As a 501(c)(3) nonprofit, we depend on the generosity of individuals like you. Help us continue our work by making a tax-deductible gift today.

The Tax Foundation is the nation’s leading independent tax policy nonprofit. Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels. For over 80 years, our goal has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

April 19, 2022

Cristina Enache

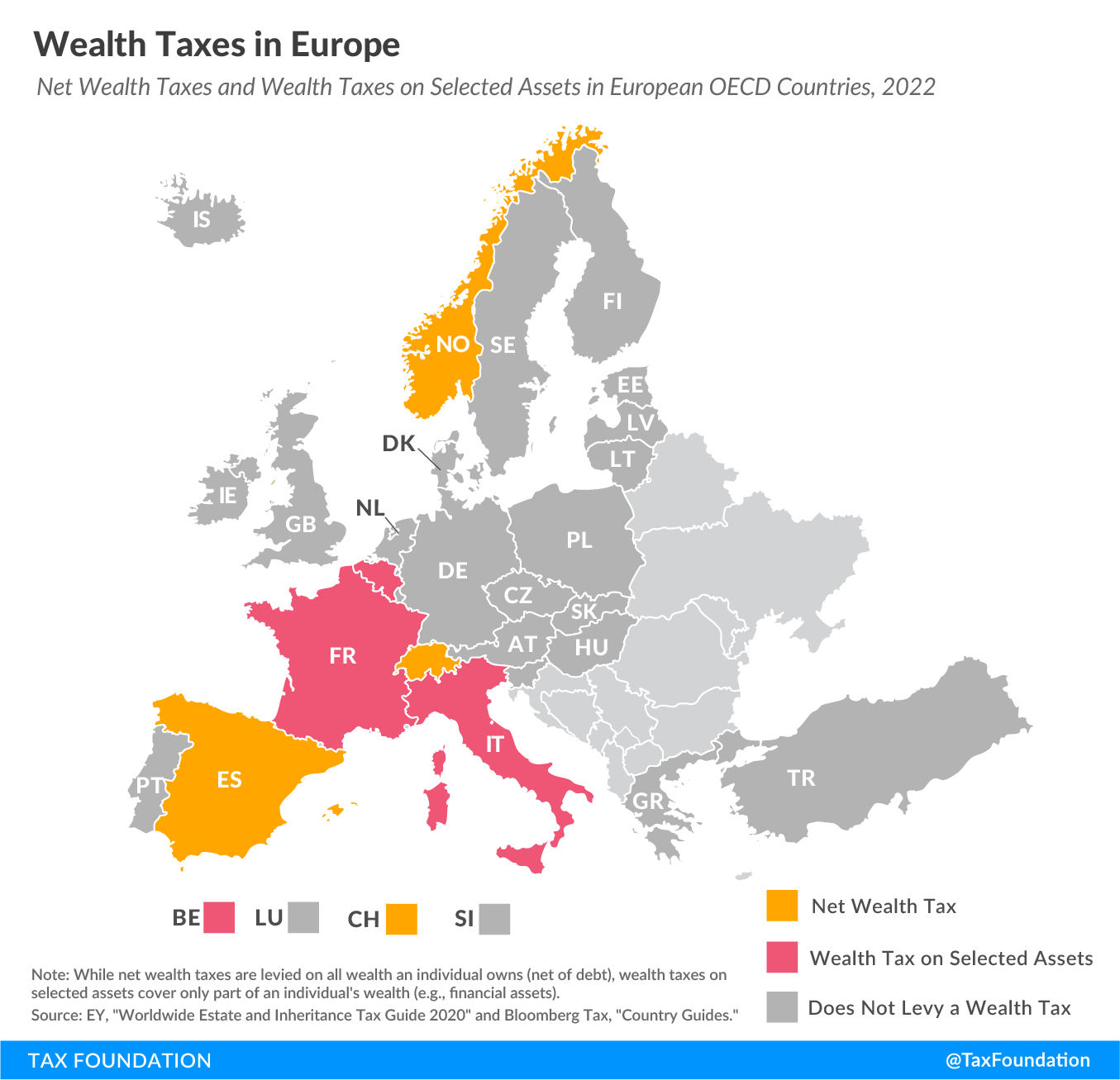

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

Norway levies a net wealth tax of 0.95 percent on individuals’ wealth stocks exceeding NOK 1.7 million (€180,000 or US $190,000), with 0.7 percent going to municipalities and 0.25 percent to the central government. Norway’s net wealth tax dates to 1892. Additionally, for net wealth exceeding NOK 20 million ($2.3 million), the tax rate is 1.1 percent.

Spain’s net wealth tax is a progressive tax ranging from 0.2 percent to 3.75 percent on wealth stocks above €700,000 ($761,000; lower in some regions), with rates varying substantially across Spain’s autonomous regions (Madrid offers a 100 percent relief). Spanish residents are subject to the tax on a worldwide basis while nonresidents pay the tax only on assets located in Spain.

Switzerland levies its net wealth tax at the cantonal level and covers worldwide assets (except real estate and permanent establishments located abroad). The tax rates and allowances vary significantly across cantons. The Swiss net wealth tax was first implemented in 1840.

France abolished its net wealth tax in 2018 and replaced it that year with a real estate wealth tax. French tax residents whose net worldwide real estate assets are valued at or above €1.3 million ($1.4 million) are subject to the tax, as well as non-French tax residents whose net real estate assets located in France are valued at or above €1.3 million. Depending on the net value of the real estate assets, the tax rate ranges as much as 1.5 percent.

Italy taxes financial assets held abroad without Italian intermediaries by individual resident taxpayers at 0.2 percent. In addition, real estate properties held abroad by Italian tax residents are taxed at 0.76 percent.

Belgium introduced in 2021 a solidarity tax or tax on securities accounts (TSA) of 0.15 percent on securities accounts that reach or exceed €1 million ($1.09 million). However, a similar tax was annulled, in 2019, by the Belgian Constitutional Court. The scope of the new TSA was broadened to include securities accounts held in Belgium and abroad and is levied on the securities account itself. Therefore, the number of account holders or their ownership status is irrelevant.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

Tweet

Share

Email

What types of taxes do developed countries rely on most to raise government revenue?

Compare Your Country

Explore our weekly European tax maps to see how countries rank on tax rates, structure, and more.

Compare Your Country

Get facts about taxes in your country and around the world.

Taxes can be complex. Our resources for understanding them aren’t.

A wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary.

A progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden.

The Tax Foundation is the nation’s leading independent tax policy nonprofit. Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels. For over 80 years, our goal has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

1325 G St NW

Suite 950

Washington, DC 20005