Pgiam/iStock via Getty Images

Pgiam/iStock via Getty Images

The proposition here is (where income taxes are not involved) one of temporary sale of presently-held BTU with proceeds invested in METC on a time-limit basis (max 3 months hold) with an open GTC initial sale order to close out the entire position at the first instance of market quote specific top-of-forecast price range before 3 months following the position’s initiation. Once the METC holding is closed, the proceeds may restore an enlarged longer-term BTU original purpose holding.

Every equity investment requires forecasts of probable payoffs. Our forecasts get made by the likely most capable forecasters available, in an honest negotiation on both sides of the trade.

Continuity of markets is essential. But running an Institution’s Billion-$ portfolio means bigger changes have to be made than in the typical individual’s $100,000 portfolio, where those everyday 10 or 100-share orders come from.

And finding “other side of the irregular surprise $-million trade order” disrupts that continuity, putting the Market-Maker to work getting it filled. Often with the MM firm putting its capital at risk temporarily to make some borrowed shares available.

Market-price-change-risk is not the MM’s job but can be “insured” against by a hedging deal, with its cost paid for by the institution to get its order filled. The cost and structure of combined derivative securities tells how much price change is to be expected – on both up and down price-change sides of the hedge – by the experienced professionals, updated trade-by-trade. The complete market makes the forecast.

Because investing performance is measured over time (which cannot be replaced once spent) time needs respect when committed. Because uncertainty increases with time commitment, the astute investors are quick to adjust their strategies to recognize change.

This is why near-term price expectations need constant attention. Institutions have the resources to demand – and get – attention. They won’t wait for four or more years to find out a mistake was made. A buy of Ramaco Resources, Inc. (METC) here appears a better choice now than a like-period-holding in Peabody Energy (NYSE:BTU).

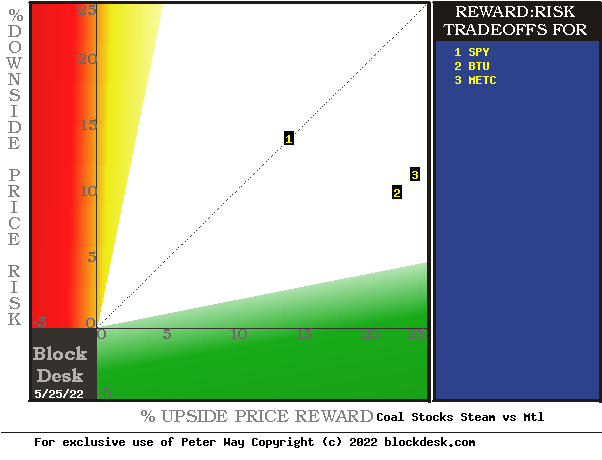

MM forecasts are of reasonable-to-expect price limits, both higher and lower. Their range, split by current market price, defines the balance of gain vs. loss prospects. Figure 1 shows those upper and lower limits of price change on the given date for each of the coal stocks identified by reader traffic on Yahoo and other internet services.

Figure 1

blockdesk.com

blockdesk.com

(used with permission)

Upside price rewards are from the behavioral analysis (of what must be done to do accomplish system trades, not driven by emotional errors) by Market-Makers [MMs] as they protect their at-risk capital from possible damaging future price moves. Their potential reward forecasts are measured by the green horizontal scale.

The risk dimension is of actual price draw-down exposures at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line. Capital-gain attractive to-buy issues are in the directions down and to the right.

Our principal interest is in BTU at location [2] and in METC at [3]. A “market index” norm of reward~risk tradeoffs is offered by SPY at [1]. Most appealing by this Figure 1 view is METC.

This map provides a good visual comparison of the two most important aspects of every equity investment. There are other aspects of comparison which this map sometimes does not communicate well, particularly when general market perspectives like those of SPY are involved. Where questions of “how likely’ are present other comparative tables, like Figure 2, may be useful.

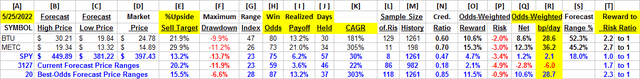

Figure 2

blockdesk.com

blockdesk.com

(used with permission)

Column headers for Figure 2 define investment-choice preference elements for each row stock whose symbol appears at the left in column [A]. The elements are derived or calculated separately for each stock, based on the specifics of its situation and current-day MM price-range forecasts. Data in red numerals are negative, usually undesirable to “long” holding positions. Table cells with yellow fills are of data for the stocks of principal interest and of all issues at the ranking column, [R].

Readers familiar with our analysis methods may wish to skip to the next section viewing price range forecast trends for BTU.

Figure 2’s purpose is to attempt universally comparable answers, stock by stock, of a) How BIG the prospective price gain payoff may be, b) how LIKELY the payoff will be a profitable experience, c) how SOON it may happen, and d) what price drawdown RISK may be encountered during its holding period.

