Visualized: The World’s Population at 8 Billion

The Biggest Tech Talent Hubs in the U.S. and Canada

The Inflation Factor: How Rising Food and Energy Prices Impact the Economy

Ranked: The Most Popular Fast Food Brands in America

Ranked: America’s Best States to Do Business In

iPhone Now Makes Up the Majority of U.S. Smartphones

Visualized: The State of Central Bank Digital Currencies

The Evolution of Media: Visualizing a Data-Driven Future

33 Problems With Media in One Chart

The Top Downloaded Apps in 2022

Mapped: The World’s Billionaire Population, by Country

Charting the Relationship Between Wealth and Happiness, by Country

Mapped: A Snapshot of Wealth in Africa

Mapped: The Wealthiest Billionaire in Each U.S. State in 2022

Visualized: The State of Central Bank Digital Currencies

Visualizing the Relationship Between Cancer and Lifespan

Explainer: What to Know About Monkeypox

Visualizing How COVID-19 Antiviral Pills and Vaccines Work at the Cellular Level

Mapped: The Most Common Illicit Drugs in the World

Visualizing The Most Widespread Blood Types in Every Country

What is the Cost of Europe’s Energy Crisis?

All Electric Semi Truck Models in One Graphic

The Inflation Factor: How Rising Food and Energy Prices Impact the Economy

Visualizing China’s Dominance in the Solar Panel Supply Chain

Visualizing 10 Years of Global EV Sales by Country

Mapped: Countries With the Highest Flood Risk

Ranked: The 20 Countries With the Fastest Declining Populations

Iconic Infographic Map Compares the World’s Mountains and Rivers

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Mapped: The State of Global Democracy in 2022

Mapped: The 10 Largest Gold Mines in the World, by Production

The 50 Minerals Critical to U.S. Security

Visualizing China’s Dominance in Clean Energy Metals

The Periodic Table of Commodity Returns (2012-2021)

