kokkai

kokkai

Sea Limited (NYSE:SE) is a consumer internet company consisting of 3 separate businesses: 1) the gaming division, Garena, 2) the largest e-commerce platform in Southeast Asia (SEA), Shopee, and 3) the digital finance service business, SeaMoney.

Back in 2009, Sea Limited or Garena was known as a pure gaming publisher in SEA. And then in 2014 and 2015, SeaMoney and Shopee were born.

Fast forward a bit and Shopee quickly rose to become the market leader in SEA, out-executing well-established peers like Lazada (BABA), Tokopedia (GOTO-INDONESIA), and Bukalapak. They have also found a strong foothold in Latin America (LatAm), particularly in Brazil where they have seen huge traction. That also significantly increases its addressable market. SeaMoney, on the other hand, went on to win multiple digital banking licenses in countries like Singapore, Malaysia, and the Philippines. Given Shopee’s dominant market share and the huge underbanked/banked population in SEA, I think that the market is underestimating its potential to become a meaningful driver of its overall revenue if they were to carefully evaluate its growth trajectory and development over the past few years.

This brings me to my next point. The company is currently facing strong macro headwinds, such as the unprecedented high-inflation environment, but I believe they can successfully navigate these temporary headwinds. That’s due to the fact that their strong track record and speed of execution in the past few quarters have resulted in significant improvements in profitability.

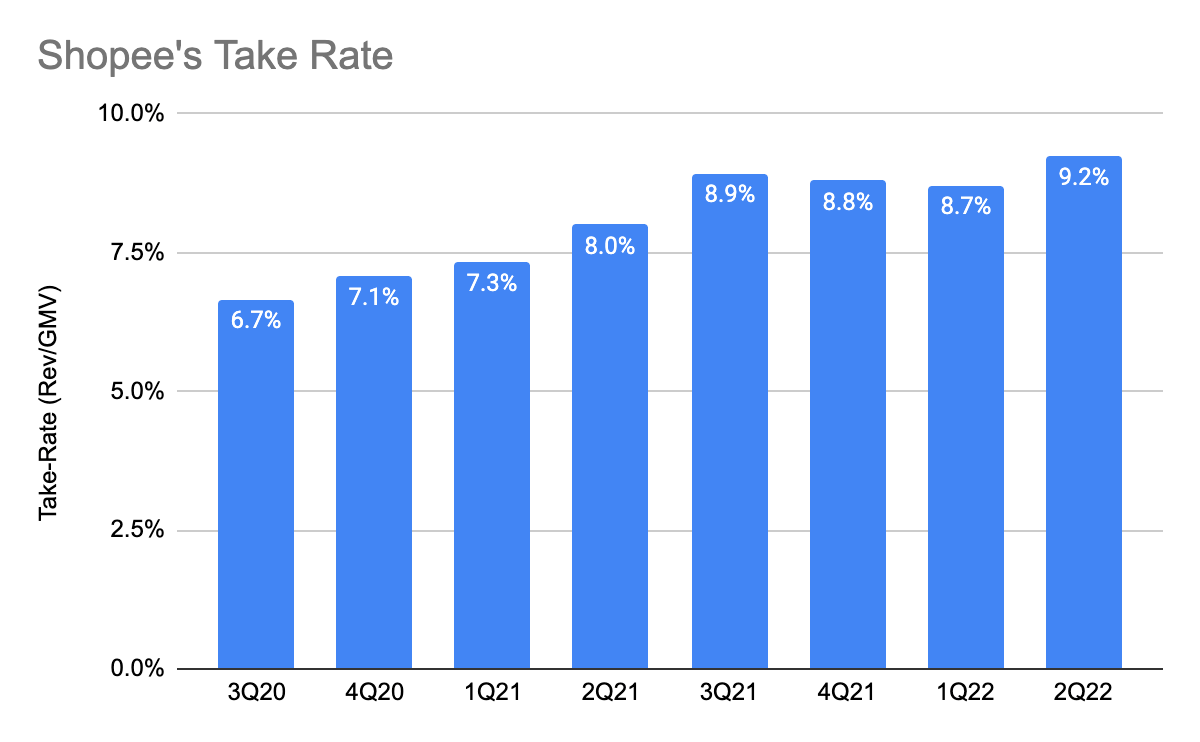

This would not be possible if Shopee had not attained market leadership in SEA, as they were focused on pursuing market share over short-term profitability in its early days. When needed, Shopee can increase its take rates (peers like Mercado Libre have a mature take rate of 13.5% vs. Shopee’s current take rate of 9%) and cut back on huge sales and marketing (S&M) expenses to achieve profitability, which is what I am seeing right now. Furthermore, the company has reiterated that Shopee is set to break even in SEA by the end of FY22.

However, investors do not seem to be confident that management can pull it off. That’s due to Shopee’s massive growth decline in recent quarters, the depleting cash balance on the balance sheet, and the deteriorating profit of the company’s only cash cow, Garena, due to the reopening of the economy. I have recently reviewed Sea Limited’s Q2 2022 earnings, and I believe that my thesis still holds:

They are on track to hit profitability as I am seeing accelerating sequential improvements in Shopee’s unit economics, driven by the combination of increasing take rates and lower S&M expenses, and narrowing losses in SeaMoney, also due to lower S&M spending.

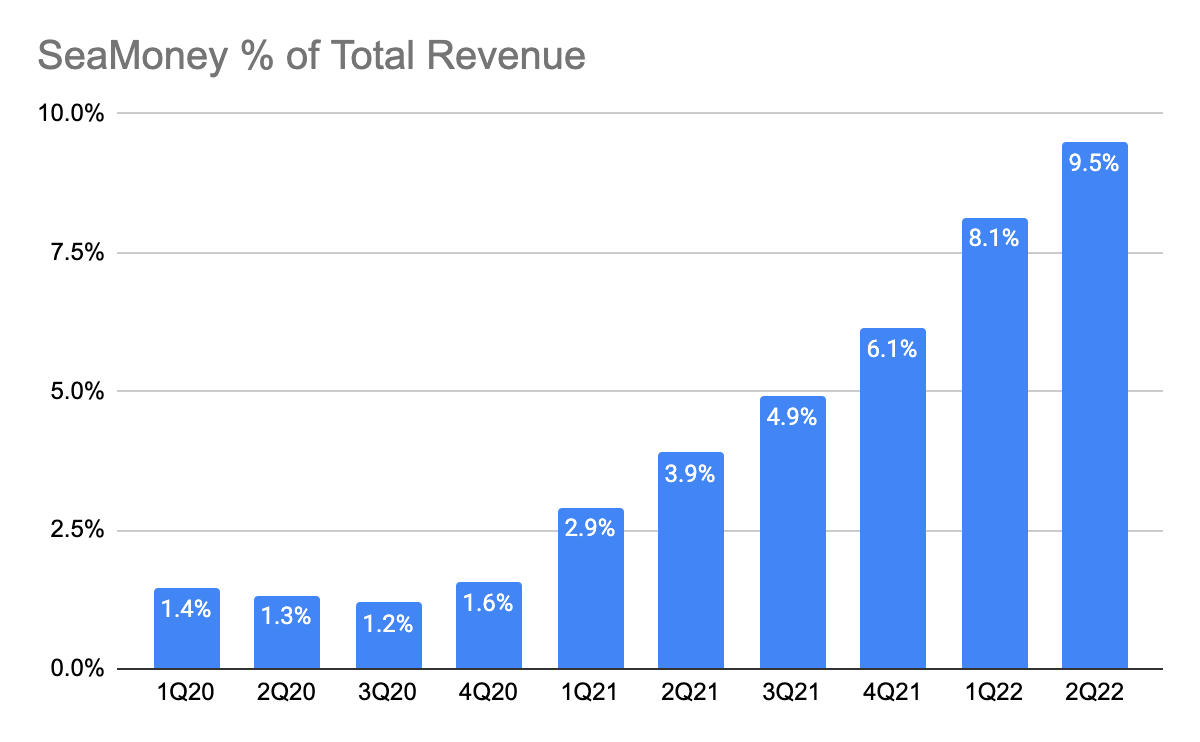

SeaMoney can grow to become a meaningful portion of the company as its revenue as a percentage of overall revenue grew from 1.4% to 9.5% in just 2 years. And they have yet to launch the full suite of their digital banking products and services.

While my thesis holds, I also do have to acknowledge there are multiple risks. For example, there’s the unpredictable impact of the macro headwinds on Shopee’s and Garena’s growth and profitability, and any slight execution risks can delay their route to profitability. If these happen, sustaining the company will be incredibly challenging, and the possibility of raising capital at today’s valuation will be a big thesis breaker for me. As of today, I maintain Sea Limited as a hold.

