NSSF Managing Director, Richard Byarugaba

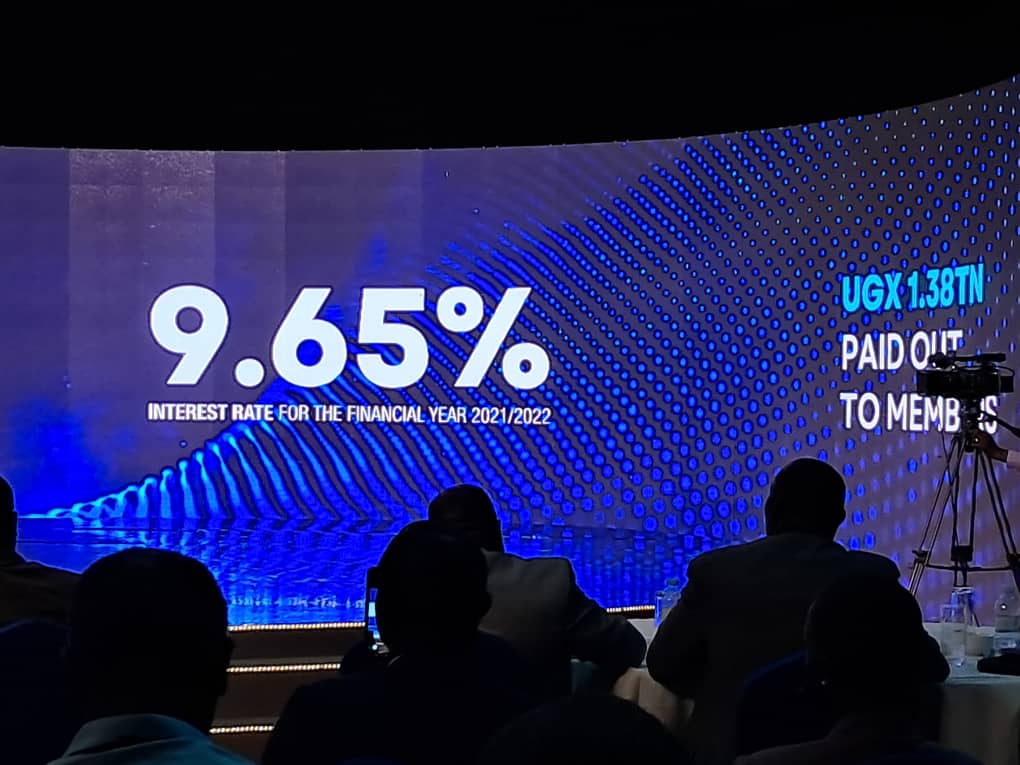

The National Social Security Fund (NSSF) has declared a 9.65% interest payment to its members for the Financial Year 2021/22.

Hon. Henry Musasizi, the Minister of State for Finance (General Duties), declared 9.65% as the interest rate for the year ended 30th June 2022.

This is a drop from the 12.15% declared in 2020/2021.

Musasizi applauded the Fund for attaining an unqualified opinion from the Auditor General for the 11th year running.

“Good governance is important for institutions in Uganda and also in the private sector to grow and for public confidence especially financial institutions like NSSF,” he said.

The Auditor General, John F.S Muwanga, confirmed his audit of the financial statements for NSSF Uganda which comprise the statements of net assets available for benefits on 30th June 2022 and statements of changes in net assets available for benefits.

This was during the 10th Annual Members’ Meeting held Tuesday at Workers House in Kampala.

“In my opinion, the financial statements present a true and fair view of the financial position of the Fund at 30th June 2022 and of its financial performance and its cash flows for the year ended. In accordance with international financial reporting standards and in the manner required by UBRA Act and NSSF Act,” said Muwanga.

He added: “I believe that the audit evidence I have achieved is sufficient and appropriate to provide a basis for my opinion.”

Speaking at the meeting NSSF Managing Director, Richard Byarugaba, said the Fund runs on five values; putting the customer first in everything we do, trust and integrity as our most important currency, innovation through new ways to deliver value, teamwork, and efficiency to deliver more value to the customer.

He said the Fund’s value proposition focuses on three key areas; preserving member savings (paying two percentage points above 10-year average inflation), convenience for the member (serving anywhere anytime) and value addition through people processes, community and stakeholders.

“The effects of the global geo-politics affected regional markets, our economy and the Fund. Our growth was slower on contributions, compliance rates dropped, real estate products became more expensive and our equity portfolio was affected, however, we remained resilient,” he pointed out.

According to Byarugaba, contributions only grew by 9%, voluntary contributions grew by 5000 new members on the employee side and 1000 on the employer side.

He said informality is growing and the new law is allowing us to deal with it and achieve more growth.

“The Fund invests member savings in three asset classes namely; Fixed income, Equities and Real Estate. It is upon these investments that revenue is generated which runs the Fund and everything else is given to members as interest.”

The Fund balance sheet size grew by 11% from UGX 15.56 Trillion to 17.25 Trillion.

“This growth is consistent with the combined growth in investments driven by contributions and income generated net of benefits paid out.”

He added: “This year, we have accelerated our Real Estate projects and fostered our ESG agenda through the Hi-Innovator Program. So far we have created over 1300 jobs, 700 entrepreneurs and provided our business advisory services through the Financial Literacy Program.”

Peter Kimbowa, NSSF Board Chairman, said the future of the Fund is data, knowledge got from data and building capabilities that will provide real-time accurate and precise data around what “we are doing by embracing systems thinking as we find solutions”.

“Sustainability and transformation of NSSF is our goal as the board. The board is system aware and understands the role of technology,” he noted.

“As a board, the road ahead is going to be marked by transforming the intra-technology company and making sure that we leverage data. We will embed data and analytics to grow existing legacy projects and new ones. We are adopting to new technology as a board to anticipate the direction of technology growth.”

According to Kimbowa, the board also considers talent as scarce capital and aims to invest in re-skilling, multi-skilling, micro-skilling, and up-skilling as an everyday activity to have the very best that “we can have”.

Your email address will not be published.

SoftPower News is a subsidiary of SoftPower Communications LLC, a Ugandan digital media group. Keep posted of the latest from Uganda and East Africa.

Plot 4B Malcolm X, Kololo

P.O Box 1497, Kampala – Uganda

Tel: +256-392-001-701

Email: [email protected]

This news site is licenced by Uganda Communications Commission (UCC)

© SoftPower News

© SoftPower News

Send this to a friend