The NZ job market remains tighter than tight, which is something that will continue to cheer the Reserve Bank as it keeps pushing up interest rates. Full employment means people can better keep up with rising mortgage payments.

And confirmation that the labour market is very strong (remember, unemployment was just 3.2% as at the end of March) comes from the latest BNZ/SEEK Employment Report.

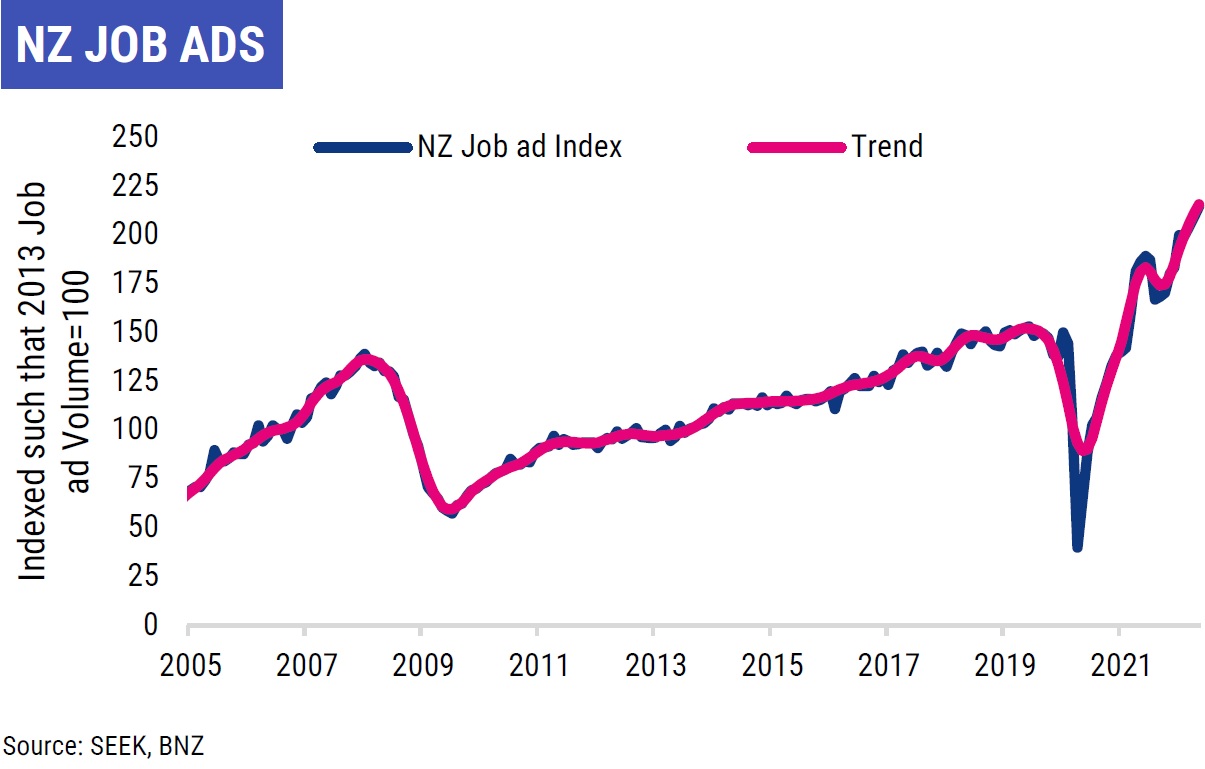

BNZ senior economist Craig Ebert said May’s job ads data from SEEK indicate New Zealand’s labour market “is still very hard pressed”.

The 2.5% monthly advance in job ads “replicated the solid pulse from April”, and maintained annual growth around the 15% mark.

Compared with December, ad numbers are up 17% (seasonally adjusted).

“It’s clear from the trend measure also, that advertising has barrelled right the way through Omicron’s disruptive influence, which began early in the year. Whether about businesses wanting to get extra cover because of COVID-induced absenteeism, or just them wanting to better meet customer demand fundamentally, heightened job ads portray exceptionally strong demand for staff at present,” he said

The SEEK data also highlightrf the relative abundance of positions wanting/needing to be filled.

Ebert said this was clear from the applications-per-ad measure, “which continued to trend lower in May, from already very low levels”.

So, in other words there’s lots of job ads but fewer and fewer people actually applying for jobs.

“This message of extreme tightness was reasonably widespread across regions and industries and is consistent with the official measure of NZ unemployment remaining exceptionally low (after the equalr ecord low rate of 3.2% it posted for Q1 2022),” Ebert said.

Hospitality & Tourism remained one of the top “go to” industries in May.

“In fact, in many ways it overtook most other industries – in terms of job ads compared to norms, as well as tightness measures – rather than just playing catch up.

“Meantime, with the housing market slowing, we have been keeping a close eye on advertising trends in the property-related industries, like Real Estate & Property, but there is no obvious weakness to report to date.”

Your access to our unique and original content is free, and always has been.

But ad revenues are under pressure so we need your support.

Supporters can choose any amount, and will get a premium ad-free experience if giving a minimum of $10/month or $100/year. Learn more here.

become a supporter

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don’t welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.

Question : as National are leading in most recent political polls :

… what are the Gnats immigration level targets ?

Will they promote selective bias towards highly skilled immigrants , doctors/ nurses , engineers , computer specialists … or , will it be open slather again … as it was under John Key … flood the joint with low skilled folks …

Or, we could talk about those things, but for the actual government in power with an absolute majority? Or are we just interested in holding the opposition to account?

