Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Find the solutions you need by accessing our extensive portfolio of information, analytics and expertise. The IHS Markit team of subject matter experts, analysts and consultants offers the actionable intelligence you need to make informed decisions.

Critical analysis and guidance spanning the world’s most important business issues.

Stay abreast of changes, new developments and trends in their industry.

A global team of industry-recognized experts contributes incisive and thought-provoking analysis.

Broaden your knowledge by attending IHS Markit events that feature our subject-matter experts. Find webinars, industry briefings, conferences, training and user groups.

During COVID-19, IHS Markit is offering more online events for the safety of our guests.

IHS Markit will resume our in-person events once it is safe to do so.

Missed an event or webinar? Review the recordings of past online events.

IHS Markit is the leading source of information and insight in critical areas that shape today’s business landscape. Customers around the world rely on us to address strategic and operational challenges.

The experts and leaders who set the course for IHS Markit and its thousands of colleagues around the world.

Sustainability drives the entire IHS Markit enterprise. It’s how we do business by guiding our values and culture on the notion that we can make a difference.

Join a global business leader that is dedicated to helping businesses make the right decisions. Be a part of a family of professionals who thrive in an exciting work environment.

The following is an extract from S&P Global Market Intelligence’s latest Week Ahead Economic Preview. For the full report, please click on the ‘Download Full Report’ link.

Download full report

Q2 GDP updates will be due for the UK, Russia and Singapore in the coming week alongside a series of inflation data for the US, India, China, Germany, France and Italy. At the same time, India and the UK will release industrial production data while Thailand will hold a central bank meeting.

Attention turns to the UK, Russia and Singapore where Q2 GDP figures will shed light on economic performance in the midst of geopolitical uncertainty and surging inflation. Last week saw the release of worldwide manufacturing, services and construction PMIs which pointed to a general slowdown in growth. For the UK, output rose at a softer pace while business activity increased at a quicker rate in Russia. Singapore, meanwhile, registered a marked increase in output amid stronger client demand. Nevertheless, steep prices pressures were once again evident. Besides ongoing inflationary pressures, July PMI data alluded to persisting supply constraints and difficulties sourcing material inputs. China’s zero-COVID policy still poses some concern on the supply front, however.

Inflation figures will flow thick and fast this week with Italy, Germany and the US seeing releases on Wednesday. Rates of inflation are expected to remain high with the US core inflation figure forecasted to come in around the 6.1% mark, while latest figures for Italy (Jun: 8%) and Germany (Jun: 7.6%) are expected to remain high and similar to those seen in June. Elsewhere, China has seen relatively tame rates of inflation, albeit the highest for two years. Meanwhile, India has seen inflation rates surge, though rates of increase are starting to subside, according to latest PMI data.

The Bank of Thailand will hold a central bank meeting this week, though the interest rate is expected to remain around the 0.5% mark.

Finally, sentiment data for the US will reveal how household perceptions have changed over the month. The index has remained low in light of scorching inflation, geopolitical uncertainty and concerns over the macroeconomic environment.

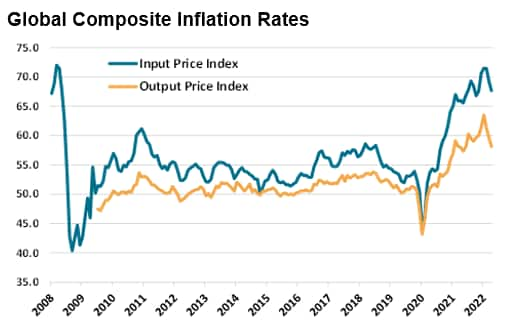

Latest PMI data signalled easing inflation rates on average across the global economy. Cost pressures were at a five-month low in July, while selling price inflation eased to a ten-month low. Improvements across the supply-side, thanks to the alleviation of pandemic restrictions in China, and notable falls in client appetite, resulted in the waning upward pressure on cost burdens and charges for the second month running. Although remaining historically elevated, the PMI data suggest that price pressures have already peaked.

Despite cooling price pressures according to the PMI, breaking the precedent, the Bank of England have raised interest rates by a further 50 basis points to 1.75%, signalling a sixth consecutive rise in rates since last December. Furthermore, more rate hikes are also projected at the Fed.

With global economic growth slowing sharply in July (led by developed nations), central banks once again find themselves in difficulty. It will be interesting to see if central banks adhere to a further tightening of monetary policy which they seem to be committed to. While it is necessary to ensure that the economy does not overheat as it had been in the wake of the COVID-19 recovery, it also becomes important to not seriously curtail demand and growth. That said, recessionary fears have recently been amplified while at the same time, rate hikes and rapid inflationary pressures continue, causing some concern over the future economic outlook.

