Arturo Holmes

Arturo Holmes

As you know, great companies originate from founders’ garages. Lovesac (NASDAQ:LOVE) was founded in the living room of Sean Nelson, the current CEO. The company has come a long way from being a supplier of bean bags to the manufacturer of recognizable modular sofas with the best sales per square pound after Apple and Tiffany. Lovesac is showing strong Same-Store sales and selling space growth. Market size, low penetration, and strong positioning will enable the company to maintain strong growth in the coming years. Positive operating efficiency, a strong balance sheet, and solid cash from operations provide the company with a solid foundation for sustainable development and enable it to navigate any market turbulence successfully. LOVE trades at a huge discount to our estimate of fair market value. The upside potential we see is more than 100%. We rate shares as a Strong Buy.

Lovesac dates back to 1995 when 18-year-old Shawn Nelson saw an ad of bean bags and decided to create a giant version of them. Large sacs quickly found their audience, but sales through The Limited stores did not bring much money. In addition, Lovesac did not own the intellectual rights to the bags and had to compete with larger, more efficient manufacturers. An attempt to concentrate on direct-to-consumer sales, opening stores in sub-tier malls, and expanding product lines led the company to increase its debt burden and to Chapter 11 bankruptcy. Lovesac has been reorganized. They closed unprofitable stores, reduced product offerings, and vertically integrated their manufacturing process.

Company’s Presentation

Company’s Presentation

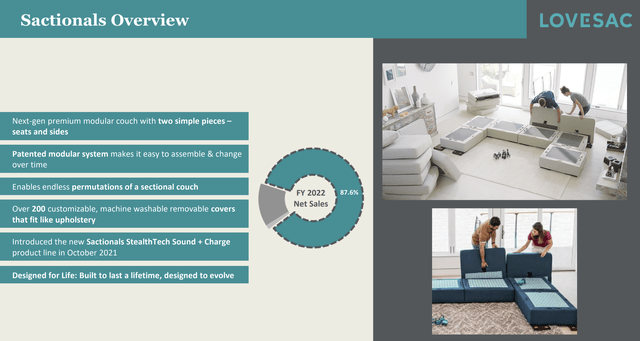

Launched during the restructuring, Sactionals, a modular sofa line that was initially seen as an ancillary product opened up a lot of room to grow. Today, Sactionals are Lovesac’s main offering, generating 87.6% of total revenue, while sacs account for 10.6%.

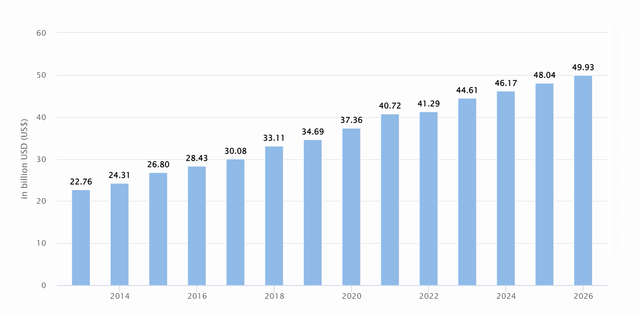

According to Statista, the Seats & Sofas market is valued at $41.29 billion in 2022 and is expected to grow at a CAGR of 4.86% until 2026. Over the years, Lovesac has maintained a double-digit sales growth rate and has been actively increasing its market share. However, the potential for further expansion is still huge, as with expected annual revenue of $653 million, the company’s market share will be about 1.6%.

Statista

Statista

Lovesac ended Q1 with 162 total showrooms versus 116 last year. The current number of stores is still small, providing the company with a lot of room for growth. If LOVE continues to open 46 stores a year with the current same-store sales, revenue through showrooms, its main sales channel, will grow at a double-digit rate through 2030.

Lovesac’s target audience is young, upper-middle-income clients committed to sustainable development values. They are less susceptible to inflation than buyers in the lower price bracket. At the same time, Lovesac must be recession-proof, as LOVE products are utilitarian in nature.

Sactionals are unique because they consist of only two components: the seat and the sides. The client can buy any quantity of each of the components and quickly assemble a sofa configuration that will fully meet his needs. Lovesac has learned the sacs’ lesson and has fully patented its version of the modular sofa, giving the company a competitive moat.

