My Account

Follow us on:

Powered By ![]()

Discover 5000+ schemes. Track your portfolio 24X7

Invest Now

MC30 is a curated basket of 30 investment-worthy

mutual Fund (MF) schemes.

Invest Now

Powered By ![]()

The new age digital currency to diversify a portfolio.

Invest Now

Visit this section to access live price and charts.

Invest Now

Learn and stay informed about cryptocurrency in India.

Learn More

Powered By

Learn, discover & invest in smallcases across different types to build your long term portfolio.

Invest Now

Explore from India`s leading investment managers and advisors curating their strategies as smallcases.

Invest Now

Powered By ![]()

Diversify your portfolio by investing in Global brands.

Invest Now

Pre-configured baskets of stocks & ETFs that you can invest

in with a single click. Developed by hedge funds, global

asset management companies, experienced wealth

management firms and portfolio managers.

Invest Now![]()

AMBAREESH BALIGA

Fundamental, Stock Ideas, Multibaggers & Insights

Subscribe

CK NARAYAN

Stock & Index F&O Trading Calls & Market Analysis

Subscribe

SUDARSHAN SUKHANI

Technical Call, Trading Calls & Insights

Subscribe

T GNANASEKAR

Commodity Trading Calls & Market Analysis

Subscribe

MECKLAI FINANCIALS

Currency Derivatives Trading Calls & Insights

Subscribe

SHUBHAM AGARWAL

Options Trading Advice and Market Analysis

Subscribe

MARKET SMITH INDIA

Model portfolios, Investment Ideas, Guru Screens and Much More

Subscribe

TraderSmith

Proprietary system driven Rule Based Trading calls

Subscribe![]()

![]()

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Subscribe

Curated markets data, exclusive trading recommendations, Independent equity analysis & actionable investment ideas

Explore

STOCK REPORTS BY THOMSON REUTERS

Details stock report and investment recommendation

Subscribe

POWER YOUR TRADE

Technical and Commodity Calls

Subscribe

INVESTMENT WATCH

Set price, volume and news alerts

Subscribe

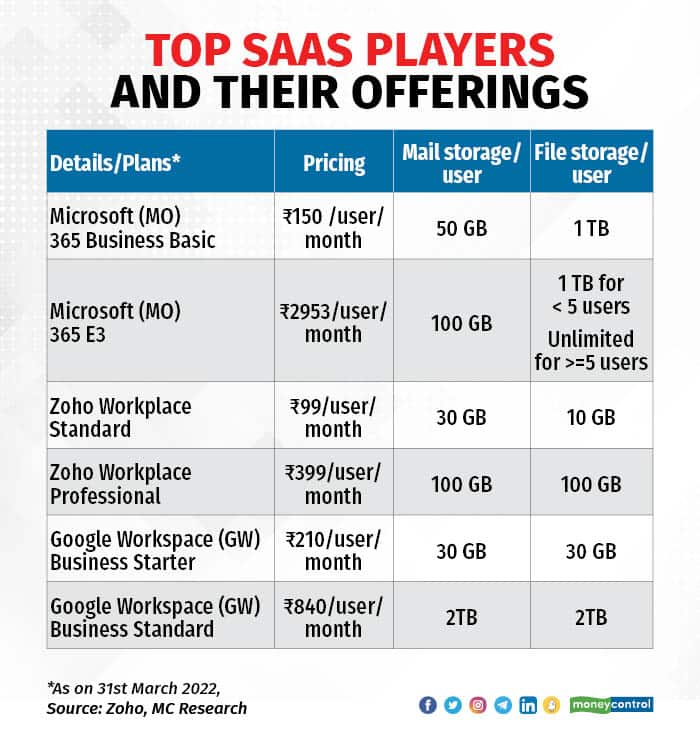

Global technology giants Microsoft and Google are passing through an inflection point. After spending several years gaining market share globally and in India for its business software-as-a-service (SaaS) suite named Microsoft 365 and Google Workspace (earlier known as G-Suite) respectively, the companies have finally increased and updated charges for its services in 2022 after a period of minimal charges and free services previously.

