Irina Kashaeva/iStock via Getty Images

Irina Kashaeva/iStock via Getty Images

Manhattan Associates, Inc. (NASDAQ:MANH) reported beneficial guidance and double-digit sales growth. Management is also repurchasing its own stock. In my opinion, with further investment in research and development, geographical expansion, and more M&A activities, MANH’s stock price will likely reach higher price marks. There are obviously many risks, and the stock is not for very conservative investors. All the rest will likely appreciate Manhattan’s business model.

Manhattan Associates offers software solutions to run unified omnichannel commerce and digital supply chain operations to a variety of well-known clients.

It is worth mentioning that MANH operates in very different industries, resultantly offering significant diversification. MANH works for manufacturing clients, wholesale, medical, and pharmaceutical among other sectors.

Company’s Website

Company’s Website

In my view, what makes MANH a must-follow stock is the company’s network of partners. Keep in mind that large partners in the software industry are offering the company’s solutions to their clients. As a result, in my view, MANH may be receiving a lot of visibility and a massive customer base.

Company’s Website – Partners

Company’s Website – Partners

There is another interesting feature that encouraged me to research MANH. The company recently approved to repurchase its stock from the market. I believe that the Board of Directors usually do not approve repurchase plans when their stock is expensive.

During the three months ended June 30, 2022, the Company repurchased 416,558 shares of Manhattan Associates common stock under the share repurchase program authorized by our Board of Directors for a total investment of $50.1 million. In July 2022, our Board of Directors approved raising the Company’s remaining share repurchase authority to an aggregate of $75.0 million of our common stock. Source

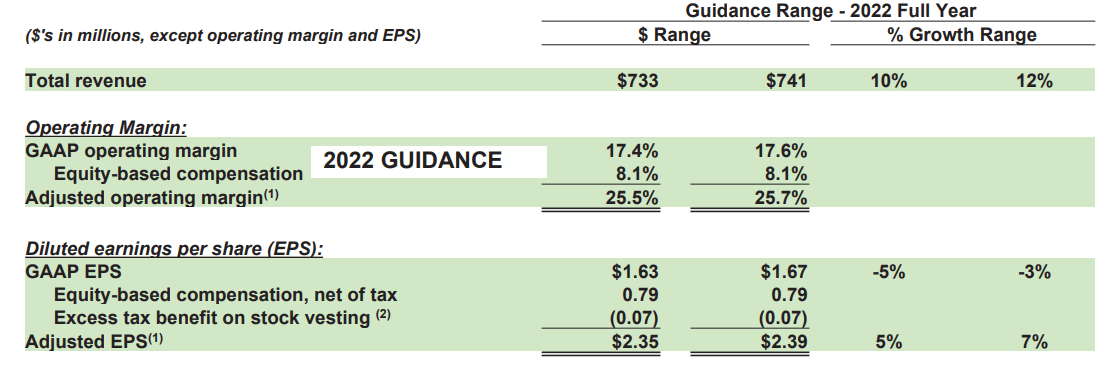

In the last quarterly release, MANH delivered a very beneficial guidance, which I want to discuss. According to management, even considering the current global macro environment, it is beneficial that cloud-native solutions’ demand continues to trend higher.

While we continue to operate in a turbulent global macro environment, our teams are executing very well for our customers, and demand for our cloud-native solutions remains robust. With our business fundamentals strengthening and revenue visibility increasing, we are again raising our 2022 guidance. Source: Press Release

The guidance for the year 2022 includes total revenue up to $741 million, an adjusted operating margin around 25.7%, and positive earnings per share. Notice that sales growth could reach even 12%.

