Snapchat, Facebook, Spotify and other phone Apps on iPhone screen

stockcam

Snapchat, Facebook, Spotify and other phone Apps on iPhone screen

stockcam

Snap (NYSE:SNAP) is the parent company of one of the most successful social media apps in the world, Snapchat. The relative newcomer in the space was founded back in 2011 by three former Stanford University students and managed to attract the attention of 383 million daily active users and more than 750 million monthly active users across the globe. Even in its early years, Snap became almost laser-focused on attracting newer generations to the platform, benefiting greatly from the network effect among young adults and tightening its grasp on the demographic. Its rapid rise helped Snap become one of the hottest tech growth stocks in the last bull market, reaching a $150 billion valuation at one point.

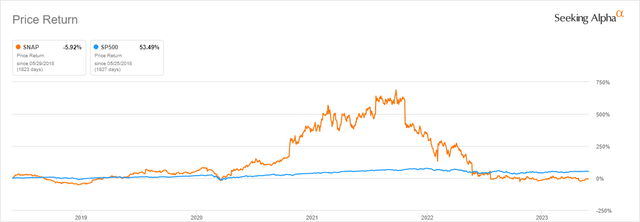

However, we live in a completely different market today, one that finds it difficult to award steep valuations to newer tech companies. A declining macroeconomic environment that’s almost drained the ad market dry isn’t doing Snap any favors either. If we add on top of that several disappointing earnings releases, the culmination of these points led to Snap trading only at a fraction of its former valuation, with investors being able to buy the popular social media app for around 10 cents on the dollar compared to its all-time highs. The wave of selling pressure has erased nearly $135 billion from its market capitalization and pushed Snap’s share price far below its 2017 IPO price.

Amidst a sea of bad news for the firm, an unexpected catalyst has lined up from Montana’s Governor Greg Gianforte’s decision to ban TikTok on personal devices in the state, setting up an important precedent. Today, we dissect if it would be enough to make a difference for SNAP.

Snap vs S&P500 5-year Return (Seeking Alpha)

Snap vs S&P500 5-year Return (Seeking Alpha)

Over the past couple of years, TikTok has proven to be one of the most successful and sought-after social media apps, especially among the young-adult American population, a group that was formerly controlled by Snap. It is estimated that the TikTok app is used by 150 million Americans, who might find themselves in a position to be forced to sideline their favorite app amid increasing calls for its ban.

The Governor of Montana, Greg Gianforte, signed a bill banning TikTok in the state last week. This controversial step marks the furthest that any federal lawmaker or government representative has gone in an attempt to restrict TikTok’s influence in the United States. The legislative hammer is set to go into effect at the beginning of 2024 unless ByteDance’s attempt to defeat it in court yields results. With a little more than a million inhabitants, the potential ban would account for less than one percent of the app’s US-based users but could mark a significant precedent in a heated political climate.

This is not the first time that the possibility of TikTok getting banned in the United States has been raised, given that the country already bans the application on federal and public servants’ as well as state employees’ phones smartphones in 32 states. However, the state of Montana is the first to actually pass legislation banning the use of the app on all personal devices, marking a huge step. In short, pressure is mounting on TikTok, and it remains unclear in what sort of position the popular social media app will find itself a year from now, let alone over the long term.

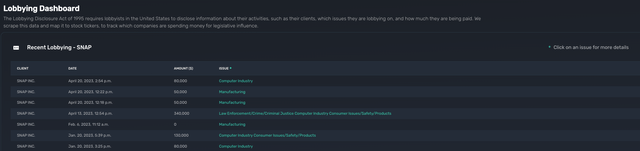

Snapchat Corporate Lobbying Efforts (Quiver Quantitative)

Snapchat Corporate Lobbying Efforts (Quiver Quantitative)

Snap, as well as other US-based tech companies, are well known for their willingness to spend on corporate lobbying and political efforts. Over the last several election cycles the big players in the space, including Meta Platforms (META), Snap, Alphabet (GOOG) (GOOGL), and Twitter, now owned by Tesla (TSLA) billionaire Elon Musk, have donated over $45 million to various candidates, parties, and PACS (Source: Quiver Quant political donations dashboard). The same group of tech giants, not including Tesla or Twitter, have collectively spent over $18 million on corporate lobbying expenses just in 2023 (Source: Quiver Quant lobbying dashboard). Interestingly, a significant allocation was made by all 3 companies to lobby on topics like ‘Computer Industry Consumer Issues’ and ‘Civil Liberties Telecommunications’. As much as $8 million of the $18 million in YTD expenditures has been directed at those two issues and/or related legislation. Snap’s relationship with D.C. actually goes a step further than some of its social media peers as it also has a relatively lucrative recurring contract with the Department of Homeland Security. They awarded Snap more than $18 million in contracts in 2022 (Source: Quiver Quant government contracts dashboard).