Visualizing the Abundance of Elements in the Earth’s Crust

Mapped: Countries With the Highest Flood Risk

Visualizing China’s Dominance in the Solar Panel Supply Chain

All the Contents of the Universe, in One Graphic

Explained: The Relationship Between Climate Change and Wildfires

Visualizing 10 Years of Global EV Sales by Country

Published

on

By

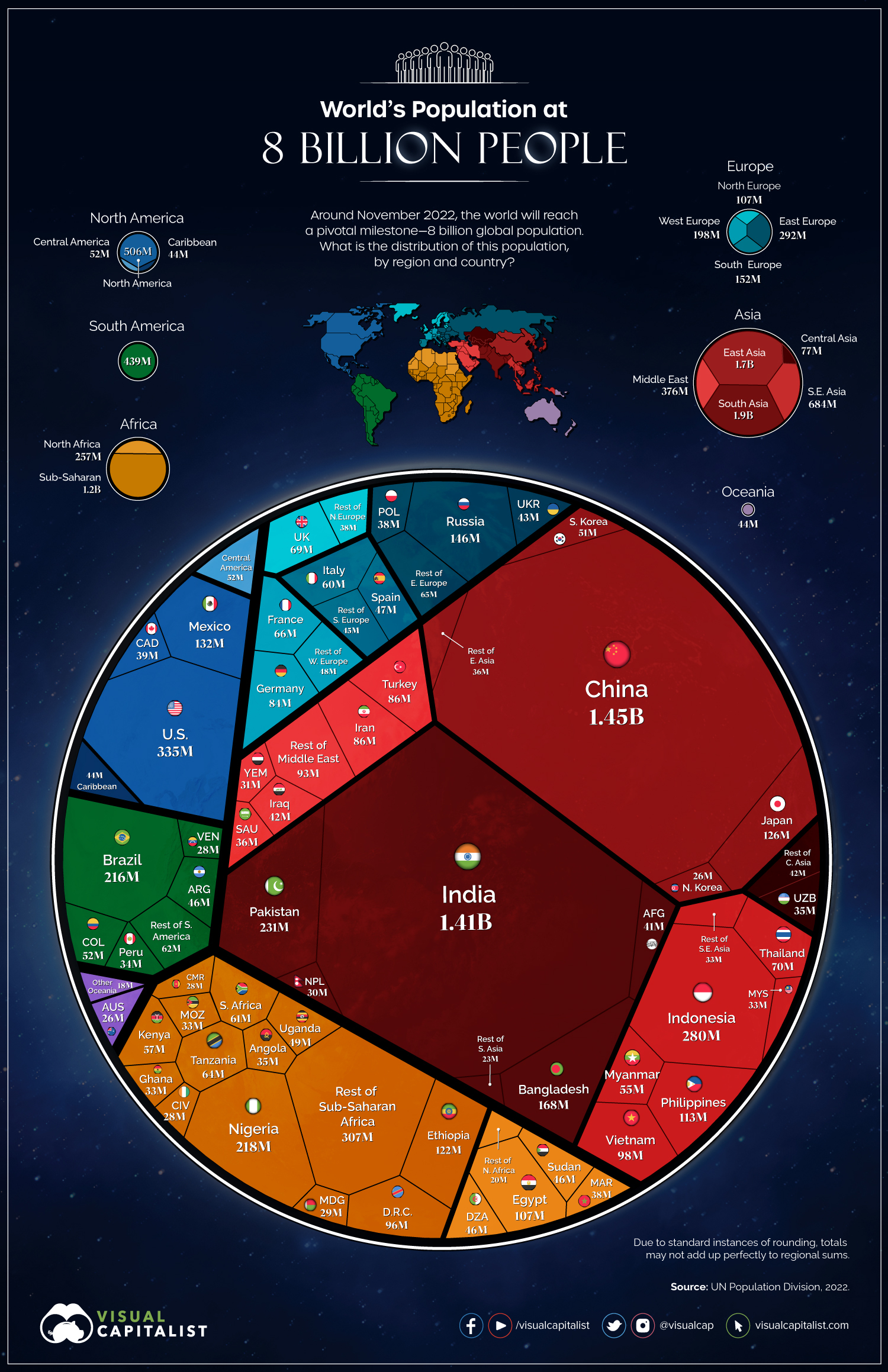

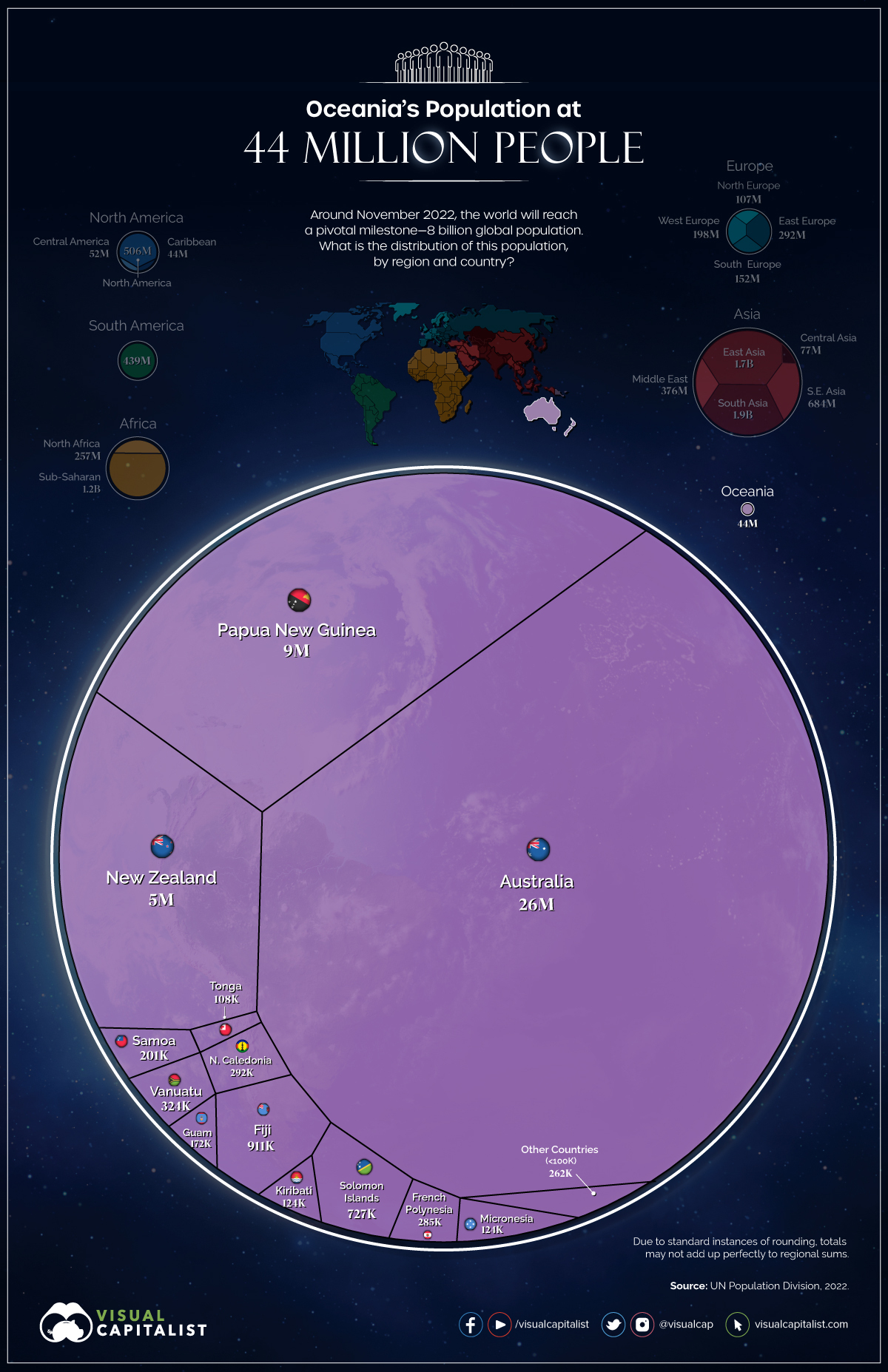

At some point in late 2022, the eight billionth human being will enter the world, ushering in a new milestone for humanity.

In just 48 years, the world population has doubled in size, jumping from four to eight billion. Of course, humans are not equally spread throughout the planet, and countries take all shapes and sizes. The visualizations in this article aim to build context on how the eight billion people are distributed around the world.

For extended coverage of this moment and what it means to the world, you can get access to our full report and webinar by signing up to VC+, our premium newsletter.

Now, here’s a look at each country’s population as of September 2022:

Below are regional breakdowns of population.