Press Release

Press Release

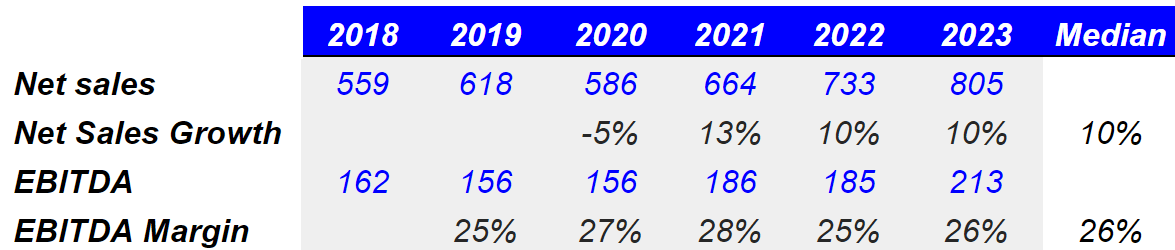

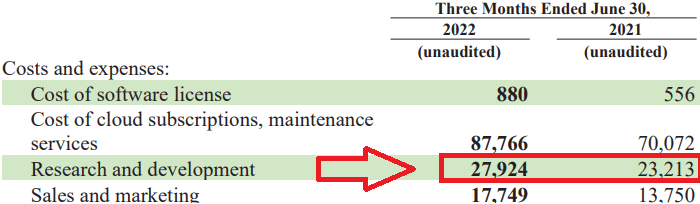

Investment analysts are also expecting double digit sales growth in 2022 and 2023 in addition to an EBITDA margin close to 26%. I used some of these numbers in my DCF model.

Work From Other Analysts

Work From Other Analysts

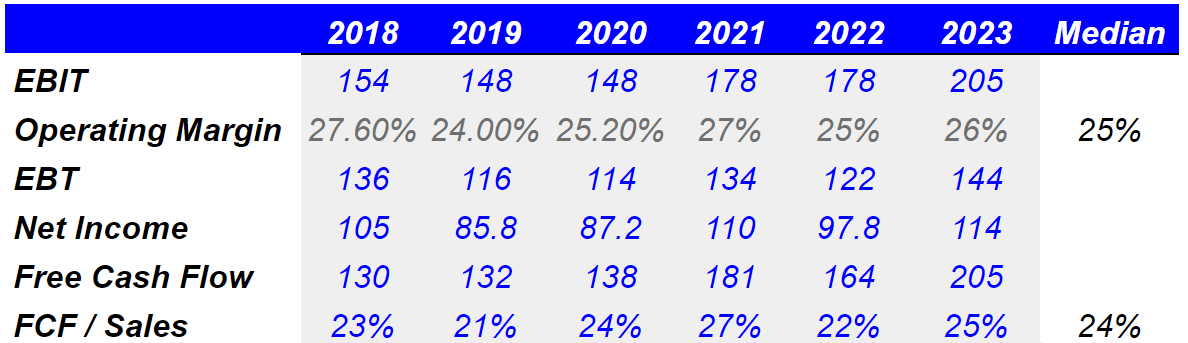

Finally, according to other analysts, the operating margin would stand at close to 25%-26%. The free cash flow would grow from $164 million in 2022 to $205 million in 2023.

Work From Other Analysts

Work From Other Analysts

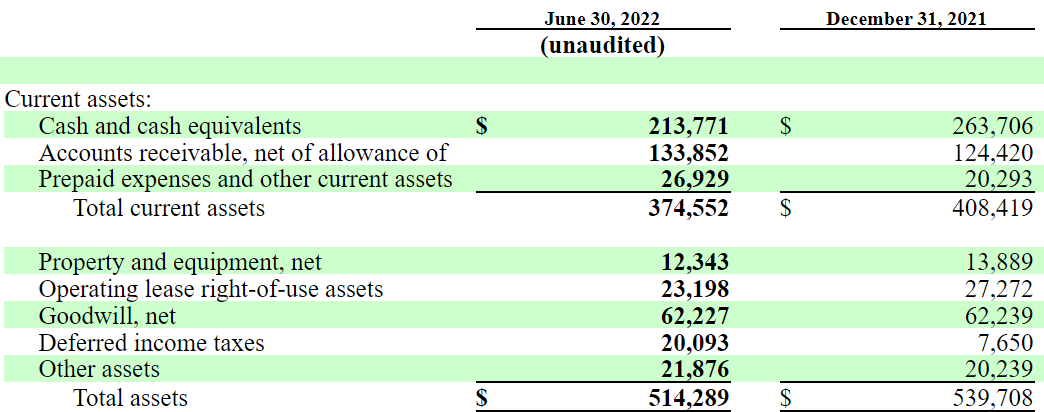

As of June 30, 2022, MANH reported $213 million in cash, $514 million in total assets, and an asset/liability ratio of 1.5x-2x. Goodwill stands at $62 million, which means that MANH does have expertise in the M&A markets. In my view, new successful acquisitions could significantly enhance future sales growth.