Now, let’s dive deeper into each individual segment to evaluate how they have performed.

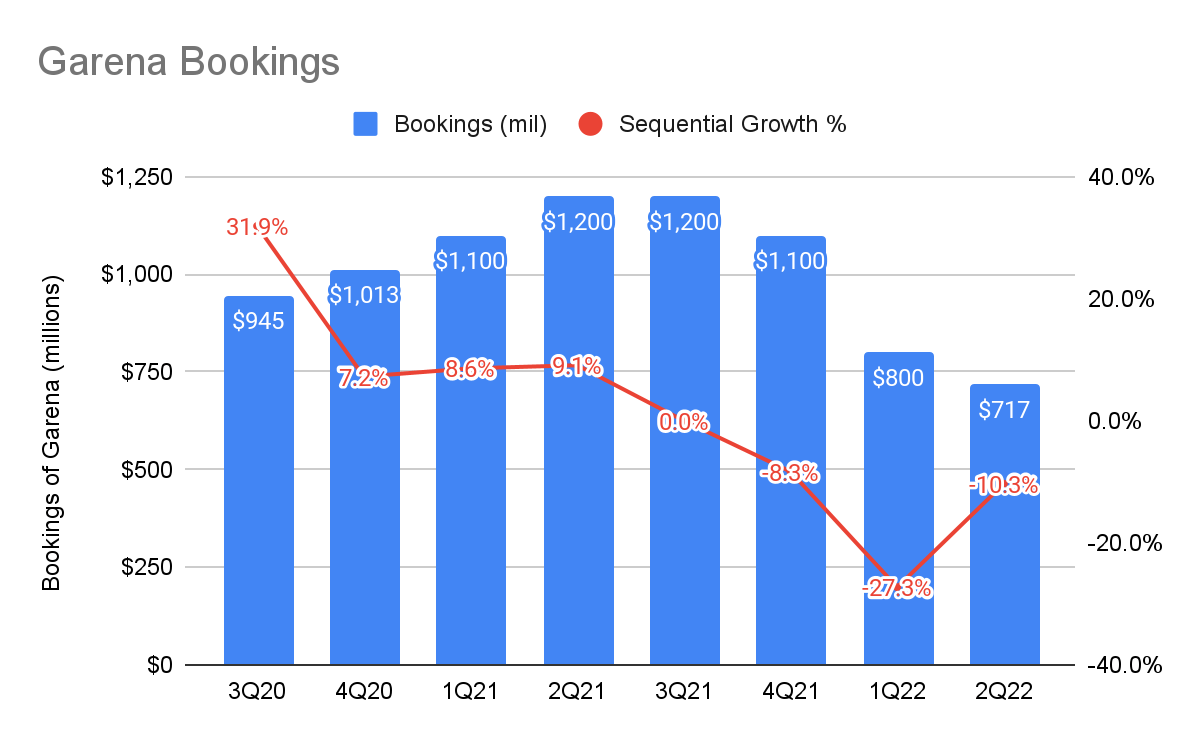

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Bookings reflect the total revenue earned (e.g., “Free Fire” users may purchase a 12-month battle pass) within a given period, but it cannot be recorded as revenue in the current quarter.

This is the third consecutive quarter in which we saw a sequential decline in Garena’s bookings. Within the same period, bookings also fell below Garena’s revenue.

This is not a great sign as it indicates that users are drastically reducing their spending and lesser users are now playing “Free Fire.” This is a double whammy mainly driven by the reopening of the economy. However, this is not exclusive only to Garena as those macro headwinds have also impacted the broader gaming industry, including the gaming conglomerate Tencent (OTCPK:TCEHY).

However, you could also argue that had Garena diversified its portfolio, the decline in revenue would not have been so drastic. They continue to push their efforts to develop new games such as “Blockman GO,” but I certainly do not expect them to contribute any meaningful growth in the near future.

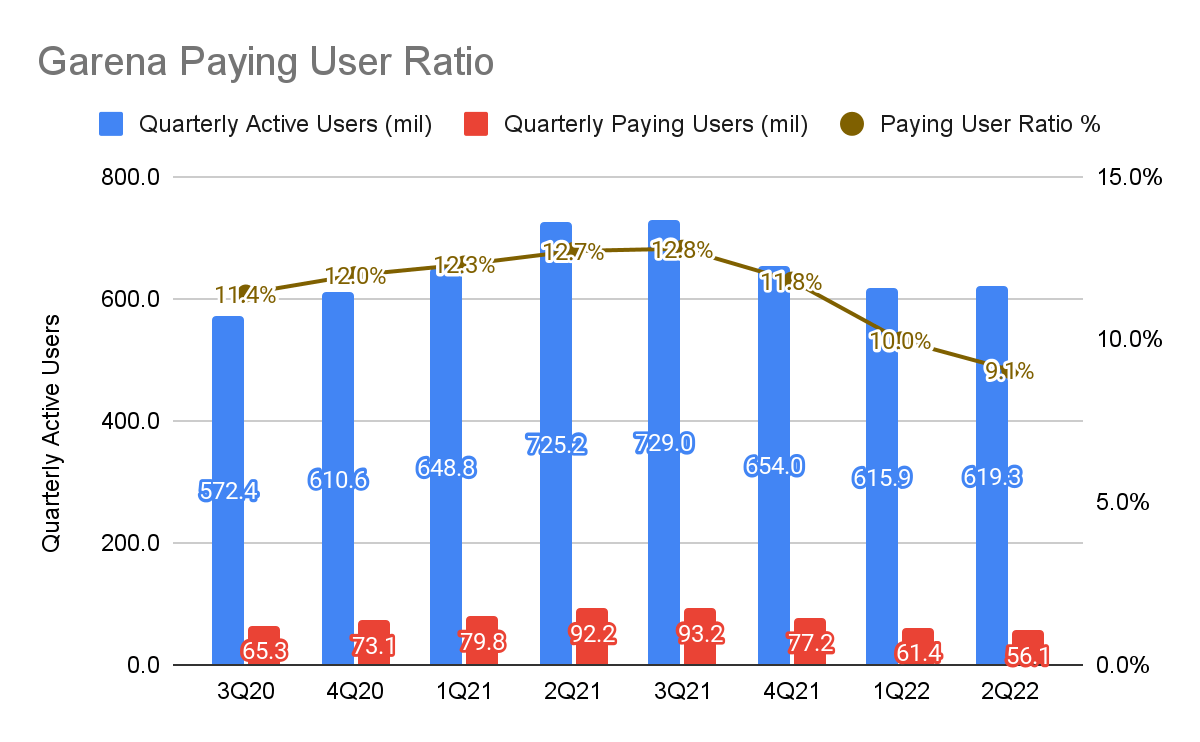

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Garena’s paying user ratio has also declined for 3 consecutive quarters, falling to 9.1% from 10% last quarter. However, it was interesting to see that the quarterly active users (QAUs) rose by 0.6% QoQ even though the quarterly paying users fell by 8.6% QoQ.

As most “Free Fire” users reside in lower-tier countries such as Brazil in LatAm, India, and Indonesia in SEA, they are inclined to cut down on spending in a high inflationary period while continuing to enjoy the game for free. According to Sea Limited’s management, QAUs are stabilizing and they are focused on user retention. During the quarter, “Free Fire” was also the highest-grossing mobile game in SEA and LatAm. I see this as a positive sign because this shows that this is not due to Garena’s inability to monetize the game, but rather, the macro headwinds being too strong to fend off.

I also came across “Free Fire’s” recent collaboration with celebrity Justin Bieber. While this does not contribute to Garena’s result, it does show that they are focused on customer acquisition and retention in the U.S., where monetization is also likely to be stronger in the region.

