mining and prior to that she served as Senior Vice President, Operations at Endeavour Mining, responsible for a portfolio of exploration, development and production projects throughout West Africa. She also served as President & CEO of Etruscan Resources Inc. (now Endeavour Mining Corp.), a gold company with producing assets in West Africa. She has served as Director of Business Development for Endeavour Financial Ltd. and has held executive positions with a number of Canadian resource companies. She was appointed Senior Vice President, Corporate Development of Petro Rubiales Energy Corp. (now Pacific Rubiales Energy) and also served as Vice President, Corporate Affairs of UrAsia Energy Ltd. (now Uranium One). In 2003 she served as President & CEO of TLC Ventures Corp. (now Calibre Mining Corp.). She has a PhD in Economic Geology from the Royal School of Mines, Imperial College, London. She is a member of the Society of Economic Geologists (SEG) and a former Director of the SEG Canada Foundation.

Mr. Flanigan is a management consultant providing financial advisory services to a number of public and private oil and gas, mining and technology companies in North America and abroad. Mr. Flanigan is a Chartered Accountant and a Chartered Financial Analyst with expertise in corporate finance, mergers and acquisitions, international taxation, risk management, banking, treasury, corporate restructuring and accounting, and has served as Chief Financial Officer for various public and private companies. Mr. Flanigan is currently a Managing Principal of Kepis & Pobe Financial Group Inc. and a key member of its executive management team responsible for the negotiation and closing of numerous recent large scale oil & gas transactions in West Africa, offshore Guyana and the Middle East. Prior to founding his own consulting company, Mr. Flanigan served as Senior Vice President, Corporate Development and CFO of Qwest Investment Management Corp., where he was responsible for regulatory reporting and corporate filings for over 15 private and publicly listed companies and limited partnerships in Qwest's portfolio, as well as arranging and closing numerous equity and debt financings. Mr. Flanigan also served as VP Corporate Development for Adelphia Communications Corporation, overseeing the company's financial restructuring and ultimate sale to Time Warner Inc. and Comcast Corporation for approximately US$18 billion.

Mr. Burney was the Ambassador of Canada to Japan from 2016 to 2021. Mr. Burney is an accomplished, high-performing public service executive and diplomat with over 30 years of experience in international affairs, particularly in the area of global economic issues. Mr. Burney graduated in 1985 from McGill University, Montreal, with a Bachelor of Arts with honours in Political Science, and in 1986 from University of Toronto, with a Master of Arts in International Relations. Mr. Burney joined the Department of External Affairs in 1987 and has held a range of positions in Ottawa and diplomatic postings overseas.

Mr. Carrick is currently Chairman of RTG Mining Inc. and has been responsible for the development of seven major gold mines in five countries around the world including the development of the largest gold mine in the Philippines. That mine was merged with B2 Gold of Canada in a US$4.5 billion merger. Mr. Carrick is a Chartered Accountant with over 30 years of experience in the resources sector. He holds a degree in Commerce from the University of Natal, and an Accounting and Finance degree from the University of the Witwatersrand, and is a member of the Institute of Chartered Accountants both in South Africa and in Australia

Ms. Heersche is a partner in the Global Mining Group at Fasken Martineau DuMoulin LLP and is the head of the firm-wide ESG Steering Committee. Prior to Fasken, Ms. Heersche was a partner at White & Case LLP where she was co-Chair of the Global Metals & Mining Practice Group and executive managing partner of its Johannesburg office. Ms Heersche is a highly regarded expert and strategic advisor in the natural resources industry with over 25 years of international industry experience. She has a particular emphasis on project development, investment agreement negotiations and the integration of ESG into development frameworks. Ms. Heersche holds an LLB from the University of Toronto and a BSc (Physiology) and BA (German Literature) from Western University .

Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold" or the "Company") is pleased to provide an update on exploration activities at the 100% owned Ikutahara Project in Hokkaido, Japan, (Figure 1).

Ryuo Prospect

Two additional drill holes are planned at the Ryuo Prospect for late 2022 to follow up on the high-grade gold drill intercepts from the 2021 and recent round of drilling, and other priority targets. Previous drilling has tested beneath five areas of workings; Jinja, Shouei, Taisei, Ryuei and Buryu that were developed along a 1.2 km long, open ended trend of alteration and mineralization prior to the government-imposed closure in 1943. Historical underground sampling in the Jinja vein workings revealed high-grade gold-silver mineralization which was sampled along a 72 m strike length giving an average grade of 40.8 g/t Au and 193 g/t Ag, with an average vein width approximately 0.5 m.