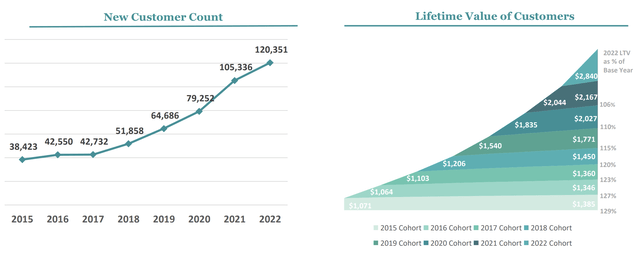

The unique offer allowed LOVE to form a recognizable brand and a loyal customer base. According to the company’s data, 41.6% of transactions are from repeat customers versus 35% a year earlier – an abnormally high figure for a furniture company. In addition, at a recent conference call, Shawn Nelson’s noted that almost a third of the company’s customers at the purchase stage say they learned about Lovesac from a friend or family member. Driven by a loyal and growing customer base, the CLV to CAC ratio has grown from around 4x to 5.3x over the past 12 months, despite a 48.9% increase in marketing spend. Notably, Lovesac has the industry’s best sales per square foot, surpassed only by Apple and Tiffany.

Company’s Presentation

Company’s Presentation

Thus, strong positioning not only provides the company with a solid foundation for growth in a highly fragmented and competitive market but also allows it to navigate through periods of economic turbulence more easily.