Amid the degrading relationship between the world’s superpowers on one end, increasing lobbying efforts by tech companies on the other, and overall mounting public pressure on politicians to make a move, a road to a scenario in which TikTok ultimately ends up getting banned in the majority of the entirety of the United States looks more plausible by the day. To recall, China has a long-held policy of forbidding access to American social media apps. Such a move would ultimately stand to benefit all U.S. social media companies, but the bullish position is that Snapchat stands to specifically benefit from this course of events. The real question is: would it be enough to save SNAP?

There are several factors that made Snapchat a unique and interesting offering back in the early 2010s. The app initially allowed users to share “snaps”, that is pictures and videos, through the smartphone app, with the added privacy quirk of them getting erased after 24 hours. Snap also implemented a rather lighthearted creative tools package allowing for interesting bitmojis and animations, as well as location sharing and geofilters, orienting themselves to a very specific demographic. Perhaps the hottest new feature was Snapchat’s stories, which allowed users to share regular updates on their daily hobbies and activities through 24-hour photo and video disappearing slideshows.

As a direct result of the engaging new features, as previously mentioned, Snapchat became tied to a quite specific demographic. It is estimated that the Snapchat app reaches 90% of the 13- to 24-year-old population and 75% of the 13- to 34-year-old population in over 20 countries across the globe. In other words, its social media presence is almost laser-focused on newer generations, and its grasp over young adults across the globe has outshined even the giants of the social media space such as Meta Platforms and Alphabet. This allows for a relatively unique MOAT to be formed, however tiny, and it positions the company for high-paced growth amid the new generation recognizing Snapchat as “the app” to use. At least that was the backbone of the bull’s thesis.

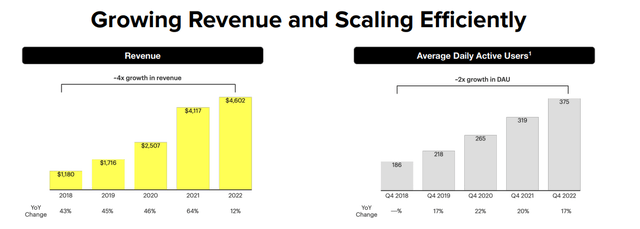

The reality as of late has been somewhat different. The company is facing mounting issues, and investor sentiment surrounding Snap obviously declined amid the worsening financial results. Backward-looking results remain highly impressive but also hold the company to high standards. SNAP has managed to double its user base and quadruple its revenue over the past five years. Recent years are much less impressive.

Five-year results (Q1 ’23 Investor Deck Presentation)

Five-year results (Q1 ’23 Investor Deck Presentation)

However, its first-quarter earnings report brought even more headaches for long-term investors, as the social media firm missed all expectations across the board. The results shaved as much as 20% off the stock price immediately after they were announced. The quarterly revenue declined by 7% from $1.06 billion reported in the previous year, as the company also lost only $0.32 billion, or 21 cents per share, compared to last year, when it lost $0.35 billion, or 22 cents per share. Margins have been contracting as well, with the first-quarter operating margin declining by 11% year-over-year to a negative 37%. Gross margins declined by an additional 5%, and EBITDA margins declined by 6% for the same time period. Furthermore, management refused to provide any guidance for the second quarter of the year.

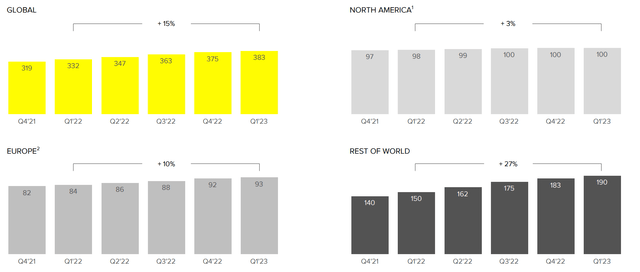

User Growth (Q1 ’23 Earnings Presentation)

User Growth (Q1 ’23 Earnings Presentation)

