Discover the power of people-inspired innovation with Jack Henry™.

Keeping up with anytime, anywhere service expectations isn’t an option – it’s a necessity. Discover three techniques to improve your accountholders’ digital banking experience.

Read More about 3 Ways to Level Up Your Digital Banking Experience

Dive into CSI’s interactive 2023 Banking Priorities Executive Report to discover where bankers stand on the industry’s hottest issues, plus how to respond to disruption.

Read More about Financial Institutions’ 2023 Forecast

Learn how Financial Institutions can create a holistic view of their customers to keep their accounts safe.

Read More about Fight Fraud by Connecting Your Financial Channels

By Steve Cocheo, Senior Executive Editor at The Financial Brand

Stay on top of all the latest news and trends in banking industry.

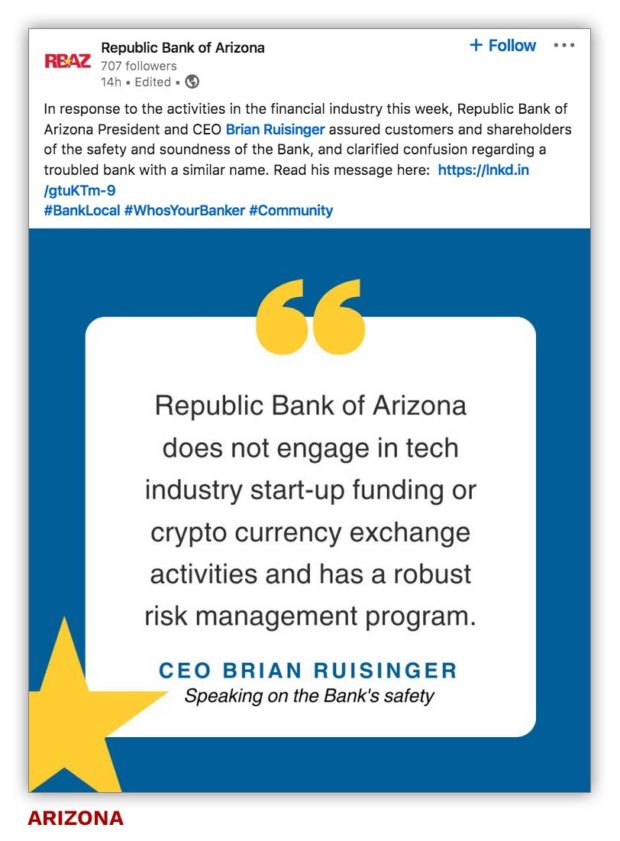

Arizona banker Brian Ruisinger heard his phone ping at 6:15 a.m. on the Monday after two large regional banks failed. A customer, who had seen First Republic Bank’s logo on a news site, texted a screenshot and expressed concern about the stock tanking.

Ruisinger is the president and chief executive officer of a bank that has $250 million in assets and is based in Phoenix. It has no connection to the $212.6 billion-asset First Republic in San Francisco, which came under heavy pressure in the wake of the two failures.

But what Ruisinger’s bank does have is a similar name: Republic Bank of Arizona.

By the end of the day, “I had a few of those messages,” Ruisinger says.

It had been a rough weekend for the banking industry. The Federal Deposit Insurance Corp. took over Silicon Valley Bank in Santa Clara, Calif., on Friday, March 10, and Signature Bank in New York on Sunday, March 12, after both suffered massive bank runs.

And so began what would be an even rougher week for bankers all over the country, as the doubt rattled investors and depositors everywhere.

None struggled more than First Republic, which ended up getting an infusion of deposits from 11 of the largest banks in the country to shore it up.

But other banks with similar names to those in the news — whether a variation of “Republic” or “Signature” — had some extra angst of their own.

Republic Bank of Arizona hurried to get the word out that it was in good shape. It issued a press release that touted its well-capitalized status, its ample liquidity, and its five-star rating from Bauer. It also posted a letter from Ruisinger on its website and shared messages on social media.