In the latest national budget, Robertson announced $192m in new funding for tourism growth initiatives. However, there was a measly $11.2m towards accelerating the growth of NZ’s SaaS sector that earned $3 billion in 2020/21, 95% of which was export revenue.

Looks like this govt clearly wants more tour guides and fewer computer specialists to come to NZ.

Software engineer is on the new greenlist so actually this government is trying to get computer specialists into the country

Good news is that Luxon wants to cut taxes on property speculation, so that should encourage more money into property speculation and less into productive business such as SaaS.

… well , if you think you can get any sense out of Chris Fafoi , be my guest … ask him … if you can find him … and dont expect any direct answers ! …

Far too much monetary and fiscal intervention in the economy in response to COVID….looks like in order to avoid a recession/depression in 2020, all we did is create conditions even more likely to result in a recession or depression a few years later by throwing far too much money at the economy in a period with stagnant or reduced productivity and tight/congested supply chains.

I agree with Elon Musk and Jamie Dimon with a bad feeling about the future economy. We’ve backed ourselves into a corner that is going to be extremely hard to get out of without pain somewhere (or widespread) in the economy.

Agreed, that’s why I always think it’s not tightening monetary policy that caused recession, it’s actually ultra loose monetary policy that did the job. It’s just the impact got delayed for couple of years. If central bank is going to review their mandate, they should make the mandate harder to meet to lower the interest rate, or have restrictions to prevent cheap debt flowing into speculative assets. They should completely ditch the stupid “wealth effect” idea which government has been talking about!

Ask your employer if you should get an increase the easy way or the hard way.

I’m getting old, but I remember the days (in the UK) when the labour market was really tight. Employers used to work with schools to identify people with an interest and aptitude for their business, and then spend years training apprentices (at their own expense), companies would work hard on employee satisfaction – paying for social events and trips, and if a company appointed a bad manager, employees would walk out of a job on a Friday and into a new one on Monday. And, of course, a single earner could afford to buy a house and support their family.

I am not saying that everything was rosey – but the pendulum has swung too far away from workers. Let us also be clear: the people wailing about labour market tightness are just using neoliberal code to say ‘we need much higher levels of unemployment so that those damn workers don’t get above themselves’.

Is that the Britain that used to make cars on a wide scale, or the Britain that voted to leave the EU then couldn’t farm enough chickens to supply Nando’s?

the very same

Job ads written with an Enigma Machine. Prospective salary a state secret. Do you actually want to hire people or is it a make work scheme for your HR departments.

People want to know what they will be expected to do and how much they will be paid for doing it. Try that using plain English. Maybe you get more applicants and some actual new employees.

It’s like some employers are acting like house vendors currently… they don’t realise the market’s changed and people have options and aren’t going to bother with time wasters (eg. make you jump through all the hoops without disclosing salary/price expectation)…

There’s nothing to stop you from asking salary/price expectation before jumping through the hoops.

Yeah you can, you ever done it?

Almost guaranteed to get a question back: What are your salary expectations?

Again similar to purchasing a property… very rarely will they come out and just tell you what they want

Actual question — Is this not just a symptom of an overheated economy? Thanks.

A warm economy, rapidly increasing retirement age population, low net migration.

Yes and assuming history repeats….central banks now raise rates to slow the economy down and cause a recession and rising unemployment…and any asset bubbles present in an economy collapse upon themselves as credit contracts.

Past time then to move some of the 350,000 beneficiaries into work

Doing what? There are a lot of unemployable people.

The part that isn’t mentioned here is the labour force participation rate.

Lots of older people have retired out of the workforce with COVID, even more now that travel has opened up again. A generational shift in leadership is happening which is quite notable in all organisations.

Lots of women have exited the workforce for family too, if you partner earns far more because of a solid economy, why work and pay 3/4ths of your wage for childcare?

Tight labour market is the only thing keeping us from plunging into the depth of economic depression with housing collapse.

How dare they!!

Raise the age of eligibility for super and kiwisaver and the interest rates – that will force the buggers back to the coal face

The elderly problem would be more manageable if we didn’t spend heroic amounts of money, skill and effort keeping people alive as long as possible. The philosophy of medicine to save a patient regardless of quality of life, spending 6 figure amounts on people to survive an extra six months while we gut our maternity wards reflects a nihilistic and foolish spending by the state.

Super/Kiwisaver are good schemes, the issue is simply how long the retired live for vs the number of workers supporting them. IMO retirement age should be raised a year or two, but kiwisaver matching by employers should be 6% regardless of employee contribution to reduce the burden of retirement in future.

I think we’re going to regret banning smoking. Average smoker dies at 65, which is about the time humans start getting super expensive for the state to support.

It’s a good thing the buggers are retiring. I can’t understand how we have this universal pension thing, a welfare of sorts, that you can still claim while working.

All paid for by the next generation itching for a promotion, but being held up by those who have received a $20k pay rise courtesy of the taxpayer.

I suspect the market will loosen as margins get squeezed with rising input costs. Now is the time to make a move / seek a bigger salary before we find ourselves in a recession.

We noticed that you’re using an ad blocker. Or, your browser is blocking ad display with its settings.

Your access to our unique and original content is free, and always will be.

Please help us keep it that way by allowing your browser to display ads. How?

OR,

Create a SUPPORTER account with no ads here.

If you’re already a Supporter, please use the Supporter Login option here.

The calculations in this tool are controlled by interest.co.nz.

Terms & Conditions apply to every loan.