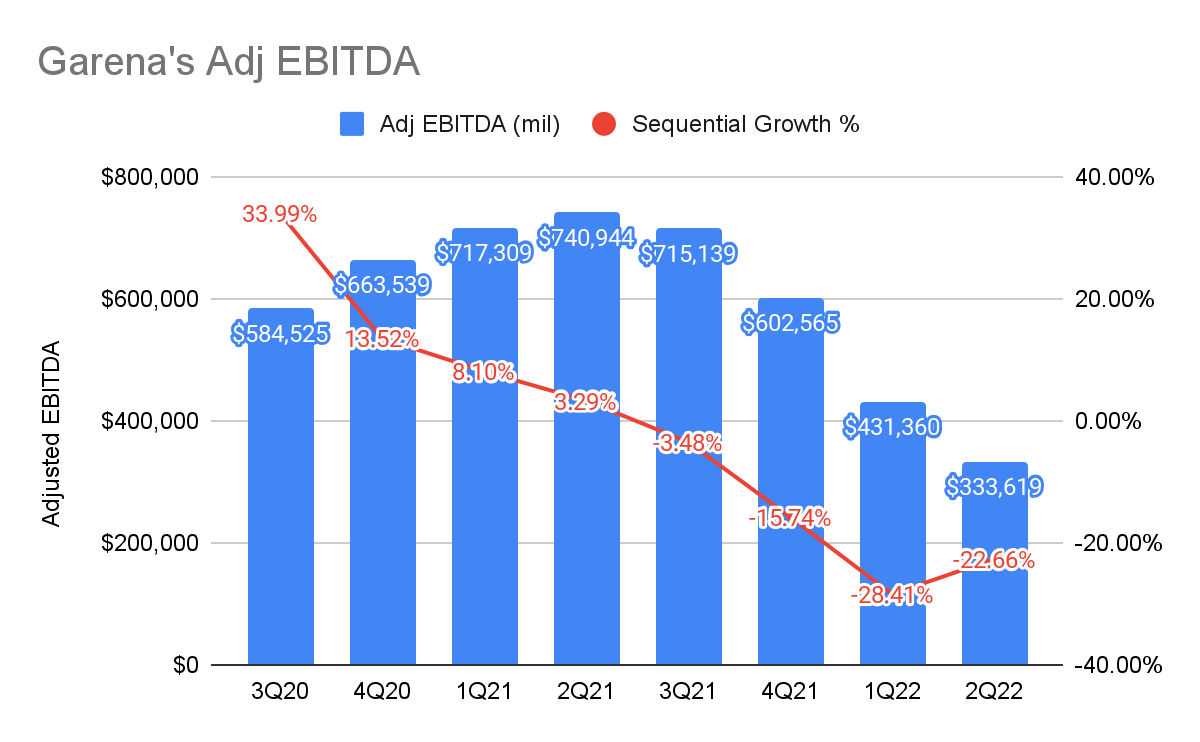

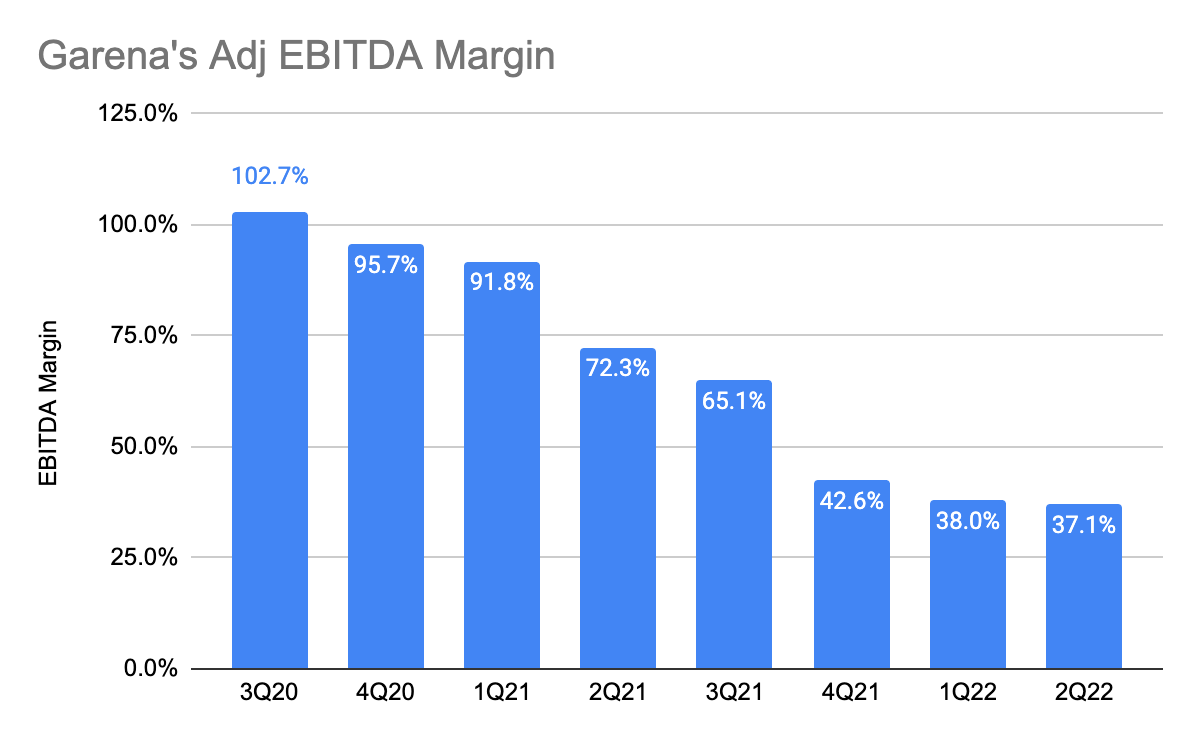

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Adjusted EBITDA continues to fall by 22.6% QoQ and adjusted EBITDA margin is now at 37.1%. If you compare this to a year ago, this is a massive decline in profitability.

Garena was effectively the cash cow funding Shopee’s explosive growth before and during COVID-19. Now that Shopee is seeing increasing macro headwinds and SeaMoney is still unprofitable, this explains why investors are concerned over the company’s ability to break even. I also share similar sentiments, except that I believe Shopee now is not as reliant on Garena’s funding as they were in the past.

Keep in mind that Shopee is now the market leader in SEA and Taiwan, and they have the ability to chase profitability by increasing their take rate and reducing their S&M expenses, as I alluded to earlier. If Shopee did not attain market leadership, it can be incredibly challenging to balance growth and profitability at the same time, especially in today’s environment.

Let’s move on to Shopee.

