Jean-Luc Ichard

Jean-Luc Ichard

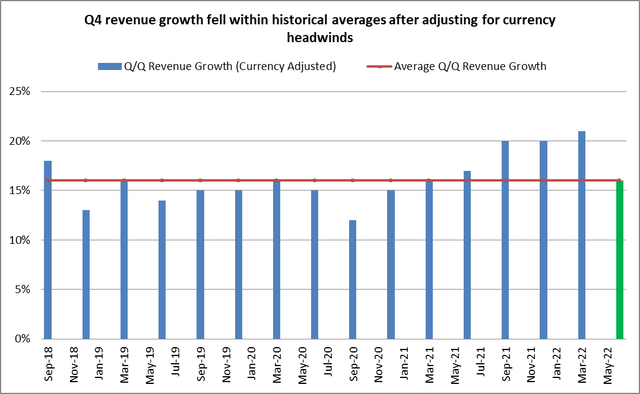

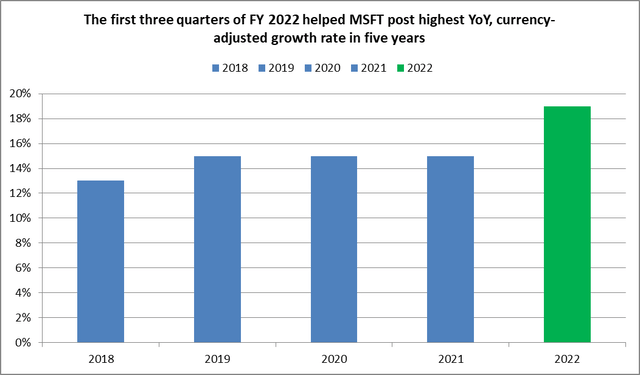

Microsoft Corporation (NASDAQ:MSFT) rebounded nicely last week, despite its revenue and EPS miss, with the market quickly realizing its resilience in the face of the current macroeconomic challenges. After adjusting for currency headwinds, Q4 (three months ended June) growth fell within historical averages, even after incorporating the strong momentum in the first three quarters of FY 2022, a performance that helped the company deliver its best yearly results in five years. The tech giant remains a top horse in the envisioned future of deeper and accelerated digital transformation trends.

Author’s estimates based on MSFT filings

Author’s estimates based on MSFT filings

Author’s estimates based on MSFT filings

Author’s estimates based on MSFT filings

Beyond currency headwinds, the company saw soft sales in some consumer-facing segments, including gaming (Xbox hardware and content) and Windows licenses, as consumers cut on discretionary spending in the face of the rising cost of living. These challenges were offset by accelerated growth in its cloud and MS Office divisions. Below is a discussion of MSFT’s major segments’ performance and market position.

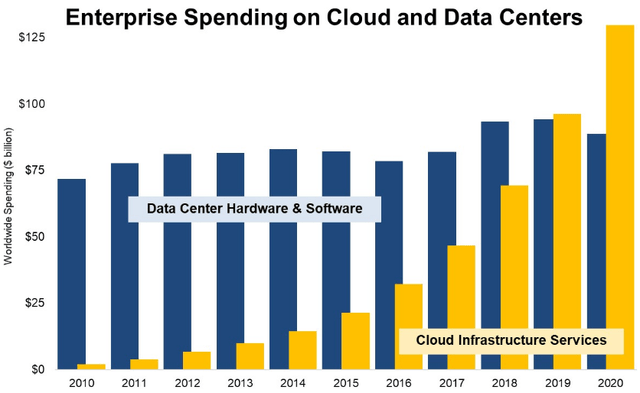

MSFT has a sizable opportunity in the cloud market, stemming from an exponential growth in data generation, storage, and processing, providing supportive revenue tailwinds for years to come. The market is largely unpenetrated, with enterprise cloud spending exceeding that for on-premise servers only in 2020, leaving much room to grow. The industry’s high growth mirror these dynamics. For example, MSFT, Amazon (AMZN), and Alphabet (GOOG, GOOGL) reported 40%, 35%, and 33% growth for Azure, AWS, and Google Cloud, respectively, in the three months ending June 2022.

Synergy Research Group

Synergy Research Group

AWS is currently the cloud market leader in terms of revenue and, arguably, market influence. Unlike MSFT and other cloud providers, AMZN manufactures its own microchips, called Graviton, giving it an edge over the competition, primarily using chips from Intel (INTC) (78% market share) and Advanced Micro Devices (AMD) (21% market share).

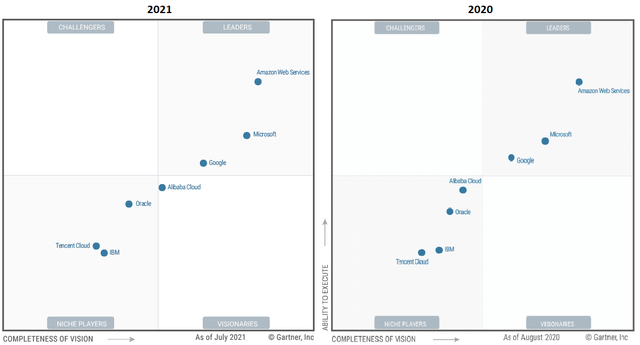

Being second place in terms of market influence and leadership is not an ideal situation for MSFT, given the sizable contribution of Azure to top-line revenue. However, I believe this gap is narrowing, as shown in the Gartner Magic Quadrant graph for 2020 and 2021:

Image edited by author to enhance visibility. Gartner.