10-Q

10-Q

It is also quite beneficial that MANH does not report financial debt. The company only reports operating lease liabilities worth $18 million. The most important liability is deferred revenue, which stands at $178 million. It means that customers are financing the operations of MANH.

10-Q

10-Q

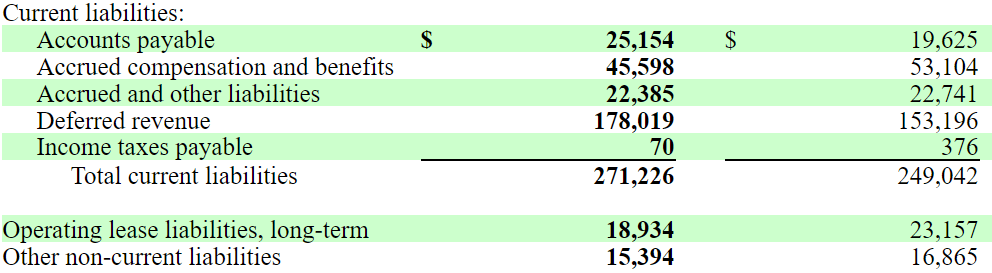

Under my base case scenario, I assumed that MANH will successfully invest in research and development, which will likely enhance the company’s software portfolio. Considering that MANH has a rich customer base, if management enhances its current offerings, and adapts to new customer needs, revenue growth will likely increase. Keep in mind that existing clients may be willing to pay a bit more for better services.

I also believe that MANH’s constant connections with different partners in different industries and solution user groups will likely enhance the generation of new innovations.

In my view, research and development will likely help MANH because management appears to be increasing the amount of R&D expenses. If research and development was not working, I don’t think management would increase R&D expenses.

10-Q

10-Q

In my view, the internationalization of the company’s business will likely help the company push revenue growth up. Notice that MANH is already in many countries in Europe, Asia, South Africa, and Asia. It means that management has expertise in going abroad. I would be expecting more offices in new countries in the coming years:

We have offices in Australia, Chile, China, France, Germany, India, Italy, Japan, the Netherlands, Singapore, Spain, and the United Kingdom, as well as representatives in Mexico and reseller partnerships in Latin America, Eastern Europe, the Middle East, South Africa, and Asia. Source: 10-k

The company’s solutions are sold through multi-year cloud subscription arrangements. It means that the company obtains a regular revenue stream that is also predictable. With this in mind, I believe that using a discounted cash flow model to assess the valuation makes sense.

Manhattan Active solutions are sold directly in multi-year cloud subscription arrangements, typically for a period of five years or more, providing clients with regular software updates during the contract period to ensure access to the latest product features and benefiting Manhattan with a highly predictable and regular revenue stream. Source: 10-k