Over the past six months, both companies have raised their prices. While Microsoft 365 suite’s price was increased by around 15-20 per cent across products in March 2022, Google Workspace introduced updated pricing from June 2022 onwards.

This comes at a time when most small and medium enterprises (SMEs) in India over the last two years had to upgrade and go digital, not just for sales but also for day-to-day operations as remote working became a norm. This saw unprecedented increase in the use of services and business suites, a market which is dominated by Microsoft and Google.

According to a KPMG-Google report from 2017, nearly 68 percent of SMEs in India were operating entirely offline back then. SMEs currently account for roughly over 35 per cent of India’s gross domestic product (GDP), which is one of the largest economies in the world. SMEs also contribute more than 50 per cent to India’s exports.

Given the market opportunity size for big techs, it will be interesting to see how they work around customising their offerings for price-sensitive geographies like India. For now, it turns out that home-grown companies like Zoho are well-positioned to fill the gap. The Chennai-headquartered technology company saw a 130-150 per cent increase in monthly migration of users from Google since the new pricing was rolled out.

“Since January of this year we started seeing a huge spike of migration of users from Google to Zoho, that’s when I think Google started increasing prices. We saw around a 130-150 percent increase in monthly migration levels,” Rakeeb Rafeek, Product Strategy Lead, Zoho Workplace, told Moneycontrol.

MSMEs displeased with price hikes

Meanwhile, the sudden price surge by the two key market leaders have ruffled the feathers of SMEs and MSME businesses in India.

An Ahmedabad-based firm Synersoft Technologies even decided to write an open letter to Google India’s management stating their concerns around the pricing, on Wednesday, while sending it to the Competition Commission of India (CCI), and the ministries of MSME, IT & Broadcasting, Science & Technology, Industry & Commerce, and Finance.

The firm’s CEO Vishal Shah said that earlier, for each enterprise user they had to pay around Rs 2,500 annually for the G-Suite Basic 30 GB storage space plan. In case a few team members needed additional storage, they could individually upgrade their plan to get 100 GB of additional storage space for an added cost of Rs 1,300 per year per user.

But now, as of June 2022, they were notified of a new pricing plan.

“Google announced rebranding G-Suite to Google Workspace with specific policy changes. We are informed that an additional 100 GB storage is no longer available. One must upgrade to the ‘Business Standard’ category, which has a minimum storage of 2 TB and costs Rs 10,100 per year per user. They also declared that if you need more than 30 GB storage in a single account, you must upgrade all the accounts to 2 TB storage,” Shah said in the letter.

“So now, because I need 130 GB for a few users, I am coerced to upgrade all 50 accounts (of employees) to a 2 TB storage at a 400 percent higher price. It works out to be an yearly outflow of Rs 5,05,000 from Rs 1,28,900. It is unfair,” he added.

Responding to our query on this, a Google spokesperson said, “We’ve introduced the pooled storage model to provide customers with greater flexibility and value for storage, we’ve transitioned away from some legacy storage plans. As of June 2022, these legacy storage add-ons are no longer available to purchase. Customers who are approaching their storage limits can manage their storage, or upgrade their edition.”

Explaining the product, the spokesperson had replied to our previous queries on Thursday, saying, “Since we launched Google Workspace in 2020, we’ve been helping our customers transition to our new editions with each customer’s unique collaboration and security requirements in mind. The vast majority of our customers will see little to no change when they transition to Google Workspace offerings, and we are working with all our customers to help with the transition.”

The spokesperson added, “Google Workspace offers tailored options that align with how customers want to purchase our integrated suite of apps, from smaller businesses looking to make fast, self-service purchases to larger enterprises with more complex needs. In addition, we’re investing heavily in the value of Google Workspace for all users across consumer, SMB, enterprise, education, and nonprofits.”

Data migration a concern

Analysts believe even if MSME customers would want to choose a different SaaS product, migration from Google or Microsoft’s environment, with content that’s been gathered over years, will be a major challenge.

“Even if MSMEs have an option, migrating to another platform is a nightmare. Because both of them will make data transfer so complex that you will end up spending so much money on services company just trying to figure out license migration, data migration, etc,” Sanchit Vir Gogia, Chief Analyst and CEO, Greyhound Research, told Moneycontrol.