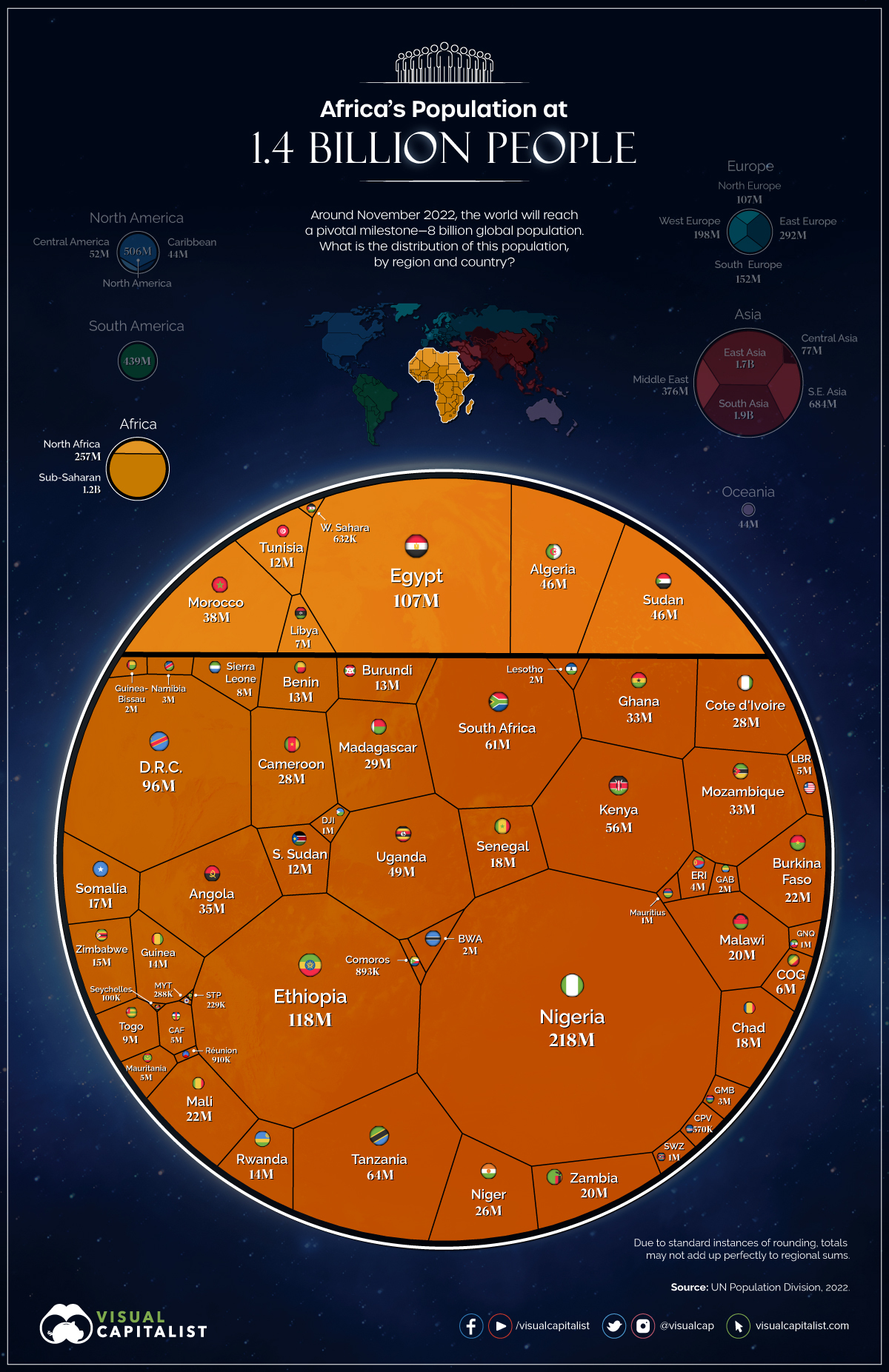

As of 2022, Africa’s total population stands at 1.4 billion people. Many of the countries with the fastest growth rates are located in Africa and by 2050, the population of the continent is expected to jump to 2.5 billion.

Nigeria is Africa’s most populous country and its largest economy. Based on current growth rates, Nigeria’s largest city, Lagos, could even emerge as the world’s top megacity by the end of the century.

Africa has by far the lowest median age of any of the other continents.