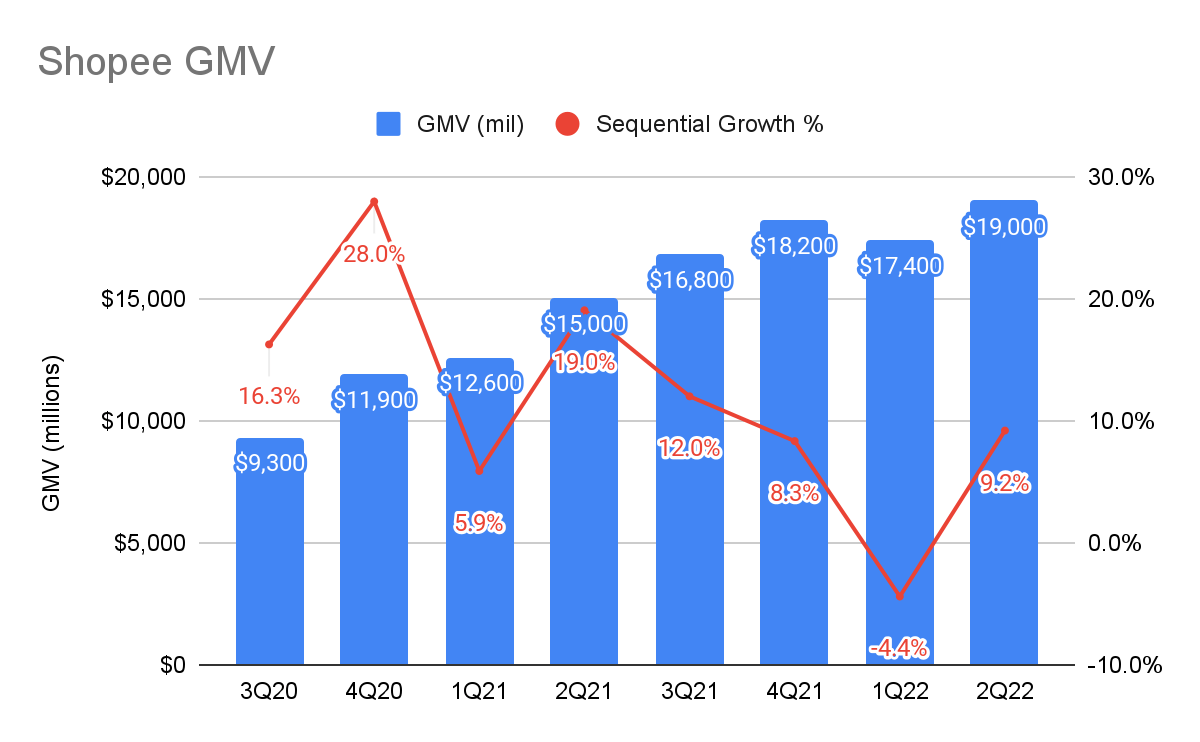

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

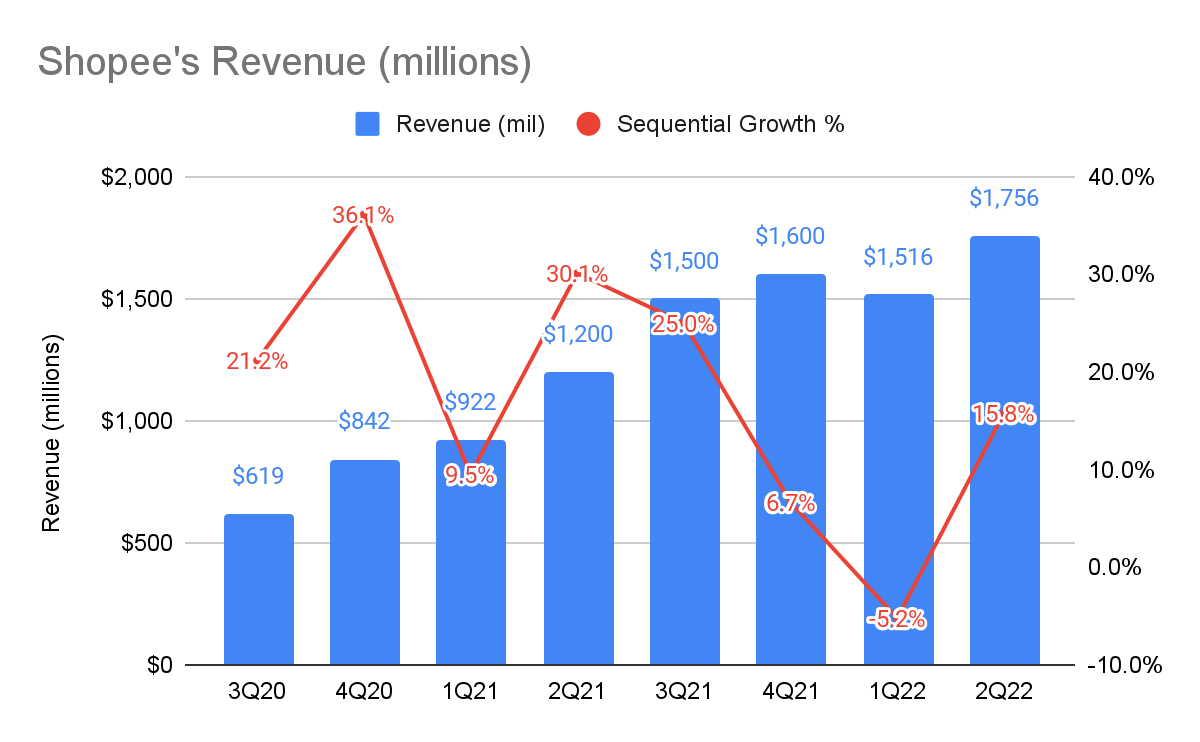

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

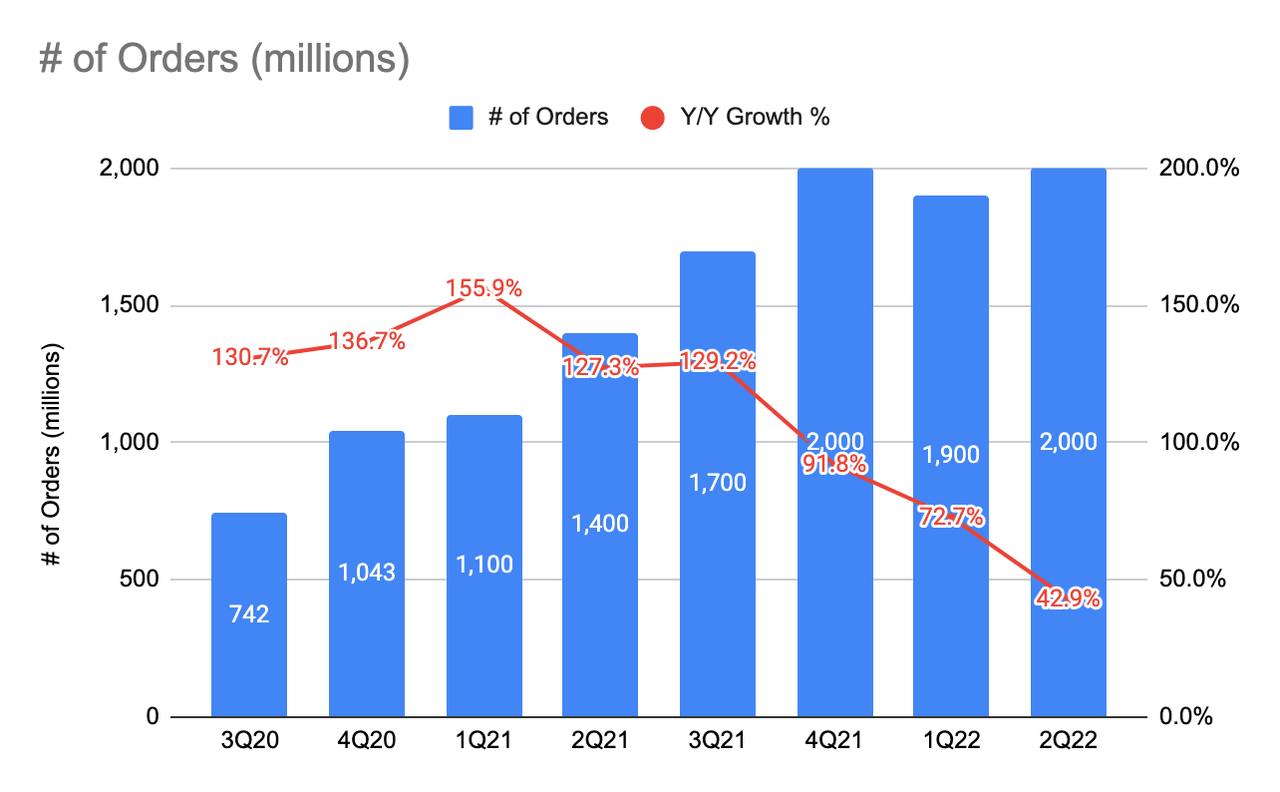

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

I personally thought that Shopee had a great quarter. Its gross merchandise value (GMV) grew 9.2% QoQ and 27% YoY, and in terms of revenue, it grew 15.8% QoQ and 54% YoY. These were mainly driven by the increase in take rates as they rose from 8.7% last quarter to 9.2% this quarter. In particular, Shopee’s Brazil – Shopee’s biggest market in LatAm – reported a 270% YoY revenue growth rate. And in terms of order volume, it grew 43% YoY and 0.5% QoQ.

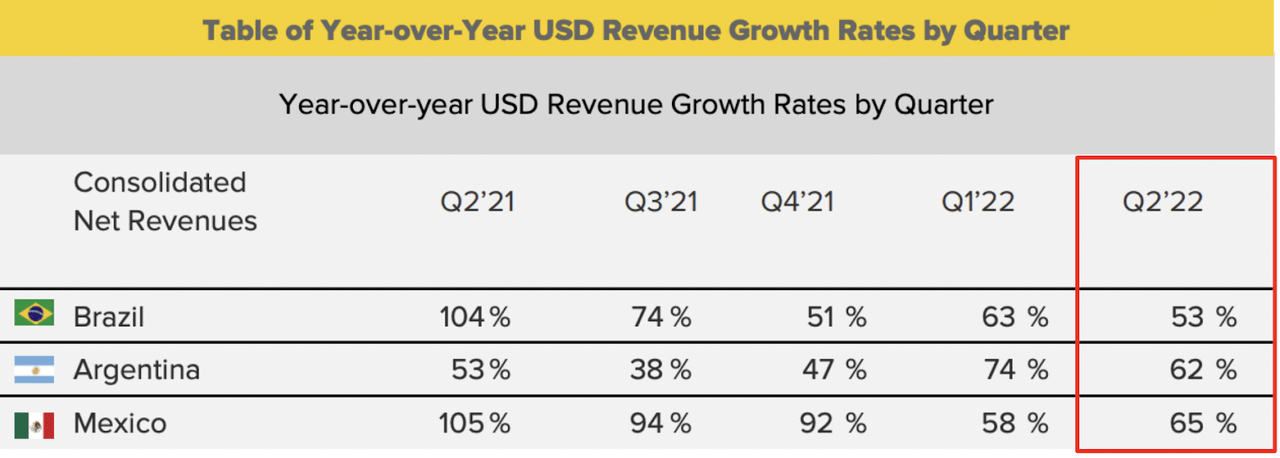

Mercado Libre 2Q22 Investor Presentation

Mercado Libre 2Q22 Investor Presentation

For comparison sake, MELI’s total e-commerce revenue grew 26% YoY, and in Brazil it is growing at 53% YoY. Lazada’s order volume only grew at a mere 10% YoY, indicating that Shopee is taking market share away from Lazada. Google trends also show that Shopee is leading the SEA market by a mile and Shopee is converging with MELI in Brazil. And according to SensorTower, the Shopee app is ranked No. 1 in Colombia, No. 2 in Brazil, No. 2 in Chile, and No. 3 in Mexico in the Google Play Store (only Mexico is currently falling behind Mercado Libre).