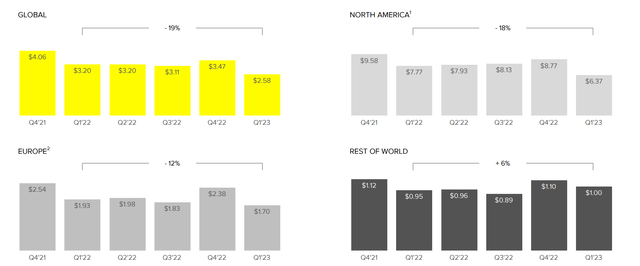

In terms of user growth, the overall pace has been on the decline. On paper, global daily active users grew by 15% year-over-year, which is still rather impressive. However, growth in the most profitable markets of the U.S. and Europe remained rather stagnant at 3% and 10%, respectively. This is offset by growth in the “rest of the world” segment, which was reported at 27%. Still, the category brings forth low-intensity ARPU, only adding to the monetization difficulties. North American-based use growth is effectively stuck in the anemic low single digits. Europe barely manages to reach double-digit annualized growth. ARPU declined by a staggering 19% globally to $2.58. Just two years ago, the firm generated north of $4.00 per user.

ARPU Growth (Q1 ’23 Earnings Presentation)

ARPU Growth (Q1 ’23 Earnings Presentation)

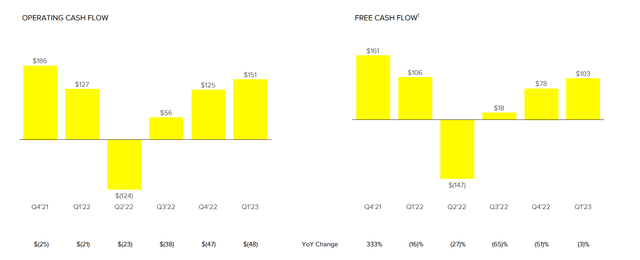

Cash flow potency and free cash flow generation remained about the only positive aspects of the financial side, with Snap continuing to make progress on this front. The firm generated $151 million in operating cash flow for the quarter, along with $103 million in free cash flow.

OCF and FCF (Q1 ’23 Earnings Presentation)

OCF and FCF (Q1 ’23 Earnings Presentation)

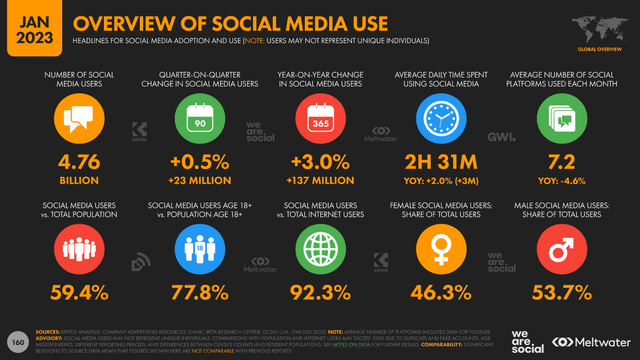

According to the latest “We Are Social Digital Global” study from January, it is estimated we have 4.76 billion active social media users. So taking into account that there are approximately 8.00 billion people in the world, nearly 60% of people alive on Earth use social media on a monthly basis. In reality, if we exclude the Chinese market currently, inaccessible by U.S. tech companies, the total addressable market for Snapchat is around 6.6 million users. With 0.75 billion active monthly users, Snap has only penetrated roughly 10-15% of its accessible market, depending on the figure used. So the company has the ability to unlock significant value in this context, which is exactly the potential so many investors have seen in Snap. Management continues to place emphasis on the massive total addressable market, but the real question is whether it can execute within a reasonable time frame.

Social Media Use Statistics (We Are Social – Digital Global ’23 Report)

Social Media Use Statistics (We Are Social – Digital Global ’23 Report)

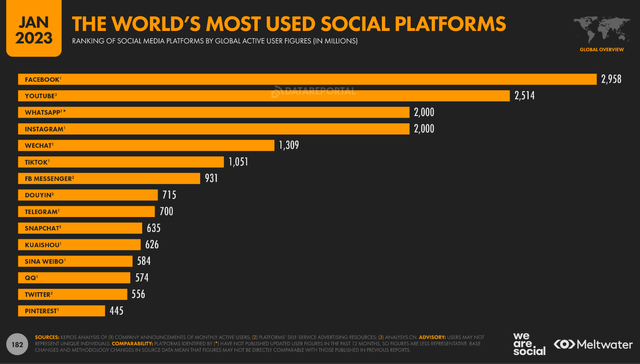

Perhaps the most difficult challenge that the company will have to overcome in the upcoming decade is retaining its significance in the social media space when faced with Meta’s ecosystem. This is largely the greatest obstacle to accelerating its growth again, besides TikTok. The rival commands an ecosystem of unprecedented scale, with its apps, including Instagram, Facebook, and WhatsApp, reaching 3.81 billion people on a monthly basis, according to their latest earnings report.