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price draw-down risks for buyers. The most severe ones actually encountered are in [F], during holding periods in effort to reach [E] gains. Those are where buyers are emotionally most likely to accept losses.

The Range Index [G] tells where today’s price lies relative to the MM community’s forecast of upper and lower limits of coming prices. Its numeric is the percentage proportion of the full low to high forecast seen below the current market price.

[H] tells what proportion of the [L] sample of prior like-balance forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. [I] gives the net gains-losses of those [L] experiences.

What makes BTU most attractive in the group up to this point in time is its ability to produce earnings most consistently at its present operating balance between share price risk and reward. Credibility of the [E] upside prospect as evidenced in the [I] payoff is shown in [N].

Further Reward~Risk tradeoffs involve using the [H] odds for gains with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preferencing. Figure 2 is row-ranked on [R] among alternative candidate securities, with METC in top rank.

Along with the candidate-specific stocks these selection considerations are provided for the averages of some 3100 stocks for which MM price-range forecasts are available today, and 20 of the best-ranked (by fom) of those forecasts, as well as the forecast for S&P500 Index ETF as an equity-market proxy.

As shown in column [T] of figure 2, those levels vary significantly between stocks. What matters is the net gain between investment gains and losses actually achieved following the forecasts, shown in column [I]. The Win Odds of [H] tells what proportion of the Sample RIs of each stock were profitable; 80% by BTU, and 73% by METC. Also contributing is the size of [I], with METC some 2x the size of BTU yet less often reached as profitable.

Peabody Energy Corporation engages in coal mining business in the United States, Japan, Taiwan, Australia, India, Indonesia, China, Vietnam, South Korea, and internationally. It is involved in mining, preparation, and sale of thermal coal primarily to electric utilities, industrial facilities, and steel manufacturers. As of December 31, 2021, it owned interests in 17 coal mining operations located in the United States and Australia; and had approximately 2.5 billion tons of proven and probable coal reserves and approximately 450,000 acres of surface property through ownership and lease agreements. Peabody Energy Corporation was founded in 1883 and is headquartered in St. Louis, Missouri. (Source: Yahoo Finance)

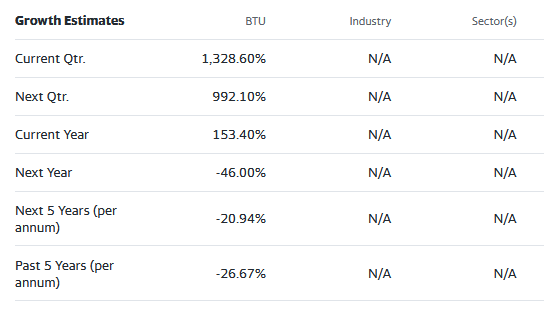

Yahoo Finance

Yahoo Finance

Ramaco Resources, Inc. produces and sells metallurgical coal. The company’s development portfolio includes 20,200 acres of controlled mineral and 16 seams located in southern West Virginia; 41,300 acres of controlled mineral on the border of West Virginia and Virginia; 62,100 acres of controlled mineral that is located in Virginia; and 1,570 acres of controlled mineral, which is situated in southwestern Pennsylvania. The company serves blast furnace steel mills and coke plants in the United States, as well as international metallurgical coal consumers. The company was founded in 2015 and is headquartered in Lexington, Kentucky. (Source: Yahoo Finance)

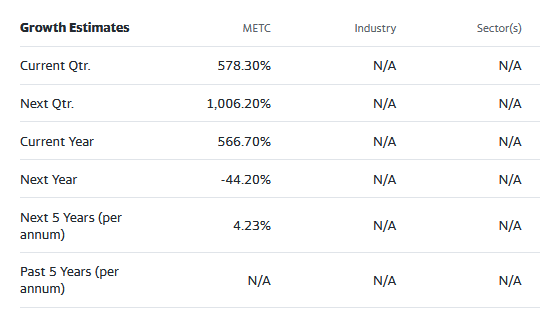

Yahoo Finance

Yahoo Finance

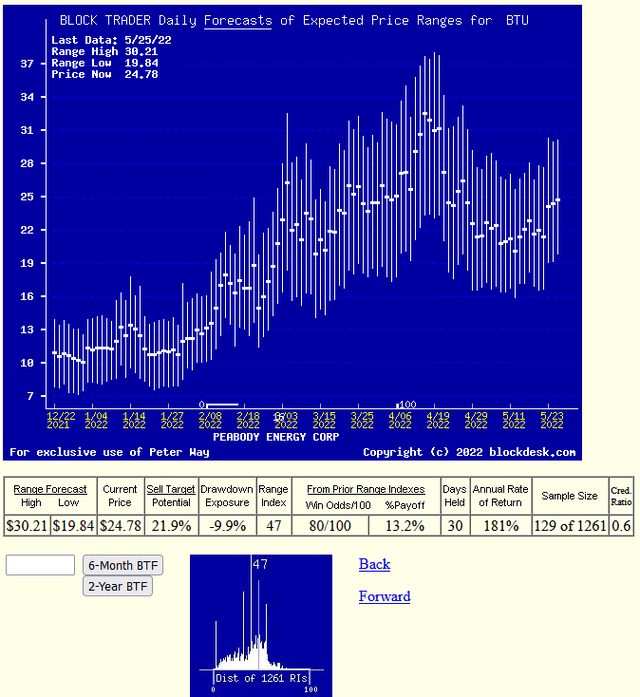

Figure 3

blockdesk.com

blockdesk.com

(used with permission)