Shopee was able to produce this respectable growth rate relative to its peers because it is well diversified in LatAm and SEA. In LatAm, Shopee’s market penetration is still low yet they are reporting massive growth rates. And its quest to pursue market share in SEA in its early days now allows them to chase profitability today. These achievements are great, but I do suspect further headwinds as consumer discretionary spending continues to be affected, and the ability to break even matters more.

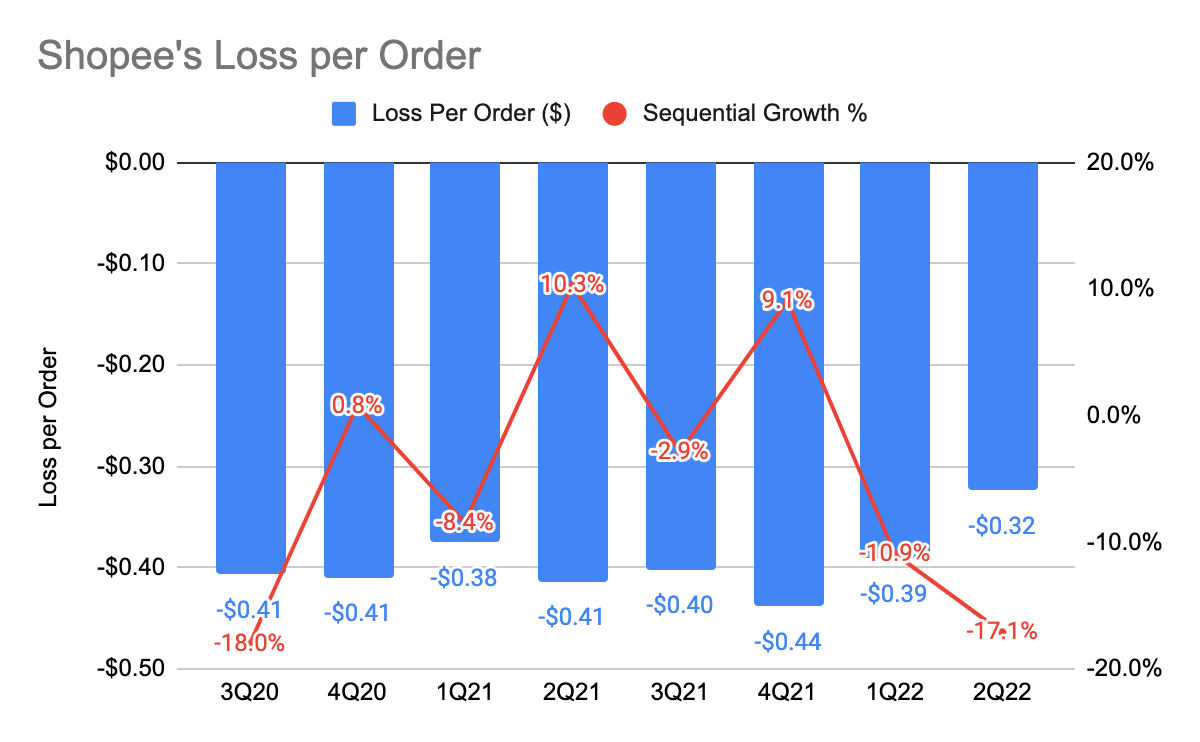

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

On a unit economic basis, Shopee had one of the biggest improvements in a quarter as adjusted EBITDA loss per order improved by 17.1% QoQ. This tells me that Shopee is accelerating its route to profitability.

In particular, SEA and Taiwan, before HQ costs, have improved by 75% QoQ to $0.01 vs. 73% QoQ last quarter. In contrast, Shopee Brazil’s losses, before HQ costs, have slowed down to 7% QoQ to $1.34 vs. 24% QoQ last quarter.

This reinforces my thesis that Shopee can aim for profitability in SEA while grabbing market share, as its peers are scrambling to balance growth and profitability. To put things into context, Lazada’s order slowed down massively from 60% YoY in Q4 2021 to 10% YoY this quarter, and I suspect that its revenue growth is in the high teens or low multi-digits. The management also reiterated that to break even (post-HQ cost) in SEA and Taiwan by the end of FY22. For Shopee Brazil, the losses did not come down as quickly as I initially anticipated. Nonetheless, the overall progress made gives me confidence that Shopee is on track for profitability.

But, of course, this does not help with the fact that management has removed Shopee’s guidance for FY22. If you read through this quarter’s earnings transcript, you will see analysts harping on the topic of the guidance removal. That, in my view, is a distraction from the material improvements Shopee had made during the quarter.