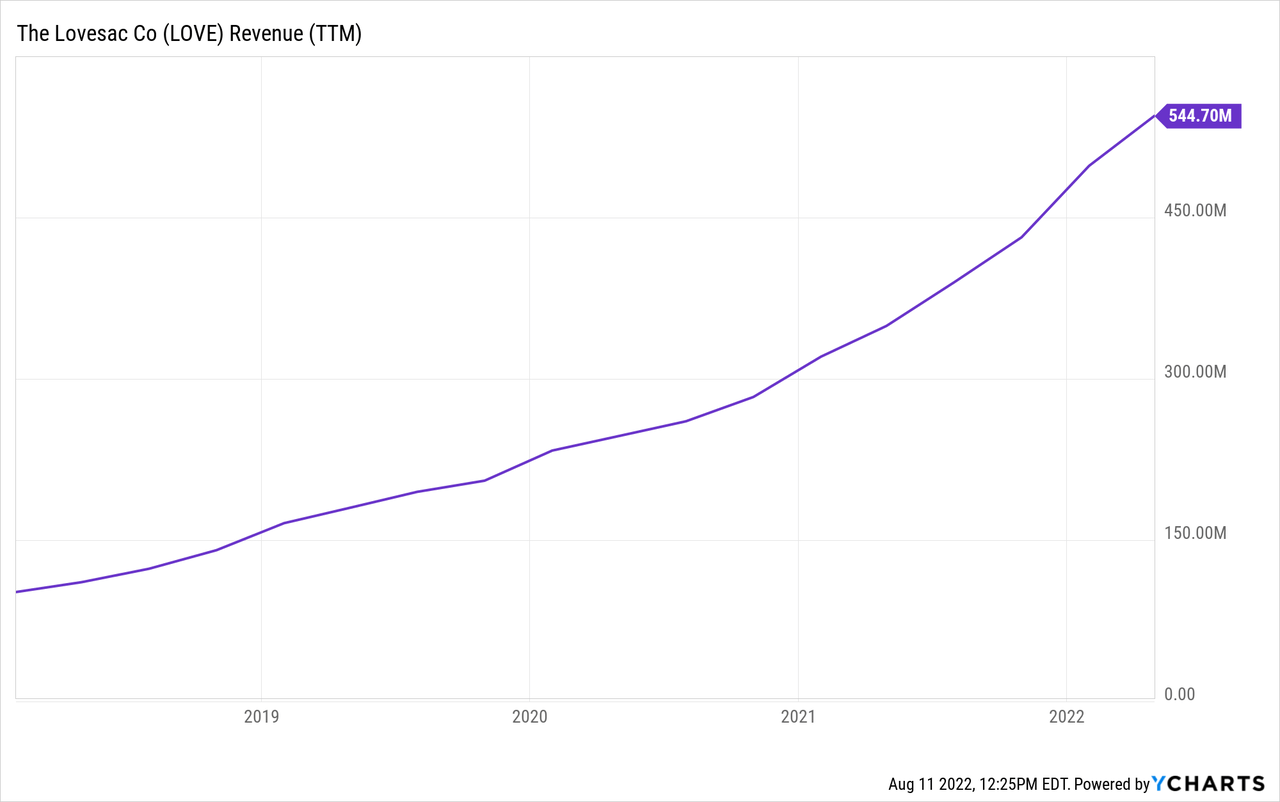

Lovesac posted strong revenue growth with no signs of slowing down. In the last reporting period, sales increased by 56% year-over-year to $129.4 million. Moreover, growth is both intensive and extensive. Market size, low penetration, and strong positioning will enable the company to maintain strong growth in the coming years.