For more information on the Ryuo prospect, refer to the Company's news release dated 11th October 2022.

Saroma Prospect

Six drill holes have now been completed at the Saroma prospect. Four drill holes were initially planned to test a 1 km strike length of the Saroma prospect. The four initial drill holes all intersected significant quartz vein zones up to 8 m wide of banded and brecciated chalcedonic quartz with ginguro banding. Based on these encouraging intersections an additional two holes were completed to test continuity of the vein zones to depth. The additional two deeper drill holes also intersected significant quartz vein zones with similarly low-temperature chalcedonic textures indicating good preservation of the vein system. The six drill holes completed at Saroma between July and September comprise a total of 1,308.8 m, all drill core samples are now at the lab with results expected by early December.

The Saroma prospect lies at the northeast end of a major 3.5 km long fault zone which also hosts the Chitose and Taiho historical mine workings, refer to the Company's news release dated 17th August 2022 for more information on the Saroma prospect.

Kitano-o Prospect

Drilling is underway at the east side of the Kitano-o prospect where two of the Company's PMC700 drill rigs are currently operating. One of three planned deep drill-holes has been completed and another two drill holes are in progress and expected to be completed by early November. The initial three scout drill holes at east Kitano-o are targeting combined geochemical and geophysical anomalies below historic workings and adjacent to major graben and rhyolite dome structures proximal to the Cretaceous basement interface. For more information on the Kitano-o prospect refer to the Company's news release dated 19th February, 2020.

Ikutahara 2022 Surface Exploration Programs

Soil sampling programs are ongoing at the Ikutahara Project to extend soil grids along the graben-margin north and south of the Kitano-o prospect and over extensions of the alteration zone at the Ryuo prospect, (Figure 1). These soil sampling programs are aimed at defining poorly exposed or concealed vein systems by their combined alteration footprints and pathfinder mineral assemblages. Definition of significant anomalous footprints can then be ranked and further advanced towards drill targeting with focused geophysical surveys such as CSAMT and induced polarization.

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold Vice President of Exploration and Country Manager, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com.

For further information please contact:

John Proust

Chairman & CEO

Phone: +1 778-725-1482

Email: [email protected]

Website: www.japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results related to future partnerships and the Company's 2022 gold exploration program. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; the timing and granting of prospecting rights; the Company's ability to execute and implement future plans, arrange or conclude a joint-venture or partnership; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable laws.

Figure 1: Ikutahara Project: simplified geology, historical mines and workings, 2022 prospect drilling areas and soil grids.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5665/141259_42e6c8c45480c81e_001full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/141259

News Provided by Newsfile via QuoteMedia

Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold" or the "Company") will hold its Annual General Meeting ("AGM") virtually on Thursday, October 20, 2022 at 3:00 p.m. (PT) at https:meetnow.globalMXNMPNU. Following the formal portion of the AGM, Management will also discuss the Company's ongoing drilling progress and the selection of 6 projects by Barrick Gold Corporation. The discussion will be followed by a question and answer period.

Registered Shareholders and duly appointed proxyholders can attend the AGM online to participate, vote, or submit questions during the AGM's live webcast. In order to participate online, Registered Shareholders must have a valid 15-digit control number and proxyholders must have received an email from Computershare Trust Company of Canada OR Computershare Investor Services Inc. containing an Invite Code.

Guests are invited to attend and submit questions during the question and answer period.

The virtual meeting platform is fully supported across most commonly used web browsers (note: Internet Explorer is not a supported browser). We encourage you to access the AGM prior to the start time.

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com.

For further information please contact:

John Proust

Chairman & CEO

Phone: 778-725-1491

Email: [email protected]

Website: www.japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/141077

News Provided by Newsfile via QuoteMedia

Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold" or the "Company") is pleased to announce results from seven additional drill holes at the Ryuo Prospect. Drilling has continued to encounter high-grade veins along the Ryuo alteration corridor, and interpretation of drill core has significantly advanced the understanding of controls on mineralization at the prospect. The Ryuo prospect is located within the Company's 100% owned Ikutahara Project in Hokkaido, (Figure 1).