The previously mentioned 750 million MAU looks bleak in comparison. In order to put things into perspective, Meta’s current cash position outweighs Snap’s entire market capitalization. To define this relationship as an unlevel playing field would be a severe understatement. Furthermore, Mark Zuckerberg’s execution when it comes to these things is cold-blooded, seemingly finding an answer to every challenge over the years.

When a then-new app called Instagram came around the block and threatened Facebook’s dominance over the social media space, Meta made an offer they couldn’t refuse and has brought it under its own wing. When Snap established a foothold among the young adult demographic, Zuckerberg first tried to buy them out as well but was later forced to simply replicate their unique features and integrate them into Meta’s app ecosystem, after the founders declined a reportedly $3 billion offer.

Most Used Social Media Platforms (We Are Social – Digital Global ’23 Report)

Most Used Social Media Platforms (We Are Social – Digital Global ’23 Report)

On paper, Snapchat finds itself in a position that should make hyper-growth in the upcoming decade a reachable goal, much to the benefit of the investors willing to engage with Snap at these price levels. But the app seems to have increasingly little to offer, stuck at the crossroads between a giant in the social media space like Meta, which shamelessly continues to replicate every successful creative decision on one end, and TikTok on the other end, whose incredibly viral and strangely addictive short-video format helped it relatively quickly gain two times more users than SNAP.

As we mentioned earlier in the article, the stock price has been completely crushed by the markets over the last two years. Snap went public in 2017 at $17 per share, at a $24 billion valuation. The hype surrounding the app’s grasp over all of the creative ways to reach millennials ultimately built up to an $80 per share market price, implying around a $150 billion valuation. Much of the interest surrounding Snap was sourced from the potential of the company to do something extraordinary rather than its potency to reward shareholders from its bottom line.

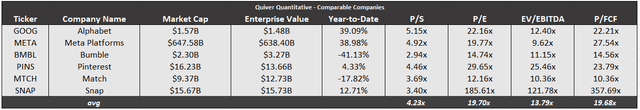

Today, with degrading financials amid a deteriorating macroeconomic environment, this situation has taken somewhat of a turn for the worse. SNAP can be bought for $9.90 per share. It is currently being traded at a relatively exuberant 121.78x NTM EV/EBITDA, 185.61x NTM P/E, and NTM 357.69x P/FCF. This is mostly due to analysts expecting negative results for the rest of the year. On the brighter side, it trades at only about three and a half times its sales, and mid-term analyst projections see the company having the potential to generate more than $1.1 billion in EBITDA and $1.3 billion in FCF in ’25, amid calls to reorient their focus on profitability. Whether or not this is plausible, or would it be enough to satisfy the appetites of long-term holders, remains an open question.

Comparable Companies (Quiver Quantitative)

Comparable Companies (Quiver Quantitative)

To finalize the discussion, it remains true that Snap’s share price has been reset close to an all-time low and the business is still leaning heavily on the expensive side. It is also true that for investors who are happy with the long-term potential of the company, SNAP trades at a fraction of its former valuation, and in that context, it becomes increasingly attractive. This is especially true when we consider how much investors were willing to pay for the company back in 2021, when it was near all-time highs. A potential unique buying opportunity for bulls is presented as Snap gets chewed up by the market. Management continues to place emphasis on the huge total addressable market, but it seems increasingly less likely they will manage to execute within an acceptable time frame as far as investors are concerned.

Getting squeezed between the likes of Meta and TikTok, the company struggles to establish a unique identity for its product that would serve to further differentiate it from the competition. New users, still largely sticking with the likes of Instagram or TikTok, are a testament to slowing growth prospects. The deteriorating macroeconomic environment, which places pressure on advertisers, has only accelerated this process. Legislative action that would see TikTok banned would provide a significant boost to its short-to-mid-term financial outlook but might not ultimately do much to resolve its long-term financial pressures. The largest positive impact there would be the potential boost to ARPU in its core markets, potentially turning the declining U.S. business around.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.