<span/>Monday 8 August

Japan Bank Lending (Jul), Eco Watcher Survey Current (Jul)

Switzerland Unemployment rate (Jul)

Greece Inflation Rate (Jul)

Czech Republic Unemployment Rate (Jul)

Brazil BCB Focus Market Readout

New Zealand Retail Card Spending (Jul)

Tuesday 9 August

Singapore market holiday

United Kingdom BRC Retail Sale Monitor (Jul)

Australia Westpac Consumer Confidence Index (Aug)

Philippines Unemployment Rate (Jun), Balance of Trade (Jun), GDP Growth Rate (Q2)

Denmark Balance of Trade (Jun)

Hungary Inflation Rate (Jul)

Portugal Balance of Trade (Jun)

Brazil Inflation Rate (Jun), BCB Copom Meeting Minutes (Jul)

Wednesday 10 August

South Korea Unemployment Rate (Jul)

Japan PPI (Jul)

China Inflation Rate (Jul)

Germany Inflation Rate (Jul)

Italy Inflation Rate (Jul)

Brazil Retail Sales (Jun)

Thailand Interest Rate Decision

United States Core Inflation Rate (Jul), Monthly Budget Statement (Jul), Wholesale Inventories (Jun) MBA Mortgage Applications (Aug)

Russia Inflation Rate (Jul)

Thursday 11 August

Australia Consumer Inflation Expectations (Aug)

China New Yuan Loans (Jul)

France IEA Oil Market Report

Mexico Industrial Production (Jun)

United States PPI (Jun), Continuing Jobless Claims (Jul), Initial Jobless Claims (Aug)

Singapore GDP (Q2), Current Account (Q2)

Brazil Business Confidence (Aug)

Friday 12 August

Japan Foreign Bond Investment (Aug)

France Unemployment Rate (Q2), Inflation Rate (Jul)

United Kingdom GDP Growth Rate (Q2), Balance of Trade (Jun), Construction Output (Jun), Goods Trade Balance (Jun), Industrial Production (Jun), NIESR Monthly GDP Tracker (Jul)

Spain Inflation Rate (Jul)

Italy Balance of Trade (Jun)

Euro Area Industrial Production (Jun)

India Inflation Rate (Jul), Industrial Production (Jun),

United States Michigan Consumer Sentiment Prel (Aug)

Russia GDP Growth Rate (Q2)

Industrial production data for the Eurozone and UK

June industrial production data will be released for the Eurozone and the UK this week. This follows last week’s manufacturing PMIs which pointed to a contraction in manufacturing production in both the UK and the Euro area. The latest releases have signalled the destructive impact that client uncertainty, weak demand and inflation has had on domestic sales. Though, it was also clear exports have also taken a hit.

Americas: US Inflation, MBA mortgage applications, and sentiment data

Last week saw some key releases for the US, namely the US non-farm data, US construction spending, PMIs, ISM surveys and balance of trade data. This week, US inflation data will reveal how prices have fared as the fed tightens their monetary policy.

Close followers of the housing market will keep an eye on MBA mortgage applications which have started to increase in recent weeks while sentiment data will also be widely watched this week.

Europe: Inflation data for France, Italy, Germany and Spain

Consumer price inflation rates will be released for a large number of European countries this week including France, Italy, Germany and Spain. July’s PMI survey releases indicated a general slowdown in input costs, though still suggest that we may continue finding elevated CPI readings in the upcoming release.

The Eurozone has been especially hard hit by rising costs, and in recent months inflation rates have been well above target. Yet, the ECB has been reluctant to tighten monetary policy rates in fears of plunging the economy into a recession, which looks more and more imminent.

Asia-Pacific: Thailand interest rate decision, India and China Inflation and Australia sentiment

The Central Bank of Thailand will meet mid-week to discuss their monetary policy, although its widely expected that interest rates will remain unchanged. Meanwhile, after last month’s interest rate decision, India will see inflation and industrial production figures come to light. The S&P Global India manufacturing PMI suggested strong production growth and waning inflationary pressures.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Only 15% of US equity investors have raised their earnings expectations for Q3 2022 while 36% of respondents revise… https://t.co/pL1ijoiSa0

Healthcare stocks were the most favoured sector in August, with energy and IT following. Consumer discretionary and… https://t.co/mreiJxwFJE

The global macroeconomic environment, geopolitics and central bank policy are viewed as the biggest drags on the US… https://t.co/5l5pA4B9U8

US equity investors remain risk averse due to market headwinds from the increasingly gloomy global macroeconomic en… https://t.co/OLNG2Kzh2n