He added, “This is ongoing and a continuous challenge. MSMEs will need to come together in a large group, which will essentially mean a large number of clients. Only then can any change happen. Google Workspace and Microsoft Office are staple diets in enterprise IT which means you cannot do without it, which means that by and large, most companies cannot do without either.”

“Google knows that MSMEs like us can’t have data of 100 TB (50 users with 2 TB each), so we will not be able to use it. So, it does not need to provision 100 TB on its cloud and can still charge for 100 TB,” Synersoft’s Shah had said in his letter.

To enable such an opportunity, Zoho too came out with a Migration Assistance Tool in January. The tool is a paid offering, where an expert is appointed to help users shift from one software to another.

Zoho’s Rafeek said, “The transition from Google Workspace to Zoho now is not that difficult. In fact, after seeing a number of queries we are running a campaign and education webinars and made it very simple. We have also built a Migration Assistance Tool to help users move.”

“MSMEs, especially were very worried about their data being stuck with Google and how the transition will happen, but the tool we built really helped many,” Rafeek added.

The price hikes were expected, as companies like Microsoft had announced their pricing change plans back in August 2021, which came into effect from March this year.

Tech giants want serious users

Industry experts, however, support the price hikes by both the companies, given the margin pressures due to operational costs going up for on-boarding customers and marketing spends. The analysts said that Zoho too, will likely use this scenario to increase their rates to some extent.

Faisal Kawoosa, Founder and Chief Analyst, Techarc, told Moneycontrol, “Companies like Microsoft and Google are really data driven. All this pricing they do is done leveraging their analytics tools. I wouldn’t say they always do it in a way trying to find out ways how it would be in the interest of their consumers. Obviously, everybody’s doing business. So, they will always look at how they can, maybe, optimise resources and maximise revenue for them.”

Kawoosa explained that whenever technology giants decide to increase their prices, they take into account that some part of the present user base will stop using the product. But the people who upgrade their plans and continue to use the services will easily offset whatever percentage of business is declining.

“Such decisions are taken by organisations thinking what kind of customer base they want to retain,” he said.

Gogia said, “Google and Microsoft has differentiated pricing in the US and India. A lot of customisation in terms of licensing, pricing (USD to INR difference) and discounting. Both the companies will go out of the way to service large enterprise customers, including creating unique offerings for them. However, the challenge comes in MSME businesses.”

Gogia noted that the cost of operations to on-board channel partners, spends on marketing and using revenue share mechanisms with new-age partners like GoDaddy and the others, results in a lot of bleed on the margins at Google and Microsoft.

“In year one, year two, when the business was young, naturally, the pricing was soft. Now the customer is hooked, multiple consumers, multiple users have been on-boarded. That is when they spike prices,” he said.

Gogia added, “Now, virtually customers have no choice. Think about it. Once you have spent two-four years in either the Google or Microsoft environment, it’s not as if that you have a lot of choices. Even Zoho isn’t an equally good competitor to Microsoft or Google.”

“Zoho is unique amongst its productivity suite competitors for not rolling out a cost increase for 2022, nor removing their freemium offerings,” commented Thomas Randall, Senior Research Analyst at Info-Tech Research Group.

“Other providers have justified price add-ons and increases to reflect the additional value they believe their customers have received over the pandemic for using their tools. Yet freemium offerings and price consistency have been central for many customers and businesses to stay afloat during the lockdowns. Now that such offerings are in short supply, Zoho will likely see increased demand for their Workplace services as customers seek strong RoI for productivity and collaboration software,” Randall explained.

“Zoho is now a complete business solution. This situation might give them some edge. But then a common trend has been that if Zoho sees that Microsoft and Google have taken up the price, they will also do a kind of proportionate increase, which will still be, maybe, cheaper than say, Microsoft and Google. These guys will also do that kind of an increase to align. That’s a generic practice,” Kawoosa added.

Copyright © e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.

Copyright © e-Eighteen.com Ltd All rights resderved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol.com is prohibited.