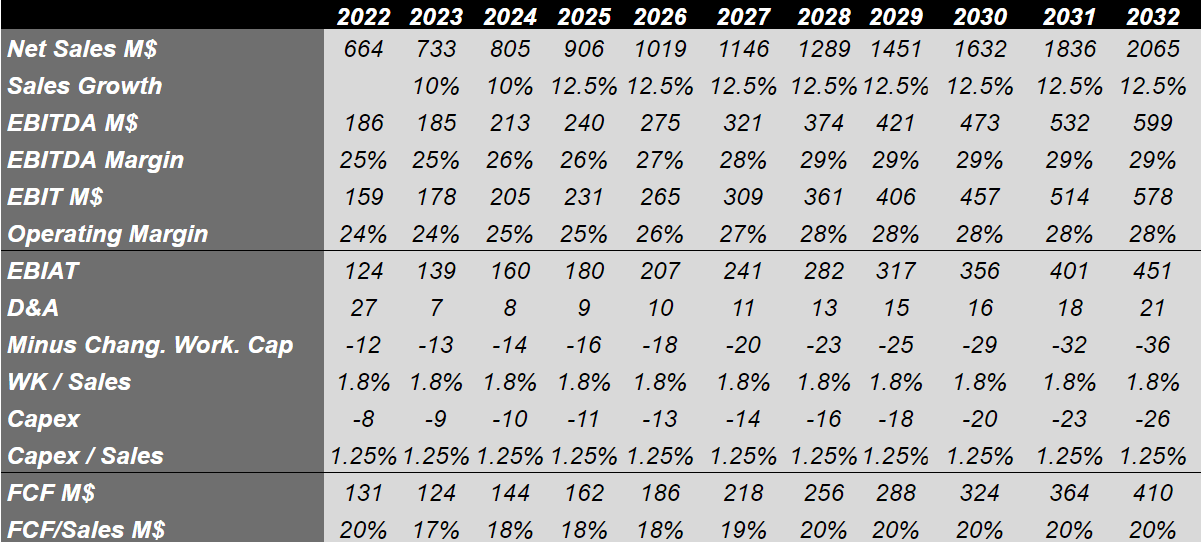

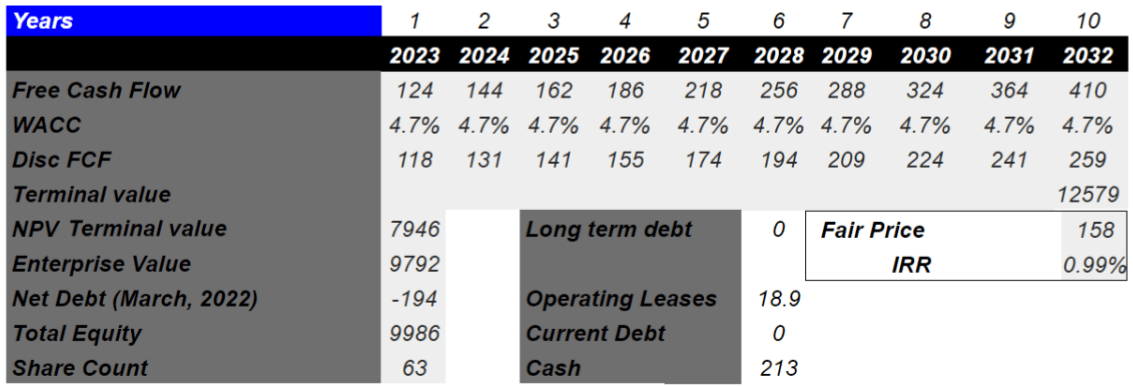

Under the previous conditions, I included sales growth around 10%-12.5% and an EBITDA margin around 26% and 29%. In my view, in this scenario, my figures are conservative. Also, considering a capex/sales ratio of 1.2% and changes in working capital/sales of 1.8%, 2032 free cash flow would stand at close to $400-$410 million.

My DCF Model

My DCF Model

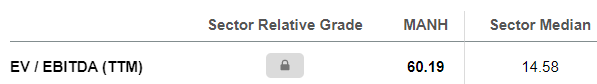

With a projection of free cash flow for the next ten years, a discount of 4.7% and an exit multiple of 21x EBITDA, the implied enterprise value would equal $9.7 billion. Note that the company appears to be trading right now at 60x EBITDA, but the sector trades at 14.5x EBITDA. With these figures in mind, in my opinion, 21x EBITDA appears conservative.

SA

SA

I obtained the enterprise value after summing the discounted terminal value of $7.9 billion and the sum of future free cash flows. If we subtract the net debt of -$194 million, the equity valuation would equal $9.9 billion. Finally, if we assume a share count of 63 million, the fair price would be $158 per share.