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

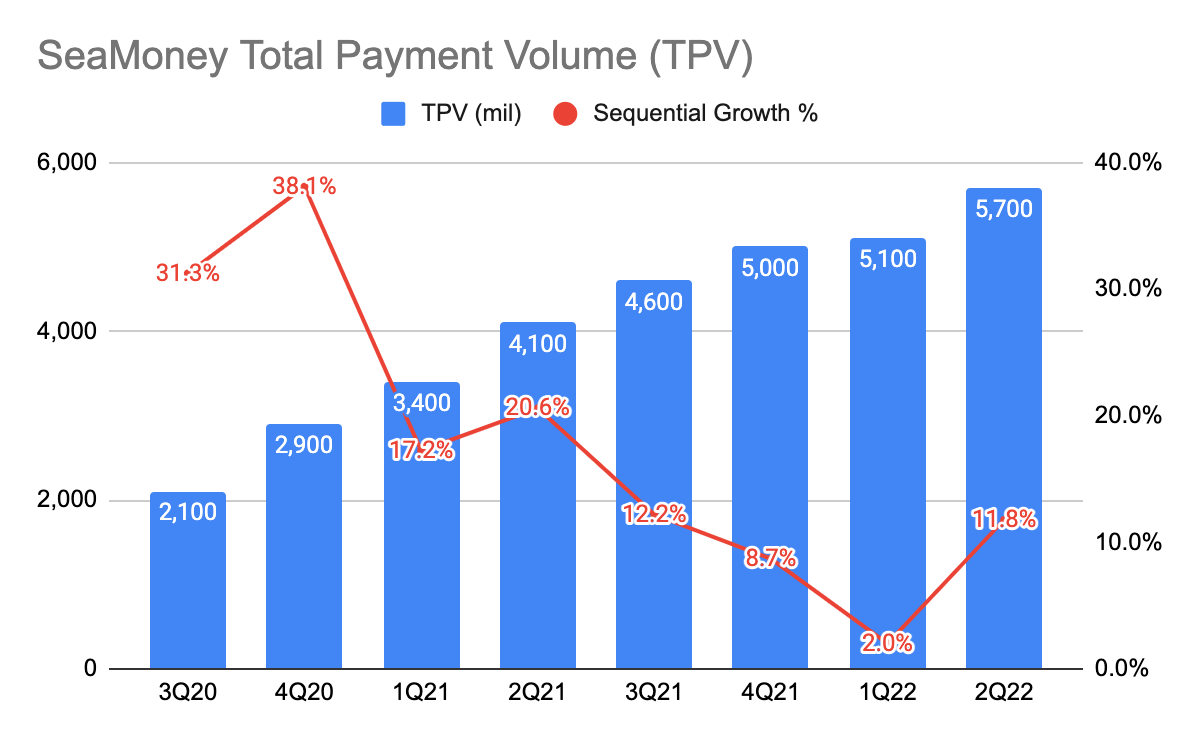

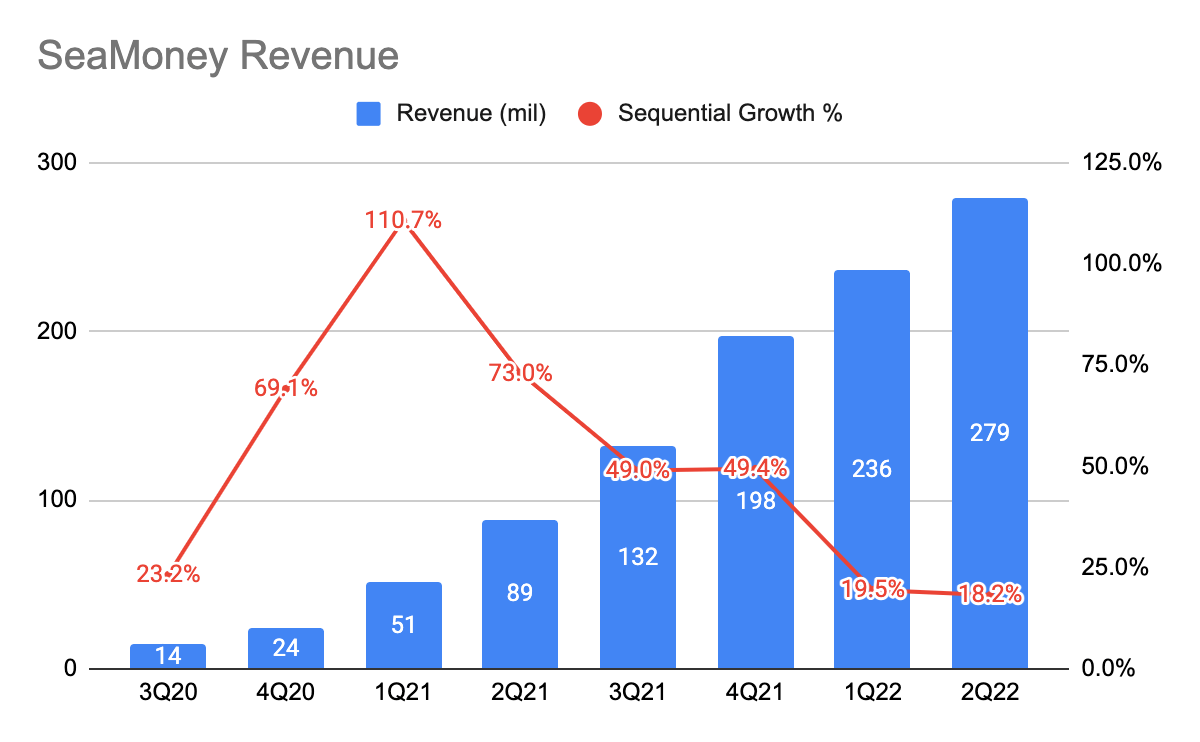

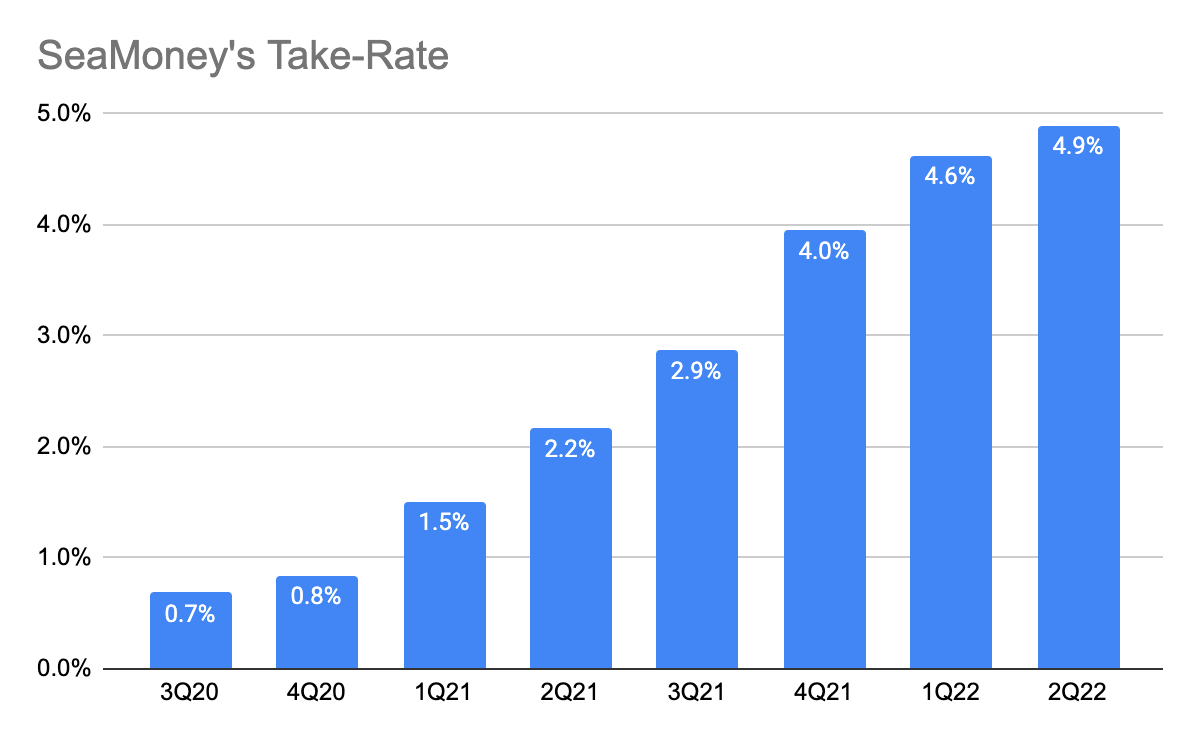

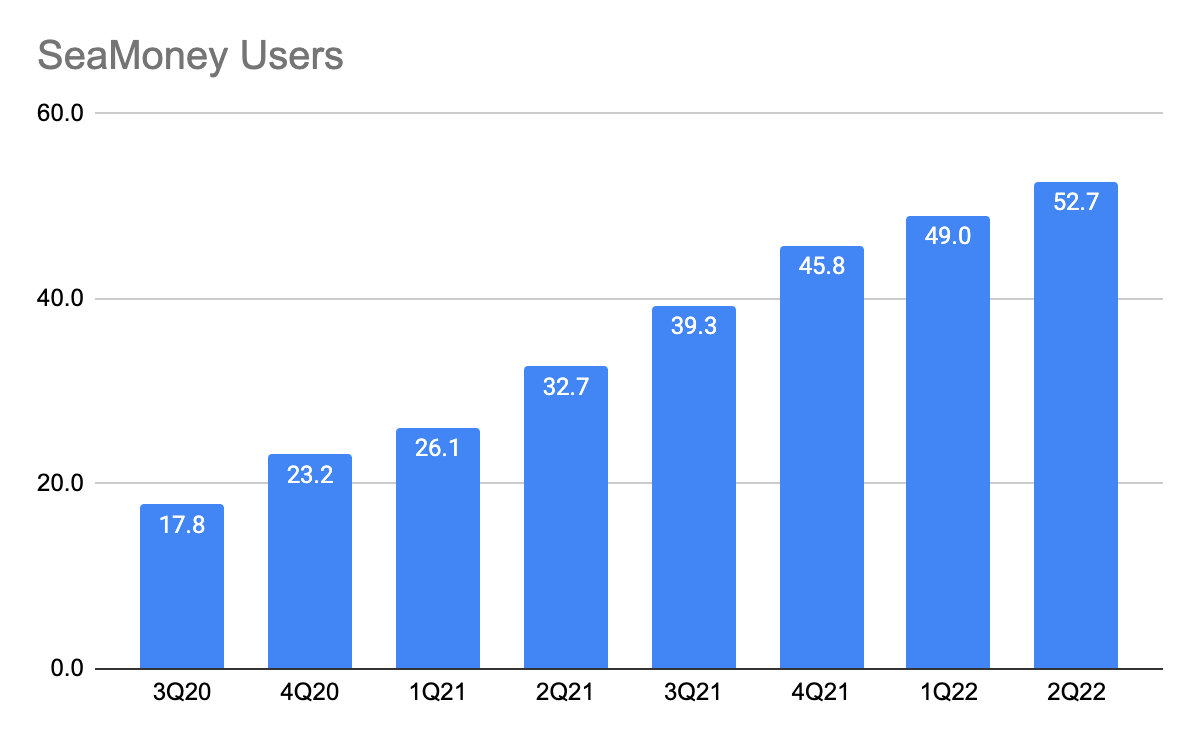

SeaMoney’s total payment volume (TPV) grew strongly at 11.8% QoQ, and revenue grew faster at 18.2% QoQ, mainly due to higher take rates of 4.9% compared to 4.6% in the previous quarter.

SeaMoney has piggybacked on Shopee’s growth in the past few years and they have seen accelerating growth as TPV had 3x in a year and revenue almost 20x in a year. Within the same period, they have effectively 3x their user base.

What they had done in a short period of time is a remarkable achievement. So, as you look at its growth in FY22, it is not surprising to see that growth has slowdown compared to FY21 as they are now growing off a larger base.