Summary of High-Grade Intercepts, (Figures 2-5 and Table 1):

0.75 m @ 22.5 g/t Au & 41.3 g/t Ag from 276.0 m

0.4 m @ 19. 0 g/t Au & 15.7 Ag from 280.95 m

(Incl. 0.2 m @ 34.6 g/t Au & 25.0 g/t Ag from 280.95 m)

1.1m @ 2.9 g/t Au & 11.7 g/t Ag from 266.8 m

(incl. 0.35 m @ 7.0 g/t Au @ 22.1 g/t Ag from 267.25 m

0.4 m @ 12.8 g/t Au & 35.3 g/t Ag from 288.4 m

(incl. 0.2 m @ 23.7 g/t Au & 74.7 g/t Ag from 288.6 m)

Andrew Rowe, Vice President Exploration stated, "We are very encouraged by the recent findings at the Ryuo prospect. The combination of multiple high-grade vein structures with high-level vein textures and a well-preserved alteration system supports deeper drilling, particularly along strike to the southwest of the prospect. We look forward to completing another round of drill holes to test these concepts before the end of this year."

Summary of Findings at Ryuo and the Implications for Ongoing Exploration:

The 2022 drill program has significantly advanced the understanding of geological controls and alteration zonation with respect to high-grade mineralization at Ryuo. Importantly, high-grade gold events have been identified along the length of the prospect in multiple parallel vein zones, and alteration studies prove the system is well preserved.

IKDD22-005 has proven an extension of the Shouei vein mineralization 100 m to the southwest. Further step out drilling is required to confirm strike continuity to depth below veining intersected in the top of drill hole IKDD21-005, and towards the open high-grade mineralization intersected 400 m to the southwest in drill holes IKDD21-008 and IKDD22-007, (Figure 2 & 3).

IKDD22-007 targeting the depth extension of the ultra high-grade vein in IKDD21-008 (0.45 m @ 1,395 g/t Au & 768 g/t Ag) terminated more than 100 m before target depth under difficult drilling conditions and due to a temporary expiry of a local forestry permit. From 200 m down-hole, intensely altered and hydrothermally brecciated rhyolite was drilled to the bottom of the hole at 289.4 m. Numerous banded quartz veins cut the brecciated rhyolite carrying anomalous gold along its length, with higher grade intervals including the 40 cm vein from the bottom of the hole which gave 12.8 g/t Au & 35.5 g/t Ag with a high-grade included interval of 23.7g/t Au & 64.7 g/t Ag (Figure 4). This breccia zone was unexpected and appears to be part of a significant, partially tested mineralized structure which subsequent drilling will target as a priority.

Hydrothermal alteration of the host rocks in low-sulphidation epithermal vein systems create a distinct zonal arrangement of clay minerals. Smectite dominant assemblages form above and peripheral to quartz veining, while a mixed-layer (illite-smectite) assemblage forms in the upper parts of the gold-bearing vein zone, this progresses downward into a chlorite-illite dominant assemblage which coincides with the boiling-zone where high-grade gold deposition occurs. This association of clay zonation and gold mineralization has been well documented in literature, including at the Hishikari mine in Kyushu2.

The upper part of this zonal arrangement of clay alteration has been interpreted from spectral analysis of drill core along the length of the Ryuo prospect. A smectite dominant zone is defined above and adjacent to higher grade veins, and a mixed-layer zone is interpreted from an illite+smectite dominant assemblage, associated with most of the high-grade veining seen to date, (Figures 3 & 4). The deeper chlorite-illite assemblage has not yet been recognized at Ryuo indicating the epithermal system is preserved and that the main high-grade boiling zone lies at depth. Additionally, the smectite / mixed-layer interface at Ryuo deepens or plunges to the southwest of the prospect. Similarly, the top of the rhyolite dome complex also lies deeper in the southwest of the alteration corridor, (Figure 4). Ongoing drilling will focus on targeting the deeper portions of the Ryuo hydrothermal system for high-grade mineralization associated with in the chlorite-illite zone.

Ryuo Prospect

The Ryuo Prospect consists of five areas of workings; Jinja, Shouei, Taisei, Ryuei and Buryu that were developed along a 1.2 km long, open ended trend of alteration and mineralization prior to the government-imposed closure in 1943 (Figure 2). Historical underground sampling in the Jinja vein workings revealed high-grade gold-silver mineralization including 'level 4' of the workings, which was sampled along a 72 m strike length giving an average grade of 40.8 g/t Au and 193 g/t Ag, with an average vein width approximately 0.5 m. Figure 3 illustrates a long-section of the Jinja vein workings with the underground sampling reported by the Metal Mining Agency of Japan (MMAJ)1.