Ruisinger says that, fortuitously, Republic Bank of Arizona had just wrapped up a full-scope FDIC exam in January, which gave him some fresh ammunition. Its press release pointed out that the bank “received excellent results,” with no liquidity issues being cited.

The bank also mentioned that it had no need to use the Federal Reserve’s Bank Term Funding Program, an emergency measure taken to provide all banks and credit unions with additional liquidity to cover all deposits on demand, as needed.

Ruisinger says it was important to put all of these facts out there. He says some customers were becoming quick studies on unrealized bond losses, which is a minor matter for his bank.

These are the 4 green flags to look out for before you sign a contract with a FinTech from a risk and regulation expert.

Read More about For Any Bank Considering a Fintech Partnership

In this webinar, learn how leading FIs are approaching personalization, using data, and tactical examples of effective touchpoints in the customer lifecycle.

Read More about Enhancing The Customer Journey with Data-Driven Personalization

In The Financial Brand timeline, we noted how the head of a state banking association recently said that, “If capital is king, then confidence is queen, and the queen in many cases runs the show.”

After New York’s Signature Bank failed, a handful of other financial institutions sprung into action to disassociate themselves from that bank. Four are also named Signature Bank, and the other is Signature Federal Credit Union in Alexandria, Va.

Several banks with “Republic” in their name also took action, lest they be mistaken for First Republic.

Thomas Geisel, the president and CEO of the $6 billion-asset Republic Bank in Philadelphia, posted a letter on its website that opened this way: “As you may be aware, two financial institutions were closed by federal regulators over the weekend. Amid everything going on, Republic Bank would like to make very clear: we are Republic Bank, Inc. (FRBK-Red/Blue Logo); we are NOT First Republic Bank (FRC-Green Logo).” [Emphasis in original.]

The letter went on to say that the bank does no crypto or startup lending and that its credit portfolio is well diversified. It also mentioned an agreement to raise $125 million capital that had been announced March 10.

“We understand what drives the market and pride ourselves on being prudent, available, and transparent,” Geisel wrote.

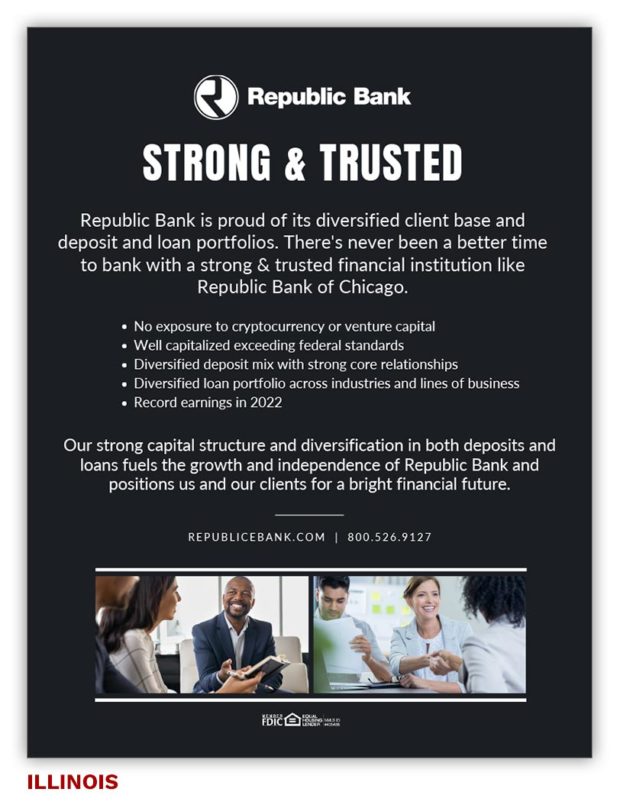

The $2.7 billion-asset Republic Bank of Chicago put a note on its website touting its strength and saying that it has “no exposure to cryptocurrency or venture capital.”