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

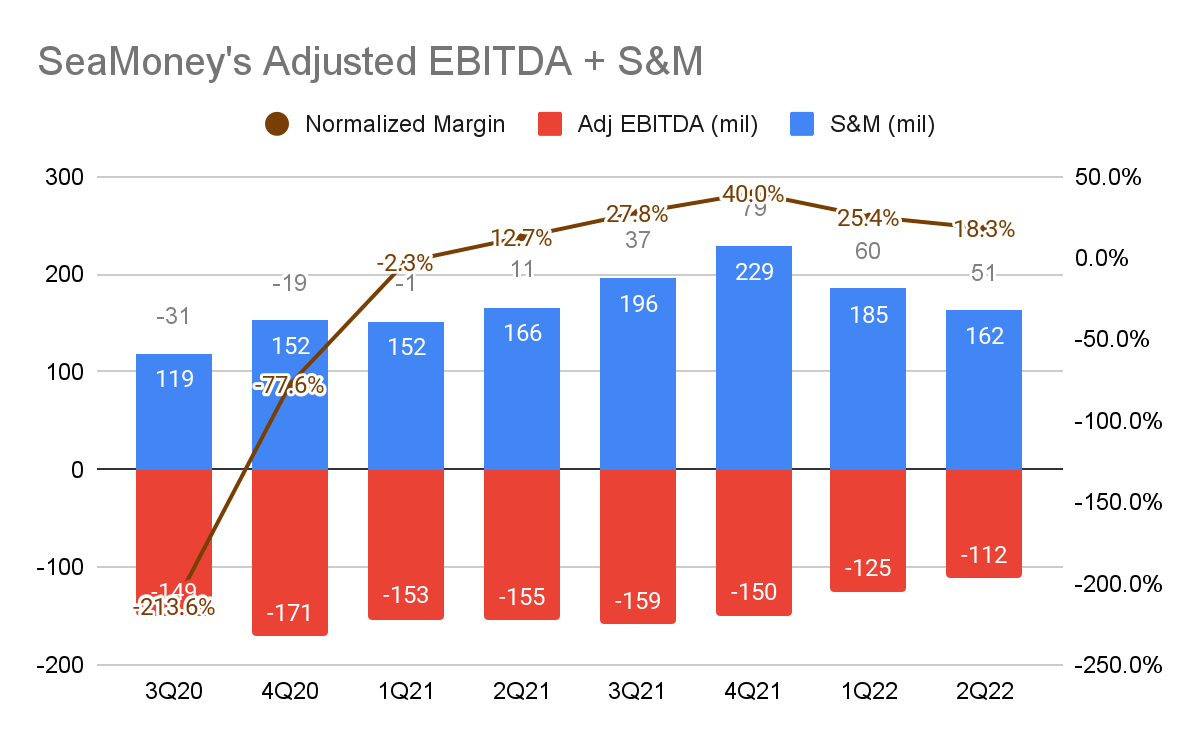

In the race for profitability, its adjusted EBITDA loss has improved by 10% QoQ vs. 12% QoQ in the last quarter. And akin to how we find out the normalized margin for software companies, SeaMoney can be profitable anytime if it decides to cut back on S&M expenses. Its S&M has reduced by 12% QoQ and 19% QoQ in the previous quarter.

Given that SeaMoney has yet to fully launched its digital banking products and services, I expect the management to continue to grow SeaMoney prudently with improving profitability moving forward.

Image created by the author with data from SE’s quarterly report

Image created by the author with data from SE’s quarterly report

I’ve seen many investors talking about how insignificant SeaMoney is contributing to its overall revenue, but I personally disagree. Over the past 2 years, its revenue has grown from a mere 1.3% to 9.5% of the company’s overall revenue. And I continue to think they will be an increasing bigger pie of its revenue in years to come.

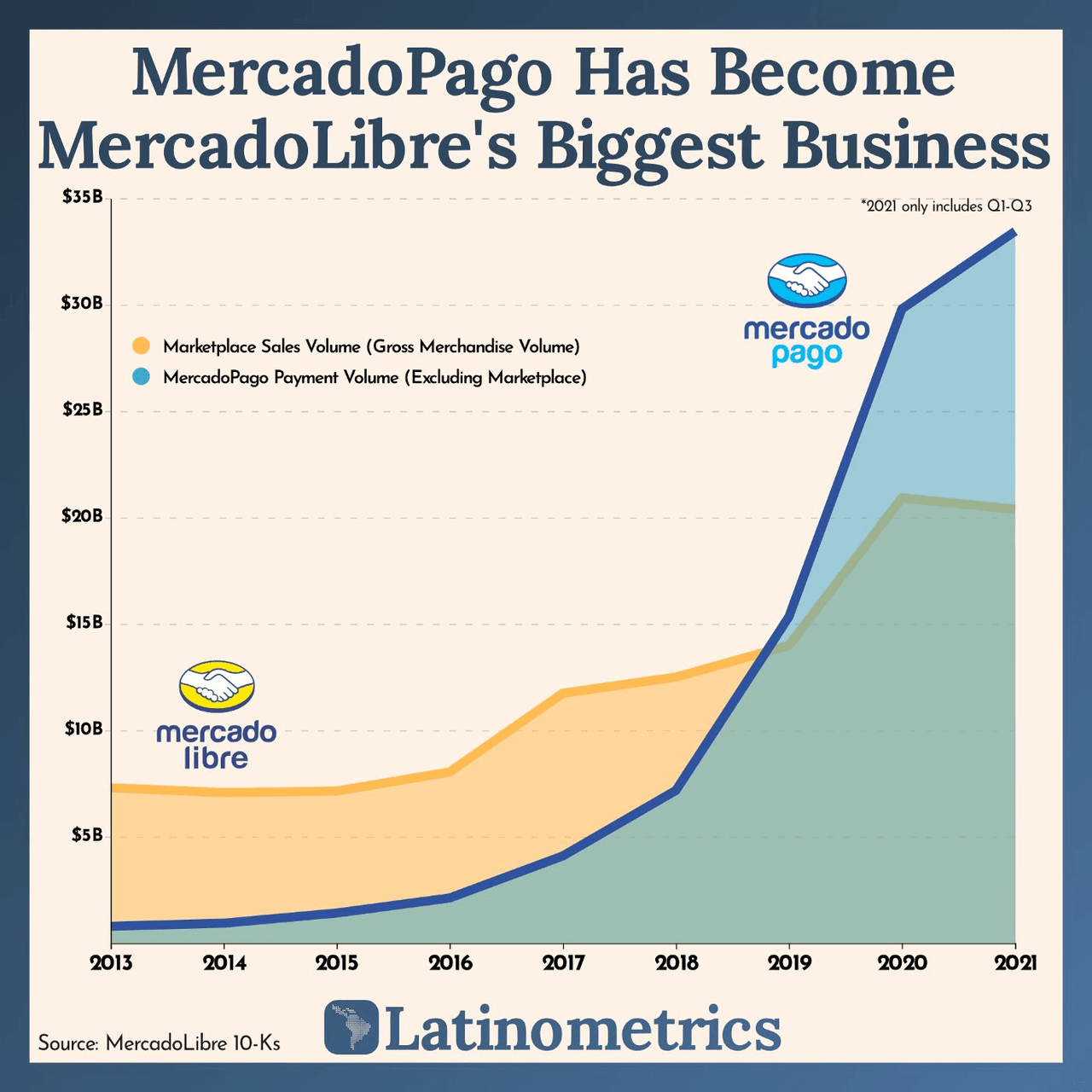

Lationometrics

Lationometrics

If you look at its peers, Mercado Pago has grown to become Mercado Libre’s largest business in 6 years. As of Q2 2022, Bukalapak’s fintech arm makes up 55% of its overall revenue. Given the stronger presence of Shopee in the SEA region, I thoroughly believe that SeaMoney is in a better position to grab market share.