New Accepted Prospecting Rights Applications at the Ikutahara Project

Eleven new prospecting rights were lodged to cover prospective Miocene volcanics immediately to the north and west of the Ryuo prospect to ensure coverage of potential strike and parallel extension to the Ryuo mineralization. The new applications comprising a total of 2,567 hectares have now been accepted by the Ministry of Economy Trade and Industry (METI) Hokkaido, (Figure 1).

Table 1: Significant Mineralized Intercepts for IKDD22-001 to IKDD22-007

Table 2: Ryuo Prospect Drill Hole Data

Reference

1Metal Mining Agency of Japan, March 1990, Geological Survey Report for Fiscal Year 1989, Northern Hokkaido Area B-Metalliferous Deposits Overview.

2 Eiji Izawa et.al. 1990. The Hishikari Gold Deposit: high-grade epithermal veins in Quaternary volcanics of southern Kyushu Japan. Journal of Geochemical Exploration, 36 (1990) pp 1-56

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold Vice President of Exploration and Country Manager, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

Sampling Techniques and Assaying

The drilling results discussed in this news release are from drill core samples obtained by PQ, HQ and NQ-size triple-tube diamond core drilling using a PMC700 and PMC-400 man-portable drill rigs owned and operated by the Company. The drilling program was fully supervised by Company senior geologists at the drilling site.

Drill core was collected in plastic core-trays at the drill site and transported by road in Company vehicles to its core shed storage facility in the nearby Ikutahara Village, located centrally within the project area. The drill core was carefully logged, photographed and sample intervals marked-up along predicted mineralized and selected unmineralized intervals by Japan Gold KK senior project geologists and VP Exploration.

Sample lengths varied from 0.15 to 1.0 m; depending on the positions of geological contacts and variations in vein texture and composition. The core was split by diamond rock saw supervised by project geologists. Half-core sample was collected from the entire length of each designated sample interval and placed into individual-labelled, self-sealing calico bags for secure packaging and transport to the laboratory. The half-core samples weighed between 0.25 to 5 kg depending on the sample length and core size. A Chain-of-Custody was established between the Company and receiving laboratory to ensure the integrity of the samples during transportation from site to the lab. The samples were sent in batches to ALS Laboratories in Vancouver, Canada for sample preparation and assaying.

Samples were crushed, pulverised and assayed for gold 50 g charge Fire Assay/ AAS Finish (Au-AA24; 0.005 ppm lower detection limit) and a 48 multi-element by 4-acid digest with ICP-MS determination (ME-MS61L; Ag 0.002 ppm lower detection limit). Over-limit Au and Ag samples were re-assayed by fire-assay and gravimetric finish (GRA-22, LDL of 0.5 and 5 ppm for Au and Ag respectively).

Certified Reference Materials (CRMs) were inserted by Japan Gold KK at every 20th sample to assess repeatability and assaying precision of the laboratory. In addition, the laboratory applied its own internal Quality Control procedure that includes sample duplicates, blanks & geochemical standards. They report these results with the certified Assay Report. Laboratory procedures and QAQC protocols adopted are considered appropriate. The CRMs and internal QC-QA results fall within acceptable levels of accuracy & precision and are considered to lack any bias.

Note on spectral analysis for identification of clay assemblages from drill core: ALS laboratories provides a spectral analysis of coarse sample material using TerraSpec® 4 HR and aiSIRIS™ expert spectral interpretation. Mineral assemblages are provided related to project geology. Spectral analysis used herein is interpretive for mixed layer species and used as a guide, more definitive XRD (X-Ray Diffraction) analysis are currently being undertaken to accurately identify clay species and subsequent alteration zonation for more accurate interpretations.

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 31 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold's leadership team represent decades of resource industry and business experience, and the Company has an operational team of geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com or by email at [email protected]

For further information please contact:

John Proust

Chairman & CEO

Phone: 778-725-1491

Email: [email protected]

Website: www.japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results related to future partnerships and the Company's 2022 gold exploration program. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; the timing and granting of prospecting rights; the Company's ability to execute and implement future plans, arrange or conclude a joint-venture or partnership; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable laws.

Figure 1: Ikutahara Project, new and existing prospecting rights and applications on simplified geology with historical mines and workings.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/5665/140103_57db67fc442739a5_001full.jpg

Figure 2: Ryuo prospect, alteration map with historical workings and drill holes completed to date.

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/5665/140103_57db67fc442739a5_002full.jpg

Figure 3: Ryuo Prospect, Jinja & Shouei veins cross section with geology, interpreted alteration and all significant drill intersections to date.