My DCF Model

My DCF Model

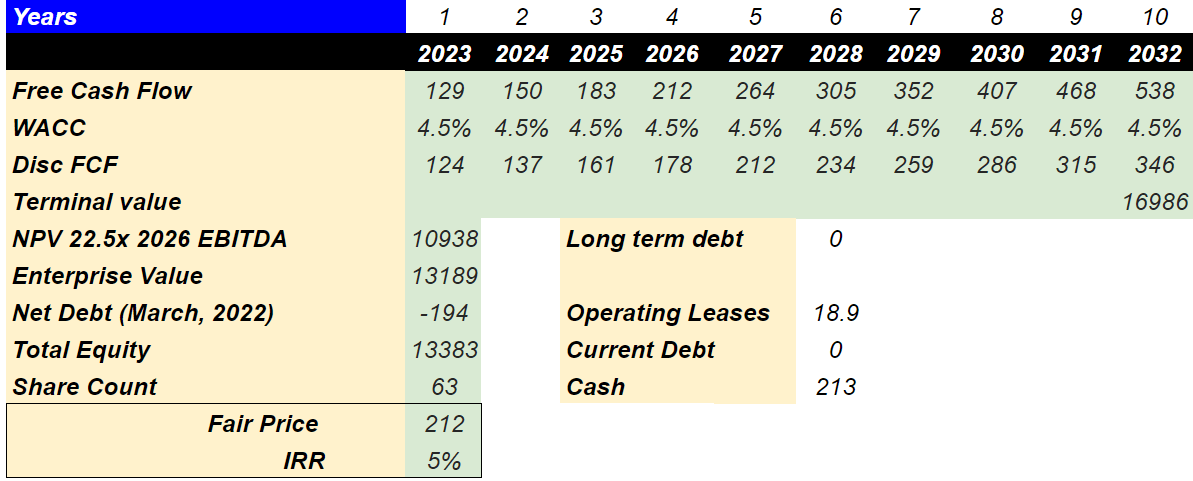

Under my best case scenario, the company would reach agreements with many new industry-leading consultants and software systems implementers. The new alliances will help the company increase market coverage, and revenue growth could trend higher.

I also assumed that management would start an ambitious M&A plan, under which many new targets will be acquired every year. Notice that management is currently looking for companies that will increase its presence in new markets, and complement MANH’s solutions:

Preferred acquisition targets are those that would complement our existing solutions and technologies, expand our geographic presence and distribution channels, extend our presence into additional vertical markets with challenges and requirements similar to those we currently serve, and further solidify our leadership position within the primary components of supply chain planning and execution. Source: 10-k

I believe that from 2024 to 2032, with sufficient acquisitions, MANH sales growth could reach close to 15%. I also assumed that as the economies of scale play a major role, the EBITDA margin could reach 30% in 2032. My results include 2032 EBIAT of $569 million, D&A of $25 million, and 2032 FCF of more than $535 million.

My DCF Model

My DCF Model

With a WACC of 4.5% and an exit multiple of 22.5x, the discounted terminal value would be $10 billion, and the equity valuation could reach $13 billion. Finally, we would be talking about a fair price of $212 per share.

My DCF Model

My DCF Model

MANH offers services that may fail in many different ways. Software bugs, cloud hosting service failures, or security breaches could be a disaster for certain clients that require constant interaction with their customers. As a result, management may be subject to liability claims or damages. The company may suffer a lack of reputation, and some clients may leave the firm. Under this scenario, I expect that some of these issues would occur, and may reduce the company’s revenue growth.

Often, MANH signs agreements and offers services for eight to nine months, so the company’s sales cycle could be long. In the worst case scenario, management may have to make investments in sales expenditures to capture revenue that may appear many months later, or may not appear at all. Management warned about these risks in the annual report:

We may incur substantial sales and marketing expenses and expend significant management effort during this time, regardless of whether we make a sale. Many of the key risks relating to sales processes are beyond our control, including: our customers’ budgetary and scheduling constraints; the timing of our customers’ budget cycles and approval processes; our customers’ willingness to replace their currently deployed software solutions; and general economic conditions. Source: 10-k

Finally, let’s note that MANH operates in an industry, in which technological changes happen pretty fast. It could happen that new competitors offer better software than MANH. Besides, the company may have to reduce its prices because there are many peers in the market. In any case, management would suffer a decrease in revenue, which may lead to a decline in the company’s stock valuation.

