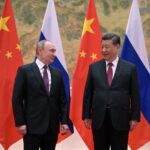

Russia turns to China as it faces a shortage of microchips. (Photo by various sources / AFP) / China OUT

By Dashveenjit Kaur | 7 April, 2022

After Russia invaded Ukraine, numerous measures designed to cripple the former’s economy were introduced by countries against its actions. Western sanctions in particular had strangled Russia’s access to the global financial systems including Visa, Mastercard, and American Express, and SWIFT. In response, its local Mir payment system took up the slack.

For context, payment operations by Visa and Mastercard cards issued by Russian banks were stalled in March. Those cards are also no longer accepted in the Apple Pay, Samsung Pay and Google Pay mobile payment systems. Holders of Visa and Mastercard cards however will still have access to their accounts and payment transactions until the expiration date of the cards.

Because those transactions are processed in the National Payment Card System (NSPC), they are not affected by sanctions. But after those cards stop working, the bank will automatically issue a new card based on the ‘MIR’ payment system. Unfortunately, there has been a huge surge in demand for new cards and that has resulted in a shortage of the microchips.

At this point, Mir cards are accepted by some banks around the world including Turkey, Vietnam, Armenia, Uzbekistan, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan and Georgia breakaway regions of South Ossetia and Abkhazia.

Dashveenjit Kaur | 9 March, 2022

In a report by Reuters, NSPC’s board member Oleg Tishakov said that since Asian manufactures have suspended production due to the surge in Covid-19 cases, and European suppliers have stopped cooperating with Moscow following sanctions, Russia is facing a shortage of microchips.

“We are looking for new microchip suppliers and [have] found a couple in China, with certification process ongoing,” Tishakov said, without sharing any further details. According to Reuters calculations based on the system’s data, NSPC issued over 2 million Mir cards between the end of 2021 and March with total cards outstanding now at 116 million.

The demand for domestic cards has peaked as reported by all major Russian banks with some issuing a co-brand with China’s UnionPay, an alternative payment system to Visa and MasterCard for purchases by Russians abroad. The NPCS recommends Russians to pay for purchases and withdraw cash abroad by issuing a co-badging card, the Mir-UnionPay card, which is accepted both in Russia and in 180 countries that support Union Pay.

As the national payment system of China, UnionPay since 2005 has acquired international status. It has surpassed Visa and Mastercard in the volume of processed transactions worldwide since 2015, due to the large size of the domestic market, where foreign payment systems are virtually absent.

By Dashveenjit Kaur

![]() @DashveenjitK

@DashveenjitK

Dashveenjit Kaur | ![]() @DashveenjitK

@DashveenjitK

Dashveen writes for Tech Wire Asia and TechHQ, providing research-based commentary on the exciting world of technology in business. Previously, she reported on the ground of Malaysia’s fast-paced political arena and stock market.

© 2022 Tech Wire Asia | All Rights Reserved

Terms of use Privacy Policy