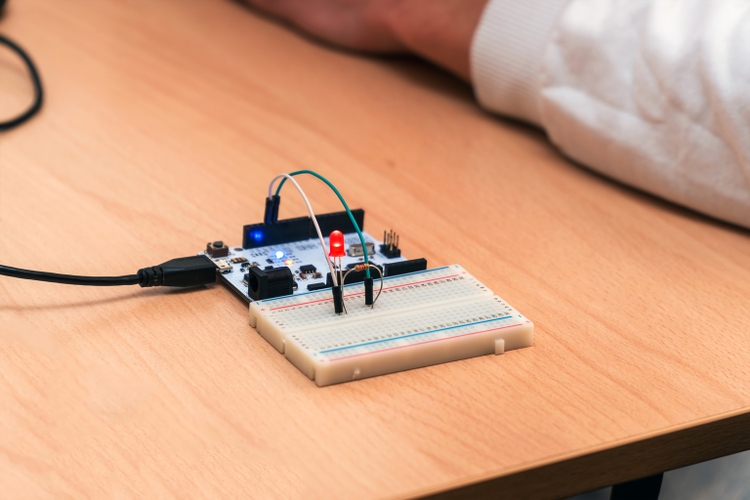

Pro2sound/iStock via Getty Images

Pro2sound/iStock via Getty Images

Microchip Technology (NASDAQ:MCHP) has been one of the dominant players in the production of microcontrollers for decades. Over those decades the use of microcontrollers, essentially small computers that can control external electrical circuits, has grown continuously. They are now found in almost every appliance, while electric cars use even more of them than gas powered models. Microchip has a huge order backlog. Its revenue is growing rapidly. It has long paid a dividend, which it has also been boosting lately. While the company is not without risk, I believe it is not just a safe stock, but a good Buy at the current price. This article will review March quarter results and then explain why the stock price is highly likely to appreciate for at least a couple of years. Downside risks will be pointed out, too.

Microchip’s March quarter results were released on May 9, 2022. Note the quarter is the fourth fiscal quarter of 2022, and full fiscal year 2022 results were also released. Revenue of $1.84 billion was up 25% from $1.47 billion year-earlier. GAAP net income was $438 million, up 24% sequentially from $353 million, and up 278% from $116 million in the year-earlier quarter. GAAP EPS (diluted earnings per share) were $0.77, up 24% sequentially from $0.62, and up 267% from $0.21 year-earlier. The company also gave non-GAAP results of net income of $764 million, up 47% y/y, with a resulting EPS of $1.35, up 45% y/y. For profit growth rates I prefer the non-GAAP results, which eliminate one-time and non-cash items. Either way, revenue and profit growth were rapid over the last year.

Microchip reported that its backlog of orders reached a record high. Lead times for shipping orders remained stretched. Microchip’s costs were affected by inflation, and it did increase some of its own prices, contributing to a record gross margin of 66.2%. However, the main reason for the record gross margin was the high volume of business, while SG&A expense was held to just $187 million. Microchip has always operated very efficiently.

Of course, no one knows what the demand for microcontrollers in general, or Microchip’s specific controllers specifically, will be for the rest of 2022 or in 2023. However, the trends are pretty clear. The general trend towards higher use of microcontrollers and analog chips in the global economy would only slow if there is a global recession. Even then it might take a couple of quarters for production to catch up with demand and fill in the order backlog. More likely, demand will ramp faster than Microchip can increase production as various economic constraints ease. Car manufacturers want to produce more vehicles, and to change over to electric vehicles. Other forms of production of goods incorporating the microcontrollers have also been constrained. Sadly, the production of armaments is gearing up because of the Russia-Ukraine war, and armaments tend to incorporate a lot of microcontrollers.

Microchip began ramping up production capacity back in late 2020, as demand resurged. It has not been able to keep to its plan on its own capacity expansion. Reasons cited include supply chain issues of its own. Anecdotally, some of the equipment it wants to buy to make silicon chips has been constrained by the lack of microcontrollers needed in that equipment! Another constraint has been hiring qualified employees. In the March quarter Microchip did invest $115 million in new capacity, but that was below plan and the incomplete investment had to be rolled forward to the current quarter.

Competition can be an issue, but the industry has tended towards consolidation this last decade, for instance with the Microchip acquisition of Microsemi. While some chips can be considered interchangeable with regard to function, usually an engineer cannot just pop a chip out of a socket, pop in a competitor’s, and expect it to work. In addition to possible pin incompatibilities, program code needs to be rewritten or at least verified. Changes between competitors tend to occur when new functions are needed. Microchip uses capital to support new, fast-growing products. Every quarter there are a variety of new products announced.

Microchip has been focusing on paying down debt since it financed the purchase of Microsemi back in 2018. It ended the quarter with long term debt of about $7.69 billion, after paying down $206 million in the quarter. That was out of operating cash flow of $748 million. Cash and investments ended at $319 million. In the quarter $141 million was paid out in dividends and $160 million was used for stock repurchases. Stock repurchases in the June quarter are expected to be about $195 million.

For years Microchip increased its dividend each quarter, but only by a fraction of a cent. As a result, the yield per share dropped as the stock price rose. In the last year dividend increases have been more rapid. For shareholders of record on May 20, the dividend will be $0.276, to be paid on June 3, 2022. At that rate, at the May 18, 2022, closing price of $66.14, the yield is 1.67%. However, the company plans to continue to increase the dividend over time. It is a growth stock more than a dividend stock, but if you have held the company for a long time, the dividend yield on the old shares is quite impressive.

A train wreck for Microchip Technologies is not likely unless we get into a global depression or world war. I have owned the stock since 2006 and have seen that the company has always been well-managed, with considerable care taken to anticipate end market demand and provide returns for shareholders. As of Wednesday, May 18, 2022, the closing price was $66.14. That is close to the 52-week low of $63.34 and far off the 52-week high of $90.00. I believe the decline from the high is due to the decline of tech stock indexes and chip stocks in particular. While microcontroller demand can be somewhat cyclical, I see no reason for a decline before 2024. If there is a decline, that would allow Microchip to cut back on capital investment and replenish its own and its distributor’s inventories. I see it currently at an attractive price point for long-term investors. I added more to my own portfolio on May 16, 2022.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MCHP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.