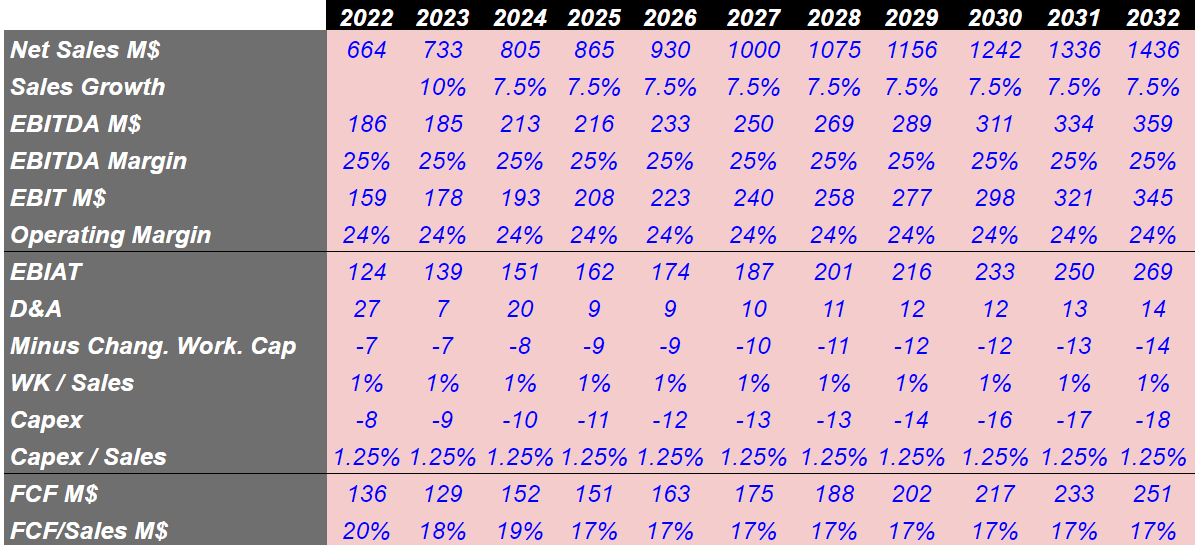

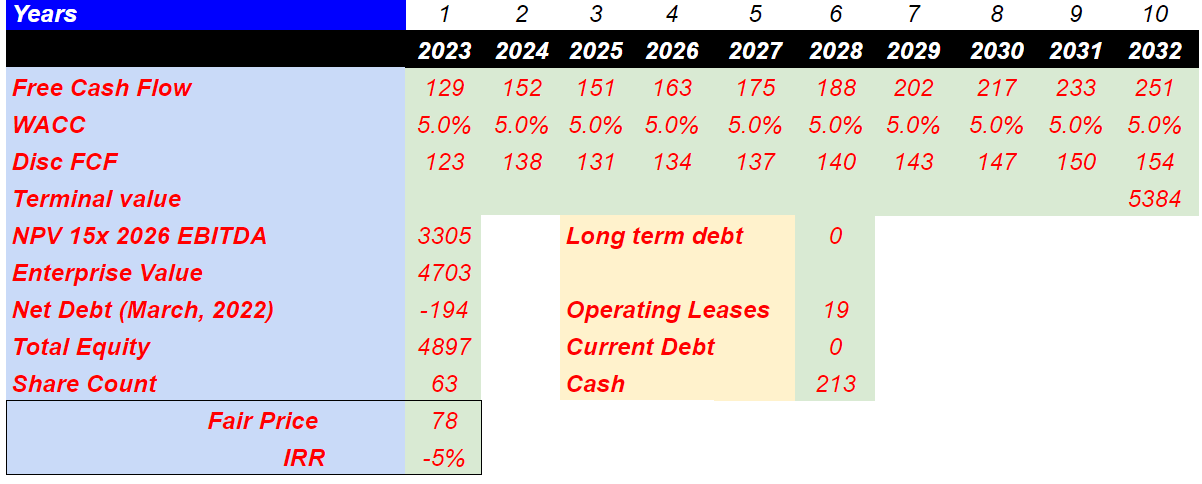

Under very detrimental conditions, sales growth could stay close to 10%-7.5%, and EBITDA margin could stay at around 25%. I also assumed changes in working capital/sales of 1% and capex/sales of 1.25%. My results included 2032 free cash flow close to $250 million, which is significantly lower than that in the previous case scenario.

My DCF Model

My DCF Model

With a discount around 5%, the net present value of the terminal value would stand at $3.305 billion. If we sum the discounted free cash flow from 2023 to 2032, the enterprise value would be $4.7 billion. Finally, if we subtract the net debt, and divide by the share count, the implied price would be $78 per share.

My DCF Model

My DCF Model

With large partners, beneficial guidance, and more repurchase stock plans, Manhattan Associates appears to be really working for shareholders. Under my own financial models, I believe that new acquisitions, more successful research and development, and geographic expansion could push the stock price north. There are obviously some risks, and the stock may not be for very conservative individuals. However, my DCF models indicate that considering the current market price, there is an upside potential.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MANH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.