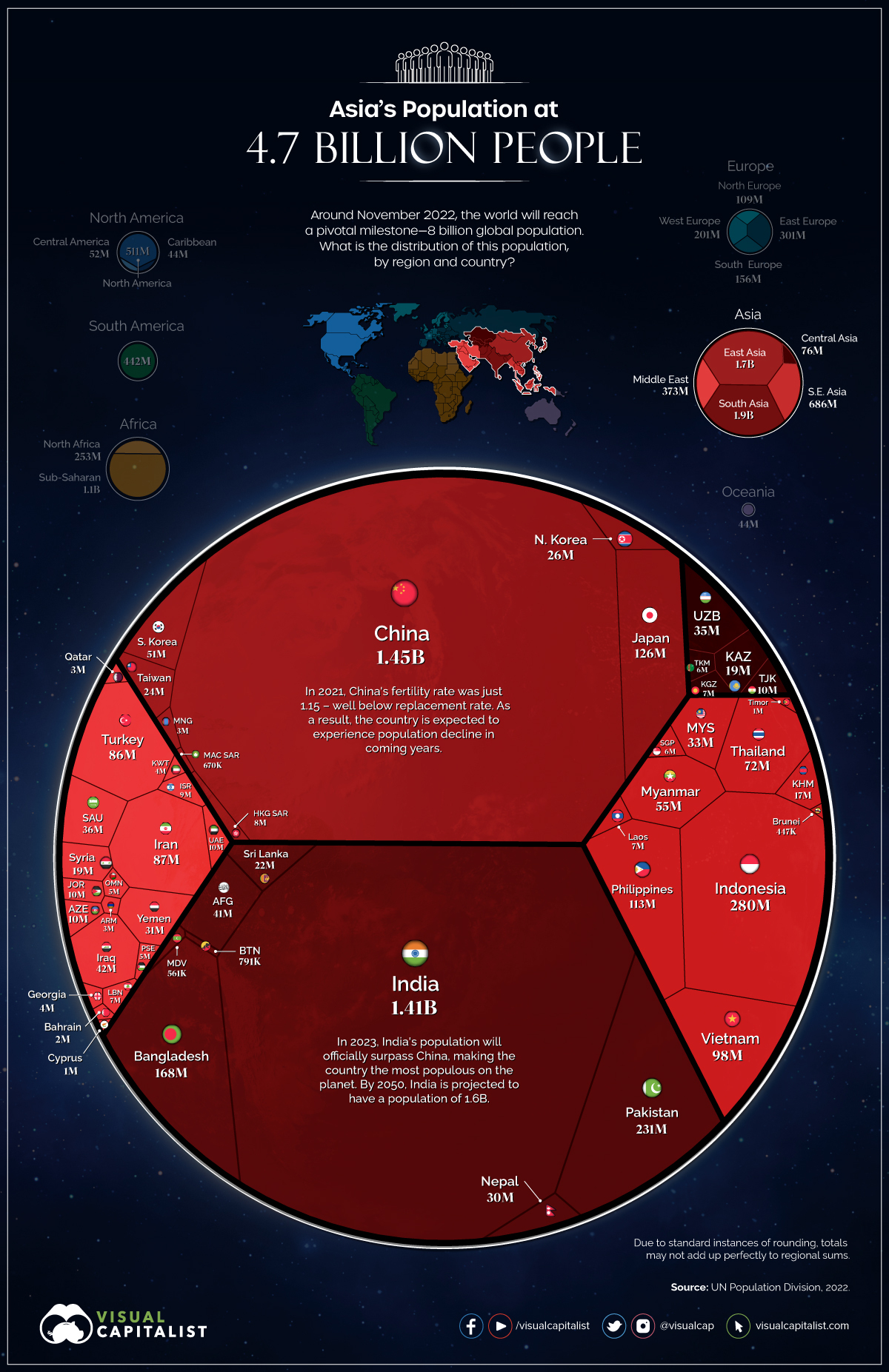

With 4.7 billion people in 2022, Asia is by far the world’s most populous region.

The continent is dominated by the two massive population centers of China and India. In 2023, a big shift will occur, with India surpassing China to become the world’s most populous country. China has held top spot for centuries, but the mismatch between the two countries’ growth rates made it only a matter of time before this milestone arrived.

Asia is a region of contrast when it comes to population growth. On the one end are countries like Singapore and Japan, which are actually shrinking. On the other, are Middle Eastern nations like Oman and Qatar, which have robust population growth rates of 4-5%.

Vietnam is on the cusp of becoming the 15th country to surpass the 100 million population mark.

Europe’s population in 2022 is 750 million people—more than twice the size of the United States.

A century ago, Europe’s population was close to 30% of the world total. Today, that figure stands at less than 10%. This is, in part, due to population growth throughout other regions of the world.

More importantly though, Europe’s population is contracting in a number of places—Eastern Europe in particular. Many of the countries with the slowest growth rates are located in the Balkans and former Soviet Bloc countries.

Russia remains Europe’s largest country by population. Although the country’s landmass extends all the way across Asia, three-quarters of Russia’s people live on the European side of the country.

Germany is the second largest country in Europe, followed by the UK, France, and Italy.

Ukraine is the seventh largest population center in Europe, but it remains to be seen how the current conflict with Russia impacts the country’s long-term population prospects.