Image edited by author to enhance visibility. Gartner.

Azure also has some specific advantages over AWS, including the broadest IT capabilities inherited from its leading position in the global digital infrastructure.

In my view, MS Office is the company’s most successful app Suite, generating nearly a quarter of revenue. It includes some of the most popular productivity apps, including Word, Excel, and PowerPoint.

Realizing a maturing market in the Office segment, MSFT resorted to new product and pricing strategies to achieve growth. For example, customers continue migrating to Office 365, the subscription-based version of MS Office. To facilitate this trend, MSFT cut its Long-Term Servicing agreement from 10 to 5 years last year, as now mirrored on the company’s website. End of Servicing often leads to higher sales as customers flock to buy the upgraded versions, pushed by MSFT’s security warnings for unserviced software. Next year, MSFT will end the support for MS Office 2013, a major product release, which I expect will generate meaningful growth, in line with October 2020’s End Of Service for Office 2010, which created a spike in Q2 (three months ended December 2020) Office sales.

Windows sales declined in Q4 as consumers tightened their belts on discretionary spending in the face of rising living costs. The primary distribution channel of Windows remains third-party OEMs such as Dell (DELL) and HP (HPQ). MSFT continues to expand its PC hardware products, creating a cannibalistic effect on its Windows OEM sales, which should boost sales but not margins.

From a competitive viewpoint, I believe that MSFT is positioned to increase its market share in the PC market this year. Dell, HPQ, and MSFT have a more comprehensive pricing range than Apple (AAPL), its primary rival, allowing MSFT to capture the increasing number of customers looking to budget PCs in light of current economic challenges.

Gaming sales declined 5%, driven by the same consumer dynamics affecting Windows OEM sales. Xbox and PlayStation have almost an equal market share, notwithstanding the former’s slightly higher sales this year.

The Activision Blizzard (ATVI) acquisition remains under anti-trust review as regulators continue their crackdown on marketplace monopoly. Earlier this year, courts dismissed the U.S. attorney’s case against AMZN because of the narrow scope of current laws, making them ineffective in addressing the monopolistic practices of marketplace providers, including Xbox. However, lawmakers responded with two bills, one in the Senate and one in the Lower House, to change the law, making a case win almost certain next time regulators come after platform providers.

Some members of Congress stated that marketplace providers should not sell their own products on their platforms, but, from my understanding, discussions mainly revolve around ways to level the playing field between tech giants and smaller firms using their platforms and marketplaces.

MSFT estimates that the ATVI deal to close in June 2023. Until then, I expect the company’s lawyers to argue based on consumer behavior in the gaming industry, characterized by the continuous pursuit of new gaming experiences, enhanced by rapid and periodic console upgrades carrying higher processing power, making it difficult to hold a dominant market position for too long without innovating and introducing new products.

However, neither investors nor the FTC will ignore the efforts of Studios, including Xbox and PlayStation Gaming Studios, to manipulate consumers into long-term engagement in their games, tempering the desire and frequency in which a gamer switches games. For example, ATVI still generates more than 80% of its revenue ($8.3 billion TTM) from World of Warcraft, Call of Duty, and Candy Crush, initially released in 2004, 2003, and 2012.

Forward P/E now stands at 26x, translating to 3.8% earnings yield, out of which 0.9% is distributed to shareholders through dividends, and 1.6% is returned in the form of share buybacks. Based on these figures, it would take more than 25 years for shareholders to recover their capital fully (assuming constant price multiples.) That’s not exactly an exciting proposition. For this reason, growth remains a fundamental element in MSFT’s investment thesis.

One can hardly think about a future without deeper digitalization. MSFT is central to this vision, boding well for revenue growth, but the question is, how long do investors have to wait? I believe less than three years.

Let’s assume that the long-run P/E ratio for MSFT is 15x. To achieve this target, MSFT must double its net income from 72 billion to 140 billion. Is this achievable? Yes?

Currently, the company records a 37% profit margin. Assuming 8% margin improvements from economies of scale, MSFT would need to increase revenue to $280 billion from current levels of $198 billion, representing 41% growth. Last year, the company grew revenue by 16%, and Wall Street expectations forecast $252 billion in revenue by 2024. Thus, within three years, I believe MSFT will be trading at 15x, in the unlikely event that shares don’t go up, an attractive proposition for long-term shareholders willing to look beyond current market disruptions.

Last quarter MSFT demonstrated resilience in the face of macroeconomic challenges. Beyond currency headwinds and softening demand in consumer-facing segments, the company maintains a strong market position in the global digital infrastructure, rendering the tech giant a top bet on the envisioned future of accelerated and deepening digital transformation trends.

Cloud computing represents a key growth opportunity for MSFT in the coming years. Being second place behind AWS is not ideal, given the strategic importance of the cloud, but it shouldn’t be a source of alarm. The gap is closing, and MSFT remains the broadest ecosystem for cloud developers.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.