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/5665/140103_57db67fc442739a5_003full.jpg

Figure 4: Ryuo prospect, Ryuei vein cross section with geology, interpreted alteration and all significant drill intersections to date.

To view an enhanced version of Figure 4, please visit:

https://images.newsfilecorp.com/files/5665/140103_57db67fc442739a5_004full.jpg

Figure 5: Ryuo prospect long section with geology, interpreted alteration and drill hole pierce points and significant intersections.

To view an enhanced version of Figure 5, please visit:

https://images.newsfilecorp.com/files/5665/140103_57db67fc442739a5_005full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/140103

News Provided by Newsfile via QuoteMedia

Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold") is pleased to announce that Barrick Gold Corporation ("Barrick") has selected six projects from the Barrick Alliance portfolio to continue as Included Projects in the Second Evaluation Phase under the Strategic Alliance Agreement dated February 23, 2020 (the "Alliance Agreement") between Japan Gold and Barrick. In addition, Barrick will be continuing their Initial Evaluation Phase on three project areas that were added to the Barrick Alliance following its formation. Japan Gold will continue to provide full support and management of the Included Projects under the Barrick Alliance.

Barrick's Vice President Exploration, Asia-Pacific, Marian Moroney, commented "The Barrick team is excited that the country-wide screening program has been successful in defining multiple projects which will now receive more focused work programs in order to progress them to the next stage. The programs are likely to include geophysical surveys and drilling on the best targets, as we continue the search for world-class orebodies in Japan."

John Proust, Chairman & CEO commented: "The Japan Gold team has completed an enormous amount of work over the past 2 ½ years evaluating the 29 Barrick Alliance projects in order to demonstrate to Barrick the high quality of the Japan Gold project portfolio and its prospectivity. We are highly encouraged that Barrick has selected 6 projects with the potential to host Tier 1 or Tier 2 ore bodies and we look forward to aggressively advancing these projects."

As part of the Alliance Agreement, Barrick agreed to (i) sole fund a 2-year Initial Evaluation Phase of all 29 projects initially included in the Barrick Alliance, as well as a 2-year Initial Evaluation Phase on any projects subsequently acquired by Japan Gold and included in the Barrick Alliance, commencing on their acquisition date, and (ii) sole fund a subsequent 3-year Second Evaluation Phase on projects which meet their criteria. In February 2022, Japan Gold granted Barrick a 6-month extension, to August 31, 2022, to complete the Initial Evaluation Phase on the original project portfolio, due to delays and travel restrictions caused by the global Covid pandemic.

Barrick requires projects to have the potential to host either a Tier 1 or Tier 2 ore body, in order to advance under the Barrick Alliance. Tier 1 ore bodies are defined by Barrick as having 5 million ounce or greater potential with annual production of at least 500,000 ounces of gold for 10 years and Tier 2 ore bodies are defined as having 3 million ounce or greater potential with annual production of 300,000 ounces of gold for 10 years. The following projects were chosen by Barrick following a comprehensive program of field and data review, completed by senior Barrick and Japan Gold personnel:

John Proust, Chairman & CEO commented, "With the thorough evaluations completed by the Barrick Alliance, the Company now holds a comprehensive and unique data set on Japan's epithermal-gold districts and is well-positioned to advance areas of high-prospectivity which don't fit Barrick's criteria but may still host large high-grade gold deposits.We are internally evaluating all projects that Barrick did not select, which remain at an early stage of investigation but offer exploration potential, with a view to determining which to advance independently or by bringing in additional partners."

The following Figures 1–5 highlight the Barrick selections and changes to the Japan Gold portfolio:

Figure 1: Japan Gold Portfolio.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/5665/136038_b90e3a17741c5b8d_001full.jpg

Figure 2: Northeast Hokkaido.

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/5665/136038_b90e3a17741c5b8d_002full.jpg

Figure 3: Southwest Hokkaido.

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/5665/136038_b90e3a17741c5b8d_003full.jpg

Figure 4: Noto Peninsula, Honshu.

To view an enhanced version of Figure 4, please visit:

https://images.newsfilecorp.com/files/5665/136038_b90e3a17741c5b8d_004full.jpg

Figure 5: Japan Gold projects in the Hokusatsu region, Southern Kyushu.

To view an enhanced version of Figure 5, please visit:

https://images.newsfilecorp.com/files/5665/136038_b90e3a17741c5b8d_005full.jpg

On behalf of the Board of Japan Gold Corp.

"John Proust"

Chairman & CEO

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold Vice President of Exploration and Country Manager, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

About Japan Gold Corp.