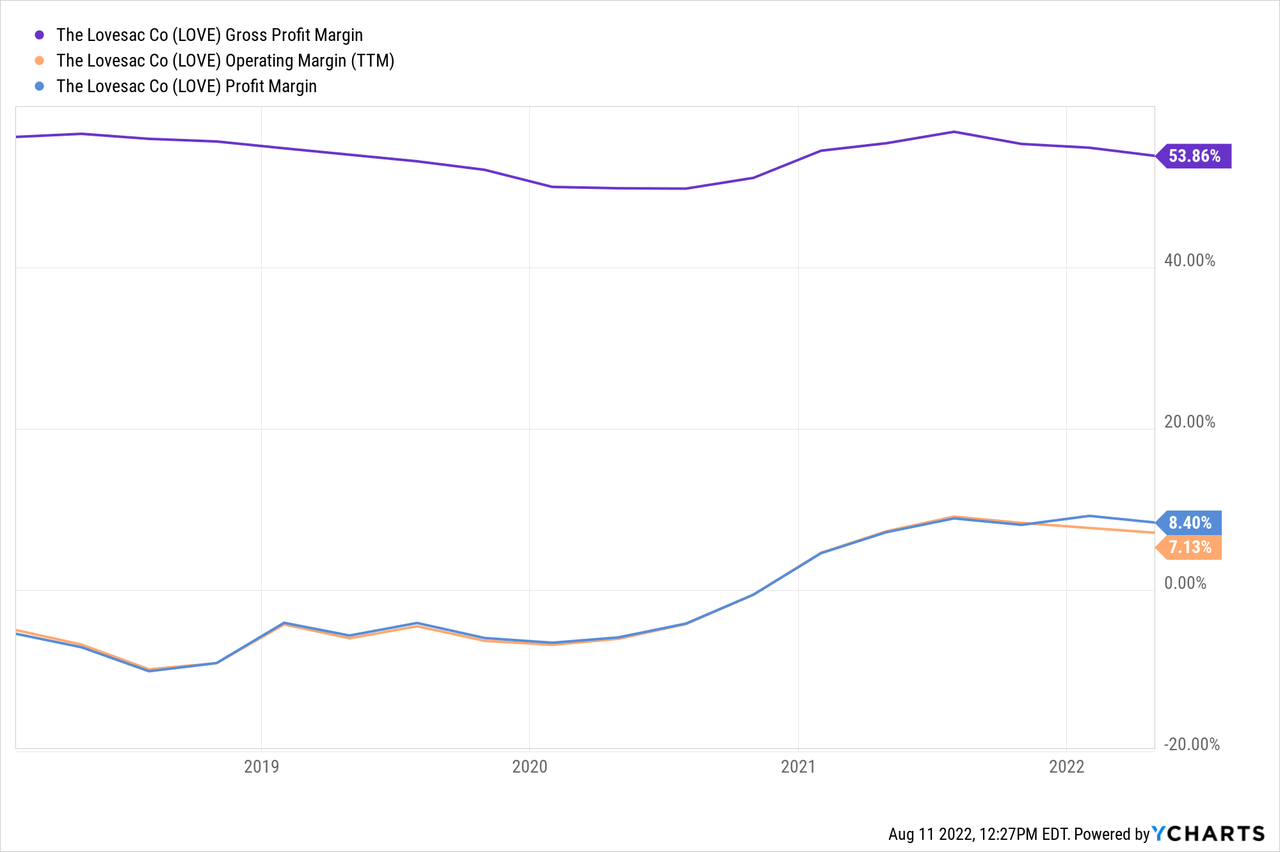

While gross margin is volatile, Lovesac is steadily improving its operating efficiency. Since the IPO four years ago, EBITDA has gone from negative to double digits. We expect the company to continue to improve profitability as the largest operating expense item, SG&A as a percentage of revenue is steadily declining (2020 – 42.1%, 2021 – 34.7%, 2022 – 32.5%), while the effectiveness of marketing expenses is growing, as evidenced by the ratio of CLV to CAC.

A strong balance sheet provides Lovesac with a solid foundation for sustainable development and allows it to successfully overcome deteriorating market conditions. In addition, despite the active expansion, LOVE generates solid cash from operations.

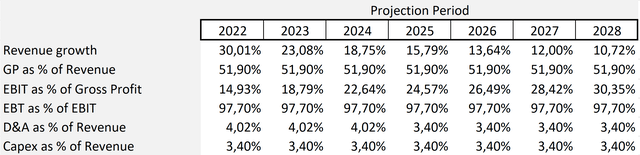

The DCF model is built on several assumptions. FY 2023 sales are expected to increase by $149.5 million. We assume that absolute revenue growth will remain at the current level until the end of the forecast period. This assumption looks quite conservative and below the Wall Street consensus. LOVE’s gross margin has always been volatile, we expect it to be about 52% until the end of the forecast period, in line with management’s guidance for 2023 but below the past five years’ average. We assume the company will continue to improve operating margins as it grows and realizes economies of scale. Management forecasts CapEx in the range of $20-22m for the year, our model includes the upper end of the range. The assumptions are presented below:

Created by the author

Created by the author

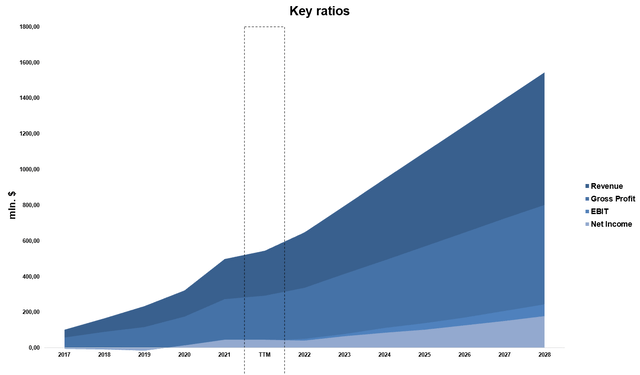

Based on the assumptions, the expected dynamics of key financial indicators are presented below:

Created by the author

Created by the author

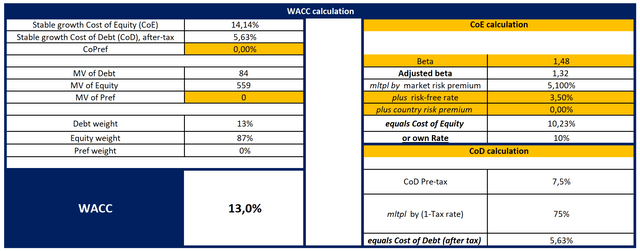

With the cost of equity equal to 14.14%, the Weighted Average Cost of Capital [WACC] is 13.0%.

Created by the author

Created by the author

With a Terminal EV/EBITDA of 6.2x, the model projects a fair market value of $1,183 million, or $78.4 per share, below the Wall Street consensus estimate of $91. The upside potential we see is about 107%.

You can see the model here.