Many investors confuse any picture of time-repeating stock prices with typical “technical analysis charts” of past stock price history. Instead, Figures 3’s and 4’s vertical lines are a daily-updated visual forecast record of price range limits expected in the coming few weeks and months. The heavy dot in each vertical is the stock’s closing price on the day the forecast was made.

That market price point makes an explicit definition of the price reward and risk exposure expectations which were held by market participants at the time, with a visual display of the vertical balance between risk and reward.

The measure of that balance is the Range Index [RI]. Here, 47% of the full forecast range of from $30 to $20 is downside from $25, leaving a similar 53% of the range to the upside. The fact that 80% of such BTU forecasts were reached marks BTU as a recovery- persistent stock.

The other 20% of forecasts where market prices did not reach the hedged upper forecast price limit, and were at a closeout price below the ending price on the day after the forecast was made (for record purpose taken as a position entry cost) explain the difference in average profit between the sell target average gain proceeds and the net amount in Figure 2 [I], or +13.2%.

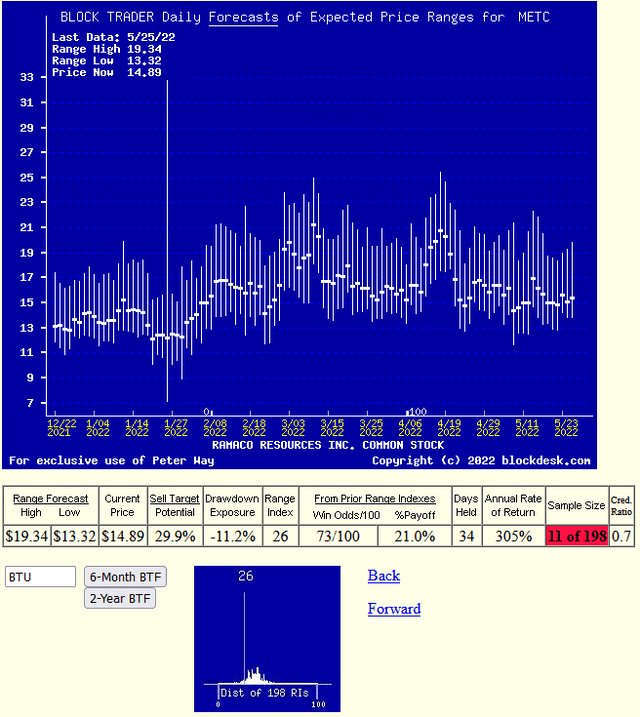

Figure 4

blockdesk.com

blockdesk.com

(used with permission)

Comparing METC results here with Figure 3, the Win Odds of 73 out of 100 profits score is better than BTU’s higher odds because the gain target was larger, 29.9% instead of 21.9%, leaving a net of +21%

Having such precise price expectation measures makes it much easier to make direct comparisons between all securities at each point in time, as was done in Figure 1.

The recorded histories of price range forecasts make it possible to understand how well each security performed in subsequent markets. It also reinforces under what Risk~Reward balance circumstances better forecasts were able to be made in the past and as in Figure 2, may be made at present for the future.

That makes METC a better holding than BTU to have at present, since its position closeout point in the past has always been larger. Capital invested in METC has worked harder than in BTU despite taking 34 market days (seven calendar weeks) to get there, compared to the 30 market days (6 calendar weeks) for BTU.

The notion of “which investment today?” is being answered by Institutional Investor circles saying that Ramaco Resources Limited is a better near-term capital gain opportunity than Peabody Energy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in METC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Peter Way and generations of the Way Family are long-term providers of perspective information, earlier helping professional investors and now individual investors, discriminate between wealth-building opportunities in individual stocks and ETFs. We do not manage money for others outside of the family but do provide pro bono consulting for a limited number of not-for-profit organizations.

We firmly believe investors need to maintain skin in their game by actively initiating commitment choices of capital and time investments in their personal portfolios. So our information presents for D-I-Y investor guidance what the arguably best-informed professional investors are thinking. Their insights, revealed through their own self-protective hedging actions, tell what they believe is most likely to happen to the prices of specific issues in coming weeks and months. Evidences of how such prior forecasts have worked out are routinely provided, both on blockdesk.com and on our Seeking Alpha Contributor website.