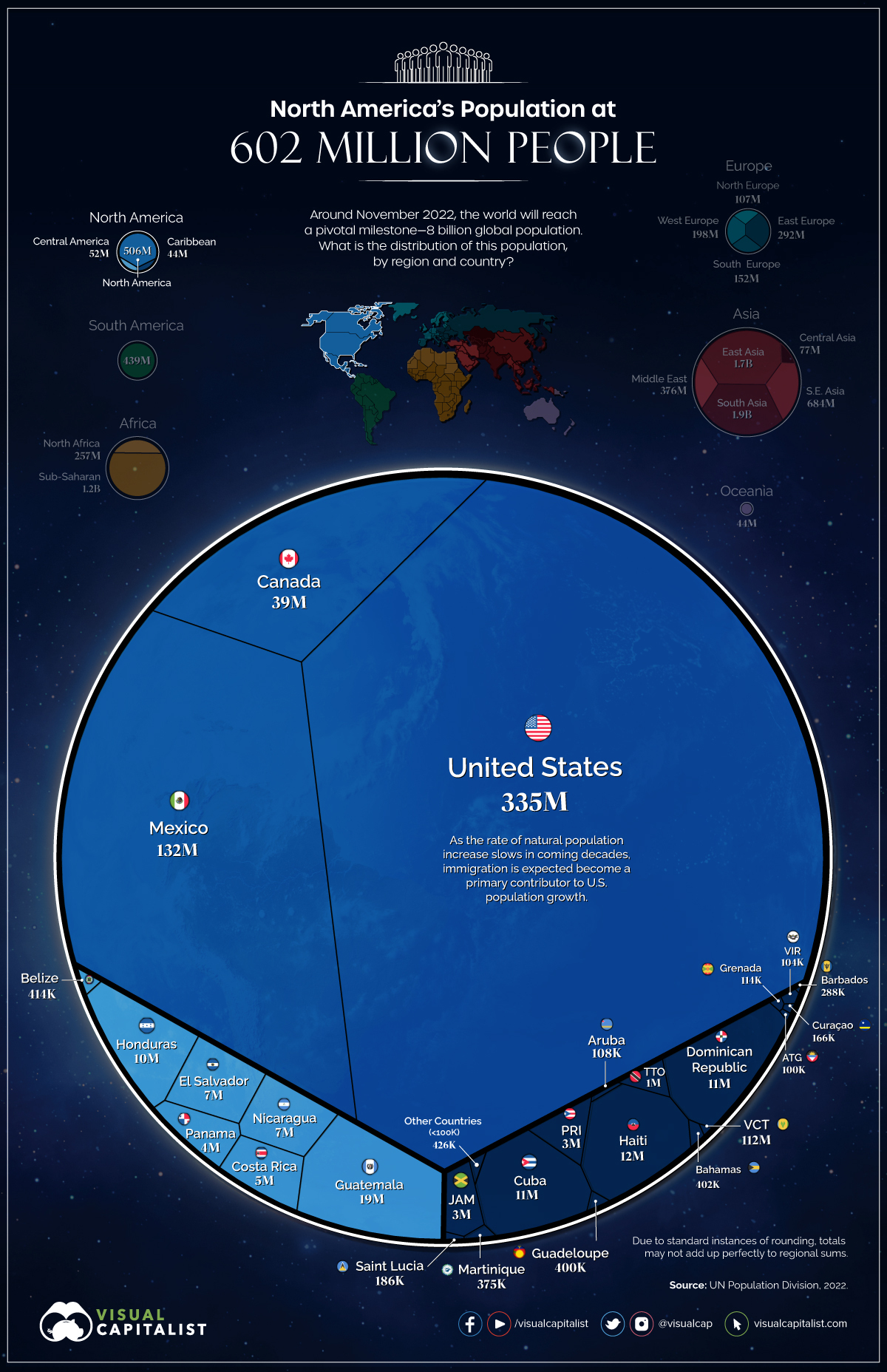

North America’s population is 602 million people as of 2022.

The continent is dominated by the United States, which makes up more than half of the total population. America’s population is still growing modestly (by global standards), but perhaps more interesting are the internal migration patterns that are occurring. States like Texas and Florida are seeing an influx from other states.

Canada has one of the highest population growth rates of major developed economies thanks to international migration.

Mexico is currently the 10th most populous country, but will eventually be bumped from the top 10 list by fast-growing African nations.

The population of South America in 2022 is 439 million. Brazil makes up nearly half of that total.

Sometime this decade, Colombia’s capital, Bogotá, will become the region’s fifth megacity (which is defined as having a population of 10 million or more). São Paulo, Rio de Janeiro, Buenos Aires, and Lima are South America’s current megacities.

The population of the Oceania region is 44 million people—just slightly higher than the population of California.

Australia, New Zealand, and Papua New Guinea make up the lion’s share of the population of this region.

Interestingly, many of the smallest countries by population can also be found in this region.

The next global population milestone—nine billion—will likely be hit sometime in the 2030s.

In fact, Earth’s population is expected to continue growing until it hits a peak at some point in the 2080s—possibly over the 10 billion mark.

Where does this data come from?

Source: United Nations, Department of Economic and Social Affairs, Population Division via Worldometer’s live tracker (as of Sept 27, 2022).

Context: The UN has estimated that November 15th, 2022, will be the date that the world population officially hits 8 billion.

The Biggest Tech Talent Hubs in the U.S. and Canada

Visualizing China’s Dominance in the Solar Panel Supply Chain

Ranked: Top 10 Countries by Military Spending

Visualizing 10 Years of Global EV Sales by Country

Ranked: The 20 Countries With the Fastest Declining Populations

The $100 Trillion Global Economy in One Chart

Visualized: Which Countries are Dominating Space?