Many financial institutions without any similarities to the embattled banks have taken to sharing messages too.

ConnectOne Bank in New Jersey is just one example of those looking to reassure customers whose accounts exceed the $250,000 limit on FDIC deposit insurance. A prominent message on its homepage let depositors know that it could provide as much as $150 million in FDIC coverage using the IntraFi Network. Seattle Bank, which operates its own rate comparison site, CD Valet, also opens its home page with an advisory about how to obtain such coverage.

But some preferred to hunker down. One community banker told The Financial Brand that his institution wouldn’t be talking about the situation because “the bloggers and the tweeters attack anybody who says that they’re OK.”

Bryan Hubbard, a communications consultant who formerly served as top spokesman for the Office of the Comptroller of the Currency, says a message does come with risk: “You can create a perception of ‘Thou protesteth too much.’”

So understand your audience and what they respond to best, whether it be email, social channels or website messages, he advises.

“Do I think that all 4,700 banks need to issue statements of assurance? No,” says Hubbard.

Read More:

Some banks get no choice about whether to speak up though.

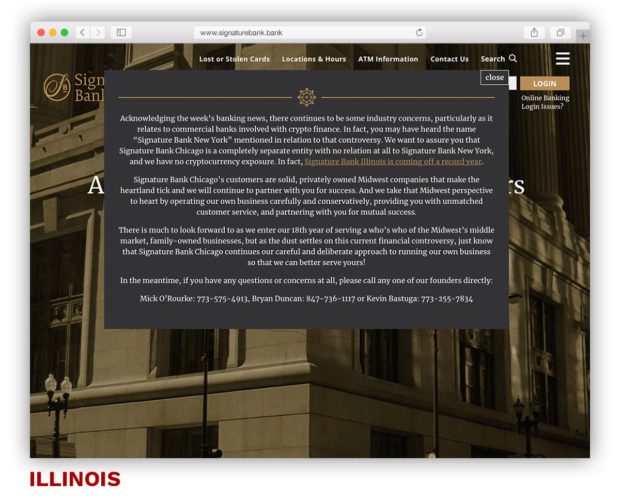

Case in point is $1.5 billion-asset Signature Bank Chicago, which saw its logo accompanying a report about the failed New York bank. The privately held Chicago bank has no connection with the Signature in New York. What’s more, the Chicago bank’s logo uses a roman typeface, while the failed bank had used a logo imitating a signature.

A key first step was getting an email out to customers, Kevin Bastuga, founding director, told AM 560 “Morning Answer” radio host Dan Proft on March 13.

After seeing the logo mistakenly used on the television news, “we felt like we needed to get out ahead of any story,” Bastuga said. So the management team acted swiftly, “to get out in front of this before it took on a life of its own.”

A popup on its homepage said that the bank had just announced a record year and had no cryptocurrency exposure. “Signature Bank Chicago’s customers are solid, privately owned Midwest companies that make the heartland tick and we will continue to partner with you for success. And we take that Midwest perspective to heart by operating our own business carefully and conservatively,” the notice said.

It was signed by the bank’s three founders and included their phone numbers.

In the interview, Bastuga said that the situation reinforced the preference he and his co-founders had to remain a privately held bank, not subject to the vagaries of the public markets, “especially with the speed at which information travels with the 24-hour news cycle.”

He added: “If there’s a bright side to this, it will force bank customers to really get to know their bank and get to know how strong it is, what its weaknesses are, what its lending practices are.”

It’s critical to provide your users the products and services they need – when and where they want them. Learn how in this webinar.

Read More about Behind the Screen: Keeping the Human in Digital

Learn how a 53-year-old community bank in Nashville, TN is reinventing itself to better serve the community and tap into a pool of next-gen customers.

Read More about Becoming a Tech-Enabled Change Agent

Signature Bank of Arkansas had an advantage in reacting to the New York bank’s seizure because this wasn’t the first time the shared name became an issue, according to Tori Bogner, its senior vice president of marketing.