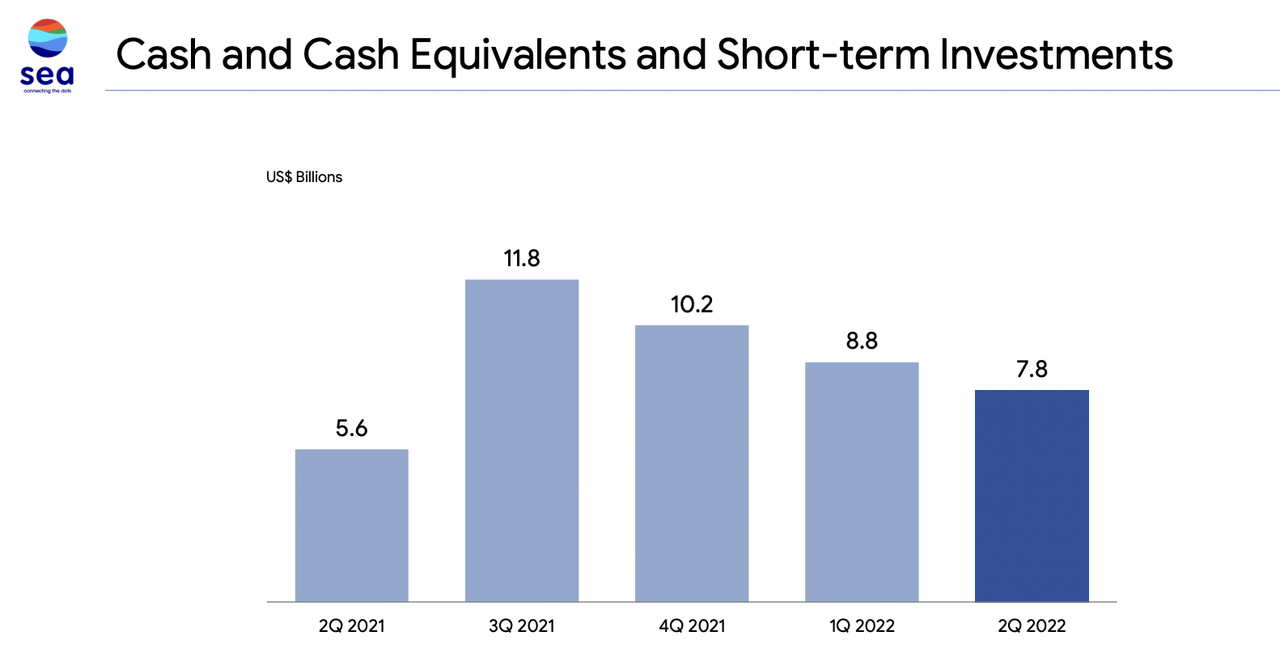

SE’s 2Q22 Investor Presentation

SE’s 2Q22 Investor Presentation

At first glance, I was shocked to see the huge decline in Sea Limited’s cash balance. This quarter, the cash outflow was $1.1 billion as compared to the previous quarter of $1.2 billion. I became curious and decided to look into what’s making up the cash outflow.

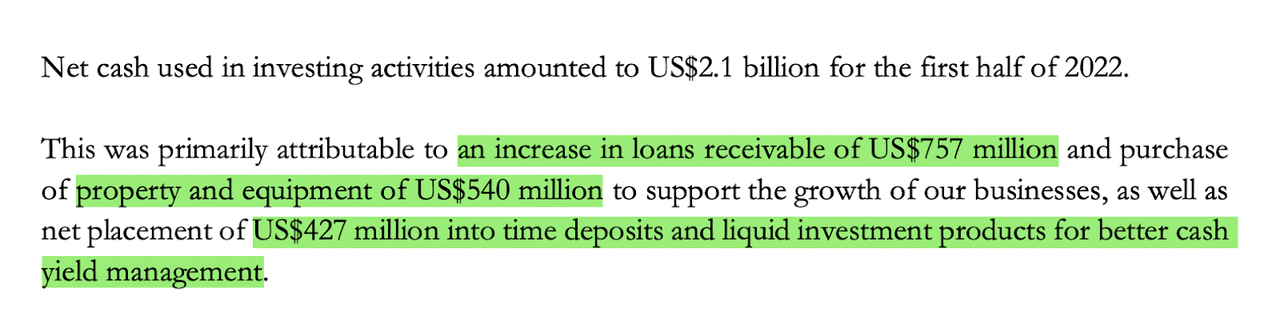

SE’s 2Q22 quarterly report

SE’s 2Q22 quarterly report

There are primarily 3 things:

Loan receivables: These are likely loans to merchants or consumers in which the principal amount and interest has to be paid back in less than a year (according to Yipit, these are current assets).

Property plant and equipment (PP&E): From my conversation with a few people, these may be investments to build out the logistic infrastructure in Brazil.

Time deposits and liquid investments: Time deposits are interest-bearing bank accounts, which suggest that management is putting those cash into good use. I believe this can be quickly converted back into cash if needed.

Except for the PP&E, I believe these are not cash burns per se, but rather it is a cash outflow.

The big execution risks lie in the fact that:

Shopee is unable to hit breakeven by FY22;

SeaMoney is unable to hit cash-flow positive by FY23; and

as Garena is SE’s only current cash cow, the inability to retain the current user base can result in further losses.

If this happens, sustaining the business will be an issue and the need to raise capital at such depressed valuation can be a big thesis breaker for investors.

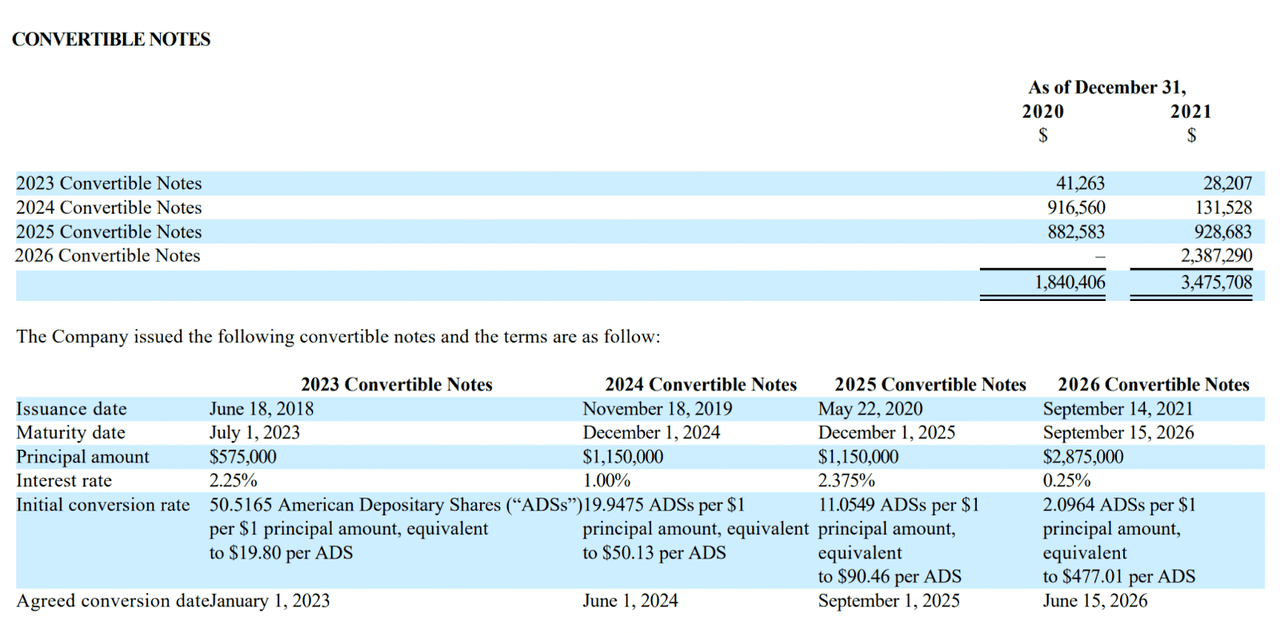

SE’s FY21 annual report

SE’s FY21 annual report

Sea Limited has multiple convertible notes maturing in July 2023, December 2024, December 2025, and September 2026, and these amount to a total of $3.47 billion. Based on its cash balance of $7.8 billion, and assuming SeaMoney hits cash flow positive by FY23 and Shopee is to be adjusted EBITDA positive by FY22, I believe paying off the convertible notes is not an issue.

However, I will not completely rule out that SE won’t be able to repay the convertible notes if the above assumptions do not materialize and there is no ample cash to sustain the business. If that happens, management has to either raise capital or extend the maturity date – either way, that’s not a good sign.

Overall, I find this to be a pretty decent quarter for SE. As the quest for profitability tightens and with Garena’s profitability deteriorating, I can see that management’s effort to accelerate the profitability of Shopee and SeaMoney has resulted in material progress, although the outlook of the macro headwinds and the removal of Shopee’s guidance have clouded these improvements. In my opinion, the market is underestimating the potential of SeaMoney if we were to compare numbers from its peers such as Mercado Libre and Bukalapak.

However, I also have to admit that there are certainly more risks as the company’s only cash cow is facing further headwinds, and any execution risk could render its inability to pay off the convertible debts and keep the business afloat. At this current junction, I believe investors are waiting to see if management can successfully navigate its way out of the woods.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.