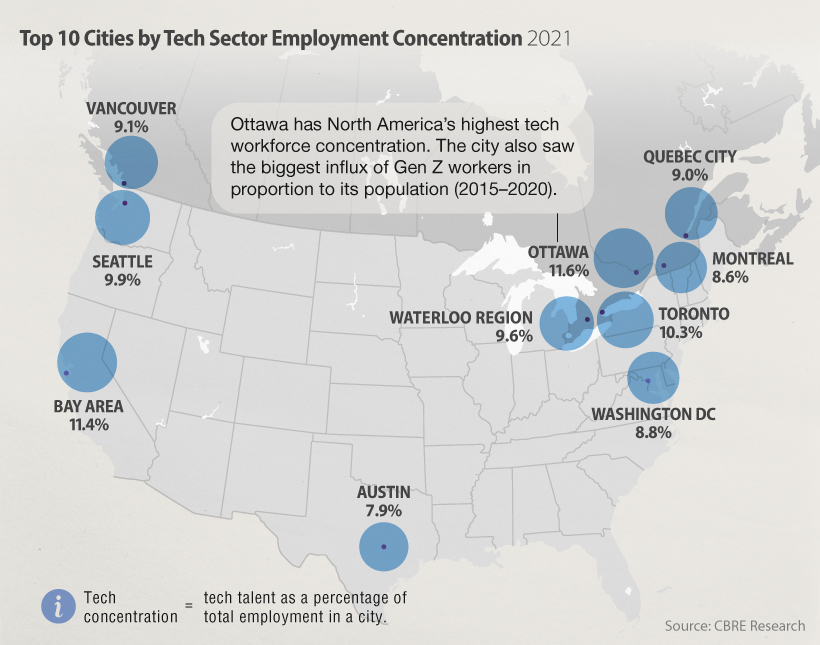

6.5 million skilled tech workers currently work in the U.S. and Canada. Here we look at the largest tech hubs across the two countries

Published

on

By

The tech workforce just keeps growing. In fact, there are now an estimated 6.5 million tech workers between the U.S. and Canada — 5.5 million of which work in the United States.

This infographic draws from a report by CBRE to determine which tech talent markets in the U.S. and Canada are the largest. The data looks at total workforce in the sector, as well as the change in tech worker population over time in various cities.

The report also classifies which metro areas and regions can rightly be considered tech hubs in the first place, by looking at a variety of factors including cost of living, average educational attainment, and tech employment levels as a share of different industries.

Silicon Valley, in California’s Bay Area, remains the most prominent (and expensive) U.S. tech hub, with a talent pool of nearly 380,000 tech workers.

Here’s a look at the top tech talent markets in the country in terms of total worker population:

America’s large, coastal cities still contain the lion’s share of tech talent, but mid-sized tech hubs like Salt Lake City, Portland, and Denver have put up strong growth numbers in recent years. Seattle, which is home to both Amazon and Microsoft, posted an impressive 32% growth rate over the last five years.

Emerging tech hubs include areas like Raleigh-Durham. The two cities have nearly 70,000 employed tech workers and a strong talent pipeline, seeing a 28% increase in degree completions in fields like Math/Statistics and Computer Engineering year-over-year to 2020. In fact, the entire state of North Carolina is becoming an increasingly attractive business hub.

Houston was the one city on this list that had a negative growth rate, at -2%.

Tech giants like Google, Meta, and Amazon are continuously and aggressively growing their presence in Canada, further solidifying the country’s status as the next big destination for tech talent. Here are the country’s four tech hubs with a total worker population of more than 50,000:

Toronto saw the most absolute growth tech positions in 2021, adding 88,900 jobs. The tech sector in Canada’s largest city has seen a lot of momentum in recent years, and is now ranked by CBRE as North America’s #3 tech hub, after the SF Bay Area and New York City.

Vancouver’s tech talent population increased the most from its original figure, climbing 63%. Seattle-based companies like Microsoft and Amazon have established sizable offices in the city, adding to the already thriving tech scene. Furthermore, Google is set to build a submarine high-speed fiber optic cable connecting Canada to Asia, with a terminus in Vancouver.

Not to be left behind, Ottawa has also taken giant strides to increase their tech talent and stamp their presence. The country’s capital even has the highest concentration of tech employment in its workforce, thanks in part to the success of Shopify.

The small, but well-known tech hub of Waterloo also had a very high concentration on tech employment (9.6%). The region has seen its tech workforce grow by 8% over the past five years.

Six out of the top 10 cities by tech workforce concentration are located in Canada.