In early 2021, after the events of Jan. 6 in Washington D.C., when a mob attacked the Capitol, New York’s Signature Bank closed President Donald Trump’s personal accounts there. The New York bank also called on Trump to resign. Bogner says her bank was getting mixed public feedback from those who mistakenly thought the Arkansas bank had taken those actions.

Some were cheering her institution for the stance, while others were criticizing it, says Bogner. But they had the wrong bank, and Signature Bank of Arkansas decided to clarify things in social media and elsewhere.

So, after news of the New York bank’s seizure broke on Sunday, March 12, Signature Bank of Arkansas jumped into action, says Bogner. This began with posting a large banner on top of its website explaining “your community bank, Signature Bank of Arkansas, [is] not associated or affiliated with a similarly named organization that you may see mentioned in the news.”

Posts went up on Facebook, Instagram, LinkedIn and Twitter. On some channels the bank re-purposed posts going back to the 2021 situation.

An email went out to customers. The bank also shared an FAQ with employees to prepare them for answering questions.

All of that happened on Sunday.

Then on Monday, the bank sent a media alert making it clear that the bank was not affiliated “with a similarly named organization making national news headlines.” In the alert it referred to the closed institution by name, “Signature Bank, New York.” Bogner says that local media picked up on it. She had no response from national media.

The bank tracked the public inquiries and the first day there were 200, ranging from “This isn’t you guys, right?” to “I’ve got to get my money out,” says Bogner. Questions were answered and nerves calmed. By Wednesday, she adds, “we were feeling a lot better about things.”

Toledo, Ohio’s Signature Bank also made it clear on its home page that it had no connection with the New York institution.

Signature Bank of Georgia put out a detailed news release. Beyond establishing that it is unaffiliated with any other bank, it also talked about regulatory capital ratios:

“Regarding Signature Bank of Georgia’s financial standing, a bank’s ratio of Tier 1 capital to average assets, known as the ‘leverage ratio,’ is considered ‘Well Capitalized’ by the regulators when above 5%. At Signature Bank of Georgia, our leverage ratio rose to 11.80% as of the month ended February 28, 2023. With its recent capital campaign being sold out on a commitment basis, the ratio will rise to approximately 15%, which is well more than the ‘Well Capitalized’ definition by regulators.”

The news release then went into significant detail on the bank’s favorable liquidity position.

It closed with this: “Whether you are a client, an investor in the bank or both, this bank is truly different than many others, and certainly those you might have read about recently in the news.”![]() THE FINANCIAL BRAND FORUM RETURNS MAY 20-22, 2024! Over 3,000 of your peers and competitors will be at the Forum 2024 exploring the big ideas disrupting banking — from digital growth strategies to the latest trends redefining the future of financial marketing. Pre-register today!

THE FINANCIAL BRAND FORUM RETURNS MAY 20-22, 2024! Over 3,000 of your peers and competitors will be at the Forum 2024 exploring the big ideas disrupting banking — from digital growth strategies to the latest trends redefining the future of financial marketing. Pre-register today!

This article was originally published on . All content © 2023 by The Financial Brand and may not be reproduced by any means without permission.

Stay on top of all the latest news and trends in banking industry.

Economic factors pushing credit unions like CSCU to Text Messaging and Video Banking – saving costs.

Read More about CSCU Cuts Call Center Costs 64% In 1 Year With Eltropy

Exclusive white paper showcasing why FIs must transform bill pay into a personal financial tool and what they can gain by doing so.

Read More about Make Bill Pay a Consumer Magnet Again

This free white paper outlines how to meet the evolving data needs of your customers and team.

Read More about Ensure Success In Your Data Journey With These 5 Steps

SLD’s latest financial study looks at why the current financial strategy of closing bank branches isn’t working for customers and how to fix it.

Read More about Why Creating A Seamless Customer Experience is Crucial for Banks