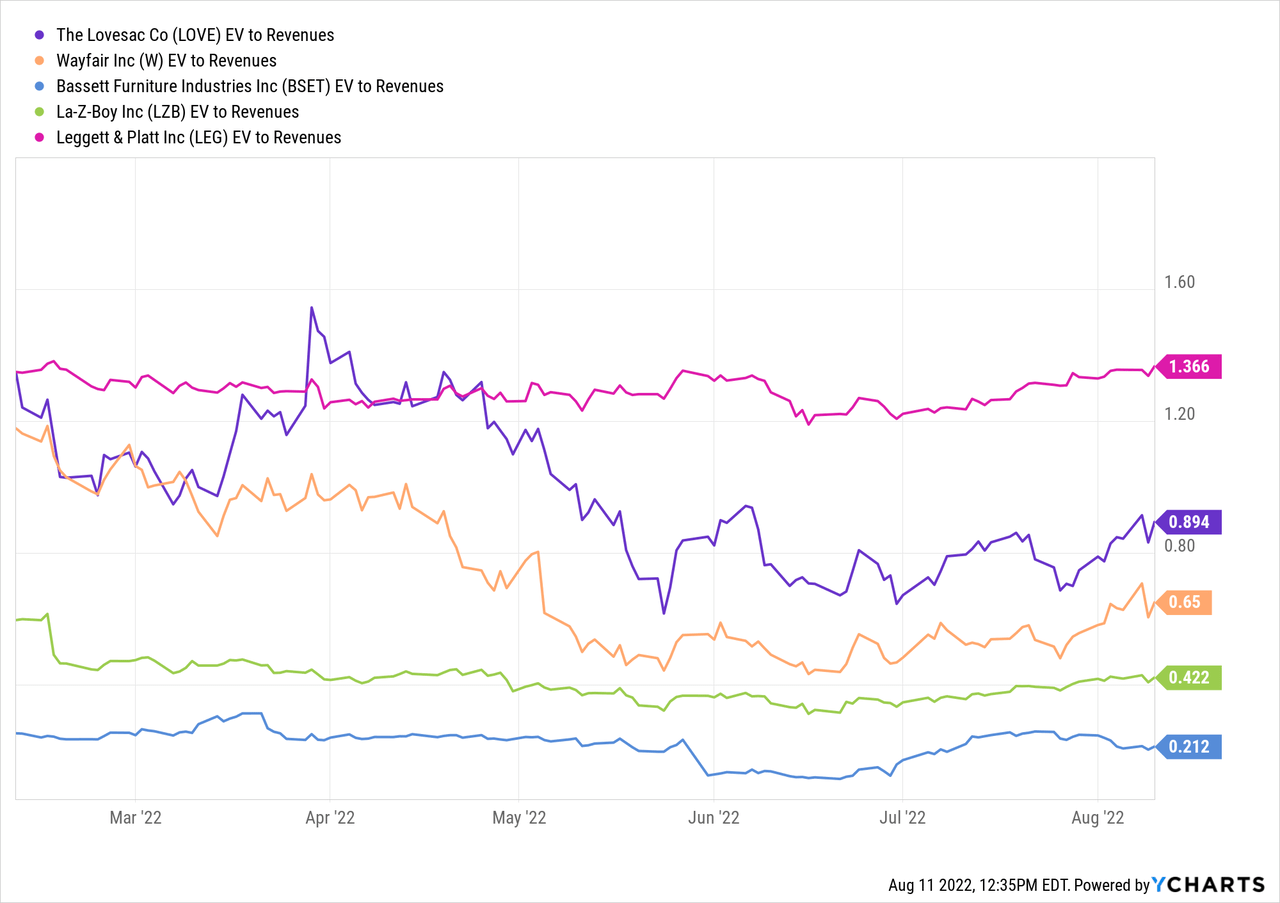

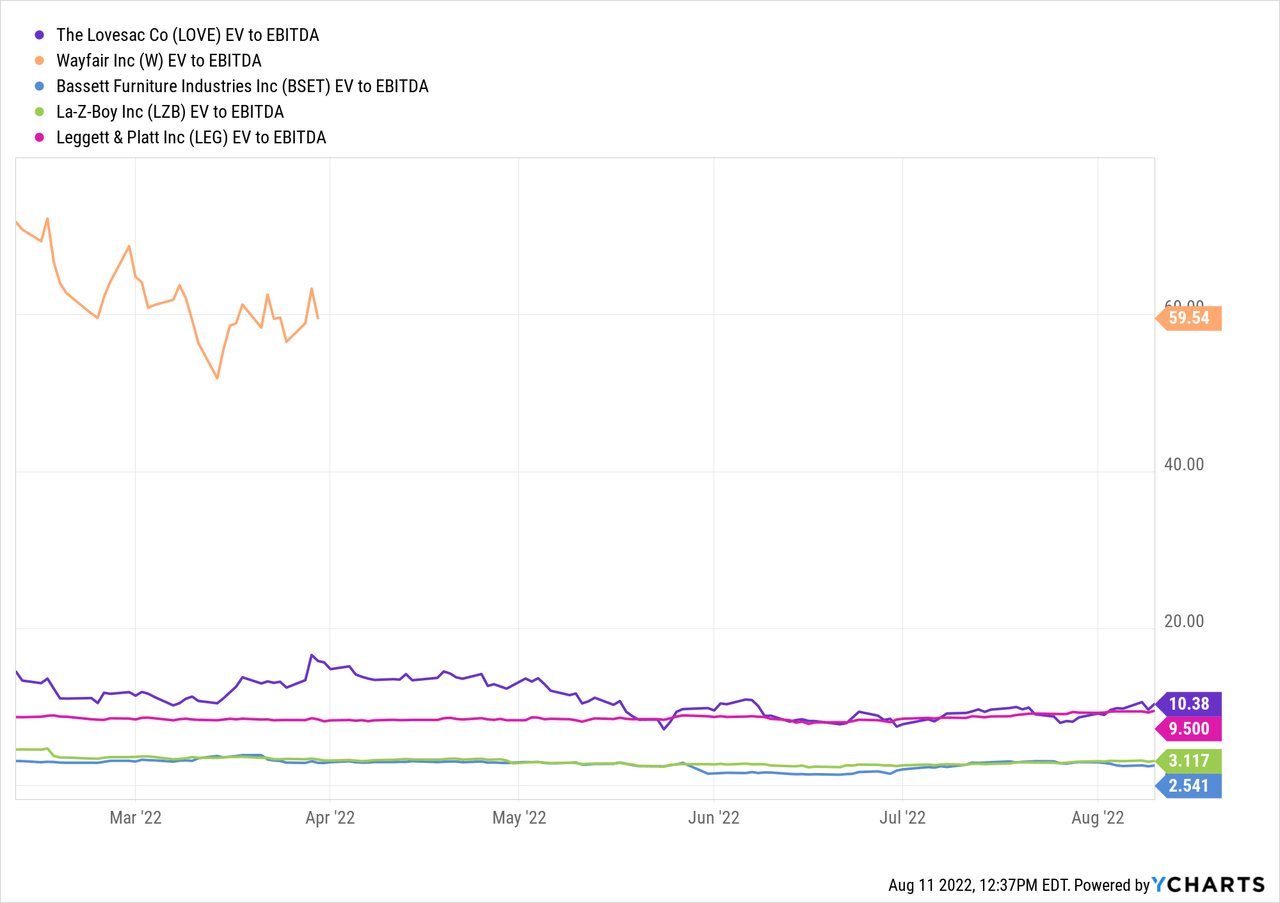

On a comparable basis, Lovesac trades at a premium to its peers. However, LOVE is the only company in the sample with a growth rate of over 50%.

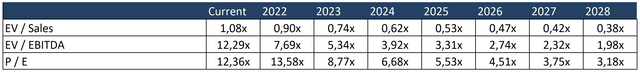

By forward multiples, LOVE looks extremely cheap.

Created by the author

Created by the author

Founded way back in 1995, Lovesac has gone through rough patches to reach a sustainable development trajectory. A loyal customer base and strong brand positioning will enable Lovesac to maintain double-digit growth in a huge and highly fragmented market. While gross margins are volatile, Lovesac has been steadily improving its operating efficiency and is likely to continue to do so. According to our valuation, the company is trading at a significant discount to its fair market value. We are bullish on LOVE.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.