The post-COVID era has seen a shifting definition of what a tech hub means. It’s clear that remote work is here to stay, and as workers migrate to chase affordability and comfort, traditional tech hubs are seeing some decline — or at least slower growth — in their population of tech workers.

While it isn’t evident that there is a mass exodus of tech talent from traditional coastal hubs, the rise in high-paying tech jobs in smaller markets across the country could point to a trend and is positive for the industry.

While more workers with great talent, resources, and education continue to opt for cost-friendly places to reside and work remotely, will newer markets like Charlotte, Tennessee, and Calgary see a rise of tech companies, or will large corporations and startups alike continue to opt for the larger cities on the coast?

U.S. interest rates have risen sharply after sitting near historic lows. This animation charts their trajectory since 2020.

Published

on

By

In March 2020, the U.S. Federal Reserve cut already depressed interest rates to historic lows amid an unraveling COVID-19 pandemic.

Fast-forward to 2022, and the central bank is grappling with a very different economic situation that includes high inflation, low unemployment, and increasing wage growth. Given these conditions, it raised interest rates to 2.25% up from 0% in just five months.

The above visualization from Jan Varsava shows U.S. interest rates over the last two years along with its impact on Treasury yields, often considered a key indicator for the economy.

Below, we show how U.S. interest rates have changed over the course of the pandemic:

In early 2020, the Federal Reserve cut interest rates from 1% to 0% in emergency meetings. The U.S. economy then jumped back from its shortest recession ever recorded, partially supported by massive policy stimulus.

But by 2022, as the inflation rate hit 40-year highs, the central bank had to make its first rate increase in over two years. During the following Federal Reserve meetings, interest rates were then hiked 50 basis points, and then 75 basis points two times shortly after.

Despite these efforts to rein in inflation, price pressures remain high. The war in Ukraine, supply disruptions, and rising demand all contribute to higher prices, along with increasing public-debt loads. In fact, a Federal Reserve estimate suggests that inflation was 2.5% higher due to the $1.9 trillion stimulus, an effect of “fiscal inflation.”

The sharp rise in interest rates has sent shockwaves through markets. The S&P 500 Index has steadily declined 19% year-to-date, and the NASDAQ Composite Index has fallen over 27%.

Bond markets are also showing signs of uncertainty, with the 10-year minus 2-year Treasury yield curve acting as a prime example. This yield curve subtracts the return on short-term government bonds from long-term government bonds.

When long-term bond yields are lower than short-term yields—in other words, the yield curve inverts—it indicates that markets predict slower future growth. In recent history, the yield curve inverting has often signaled a recession. The table below shows periods of yield curve inversions for one month or more since 1978.

*Data as of September 9, 2022

Source: Federal Reserve

For example, the yield curve inverted in February 2000 to a bottom of -51 basis points difference between the 10-year Treasury yield and the 2-year Treasury yield. In March 2001, the U.S. economy went into recession as the Dotcom Bubble burst.

More recently, the yield curve has inverted to its steepest level in two decades.

This trend is extending to other countries as well. Both New Zealand and the UK’s yield curves inverted in August. In Australia, the yield spread between 3-year and 10-year bond futures—its primary measure—was at its narrowest in a decade.

Sustained Treasury yield inversions have sometimes occurred after tightening monetary policy.

In both 1980 and 2000, the Federal Reserve increased interest rates to fight inflation. For instance, when interest rates jumped to 20% in 1981 under Federal Reserve Chairman Paul Volcker, the U.S. Treasury yield inverted over 150 basis points.

This suggests that monetary policy can have a large impact on the direction of the yield curve. That’s because short-term interest rates rise when the central bank raises interest rates to combat inflation.

On the flip side, long-term bonds like the 10-year Treasury yield can be affected by growth prospects and market sentiment. If growth expectations are low and market uncertainty is high, it may cause yields to fall. Taken together, whether or not the economy could be headed for a recession remains unclear.

Charting the Relationship Between Wealth and Happiness, by Country

Mapped: The World’s Billionaire Population, by Country

Mapped: A Snapshot of Wealth in Africa

Mapped: Countries With the Highest Flood Risk

Ranked: The Most Popular Fast Food Brands in America

Mapped: Which Countries Still Have a Monarchy?

The Biggest Tech Talent Hubs in the U.S. and Canada

Visualizing China’s Dominance in the Solar Panel Supply Chain

Copyright © 2022 Visual Capitalist